Is Rollup a good investment category among many infrastructures?

The investment logic of Rollup may have different answers at different stages of industry development, from the early ZK/OP narrative dispute to the later TPS and user experience comparison in practice, and then to the moat built around derivative tools such as OP Stack.

But ultimately, what we need to answer is whether Rollup is a profitable business. What is the economics of Rollup? This article attempts to study and explore the business model of Rollup and its design space for monetization.

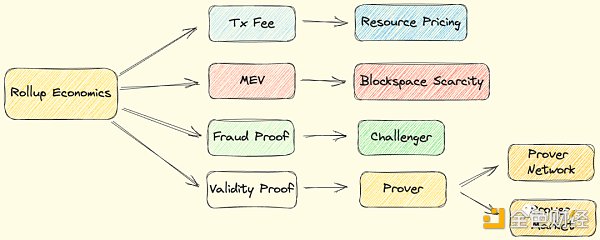

Barry Whitehat first proposed the concept of Rollup on the Ethereum Research forum. When the concept of Rollup was in its infancy, we collectively referred to the role of operating Rollup as a Relayer or Operator. As the infrastructure became more refined, this role was divided into multiple entities: Sequencer is responsible for ordering transactions and writing to DA, Challenger is responsible for raising challenges, and Prover is responsible for generating proofs. When discussing the economics of Rollup, we can basically start by sorting out these entities.

- The Current Situation of Stablecoin Yield Comprehensive Overview

- Is there any evidence that the ‘runaway Meme coin BALD’ is related to SBF?

- How much does it cost to issue a meme on Base?

Source: IOSG

This article mainly discusses several aspects of Rollup Monetization:

-

The reasons, composition, and profitability of transaction fees;

-

The form and monetization of MEV in the context of Decentralized Sequencer;

-

The possibility of monetization based on Fault Proof and Validity Proof.

Transaction Fee

Similar to other chains, users need to pay transaction fees when sending transactions on Rollup.

From the perspective of the Sequencer, this transaction cost mainly covers two parts: execution cost and security cost.

Execution Cost

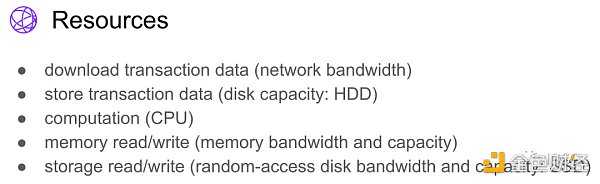

Source: John Adler

The execution cost of Rollup inherits the model of Ethereum. In abstract terms, each Ethereum node runs a replicated state machine. As shown in the above figure, the node downloads and stores transaction data, executes calculations, reads and writes memory and storage, and these operations correspond to physical resource expenses and consumption. Gas, as the unified pricing unit for resources, is used to measure the underlying resources behind these operations.

So the same applies to Rollup. Operating a Rollup node will incur certain execution costs, which are the transaction fees paid by Rollup users. Due to the subtle differences in EVM equivalence and the differences in Rollup design, different Rollups also have slight differences in the pricing of execution costs (for example, zkSync Era provides native account abstraction, and some operations may require more Gas compared to EOA), but overall, the Gas model of Ethereum is still used.

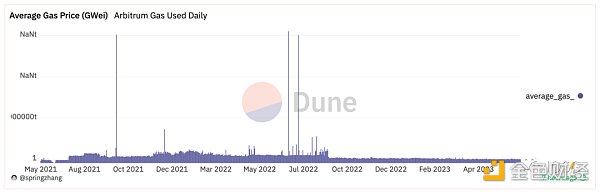

Source: Dune Analytics @springzhang

In addition to the aforementioned execution costs, congestion fees and minimum transaction fees should also be considered.

Congestion fee. Reflected in the dynamic balance between gas prices and network traffic. For example, during the Arbitrum Odyssey period, the surge in network traffic led to a substantial increase in gas prices.

Minimum transaction fee. On blockchains with extremely low network fees, it is necessary to set a lower limit for transaction fees to avoid SLianGuaim and DoS attacks. Currently, it is 0.1 gwei on Arbitrum One and 0.01 gwei on Arbitrum Nova. The value of the minimum transaction fee depends on the design of the network (0.001 gwei on Optimism).

