Author | Consensys&YouGov

Translator | Huohuo

Produced by | Easy Blockchain (ID: hellobtc)

Since the birth of Bitcoin in 2009, discussions around the crypto industry have been active, mainly focused on “Money Crypto”. This includes price fluctuations of cryptocurrencies such as Ethereum (ETH) and Litecoin (LTC), as well as regulatory and legal issues of CEXs like FTX.

Consensys and YouGov conducted a global survey on crypto and Web3, aiming to understand the views and insights of people from different regions worldwide regarding crypto and Web3. In addition to typical questions about investment in crypto assets, the survey explored topics such as data privacy, digital ownership, and recent crypto news cycles. This report interviewed 15,158 people aged 18 to 65 from 15 countries in North and South America, Europe, Africa, and Asia to form the survey results.

01, Data Privacy, Value Creation, and the Current Financial System

(1) Data Privacy

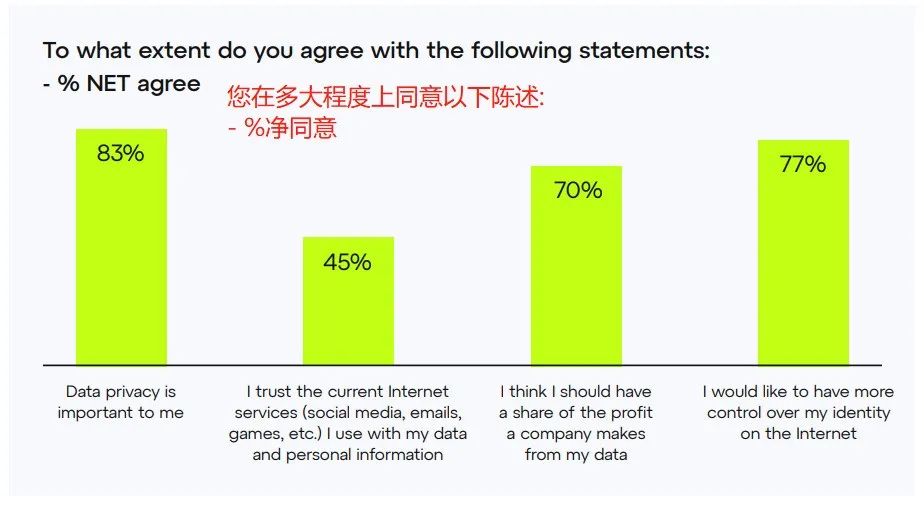

Do people worry about their data privacy? Globally, 83% of people believe data privacy is important. However, in countries with strong data protection laws, such as Germany (58%), the United Kingdom (57%), and France (63%), people are somewhat ambivalent about the importance of data privacy because it is already well-protected.

Although data privacy is important to most respondents, only 45% of respondents fully trust current Internet services (social media, email, games, etc.) to securely use their data and personal information. 79% of respondents want more control over their online identity, and 70% believe they should share in the profits companies make from their data.

In Nigeria and Indonesia, respondents have higher trust in their data usage, but they are also more likely to want better control over their online identity and have high expectations for sharing profits from their data.

To what extent do you agree with the following statement? Data privacy is very important to me

