Author: Jesse Coghlan, Cointelegraph; Translation: Song Xue, LianGuai

The US Consumer Financial Protection Bureau is considering applying the Electronic Fund Transfer Act (EFTA) to cryptocurrencies to protect consumers from fraudulent cryptocurrency transfers.

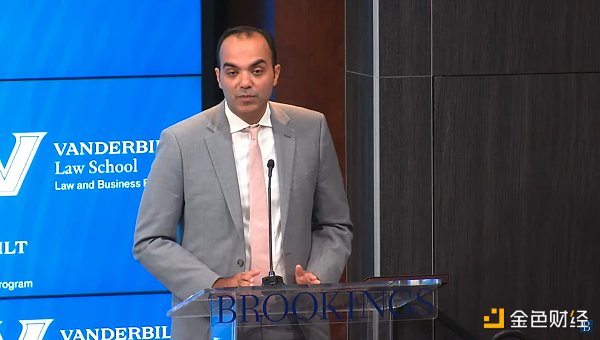

During a speech at the Brookings Institution’s payment conference on October 6th, Rohit Chopra, the director of the Consumer Financial Protection Bureau (CFPB), stated that the agency is considering applying the EFTA to “private digital dollars and other virtual currencies.”

Chopra said, “In order to reduce the harm of errors, hacking attacks, and unauthorized transfers, the CFPB is exploring providing additional guidance to market participants to answer their questions about the applicability of the Electronic Fund Transfer Act to private digital dollars and other virtual currencies.”

- Market value has been declining for 18 consecutive months, who is the big winner in the stablecoin family?

- The biggest use case of crypto building permissionless identity

- Legal Analysis of Possible Embezzlement by Employees of a Digital Collectibles Company

The European Free Trade Association (EFTA) was established in 1978 as a federal law aimed at protecting consumers’ funds transferred electronically (whether through debit cards, ATMs, or bank accounts) and limiting the losses consumers suffer from unauthorized transfers.

Chopra stated that the CFPB’s cryptocurrency-related plans include providing guidance on how the existing Electronic Fund Transfer Act applies to cryptocurrencies. Source: YouTube

These regulations require financial institutions to inform consumers whether they are responsible for unauthorized transfers and when they should be held accountable. Disclosure of liability should be conveyed before the first electronic transfer occurs in the user’s account.

The agency is taking this step as the number of hacks on cryptocurrency platforms has increased by over 150%, and the first criminal trial of FTX co-founder Sam Bankman-Fried enters its second week, where he is charged with fraudulent access and use of customer funds.

The exchange also suffered over $400 million worth of hacks in the weeks following its bankruptcy.

Chopra added that the CFPB will also issue orders to “certain large technology companies” to obtain information about their business practices regarding the use of personal data and the issuance of private currencies.

In addition, the agency will also study the regulation of non-bank institutions that provide payment platforms.

Chopra also suggested that the Financial Stability Oversight Council of the Treasury Department should classify certain cryptocurrency activities as “systemically important payment, clearing, or settlement activities.”

“For example, this can provide other institutions with critical oversight and tools to ensure that stablecoins are actually stable.”

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!