LianGuaiRT 1

Industry Analysis

NFT Market Declines Significantly Compared to Last Year

- Key Policy Elements for Cryptocurrencies

- Argentine cryptocurrency trader Fernando suspected of being murdered and dismembered by professionals

- Is there any situation in which virtual currency involvement in pyramid schemes is considered innocent?

-

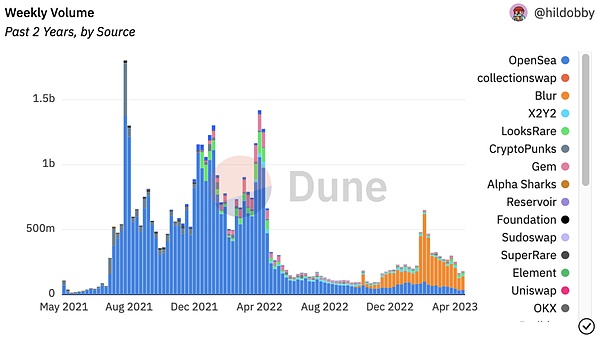

The sales volume of non-fungible tokens (NFTs) has dropped to an average of about $19,000 per day this week, a decrease of 92% compared to the peak in September last year (approximately $225,000).

-

The number of active wallets in the NFT market has decreased by 88% from the peak of 119,000 in November last year, with only about 14,000 remaining last week.

-

Both OpenSea and Blur have observed a downward trend in daily unique users and sales, which may be a combination of various factors.

-

The reasons for the decline in users and sales are still unclear, and they may be influenced by “macro conditions”. It is also possible that they are caused by high gas prices and cash flow issues during tax season.

Opensea has long been the representative of the entire NFT market, occupying 70%-90% market share

-

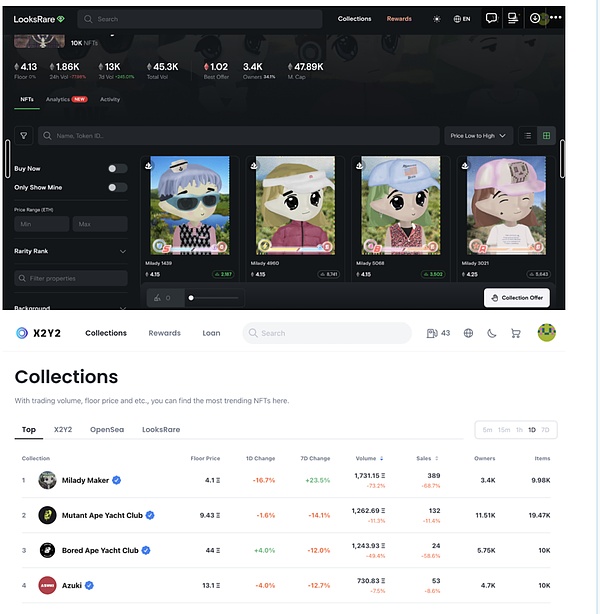

Several challengers have tried to challenge OpenSea’s monopoly position, but they have been unable to overthrow OpenSea (e.g. Magic Eden, LooksRare, X2Y2, Gem.xyz, and Sudoswap).

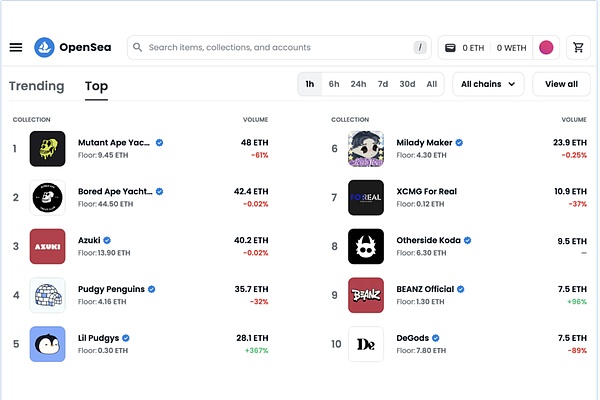

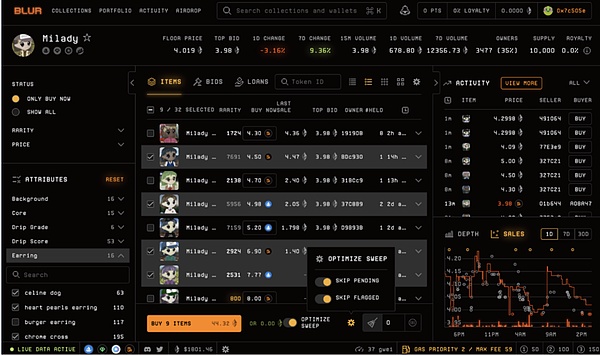

A new player, Blur, has entered the market and exceeded everyone’s expectations, surpassing OpenSea in trading volume

-

Opensea still leads in the number of NFTs sold/traded in the NFT market and has more unique users.

-

Blur dominates the market in terms of trading volume, surpassing OpenSea despite the decline in NFT trading volume.

