Status compression has reduced the cost of NFT minting on Solana by over 2000 times.

Source: X

Author: Nansen

- Ordinals vs Taro Feasibility Discussion of Bitcoin Layer 2 Network (Part 2)

- Brazil’s securities regulatory agency plans to establish a tokenized sandbox in 2024.

- Forbes Survey | How Did Zhao Changpeng Turn a Failed Token ICO into Unexpected Billions of Dollars

Translation: Yvonne

Note: The original article was published by @nansen_ai, compiled and translated by MarsBit.

We are pleased to release our comprehensive in-depth research on the Solana ecosystem. The content covers catalysts, risks, advantages, on-chain data, and network development of the ecosystem.

Since the beginning of this year, Solana’s TVL has almost doubled, reaching 30.95 million SOL.

Source: @DefiLlama

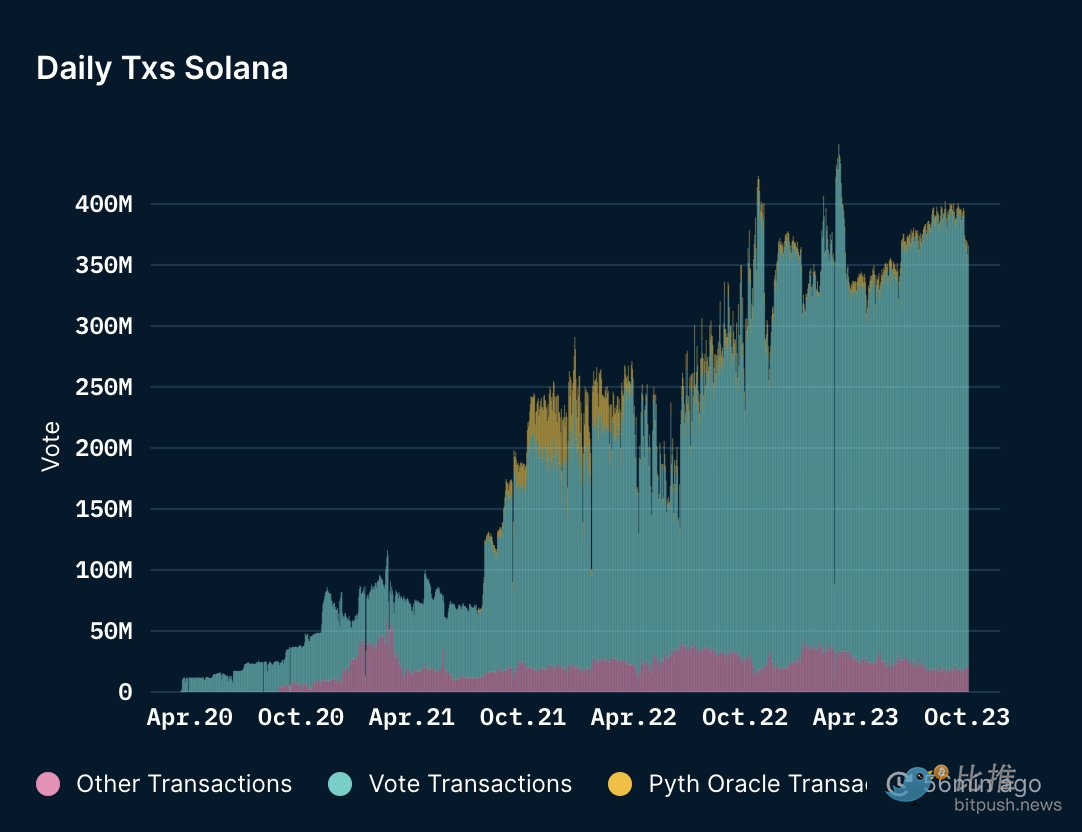

This year, Solana’s monthly transactions have been relatively stable, with an increase in voting transactions. (Solana’s transactions include voting and non-voting transactions)

Despite incidents such as network interruptions and FTX/Alameda crashes in the past, Solana has been operating almost normally this year, demonstrating significant improvements and resilience.

Solana’s growing TVL, strong DeFi development speed, and stable monthly transaction data highlight its potential to become a center of active economic activity.

Solana has introduced solutions such as state compression and segregated fee markets to address prominent issues in its technical stack.

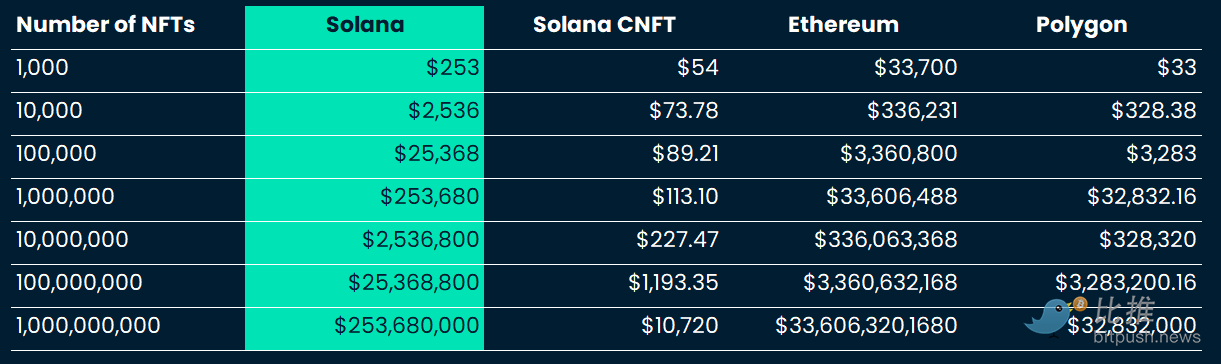

For example, state compression has reduced the cost of NFT minting on Solana by over 2000 times.

Source: @flipsidecrypto

The cost of minting 1 million NFTs on Solana was $253,000 before state compression was enabled, and only $113 after state compression was enabled. A similar scale of NFT minting on Ethereum would cost $33.6 million, and on Polygon it would cost $32.8 million.

The field of liquidity staking is developing rapidly, with @MarinadeFinance, @LidoFinance, and @jito_sol making a name for themselves in this field.

Less than 3% of total SOL is staked in Solana’s liquidity staking protocol, indicating significant growth opportunities.

Source: @flipsidecrypto

Interest from enterprises in adopting and payment channels is increasing, especially with Visa integrating settlements with USDC on Solana, the growth of liquidity staking on Solana, and partnerships with entities like Shopify.

Other potential advantages of Solana include: increasing adoption by more enterprises, the successful realization of the Firedancer vision, and the growth of applications that leverage Solana’s advantages to serve consumers.

Solana has developed an impressive range of technologies to address key challenges and has opened up potential future directions in infrastructure, applications, and collaboration with traditional financial stacks.

However, potential challenges such as the uncertainty of FTX/Alameda’s holdings of SOL may pose temporary risks to its growth trajectory.

FTX holds a large amount of SOL, with over 71.8 million SOL locked and held, worth approximately $1.16 billion. This accounts for 17% of the circulating supply of SOL (as we have written), and 13% of its total supply.

(Disclaimer: These data are based on addresses that we are aware of. FTX may hold more.)

So far, Solana’s journey symbolizes a broader trajectory of blockchain development – full of hope, occasional challenges, but constantly evolving.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!