Fully Diluted Market Cap, often referred to as FDMC or Fully Diluted Value (FDV) in the cryptocurrency field, is a concept that distorts the stock market concept into the realm of cryptocurrencies. The concept aims to capture the dilutive nature of protocols. However, there are flaws in the current way it is used and updates are needed.

This article explores the fallacy of the concept of “Fully Diluted Market Cap” in cryptocurrencies and proposes an alternative solution.

Review

Market cap represents the equity value of a company in the public market. It is equal to the company’s stock price multiplied by the number of outstanding shares. The rise of technology companies in the 1990s gave birth to stock-based compensation systems. Companies started paying employees with stock options. Stock-based compensation has several benefits. It aligns the incentives of the company and its employees. It is a non-cash expense. It enjoys favorable tax treatment.

Until recently, stock-based compensation was not reflected in the company’s income statement and was not a cash item on the company’s cash flow statement. It was an expense that didn’t show up anywhere. But it would eventually show up in the number of outstanding shares. As the number of shares increases, earnings per share would decrease, holding other factors constant.

- How to Identify Future Hyped Cryptocurrency Projects at an Early Stage

- Five years of Bitcoin theft using Monero tracking program, seeking help from the FBI, transatlantic litigation

- Zhao Changpeng’s old article Why I don’t like large-scale ICOs.

Investment analysts adjust the number of outstanding shares to adjust for the virtual stock-based compensation expense. Analysts add the shares that will be issued to employees in the future to the existing number of outstanding shares. The sum of these two is called fully diluted shares. Fully diluted shares multiplied by the stock price gives the fully diluted market cap. Fully diluted shares and market cap are very common in equity investments.

Application to Cryptocurrencies

A similar market cap concept applies to cryptocurrencies as well. The market cap of a protocol is the token price multiplied by the number of circulating tokens. The number of circulating tokens is essentially the same as the number of outstanding shares. However, unlike the number of outstanding shares in a company, the number of circulating tokens of a protocol often increases significantly.

Companies tend to avoid issuing more shares. Issuing shares is equivalent to selling equity in the company at the current stock price. If a company is optimistic about the future, why sell equity at today’s price? It would dilute the value of existing shareholders.

On the other hand, protocols often issue additional tokens. Token issuance is part of their “business plan”. It all started with Bitcoin. Bitcoin miners ensure that transactions are correctly entered into the Bitcoin blockchain. They are rewarded with Bitcoin. Therefore, the Bitcoin network needs to continuously issue new Bitcoins to reward the network’s miners. Subsequent blockchains adopted the same pattern: issuing native blockchain tokens to reward those who accurately input transactions.

The token issuance model inherent in blockchain means that there are constantly more tokens in circulation. Cryptocurrency market cap does not capture the number of future circulating tokens. As a result, the concept of fully diluted market cap has been developed. Fully diluted market cap is the current token price multiplied by the total number of tokens to be issued. For protocols with continuously increasing token supply, data on the token supply ten years later is often used.

Complete Dilution Market Cap Makes Sense to Some Extent

People rightly realize that the market cap of cryptocurrencies does not fully reflect the actual situation. Different measurement standards need to be adopted to capture the impact of all future tokens to be issued.

At the same time, the “business plan” of the protocol is also evolving. The issuance of new tokens is no longer just for rewarding miners, as was the case with Bitcoin initially. Tokens are also used for network development. Token issuance can help guide the network to achieve its functionality. A network, whether it is Facebook, Uber, Twitter, or blockchain, has little practicality if not many people use it. But few are interested in becoming early adopters. Issuing tokens to early adopters gives them financial incentives to use and promote the network until others join and make the network itself practical.

Token issuance has also become a form of compensation for ambitious developers who build protocols and the venture capital funds that support them. There is nothing wrong with rewarding entrepreneurs, supporting venture capital funds, and early adopters. The key is that token issuance has become more complex.

But Complete Dilution Market Cap also Has Flaws

The logic of complete dilution market cap has many flaws.

1. Mathematical Mistake

For some reason, the cryptocurrency market believes that if a protocol issues more tokens, its value should be higher. This is completely wrong. In business, economics, or the cryptocurrency field, there is no example that issuing more things will increase the value of individuals. This is a simple supply and demand relationship. If supply increases and demand is not met, the value of that thing will decrease.