Security Cost

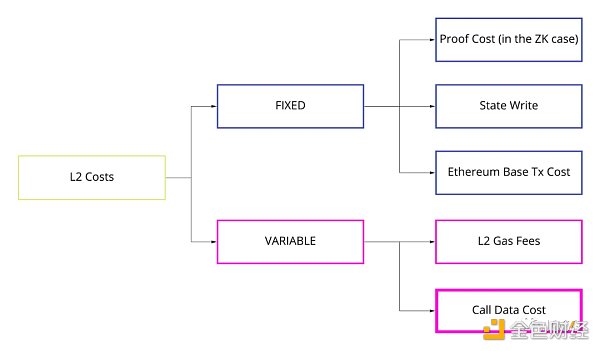

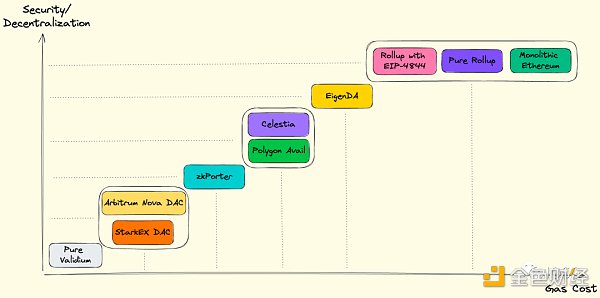

Source: Celestia Forum @adeets_22

Security cost refers to the data availability (DA) cost we are discussing. DA is the guarantee of Rollup’s equivalence to Ethereum security, ensuring that everyone can reconstruct the state of Rollup based on the data published on Ethereum L1 (here we are discussing the case of Ethereum L1, and of course there are other DA schemes). The DA cost contributed to Ethereum L1 accounts for the vast majority of the total cost of Rollup. In May of this year, Arbitrum submitted approximately 3,927 MB of data to Ethereum and paid 4,856 ETH for it, with a DA cost of about 1.24 ETH/MB (calculated based on S3 Standard’s $0.023 per GB and ETH price of $1800, Ethereum’s DA storage cost is about 100 million times that of AWS).

Because on-chain DA is very expensive, various Rollups have adopted data compression methods. Arbitrum and Optimism Bedrock use open-source data compression libraries Brotli and zlib to compress the data published on Ethereum L1. StarkNet and zkSync Era compress the data by publishing State Diffs (i.e., the difference between the previous state and the new state) instead of all the data. (P.S: Optimism Bedrock’s upgrade also takes multiple methods to compress transaction costs, and we can see more data indicators here).

Source: IOSG

It is worth looking forward to the significant relief of Ethereum L1’s high DA cost after the introduction of EIP-4844 in the Decun Upgrade. In addition, the “security cost” discussed here actually implies different security levels. In addition to DA guaranteed by Ethereum L1, DAC and solutions such as Celestia, EigenDA, etc., provide diverse “security-cost” trade-offs, offering a variety of choices for the DA demand side. Some low-frequency, high-value DeFi applications require more security guarantees, while some high-frequency, relatively low-value applications (such as games) can consider costs more; to each their own.

Source: Dune Analytics @optimismfnd

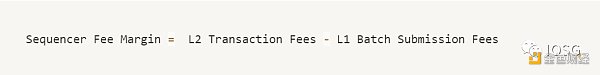

In summary, simply from the perspective of the Sequencer: the Sequencer collects transaction fees from users and pays DA fees to Ethereum. Then the profit of the Sequencer can be calculated in the above-mentioned way. Currently, most Sequencers are operated by Rollup teams, and if we ignore a series of details such as income from token issuance and inflation, the income of Rollup can also be roughly measured in this way.

