Author: Crypto Ann Translator: Baize Research Institute

Although the situation of major cryptocurrencies such as Bitcoin, Ethereum, and popular altcoins is severe, the situation in the on-chain world is not so “bloody”. Instead, you often see price charts like the one below.

The summer of “on-chain speculation” is still ongoing.

- Selected Weekly Highlights BTC and ETH experience flash crashes, causing $1 billion in liquidations; Sei airdrop sparks controversy; LianGuaiNews Hong Kong and Taiwan branch officially established.

- Reflecting on the Cryptocurrency Market Returning to Common Sense and Rationally Examining Market Chaos

- July NFT Industry Analysis Game and Music NFTs Lead the Growth, Opepen Sparks a Craze

But will they remain solid, lasting, and extend into a bull market?

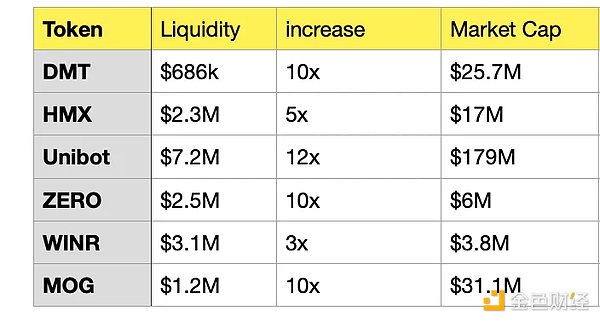

Today, I want to delve into the performance of the current top 6 tokens. After comparing them side by side, analyze the commonalities, patterns, and characteristics that make them perform so well (or appear to be so).

The candidates for analysis are as follows, and I will refer to them as Sh*tcoins due to the speculation surrounding them:

-

Perpetual DEX HMX ($HMX)

-

Crypto game Sanko Game ($DMT)

-

Telegram bot Unibot ($UNIBOT)

-

On-chain gambling game WINR ($WINR)

-

Non-liquidating lending protocol ZeroLiquid ($ZERO) backed by LSD

-

Meme coin $MOG

Goal: Market Cap

Market cap is the most easily noticed indicator for token holders, representing achievements and milestones.

You often see on Crypto Twitter, “Let’s reach a market cap of X million dollars!!” with rocket emojis.

Among the 6 projects studied in this article, Unibot is far ahead with a market cap of nearly $200 million, and other projects also hope to achieve this goal.

However, market cap is a misleading indicator. Just like support and resistance in technical analysis. You can profit at the resistance level or buy when the price breaks through the resistance level. This actually doesn’t make any sense. Some projects have a market cap of up to $50 million, while others will never exceed $10 million. Some projects can easily reach $5 million, but then it becomes difficult to climb further.

Liquidity is more important

Liquidity is actually the only comparison you need.

DMT and MOG have the highest capital efficiency, both achieving a 10-fold price increase with minimal liquidity.

HMX and WINR still have a lot of room for growth, provided that they maintain liquidity at the current level.

ZERO is more prone to sell-offs because the ratio between market cap and liquidity is quite close. On the other hand, Unibot is the opposite because with a market cap of $179 million, it is difficult to sell/liquidate with $7.2 million of liquidity.

The larger the gap between market capitalization and liquidity, the more people are forced to continue holding. Assuming the buyers of Unibot successfully earn a profit of $5 million, but this profit is only on paper because they cannot maintain price stability when selling Unibot for ETH. (If the liquidity pool consists of $3.5 million worth of ETH and $3.5 million worth of Unibot, they cannot sell it at all because there is not enough Unibot in the pool.)

The only strategy to win in this speculative game of “chasing garbage coins” is to become an early buyer (or the token deployer themselves) while maintaining a position much lower than that in the liquidity pool. Buying early is best because if the token fails and encounters a sell-off, you can still save your initial capital (cost) and even make some profit. Insiders usually gradually sell when the price rises, maintaining relative stability in the pool’s liquidity, thereby sustaining the upward momentum.

Why should you sell gradually?

I used to think that the “age” of a project or token is not important, but later I realized I was wrong. Although this article only studies six projects, the sample size is small, but a common pattern can be identified. The best-performing projects are neither too young nor too old, with the optimal “age” being a few months old.