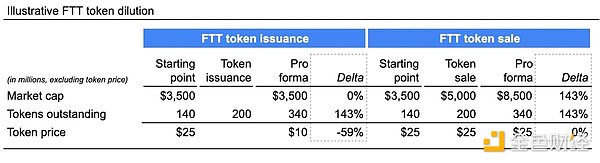

FTT token is a typical example. Its token structure and mechanism are similar to other tokens. Before FTX crashed, the price of FTT was $25. The market cap was $3.5 billion, and the circulating supply was 140 million tokens. The fully diluted market cap was $8.5 billion, with a total circulating supply of 340 million tokens.

Therefore, by issuing an additional 200 million tokens, which is 2.4 times the original supply, the market cap of FTT also increased by 2.4 times… How does this make sense?

To truly achieve a fully diluted market cap of $8.5 billion for FTT, the additional 200 million tokens issued must be sold to buyers at the current price of $25. But that’s not the case. The additional 200 million tokens issued were simply given away without any issuance revenue.

The table below shows the difference in FTT market cap and token price if the issuance of 200 million FTT tokens is compared to selling. Token issuance simply adds 200 million tokens to the existing token supply, resulting in a fully diluted total token supply of 340 million tokens. Token issuance has no impact on FTT’s market cap. The expected impact is an increase of 143% in the total token supply and a decrease of 59% in the price per token. This is simple math. The numerator is constant, while the denominator increases. The result is a smaller number.

Alternatively, if these 200 million FTT tokens are sold at the token price of $25 at the time, FTT will generate $5 billion in revenue, increasing its market capitalization to $8.5 billion, with the fully diluted market capitalization. The circulating token quantity will increase to 340 million. Both market capitalization and circulating token quantity have increased by 143%. The end result is that the price per token remains unchanged.

The operation of stocks is similar to this. If Apple issues additional shares to employees as stock compensation, it does not generate revenue. The result is an increase in fully diluted circulating shares and a decrease in the price per share. If Apple sells shares to the market at the current price, it will generate cash revenue. Its market capitalization will increase by the corresponding amount. Circulating shares will also increase accordingly. The end result is that the stock price remains unchanged.

Applying the logic of fully diluted market capitalization to stocks highlights its flaws. If this logic holds true, every company should issue more shares to increase its fully diluted market capitalization. Obviously, this is not the case. According to the reasonable inference based on this logic, the fully diluted market capitalization of every company should be infinite. There is no limit to the number of shares a company can issue. Therefore, regardless of the company’s size, growth potential, profitability, and return on capital, their fully diluted market capitalization should be the same, that is, infinite. However, the reality is obviously not the case.

So, what about deflationary protocols?

Most protocols are inflationary, meaning that more tokens are issued over time. Some protocols are or will become deflationary, meaning that the quantity of tokens circulating in the future will decrease. According to the logic of fully diluted market capitalization in cryptocurrencies, deflationary protocols will have lower future value than today’s value.

Something in the future will decrease, yet its value will decrease because of its decrease. This is unreasonable. It violates the basic economic principles of supply and demand.

2. This implies impossible scenarios

The logic of fully diluted market capitalization in cryptocurrencies implies impossible scenarios. If the fully diluted market capitalization of FTT is $8.5 billion, while the market capitalization is $3.5 billion, then the market implies that each person receiving an additional 200 million FTT tokens will create a value of $5 per token after receiving the extra tokens. As explained, the issuance of these 200 million tokens does not generate any profit. Therefore, the only way to achieve a fully diluted market capitalization of $8.5 billion is for those who receive these 200 million tokens to create a value of $5 billion overnight.

But how can they do that?

How does handing out more tokens to people increase its market value? This is impossible. These tokens are likely to be just stored in wallets as part of an investment portfolio. The recipients will do nothing other than trade these extra tokens.

3. Unexpected Consequences

The unexpected consequence of the complete dilution market value logic of cryptocurrencies is the exaggeration of the protocol’s value. Investors, whether right or wrong, often believe that the larger the market value of an asset, the higher its value and stability. Investors feel reassured by the huge completely diluted market value valuation of these protocols, but often fail to realize the logical flaw in the calculation of the completely diluted market value. In this regard, FTT is the main culprit.

When the price of FTT is $50, its market value is $7 billion, and the completely diluted market value is $17 billion. However, during that time, the average daily trading volume of FTT rarely exceeded a few hundred million dollars.