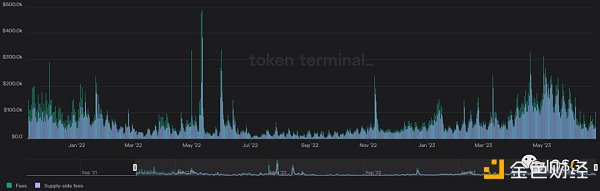

Source: Token Terminal

Source: IOSG

Take Optimism as an example. In the past 30 days, Optimism has made a profit of approximately $20,000 per day. According to Token Terminal’s data, Optimism has made a profit of approximately $10.9 million since its launch.

MEV

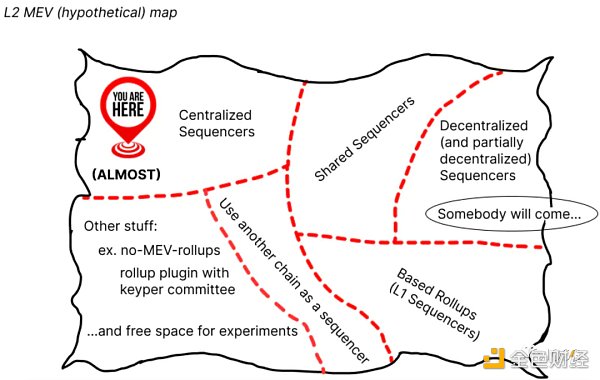

MEV is an important way for Rollups to establish a business model. Discussing MEV in the context of a centralized single Sequencer doesn’t make much sense, so let’s start with decentralized Sequencers and then explore the MEV economy of Rollups.

Decentralized Sequencer (DS)

Currently, Arbitrum ($5.87 billion), Optimism ($2.14 billion), and zkSync Era ($649 million) rely on centralized Sequencers/Operators for transaction ordering and batch submission.

Decentralization is a complex matter, and the process of introducing multiple participants needs to be carefully polished. It is not necessary to achieve everything in one step. Considering security, competition, and developer resources, it is reasonable to adopt a centralized Sequencer in the early stages of a project. However, centralized Sequencers have at least two obvious flaws (which are also flaws of most centralized means).

-

Transaction censorship: i.e., reviewing transactions of specific users, including ransom attacks, etc. To address this issue, Arbitrum and Optimism provide options for users to force inclusion of transactions. For example, all users of Arbitrum can call the forceInclusion method to include transactions forcibly. StarkEx has implemented an escape hatch mechanism, which achieves partial anti-censorship.

-

Active guarantees: Can the Sequencer remain online continuously? If the centralized service experiences a single point of failure (such as hardware failure or software configuration error), the entire network will be shut down. Although this possibility is small, once it happens, it will have a wide range of negative impacts.

Source: Taiko

Currently, the Sequencer actually plays the role of both Builder and Proposer on Ethereum L1: it is responsible for transaction ordering and batch submission. The process of implementing DS is somewhat similar to retracing the old path of Ethereum PBS.

To achieve DS, Rollups typically have several options.

-

Leader election/rotation mechanism, combined with local block construction, i.e., the case where Ethereum L1 is not PBS. Vitalik proposed several methods for leader election/rotation in his article “An Incomplete Guide to Rollups”: Sequencer auction, PoS-based random selection, DPoS voting, etc. Based on Ethereum’s practice, PBS is obviously a better solution.

-

Leader election/rotation mechanism, combined with an open block construction market, i.e., the case where Ethereum L1 has Enshrined PBS or Proposer with MEV-Boost.

-

Some specific mechanisms, such as FCFS (First Come First Serve). FCFS will eventually lead to a latency race, similar to colocation in traditional high-frequency trading. Arbitrum currently adopts FCFS and is researching variants like Time-Boost. Time-Boost introduces priority fees on top of FCFS, allowing transactions to be accelerated by up to 0.5 seconds. This is a two-dimensional trade-off between latency and fees.

Rollup teams can choose to build DS internally using the options mentioned above, or consider outsourcing sequencing:

-

Projects like Espresso/Astria have proposed their DS/SS services;

-

Flashbots is building SUAVE, a cross-domain generalized encrypted memory pool;

-

Based Rollup proposed by Justin Drake directly relies on L1 consensus, where the L1 proposer of Ethereum includes the Rollup block in the L1 block, inheriting the same level of decentralization and active guarantees as L1.