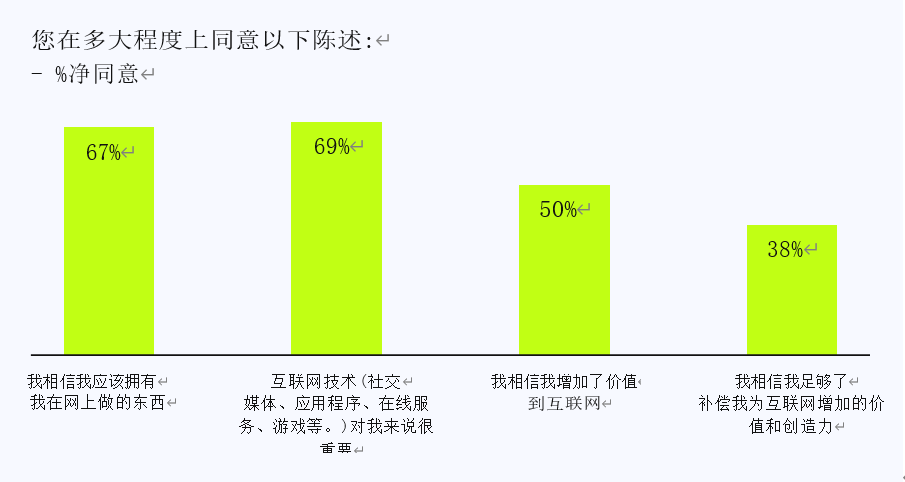

(2) Views on creating value on the Internet

There is a strong sense of value and ownership among respondents, with 50% believing that they add value to the Internet and 67% asserting that they have the right to own what they create online. However, only 38% feel that their creative contributions are fully compensated. Respondents from France, Germany, and Japan have a lower sense of the value and ownership of what they create online, and they also feel that their contributions are less compensated.

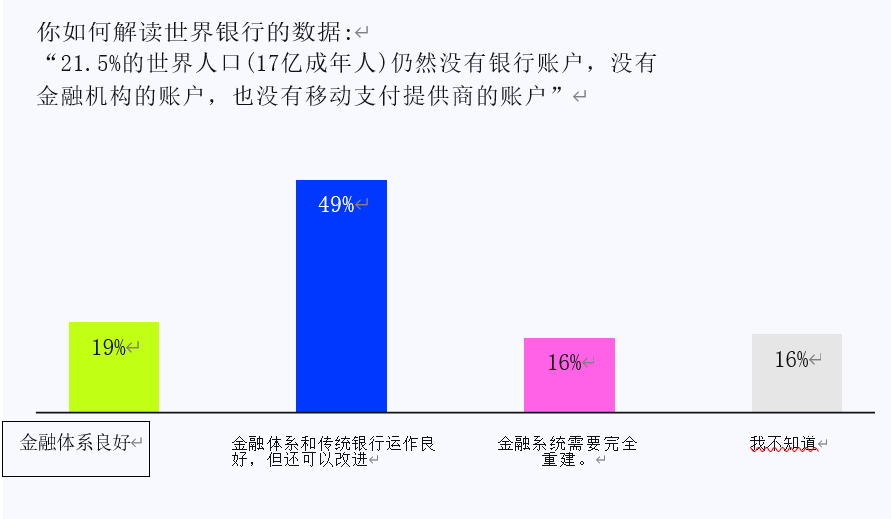

(3) Views on the current financial system

Most people believe that the current financial system can be improved, and this view is particularly strong in Nigeria. In addition, most respondents agree that Tech Crypto can help to transform or rebuild the ecosystem. Countries such as Nigeria, South Africa, Brazil, Vietnam, the Philippines, India, and Indonesia have a higher degree of recognition in this regard.

02, Adoption of Cryptocurrency Applications Worldwide: Public Awareness, Cryptocurrency Holdings and Entry Barriers

Despite frequent mentions of cryptocurrency assets in the media and public discussions, do people really know what cryptocurrency assets are? Do people own or plan to own some cryptocurrency assets in the near future? What do people around the world think about cryptocurrency assets?

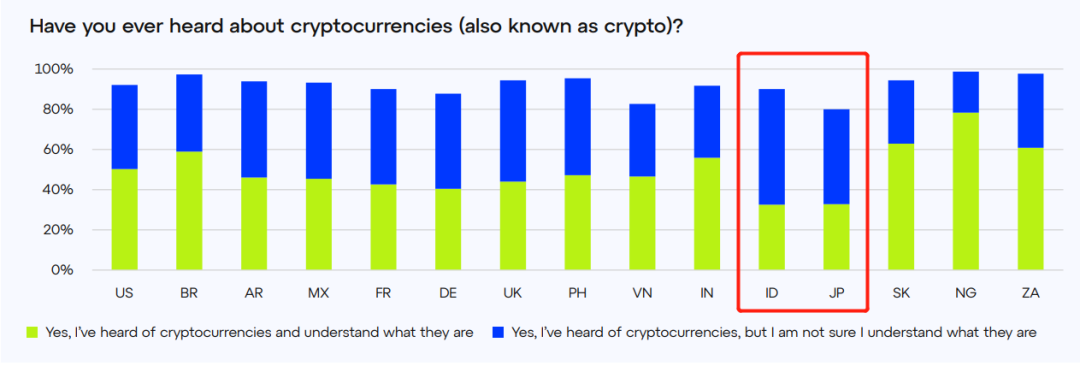

(1) Public Awareness

Overall, the majority of people (92% worldwide) are aware of cryptocurrency assets. Of these, 50% claim to also understand what they are. In the following countries, there is a significantly higher level of understanding of cryptocurrency assets: Nigeria (78%), South Korea (63%), South Africa (61%), Brazil (59%), and India (56%). However, in Indonesia and Japan, the percentage of people claiming to understand cryptocurrency is lower, with only one-third of people saying they know what cryptocurrency is.