The huge completely diluted market value, small market value, and tiny trading volume are the reasons for the disaster. Some tokens executed this pattern during the peak of the cryptocurrency market. This setup made market manipulation possible. The small trading volume allowed a few parties to control the volume and thus control the price. The token price determined the market value, which ultimately determined the completely diluted market value. This means that tokens that are hardly traded or involved in money laundering transactions support artificially inflated token values, and the exaggerated value is used as collateral for loans. It also hides the actual size of the investment.

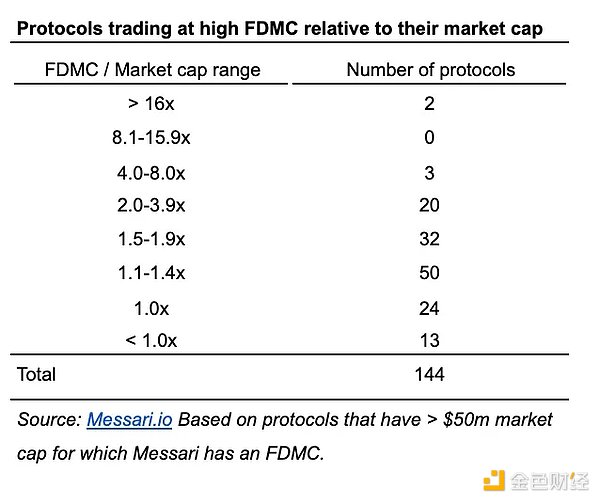

Today, assets with high completely diluted market values and low market values are no longer so common. But they still exist. The following table lists the number of protocols with a multiple relationship between the completely diluted market value and the market value.

4. Token Issuance is Becoming More Like Stock-Based Compensation

Since Satoshi Nakamoto wrote the Bitcoin whitepaper, the purpose of token issuance has changed significantly. Tokens are issued for various purposes other than rewarding network miners and validators.

Token issuance is becoming more like equity compensation in the cryptocurrency market. Protocols reward participants in building the network by granting them native tokens, just like companies grant employees, advisors, and investors stock options to reward their contributions to the company.

Token issuance should be seen as similar to stock-based compensation. Issuing tokens, like issuing shares, is a cost for the protocol or company. It dilutes the number of circulating tokens or shares. However, if done correctly, this cost is an investment. It generates returns. The stock granted to a hardworking employee can create value for the company that exceeds the value of the granted stock. Similarly, network participants can create value for the protocol that exceeds the value of the granted tokens.

The returns generated from the granted stock or tokens may not be known until much later. Before that, a well-thought-out stock or token grant plan is the best guide and can indicate possible scenarios: a large-scale use of token distribution or severe dilution with no value.

Not all token distributions are equal

The fully diluted market cap calculation includes all future token issuances. However, not all token issuances are the same. Some tokens are allocated to early adopters, some to the founding team, and others to early investors. Some tokens are allocated to the protocol’s foundation for future use. These include tokens allocated to the protocol’s reserve and ecosystem funds. They are tokens intended for the development of the network. Tokens intended for future investments in the network should not be included in the circulating token supply.

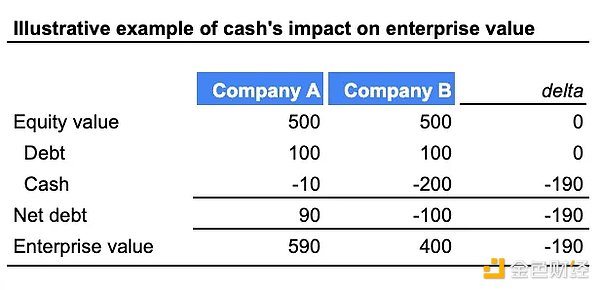

Tokens allocated for future investments are equivalent to cash on a company’s balance sheet. Cash on a balance sheet reduces the overall value of the company. The overall value of a company is its enterprise value. Enterprise value reflects the value of all the company’s assets. A part of the enterprise value is the equity value of the company. For a publicly traded company, the equity value is its market capitalization. Another part is net debt. Net debt is the total debt minus cash. The concept is that the total assets of a company are funded by equity and net debt. The table below shows how increasing cash reduces the enterprise value of a company under otherwise identical conditions.

