On August 28, 2023, the U.S. Securities and Exchange Commission (SEC) took regulatory enforcement action for the first time against the NFT industry, accusing entertainment company ImLianGuaict Theory, LLC, based in LA, of selling unregistered securities. The company ultimately reached a settlement with the SEC.

This is the SEC’s first regulatory enforcement action against the NFT industry. ImLianGuaict Theory promised investors to increase the value of NFTs, the company, and shared wealth, which is crucial in determining NFTs as “securities”. This article will examine the SEC’s regulatory enforcement action against ImLianGuaict Theory and the dissenting opinions of SEC commissioners to see what kind of NFTs would be considered “securities” by the SEC.

1. Background of ImLianGuaict Theory NFT Case

According to the SEC, ImLianGuaict Theory provided and sold three different types of NFTs, called Founder’s Keys, to investors from October to November 2021. Prior to the NFT sale, ImLianGuaict Theory held online events on Discord and promoted the information on its own website and social media channels.

- A Brief History of Stablecoins Exploding in Silence or Dying in Silence?

- LianGuaintera Partner Three Key Trends of Stanford Blockchain Week, ZKP Optimization, Achieving Composability through Modularity, Bitcoin Ecosystem Revival?

- Why does Bitcoin need a lending ecosystem?

The SEC claims: (1) ImLianGuaict Theory represented to investors that purchasing NFTs was an investment in the company’s business and would bring profits if ImLianGuaict Theory succeeded; (2) ImLianGuaict Theory told potential investors that it was “trying to build the next Disney” and that the value of NFTs would increase as a result; (3) ImLianGuaict Theory also stated that the fate of NFT investors was closely linked to the fate of ImLianGuaict Theory and its founders.

(https://opensea.io/collection/imLianGuaict-theory-founders-key)

ImLianGuaict Theory sold 13,921 NFTs to investors and raised over $29 million worth of ETH. Additionally, ImLianGuaict Theory receives a 10% royalty on each resale of the NFTs, generating an additional value of approximately $978,000 worth of ETH for ImLianGuaict Theory.

Based on the aforementioned facts, the SEC concluded that “both potential and actual investors of ImLianGuaict Theory NFTs believed that they were making an investment and that the NFTs would appreciate.” The SEC charged ImLianGuaict Theory with violating Sections 5(a) and (c) of the Securities Act, which prohibit the sale of unregistered securities.

Prior to settling with the SEC, ImLianGuaict Theory took some remedial measures, such as repurchasing NFTs worth approximately $7.7 million from investors. As part of the settlement with the SEC, ImLianGuaict Theory agreed to (1) destroy all NFTs it owns or controls within 10 days of the order’s issuance; (2) publish a notice of the regulatory enforcement on its website and social media; (3) modify the NFT contracts to eliminate the royalty; (4) forfeit funds and pay fines totaling approximately $6.1 million.

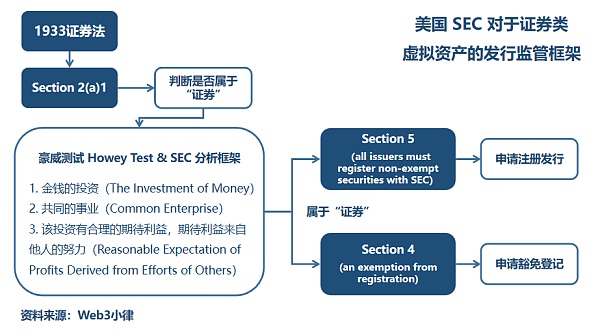

2. What is a “security”? – Howey Test

After the SEC v. Ripple case, the U.S. regulatory authorities apply the Howey Test to determine whether something qualifies as a “security”. Although the SEC did not explicitly explain how this NFT satisfies the Howey Test in this regulatory enforcement document, we can still infer from the fact that ImLianGuaict Theory issues and sells NFTs to conclude that the SEC considers NFTs as “securities”.

This article does not go into detail about the Howey Test. For more information, please refer to the previous article: Understanding the SEC v. Ripple case, further clarifying regulatory uncertainties. Not all NFTs can be classified as securities, starting with SEC v.s. Yuga Labs.

In this case, we can indeed see that ImLianGuaict Theory’s NFTs on the surface do meet the criteria of the Howey Test: (1) investors contribute money (ETH); (2) the purchased NFTs are for a “common enterprise” where investors’ wealth is linked to ImLianGuaict Theory’s wealth; (3) investors expect to profit through ImLianGuaict Theory’s efforts to build “the next Disney”.

Key to the determination of “securities” is that ImLianGuaict Theory promises NFTs and the company to investors, and that their shared wealth will grow.

3. Dissenting statements from SEC Commissioners

After the release of the regulatory enforcement order, SEC Commissioners Hester Peirce and Mark Uyeda immediately issued dissenting statements, stating that there are still many issues with the first regulatory enforcement action against the NFT industry and that clarification is needed before the next regulatory enforcement case comes out.

Firstly, they believe that ImLianGuaict Theory’s vague promises to NFT investors do not meet the criteria of the Howey Test. The full disclosure principle of the U.S. Securities Act requires issuers to have a relatively clear and explicit plan for the use of funds raised from the sale of securities and profit expectations, similar to the prospectus in an IPO or the white paper in an ICO. Peirce and Uyeda further point out, “The SEC does not take enforcement action against people selling watches, paintings, or collectibles, even if they make some vague promises of value appreciation, such as gradually building brand awareness to increase the resale value of these tangible items.”