No need to compete for the small user group currently trading on-chain

-

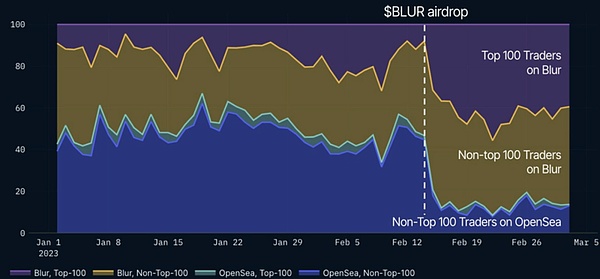

Over 45% of the NFT market trading volume comes from blue-chip NFT investors.

-

24% of the trading volume comes from the top 1% of NFT whales on Opensea.

-

The top 1% of Blur wallets account for 70% of TVL, and only 100 traders account for 46% of the trading volume.

LianGuaiRT 2 Comparison of Competitive Advantages and Disadvantages

From the buyer’s perspective when BLUR was launched:

Provide suitable tools for professional NFT trading

-

Whale investors can get rid of a large number of NFTs on Blur, and the platform’s bidding feature is similar to automated order matching, further incentivizing liquidity.

Low fees

-

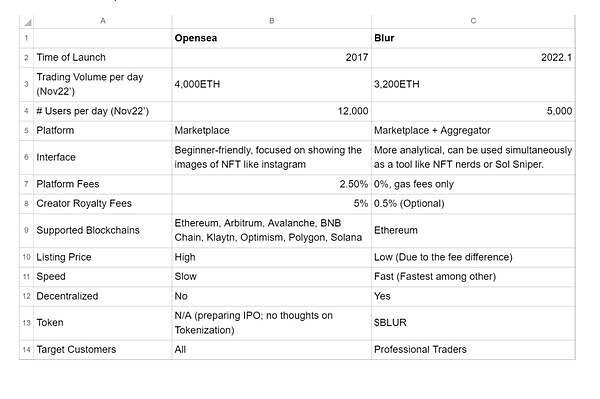

Investors’ concern is that the total fees on Opensea are very high. It used to be 15 times that of Blur. (Opensea: 7.5%. Blur: 0.5%)

-

Blur’s zero platform fees attract traders and investors.

-

The large-scale transfer of NFTs by whale traders (71 Bored Ape Yacht Club (BAYC) NFTs, 11 Mutant Ape Yacht Clubs (MAYCs), 7 Azukis and BEANZ NFTs) is much cheaper compared to Opensea. The prices remain stable and do not immediately drop.

-

This news went viral, and many whale investors quickly rushed into Blur.

Token Incentives

-

Blur uses the $BLUR token as a strategy to attract whale investors to its platform.

-

The $BLUR token aims to provide unique value to professional NFT traders, giving them the opportunity to benefit from a lower fee structure on the platform.

-

Many traders believe that Opensea will not use tokenization as a marketing tactic because Opensea is seeking an IPO rather than an ICO.

Faster Speed

-

According to Blur’s official statement, Blur is ten times faster than GEM (Opensea Pro), essentially achieving the fastest listing information updates among all platforms.

-

Processing time: 0.4 seconds (BLUR) vs. 9.4 seconds (GEM)

-

List update time: 4 seconds (BLUR) vs. 51 seconds (GEM)

-

It is crucial to be fast because users may not be able to submit transactions or miss opportunities if submissions are not completed in a timely manner, resulting in gas fee losses.

Liquidity

-

Many NFT markets, including Opensea, do not have real-time order books. (Refresh the underlying system)

-

Blur positions itself as a real-time spot exchange for NFTs.

When Blur began to pose a threat to Opensea, Opensea announced that it would charge the same fees as Blur and issue tokens. In addition, Opensea also released Opensea Pro, designed for professional traders. However, despite Opensea’s proactive and rapid improvement measures, Blur still maintains an advantage due to its better UI/UX, price change and trading record charts, and faster speed.

LianGuaiRT 3 compared to the previous so-called “Opensea Killer”

1. LooksRare, X2Y2, and OpenSea are all NFT markets with similar browsing, buying, and listing experiences.

-

No significant difference in user experience

2. Blur’s airdrop strategy: Never incentivize trading volume, only incentivize liquidity and order placement

-

Many other markets that have launched airdrops directly link token rewards to trading volume, which has failed due to high wash trading rates (both in the NFT market and DeFi market)

-

Boosts the metrics, but everyone knows those are fake.

-

It is also difficult for developers as they cannot speculate on how the platform will perform.

LianGuaiRT 4 Conclusion: What can we learn?

1. Airdrops and tokenization are ways to attract customers to the platform, and newcomers should be cautious.

-

Providing tokenized airdrops to the community will not last long. When organizing airdrop activities, the efficiency of token airdrops should be highly considered.

-

Platforms that have airdrops usually face sustainability issues as the number of users decreases along with the decrease in reward token quantity.

2. The next step for them after receiving the airdrop is the platform’s fundamental value.

-

Looksrare and X2Y2 were launched prior to Blur and failed to differentiate themselves in terms of user experience, showcasing similar designs and features.

3. Professional traders are an important customer segment for newcomers.

-

Professional users are more sensitive to better services and incentives.

-

Since Web3 has not yet reached the stage of mass adoption, professional users occupy a large portion of the market share, especially in the NFT market.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!