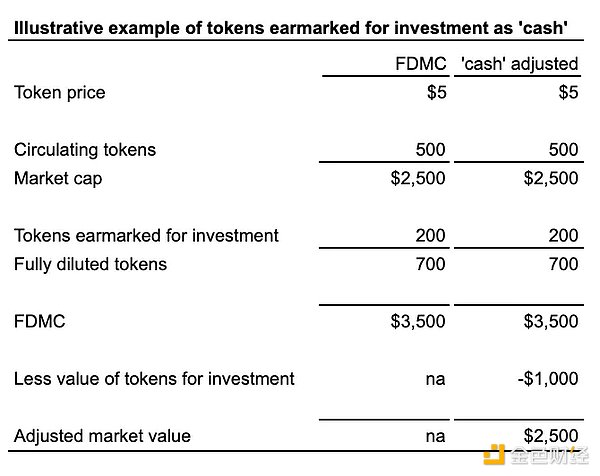

The value of tokens allocated for investments is equal to the token price multiplied by the designated number of tokens. This is the funding that the protocol must invest. It is equivalent to cash on the balance sheet.

The table below mechanically outlines this logic. The example in the table outlines a protocol with a circulating supply of 500 tokens. An additional 200 tokens are issued to the reserve. These 200 tokens are designated for investments in the network. With a token price of $5, the market cap and fully diluted market cap are $2,500 and $3,500 respectively. The value of the 200 tokens designated for investments in the reserve is $1,000. This $1,000 value should reduce the overall value of the protocol, just as cash reduces the enterprise value of a company.

Tokens allocated for future investments can be thought of as the unissued shares of a company. The conclusion is the same as treating them as “cash”. The unissued shares that Apple may issue in the future are not included in its fully diluted market cap. Apple can sell shares to generate cash inflows. This cash can be used to develop Apple’s products. The future value of these products will ultimately be reflected in Apple’s market capitalization. Similarly, a protocol can issue tokens to its treasury to generate “cash” inflows for investment in its network. The difference is that for a protocol, the “cash” is its native token. It doesn’t actually need to sell shares on the market to generate revenue like Apple does. In this case, the protocol is more like the Federal Reserve, which issues more currency to pay for expenses.

The difference lies in flexibility

The reason why protocols have so many tokens in circulation from the beginning is because their structures are very flexible. Companies can freely issue and repurchase shares, but they require approval from the board of directors and ultimate shareholders. In contrast, protocols attempt to make issuing and destroying tokens much easier.

From the beginning, the protocol needs to determine how many total tokens will be issued and when they will be issued. This is a mindset of “everything is determined on the first day”. Companies and the Federal Reserve do not operate with such strictness. The number of company shares and the amount of circulating dollars fluctuate based on market dynamics. The protocol needs to disclose a certain number of tokens because their tokens are used as currency value to reward network participants. If the token quantity is uncertain, participants will be concerned that the value of the currency they receive will depreciate due to token inflation. The cost of eliminating this concern is an inflexible token structure.

Exaggerated Fully Diluted Market Cap (FDMC)

Some protocols exaggerate the fully diluted market cap (FDMC). The number of tokens used to calculate FDMC includes tokens issued to the protocol treasury for investment. The expanded token circulation leads to an exaggerated FDMC. This further leads to higher valuation multiples.

For example, Arbitrum and Optimism exaggerate FDMC. Their FDMC includes the total number of tokens to be eventually issued. However, in both cases, a large number of tokens are issued to the finance department or equivalent departments. These tokens are designated for investment in the ecosystem. By removing these tokens from the total token circulation, a more accurate adjusted token supply can be obtained, resulting in an adjusted market cap.

The table below illustrates the adjustments made to the token circulation for Arbitrum and Optimism. The adjusted token supply is 45% lower than the fully diluted figure.

So what is the correct token supply?

The circulating supply is correct to some extent. It reflects the current number of tokens issued. But it ignores the impact of future token issuance. The fully diluted supply is also correct to some extent. It reflects the total number of tokens to be eventually issued. But it fails to adjust for tokens issued to the treasury. The adjusted figure should be based on the fully diluted figure and exclude tokens issued to the treasury.

One thing is certain, the fully diluted market cap figure is misleading. Sharp analysts should not exaggerate the protocol’s market cap based on future token issuance, but weaken the existing valuation by the dilution impact of future issuance.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!