There are pros and cons to choosing internal construction or outsourcing, which will be further discussed later in this article.

Rollup MEV in the context of DS

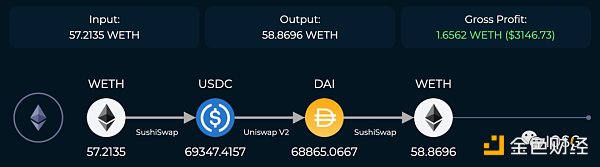

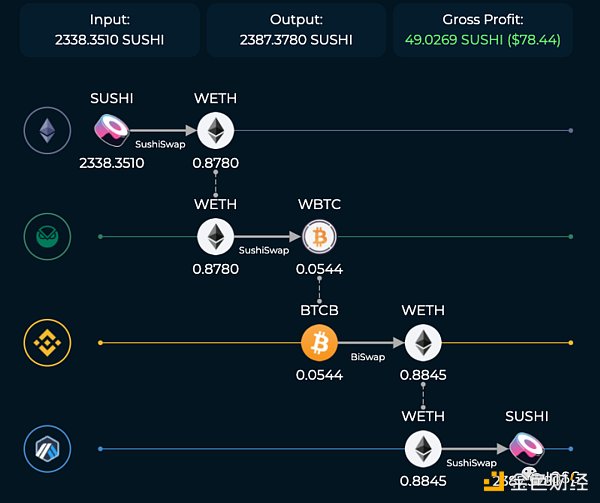

Source: odos.xyz/arbitrage

If we have an open market for DS construction of blocks, the MEV supply chain on Ethereum will be replicated on Rollup. Intradomain MEV refers to the MEV that occurs within Rollup, which is not much different from the MEV on Ethereum L1. For example, sandwich attacks in DEX, cross-DEX arbitrage, and so on. Since Rollup has not implemented DS yet, the image above uses cross-DEX arbitrage on Ethereum L1 as an example.

Even more interesting is the possibility of cross-domain MEV. We divide cross-domain MEV into ordinary cross-domain MEV and cross-domain MEV under Shared Sequencer (SS).

-

Ordinary domain MEV

Source: odos.xyz/arbitrage

Ordinary cross-domain MEV occurs between Ethereum L1 and Rollup, and between Rollups. In the context of DS, each domain has its own MEV pipeline, covering different roles. The image above is an example of cross-domain arbitrage.

On the Searcher side, cross-domain MEV involves complex execution risks because different domains have different confirmation times and finality, making it uncertain if transactions will be included as intended. To address this, Primev is building a communication network where Searchers can submit bids to multiple Builders in multiple domains to obtain pre-confirmation guarantees for their Bundles. This allows Searchers to quantify and manage their execution risks.

There is a trend towards centralization in cross-domain MEV. As Flashbots pointed out, Builders who build blocks on multiple chains have a greater advantage in cross-domain MEV compared to Builders who only build blocks on one chain, which can easily lead to centralization. Under the Rollup-centric Roadmap, this is a topic that needs to be addressed in the coming years.

-

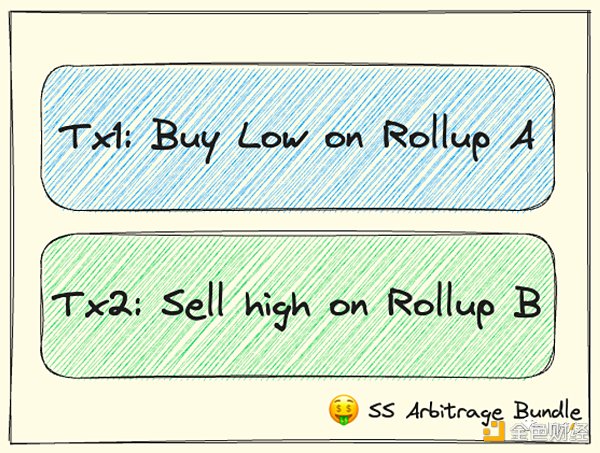

MEV under SS

If multiple Rollups use the same SS, the situation is different.