Recently, more and more project teams know that it is better to maintain the token’s rise for a period of time rather than quickly raise it and sell off. They know that keeping the price at a sufficient length of time is enough to make people believe that the project “won’t run away,” but the time cannot be too long to avoid attention being diverted and people gradually losing interest.

I am convinced that maintaining low liquidity is one of the strategies. If you are buying “garbage coins” similar to the projects mentioned above on-chain, the first thing to pay attention to is whether the liquidity is increasing.

People might think that more liquidity is bullish, just like what happened with the $BALD token a few weeks ago. Liquidity increased to $31 million, attracting more and more buyers, and shortly after, the token collapsed completely.

On the contrary, if your position is large, you can consider increasing liquidity as a selling signal and gradually sell off.

Unibot, the center of meme coins

I also believe that the type of project is not important for liquidity. In general, the working principle of “garbage coins” is that if a token’s use case or narrative is unique, the hype surrounding it lasts longer than other tokens.

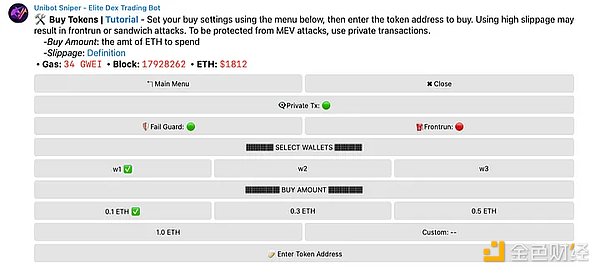

Here, I am referring to Unibot. For this, we need to talk about what Unibot actually is.

Supporters argue about how Unibot completely changes the user experience. I just want to say that it’s all nonsense.

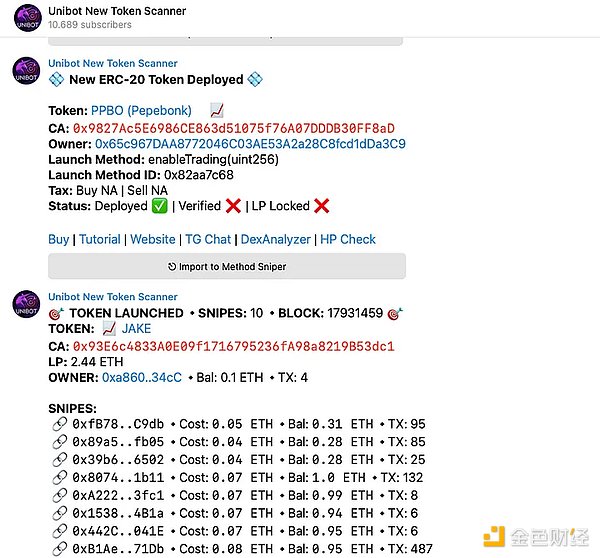

On the contrary, the real attraction of Unibot lies in its meme coin trading function. With it, you can get reminders of new token releases and be able to buy tokens immediately after they are listed. For on-chain traders, this is certainly a good user experience, and it is also the reason why “pump and dump” (disguised gambling) is fascinating.

In short, Unibot is not only a meme coin itself, but also the center of the meme coin universe.

Unibot has successfully maintained hype for a longer period of time because it has gone from being unique to being a leader in the race. Other projects find it difficult to replicate its successful fate.

When the hype surrounding Unibot will end depends on the situation of on-chain speculation and the entire crypto market. (Unibot maintains liquidity pools at a low level to avoid a cascading drop in price.)

These “trash coins” are easily affected by capital rotation

Once traders notice changes in liquidity in the broader crypto market, they will leave the hype surrounding “trash coins.”

The cycle where Bitcoin and Ethereum dominate most of the liquidity will come again, which usually happens in the early to mid stages of a bull market.

As early as 2021, DeFi blue-chip tokens like $UNI and $SUSHI have stagnated, while newcomers (Layer1-“Ethereum killers”) have pushed the bull market to its peak. For the 6 “trash coins” mentioned in this article, the situation is no different.

However, the real thousandfold projects of the bull market are still lurking somewhere. Their tokens will not increase 10 times in 2 months, and they certainly won’t be yet another perpetual DEX. Currently, there is a significant gap between the prices of these tokens and the innovation/quality of the projects themselves. At least in the “on-chain speculation” frenzy of 2019-2020, DeFi blue-chip projects like UniSwap and Curve were indeed novel and pioneering, which cannot be said for the current “trash coins.”

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!