Have you heard of cryptocurrency? (Green for Yes / Blue for No)

The understanding of different populations regarding cryptocurrencies varies significantly, consistent with the global digital divide in age and gender. Men aged 25-34 are the social demographic that is more knowledgeable about this financial technology, while women and older respondents are less knowledgeable. This is a trend that only appears with varying intensity in most of the countries analyzed.

(2) Ownership of Cryptocurrencies

40% of respondents worldwide currently own or have bought cryptocurrencies. Among the surveyed countries, the highest proportion of past or current owners is in the United States, the Philippines, Vietnam, India, Nigeria, and South Africa. On the other hand, Japan, Argentina, Mexico, and European countries (France, Germany, the UK) lag further behind, with a higher likelihood of never having bought any cryptocurrencies. Nigeria has particularly high ownership levels, with seven out of ten people confirming that they own or have owned cryptocurrencies.

Have you ever bought cryptocurrency (Bitcoin, Ethereum, etc.)?

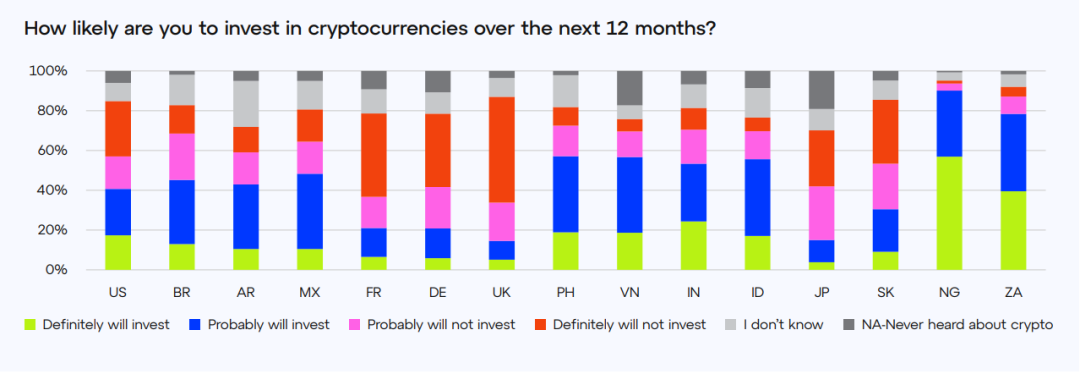

When looking to the future of owning cryptocurrencies, Asia and Africa are generally more willing to invest in cryptocurrencies: Nigeria (90% definitely or possibly investing), South Africa (78%), the Philippines (57%), Vietnam (57%), Indonesia (56%), and India (53%). This is in stark contrast to Europe and Japan, which have much lower willingness, with high proportions of respondents confirming that they will definitely not invest.

How likely are you to invest in cryptocurrency in the next 12 months?

(3) Barriers to Entry

The cryptocurrency ecosystem faces challenges in improving adoption rates, as respondents often perceive the market as too unstable, risky, or express concerns about potential fraud. These issues are particularly pronounced in Brazil, the Philippines, and South Africa.

More education on how to safely access web3 platforms could be helpful for adoption in countries like Nigeria and South Africa, where investment willingness is highest despite associated risks. This is because when respondents are willing to participate in the ecosystem, they may not necessarily know where to start and how to protect themselves, especially in the case of South America (Brazil 18%, Argentina 19%, Mexico 20%), the Philippines (17%), and India (21%).

What do you think is the main barrier to entering the crypto ecosystem?

Please rank the following options in order of importance — top choice

03, The Recent Crypto Cycle: The Impact of Centralized Crypto Big Company Bankruptcy

2022 has been a year of CEX bankruptcies such as FTX and Celsius, but has the public noticed?