Source: IOSG

One of the characteristics of SS is that it enables cross-Rollup atomic arbitrage. Previously, when a Searcher submitted transaction 1 and transaction 2 separately, it was uncertain whether these two transactions would be included as expected (e.g., included in the next block). With SS, Searchers can submit a Bundle similar to the one shown in the image above, and the execution only occurs when both transaction 1 and transaction 2 can be fulfilled simultaneously; otherwise, neither transaction is executed (of course, the transactions must be valid). This implementation reduces the Searcher’s execution risk.

Ideally, SS will achieve a “whole greater than the sum of its parts” scenario. For example, the information covered by a single transaction may have no value on a single Rollup, but when combined with transactions on multiple Rollups that share ordering, it can be combined with other transactions on other Rollups to fully utilize some “invalid information” and achieve positive-sum games.

Despite the many benefits, Sequencing involves complex business issues, so the author believes that SS will not be adopted by head Rollups in the short term, but may be implemented and verified first in the long tail of App-specific Rollups, or offered as an option for Rollup-as-a-Service projects for developers to use.

-

Rollup Economy around MEV

Source: IOSG

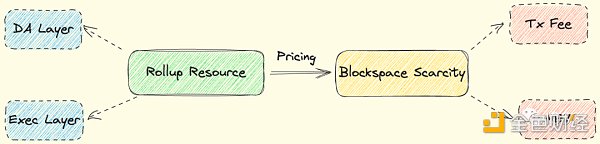

After DS is implemented, the problem returns to how to build an economic model and value capture mechanism around MEV.

In the previous discussion, we talked about the cost of Rollups. The source of this cost is the DA resources and the physical resources of operating the Rollup itself. These limited resources constitute the scarcity of block space. MEV reflects the dominance over the scarcity of block space. Rollups can price this dominance.

Fuel Network believes that an optimized token model should reasonably capture the value of block space. Users pay transaction fees using Rollup tokens, which is one way of capturing value (i.e., granting token utility). However, this also introduces additional user friction. Fuel’s idea is also to tokenize the scarcity of block space, but what is tokenized is the “right to charge fees for block space.” This is from the perspective of block producers and MEV and does not affect end users.

Corresponding to the options mentioned above, the author believes that there may be the following design spaces:

-

MEV Auction (MEVA). Sequencers participate in the auction to determine the transaction ordering rights for specific blocks or blocks within a specific period of time. The auction bid serves as income for the Rollup.

-

PoS. Stake Rollup tokens and randomly select Sequencers; the more tokens staked, the greater the probability of becoming a Sequencer. Note that Rollups still rely on Validity/Fault Proof and Ethereum for security and do not rely on PoS for economic security. PoS is only used as a way to select leaders. Staking tokens provide value capture for the Rollup, and this locking nature is essentially a reflection of the scarcity of block space.

-

SS. Compared to the above two points, SS is an interesting new topic that currently has no consensus. Assuming that the Rollup outsources Sequencing to SS, it also means relinquishing the right to capture MEV within its own domain—although the benefit is that multiple domains will generate network effects, resulting in positive-sum outcomes. However, from another perspective, the Rollup can choose to keep its own MEV within its own ecosystem, capturing it itself or tokenizing the MEV within the domain.

Therefore, the author believes that SS should redistribute the MEV captured by each of its domains in some way. In cases where multiple SSs compete for their Rollup clients, this redistribution incentive becomes especially important. In this case, the redistributed MEV can serve as income for the Rollup.

“Fraud” Proof

The common design of fraud proof is that during the challenge period, people (called challengers) can question the state transition; once the challenge is verified as correct, the wrongdoer will be penalized and the challenger will receive a portion of the forfeited funds as a reward. The remaining forfeited funds may be destroyed. If the forfeited funds are tokens of Rollup, this is considered as compensation for all token holders (rather than the victims of the attack). Arbitrum and Optimism Cannon currently adopt interactive fraud proof.

In Arbitrum, the party observing the state transition and making challenges is called a validator, while the party observing the state transition is called a watchtower validator. The main difference between the two is that the former can make challenges, while the latter can issue warnings in any way (such as through the community or social media). Becoming a validator requires whitelist permission, while a watchtower validator does not.

