Author: Alice@Foresight Ventures

There is no doubt that Friend.tech has become a hot topic. When you open the news and Twitter, the praises from KOL investors seem to overflow the screen.

There is nothing new under the sun. Twitter fan tokens are not innovative. Before Bitcloud, which was supported by a16z, and now the kol community Only 1, Monaco, it seems that they have not been able to avoid the fate of losing popularity.

What is different about the newcomer Friend.tech? Can it bring new opportunities to the long-silent Web3 Social?

- Tsinghua Blockchain Association A Quick Understanding of Full-Chain Gaming

- Opside launches the NCRC protocol, allowing trustless native cross-rollup communication.

- Evening Must-Read | How is the current situation of Ethereum given the dual expectations of futures ETF and Cancun upgrade?

1. Stealcam

The team behind friend.tech is anonymous. According to publicly available information, its predecessor was a photo sharing app called Stealcam.

Stealcam is a photo social sharing app. The photos posted on this platform are not freely accessible. You need to “steal” (pay a certain fee) to obtain the reveal right to view the specific content of the photo. The reveal right is not permanent. Only when you are the latest person to reveal the photo, can you view its content. The founders of the team are anonymous OG Racer (Twitter handle @0x RacerAlt) and shrimp (@shrimppepe).

a. Economic Model

Each photo can be stolen an unlimited number of times. Each time you steal, the price will increase by 10% based on the previous steal price, plus 0.001 ETH.

The income generated from each steal will fully refund the purchase cost of the previous stealer, and the price difference generated by two consecutive steals will be distributed among the creator, the previous stealer, and the protocol. The creator and the previous stealer will receive 45% each, and 10% will be allocated to the protocol.

b. User Data

In just two weeks, without relying on airdrop expectations or issuing tokens, the protocol has accumulated transaction volume of over 313 ETH (equivalent to about $500,000). As of now, stealcam has generated nearly $100,000 in revenue. It has attracted a large number of artists, KOLs, and VC partners, such as USV (Union Square Ventures) co-founder Fred Wilson (ranked 14 on the leaderboard), Variant Fund co-founder Li Jin (ranked 25), Variant co-founder Jess (ranked 79), and wallet rainbow (ranked 16), etc.

(Stealcam Leaderboard- 2023.3.29)

Based on the success of this MVP product, the team decided to upgrade the product, rebrand it as friend.tech, and receive seed round investment from LianGuairadigm.

2. Friend.tech

Friend.tech is a decentralized social platform that allows users to purchase shares (Shares) of any Twitter user on Friend.tech through the Ethereum of the Base chain, by strongly binding with Twitter. They become shareholders and have the right to directly communicate with them, and they can profit from buying and selling shares.

a. Economic Model

Currently, there is no clear economic model. The official website is relatively simple, and the white paper and roadmap have not been released yet. What is currently known is that an increase in the Shareholder of each token will cause the Token to rise, and an additional 10% transaction fee is required for transactions, with 5% going to the protocol and 5% going to the creator.

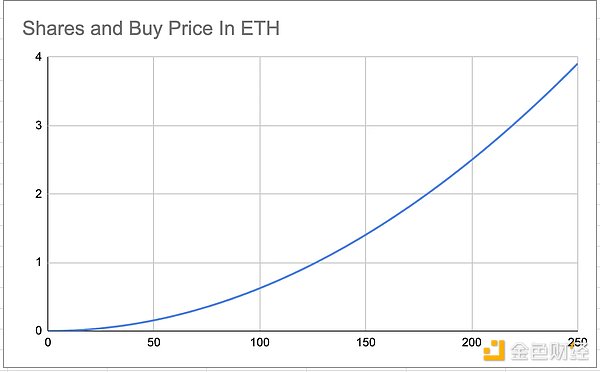

Unlike Stealcam’s linear growth of one yuan, Friend.tech should have modified the model parameters to make the price rise rapidly in relation to the number of shareholders, achieving a quadratic relationship between price and shareholders (calculated by Twitter account @functi 0 nZer 0, but not yet officially confirmed):

The number of personal shares held is determined by a quadratic relationship with the price of the next share. The formula for calculating the price of the next share is S^2 / 16000 * 1 ETH, where S represents the current number of shareholders.