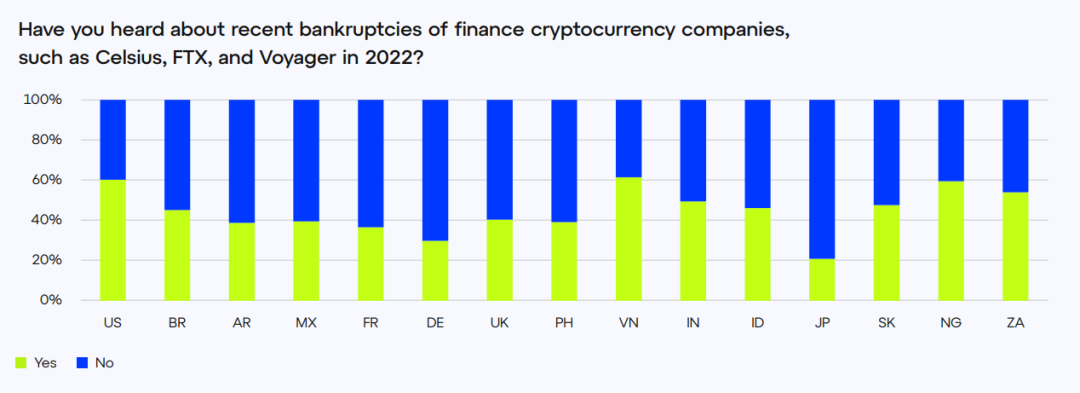

Approximately two-thirds of global respondents have heard about these CEX bankruptcies, but there are significant differences between countries. The United States, Vietnam, India, Nigeria, and South Africa are more aware of this, with over half of the population in each of these countries being aware. In contrast, only 1/5 of Japanese respondents have heard of it.

Have you heard of recent financial cryptocurrency company bankruptcies?

For example, Celsius, FTX, Voyager in 2022?

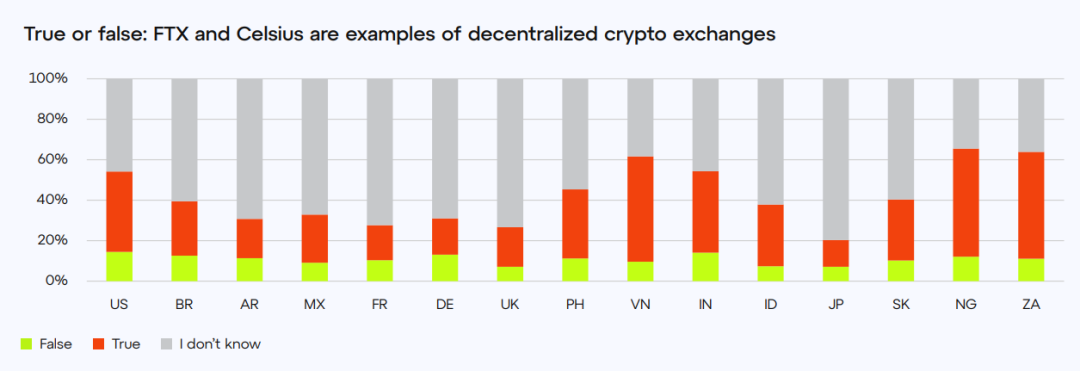

Most respondents mistakenly believe that FTX and Celsius are DEX. This misunderstanding is particularly common in Nigeria (53%), South Africa (53%), and Vietnam (52%). Respondents in the United States and India are more likely to correctly identify that FTX and Celsius are not DEX, but this number barely reaches 14% in both countries.

True or False: Are FTX and Celsius DEX?

This series of CEX bankruptcies has had an impact on respondents’ overall trust in blockchain, crypto, and web3. However, respondents in Germany, Vietnam, India, and South Africa are more likely to claim that this has had no impact on their trust in the ecosystem.

Do you think that the bankruptcy of several CEXs in 2022 has affected people’s trust in blockchain, crypto, or web3?

How to rebuild trust?

All countries agree that improving security measures and transparency are key actions to rebuild industry trust. South Korea and Vietnam hope that government agencies will intervene to improve regulatory systems. Accountability is also considered crucial in Asia, especially in Japan and Indonesia, while Nigeria and Argentina tend to focus on educating and exchanging risks and practices with users.