Arbitrum may decentralize the role of validators (i.e., challengers) in the future. However, in fact, challengers only need a 1 of N trust assumption, and an honest challenger is sufficient for the network. Therefore, the author believes that decentralized challengers only satisfy the requirement of decentralization. In addition to the aforementioned reward for challengers receiving a portion of the forfeited funds, there is not much design space in terms of economics. It is more likely due to considerations of design redundancy.

Prover Network/Market

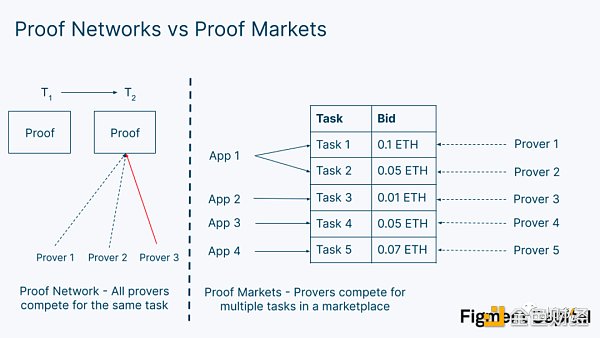

Source: Figment Capital

In its article, Figment Capital distinguishes between the Prover Network and the Prover Market: the Prover Network is a collection of Provers that only serve a single application (such as Scroll). The Prover Market is an open market where multiple applications (such as Scroll and Succinct) can submit proof requests. This article has already summarized all aspects of Decentralized Provers, so this article will not repeat too much.

Prover Network

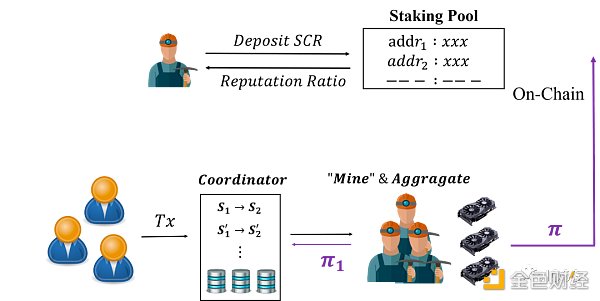

Scroll proposed the idea of decentralized Provers two years ago.

Source: Scroll

The Prover (referred to as Roller by Scroll) needs to stake tokens to obtain initial reputation, which is proportional to the staked tokens. When the network needs to generate a proof, the Sequencer randomly selects multiple Provers based on their reputation and requires them to generate the proof within time T. If the proof is invalid, they will be fined. If the proof is valid but late, their reputation will be lowered. If the proof is valid and within time T, they have the opportunity to receive a reward.

The introduction of the design with a limited time T, instead of simply using “the fastest,” is to avoid a situation where the fastest Prover takes all the rewards. As long as they can complete the proof within time T, the probability of the fastest Prover and the slightly slower Prover receiving rewards is the same. This mechanism encourages the fastest Prover to generate proofs for other blocks in parallel to maximize profit.

Prover Market

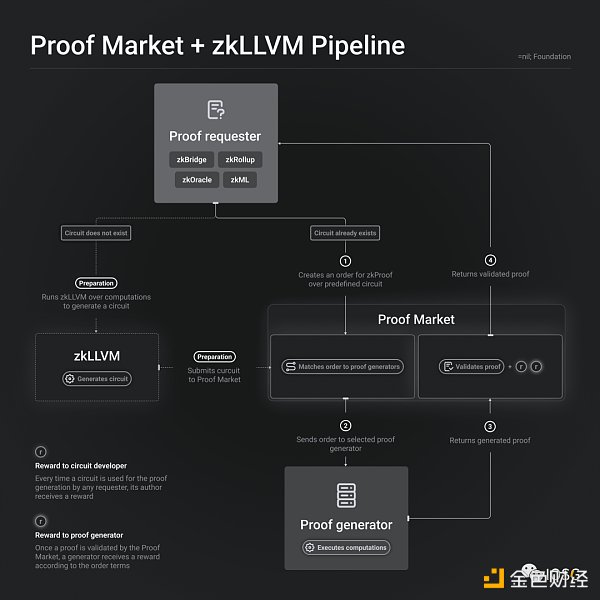

Source = nil;

=nil; provides a generalized service for building circuits and proof markets. Developers who build circuits and Provers who generate proofs both receive a portion of the income.