It is worth noting that in version 1.0 of Stealcam, if the next player purchases the mapping rights from you, your purchase cost will be automatically refunded in full and you will earn the difference; whereas in version 2.0 of Friend.tech, adding a shareholder will only benefit the KOL and increase the per share price. As a trader, your paper profit has increased, but if you want to realize the profit, you need to pay a 10% transaction fee and choose the right time to sell.

For users, trading friction has increased, so everyone is more inclined to lock their shares; on the other hand, the project has created a more cohesive community with this mechanism (no longer a one-off transaction), helping early participants and KOLs achieve high returns and create a perfect wealth creation myth.

In summary, the three parties involved in Friend.tech benefit as follows:

-

Protocol: Can receive a 5% fee income for each transaction.

-

KOL: Earn the spread between buying and selling prices, regardless of whether it is during the protocol’s rise or decline. Transaction fees are paid by the buyer and seller initiating each transaction, ensuring that KOLs and the protocol always make a profit.

-

Users: Become Shareholders. Each increase in Shareholders causes the Token price to rise rapidly (attracting traffic through the wealth effect, thereby pushing up the token price). Since a 10% transaction fee is required for each transaction, short-term buying and selling cannot generate large profits, effectively encouraging users to lock their shares. This pricing model has a significant upward and downward speed, and users bear all the risks.

b. Data Situation

Friend.tech is currently thriving, with protocol fees reaching $1.12 million in the past 24 hours, ranking third after Ethereum and Lido, surpassing Tron and Uniswap. The number of active addresses in the past 24 hours reached 20,000.

III. Author’s Opinion

1. Friend.tech’s marketing strategy combines the strengths of various approaches and is a classic case in terms of content tactics, timing, and community selection. The strategies include: creating a sense of mystery in the early stages, KOL shout-outs for cold starts, hungry marketing with invite codes, and post-investment promotion with VC endorsements.

2. The user growth strategy is also excellent, providing sufficient incentives and future expectations to KOLs and users, relying on the power of the community to achieve rapid explosive growth.

3. The Base community generally lacks risk awareness. Apart from the product, the Friend official website does not disclose any project information. The overwhelming marketing focus is clearly on user growth/transaction volume/first-line community comparison, with few articles analyzing its tokenomics economic model. There seems to be a tendency to avoid heavy topics and focus on light ones, apparently intentionally provoking public FOMO sentiment.

4. Overall, it is a very Ponzi-like model, but also has a strong wealth effect and community foundation. If a community culture and unique discourse system can be established before it collapses, it is possible to continue. On the contrary, if everyone buys Shares with a speculative mindset, a large amount of selling pressure will be generated after a certain price threshold/token collapses, leading to a price collapse.

5. The introduction of a points system enhances user activity and stimulates individual investors to further invest and hold the Token owned by CX. Of course, from the analysis of the explosive efficiency, although the Twitter user base is large, Base chain interaction/deposits and withdrawals are still a high threshold thing, which is likely to be optimized in the future.

6. From the perspective of financing, it has already completed seed round financing from LianGuaradigm. We can track the follow-up situation. The team can use this money to distribute airdrops, allowing shareholders to obtain additional income rather than simply speculating on shares.

IV. Future Outlook: Creating a Growth Flywheel with Creator Economy + Tokenomics

It is still too early to judge the success or failure of this project, but Friend.tech has validated the success of community marketing and proved that Social+Fi is an excellent customer acquisition method. Properly distributing benefits and providing incentives for KOLs and individual investors to promote the community is undoubtedly the fastest and most native way to grow.

In a larger context, the combination of Token and creator economy is feasible in social track products, especially providing token incentives to core creators to leverage fan groups for cold starts. This approach is beginning to show signs of Product-Market-Fit (PMF) (at least it can ensure that the project obtains good results in the first step of breaking through the circle). Based on this idea, future directions for further exploration include:

-

Web3 Only Fans: Users can unlock chat and encrypted images after paying, with fan tokens as entry thresholds and DID. Examples include PopPlanet. This model is suitable for the majority of mid-level and even amateur KOLs, with a large user base.

-

Co-creation of content: A community established around well-known IP/NFT communities/creator groups, where creators attract more fans to participate, produce co-created works, and consume content to receive token rewards. Examples include storyverse, story protocol.

-

Fan investment economy: On-chain boy bands, girl groups, on-chain esports, etc. Relying on the influence of idols to attract fans to purchase web3 support products, while the artists themselves can receive higher profit sharing. This model relies heavily on a single IP and requires a high level of popularity.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!