In addition, due to the extravagant promotion and ambiguous statements by ImLianGuaict Theory, investors have been misled. As Peirce and Uyeda pointed out, “In reality, this NFT has no relation to company equity or the value of the company at all. Could this illusion/misleading also constitute fraud charges?“

Secondly, Peirce and Uyeda also stated that even if the requirements of the Howey Test are met, it is questionable whether the SEC needs to take such regulatory enforcement action. Violations of unregistered securities offerings can usually be resolved through rescission offers, and ImLianGuaict Theory has already made such an offer through its buyback plan.

Finally, Peirce and Uyeda raised several questions that they believe the SEC should consider before regulating the NFT industry, including:

-

Is the “Securities Law” suitable as the regulatory law for NFTs? Is there a feasible regulatory path for NFTs under the “Securities Law”?

-

In addition to the securities attributes of NFT assets themselves, do the methods of NFT issuance and royalty transactions in the secondary market also constitute “securities”?

-

Regarding the compliance measures to be taken for the above regulatory enforcement and resolution, such as destroying NFTs and modifying them to have a 0% royalty, should they become the standards for subsequent regulatory enforcement cases, and are they appropriate?

(https://metanews.com/sec-says-nfts-sold-by-imLianGuaict-theory-are-securities-in-landmark-case/)

IV. What kind of NFTs will be considered as securities?

First, let’s try to answer the question of how to regulate NFTs raised by Peirce and Uyeda, which is the foundation.

4.1 How should NFTs be regulated?

NFTs are essentially a type of token, and their captured value depends on the value of the underlying assets they are anchored to. The source of value can be diverse, and the specific asset value attributes of an NFT are linked to the value attributes of its underlying assets.

Referring to the warning issued by the Securities and Futures Commission (SFC) of Hong Kong on June 6, 2022, regarding the risks of NFTs, if an NFT is a true digital representation of a collectible item (such as art, music, or film), activities related to it are not within the regulatory scope of the SFC. However, some NFTs cross the boundary between collectibles and financial assets and may have the attributes of “securities” regulated by the “Securities and Futures Ordinance” and therefore will be subject to regulation.

Based on this, NFTs can be classified into three categories based on the attributes of their underlying assets: (1) NFTs with securities as underlying assets will be regulated according to securities-related laws and regulations; (2) NFTs with commodities as underlying assets will be regulated according to commodity/virtual asset-related laws and regulations; (3) If the underlying assets are various rights, the attributes of the rights will be evaluated on a case-by-case basis.

Similarly, how NFTs disclose information also needs to be determined based on the attributes of their underlying assets.

(https://cointelegraph.com/news/sec-investigating-nft-market-over-potential-securities-violations-reports)

4.2 In addition to the securities attributes of NFT assets themselves, do the methods of NFT issuance and sales (secondary market transactions) also constitute securities issuance?

Based on the economic substance of the transactions, there are two ways in which NFTs may be subject to “securities” regulation: (1) if the underlying assets being issued are securities themselves, such as converting company equity into NFTs; (2) regardless of whether the underlying assets are securities or not, the methods of NFT issuance constitute the issuance of “securities”.

In the case of SEC v. Ripple, the court held that: the underlying asset of most “investment contracts” is only a standalone commodity, which may not necessarily meet the definition of “securities”, just like the orchard in the case of SEC v. W.J. Howey Co., while the underlying assets of other “investment contracts,” such as gold and crude oil, may vary. To determine whether a transaction constitutes an “investment contract,” it is necessary to consider the economic substance of the underlying transaction and whether different methods of issuance constitute the issuance of “securities.”

In the case of SEC v. Ripple, the XRP tokens issued by Ripple may not meet the definition of “securities,” but the fact that they were promoted and sold to early investors constituted an “investment contract,” thereby falling within the definition of “securities.”

In this case, NFTs themselves do not possess the attributes of “securities,” but the marketing and promotion of ImLianGuaict Theory Company, which tells potential investors that it is “trying to create the next Disney,” will increase the value of NFTs. Thus, the sale of NFTs has the possibility of becoming an “investment contract,” falling within the definition of “securities.”

In summary, “securities” refer to situations where investors passively participate in the activities of third parties solely through monetary investments and expect to gain benefits through the efforts of these third parties. If the efforts of the third parties fail or are absent, investors face the risk of losing their investment.

Conclusion

Although the regulatory enforcement actions by the SEC do not have the force of judicial decisions, the results are still significant as they mark the first discovery that the sale of NFTs violates the regulations on the offering of unregistered securities under the Securities Act.

In an unclear regulatory environment, regulatory agencies such as the SEC and CFTC continue to challenge the cryptocurrency industry and deepen their involvement. After initiating lawsuits against crypto giants Binance and Coinbase, the SEC’s regulatory enforcement action against the NFT industry indicates that the SEC has not slowed down.

Previously, in the article “Legal Compliance Issues for Brand NFT Projects Operated Overseas,” some compliance points for NFT projects were covered. However, it is evident that with the continuous strengthening of regulation, companies in the cryptocurrency industry still need to continue exploring how to respond to litigation, regulation, and compliance in collaboration with experienced lawyers.

(https://nftplazas.com/imLianGuaict-theory-sec-case/)

REFERENCE:

[1] SEC Charges LA-Based Media and Entertainment Co. ImLianGuaict Theory for Unregistered Offering of NFTs

https://www.sec.gov/news/press-release/2023-163

[2] Dissenting Statement, NFTs & the SEC: Statement on ImLianGuaict Theory, LLC

https://www.sec.gov/news/statement/peirce-uyeda-statement-nft-082823

[3] Ballard Spahr, SEC Finds NFT to Be a Security in Landmark Action

https://www.ballardspahr.com/Insights/Alerts-and-Articles/2023/08/SEC-Finds-NFT-to-Be-a-Security-in-Landmark-Action

[4] Interpreting the SEC v. Ripple case to further clarify regulatory uncertainties

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!