As an open market, =nil; is similar to a spot market, with two roles: proof requesters and proof producers. The former can place buy orders, while the latter can place sell orders. The parameters for placing orders include the statement (such as the state proof circuit of Mina or Solana), cost, order timeout, and proof generation time.

=nil; also adopts a similar reputation system, where Provers who fail to generate proofs on time or generate incorrect proofs will have their rating lowered or even penalized.

Scroll and =nil; both use the design of staking-slashing and reputation systems, but they target different groups of demand. The former serves the ZKRollup itself, while the latter serves multiple ZK applications. These two instances correspond to the two forms of internally built Provers and outsourced Provers, respectively.

Closing Thoughts

Based on the above discussions, the author puts forward several viewpoints:

-

Transaction fees are a simple and effective business model, and one of the main selling points of Rollup for scaling Ethereum is low fees. Therefore, they will not make many innovations in transaction fees. With the adoption of EIP-4844 and the maturity of various DA solutions (such as Celestia, EigenDA, etc.), Rollup transaction fees will be further reduced. This is a good thing for users.

-

In terms of Rollup, the author believes that mainstream Rollups will gradually move towards DS in two to three years, and some niche Rollups may move faster. MEV, as a relatively hidden business model, will become the main growth point of Rollup’s revenue. Among them, if an internally built DS is chosen, it will involve token economics design; if DS & SS is chosen, how to reasonably allocate the MEV in it is a point that both Rollup and DS & SS projects need to consider. The importance of MEV on Rollup is currently severely underestimated.

-

Decentralization is often a progressive process, and there are different degrees of decentralization. Whether it is a decentralized Sequencer or Prover, there are mainly two options: internal development by the team or outsourcing. The design space of the former is broader and is mainly based on the cryptographic economic primitives of staking-slashing. There are already some mature mechanism designs available for reference. The author speculates that the latter may rely on a payment model similar to DA.

DS may be more complex in mechanism design, while Prover is relatively intuitive. Because it is difficult to determine whether the transaction sequence returned by Sequencer is correct or incorrect, mathematical proofs are deterministic and can be quantitatively measured, such as time, cost, and other parameters. DS is more concerned with the MEV economy.

The choice between the above two methods for Rollup may vary depending on the stage of the project, considering factors such as capital efficiency and developer resources. For early Rollups, including some App-specific Rollups, outsourcing this decentralized work and quickly bootstrapping may be the best solution (through DS & SS or EigenLayer). On the other hand, more mature Rollups have more abundant developer resources and funds, and they will also consider capturing token value and resource connections to build moats and flywheels.

Reference

1. https://joncharbonneau.substack.com/p/rollups-arent-real

4. https://dba.mirror.xyz/LYUb_Y2huJhNUw_z8ltqui2d6KY8Fc3t_cnSE9rDL_o

5. https://hackmd.io/@EspressoSystems/EspressoSequencer

6. https://mirror.xyz/electriccap.eth/SD0wT7qSSfis9gLT_Ki1gY6_oTYEqgwcGE0hDw7kMDY

7. https://hackmd.io/@yezhang/SkmyXzWMY

9. https://fuel-labs.ghost.io/token-model-layer-2-block-production/

10. https://offchain.medium.com/time-boost-a-new-transaction-ordering-policy-for-arbitrum-5b3066382d62

12. https://forum.celestia.org/t/ethereum-rollup-call-data-pricing-analysis/141

14. https://vitalik.ca/general/2021/01/05/rollup.html

15. https://twitter.com/sreeramkannan/thread/1637496244317880321

16. https://twitter.com/jon_charb/thread/1637488620729774080

17. https://barnabe.substack.com/p/understanding-rollup-economics-from

18. https://developer.arbitrum.io/intro/

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!