04, Opportunities in Web3: About NFTs and Metaverse

From NFTs to the underlying technology blockchain in the metaverse, web3 encompasses several different concepts. Do people know what blockchain is? Have they heard of NFTs? Do they plan to own some in the future?

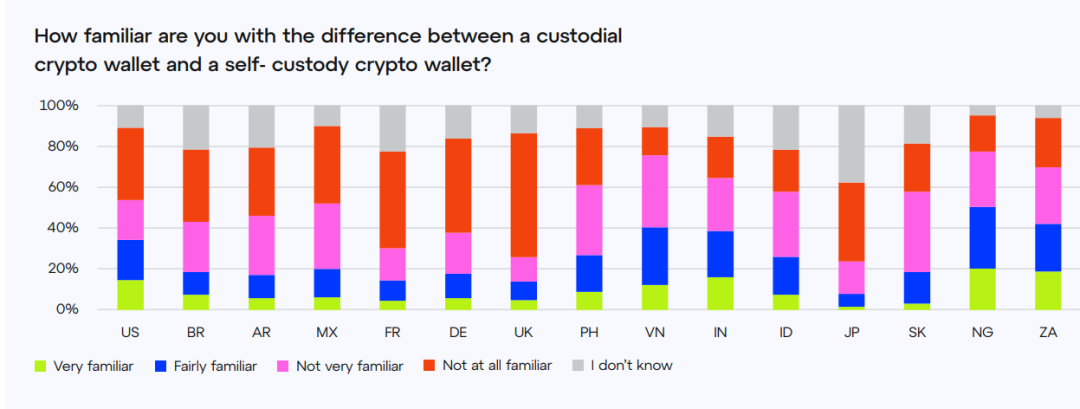

The majority of global respondents are not familiar with the difference between custodial and self-custodial wallets. This lack of familiarity is particularly pronounced in the UK (72% not very familiar or not familiar at all) and Mexico (70%). However, those familiar with the concept are mainly in Nigeria (50% very familiar or quite familiar), South Africa (42%), Vietnam (40%), and India (39%).

How familiar are you with custodial and self-custodial wallets?

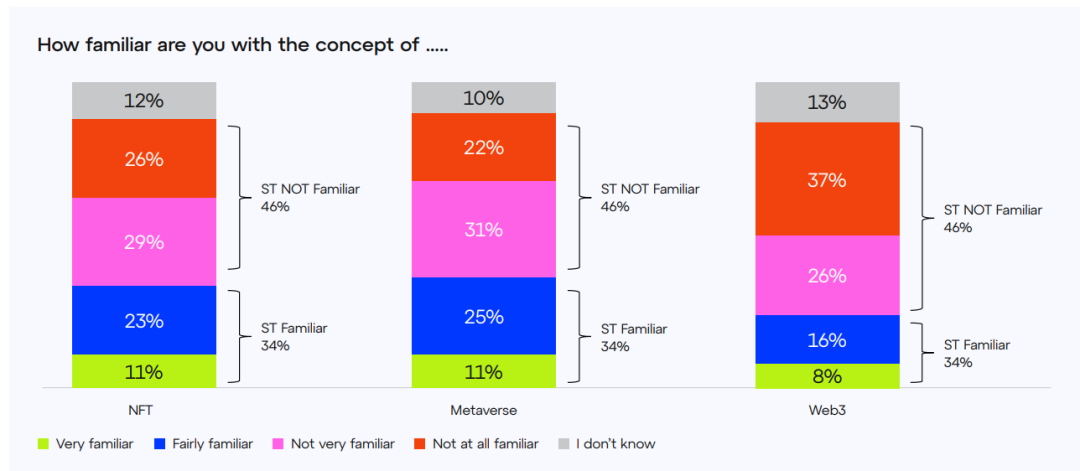

The majority of global respondents are familiar with all the concepts tested in the survey. However, there are also related differences: the most popular concepts are metaverse (36%) and NFTs (34%), while web3 is the least known concept, with only 24% of respondents familiar with it.

How familiar are you with these concepts?  ST = Net percentage (e.g. ST family = “very familiar” + “quite familiar”)

ST = Net percentage (e.g. ST family = “very familiar” + “quite familiar”)

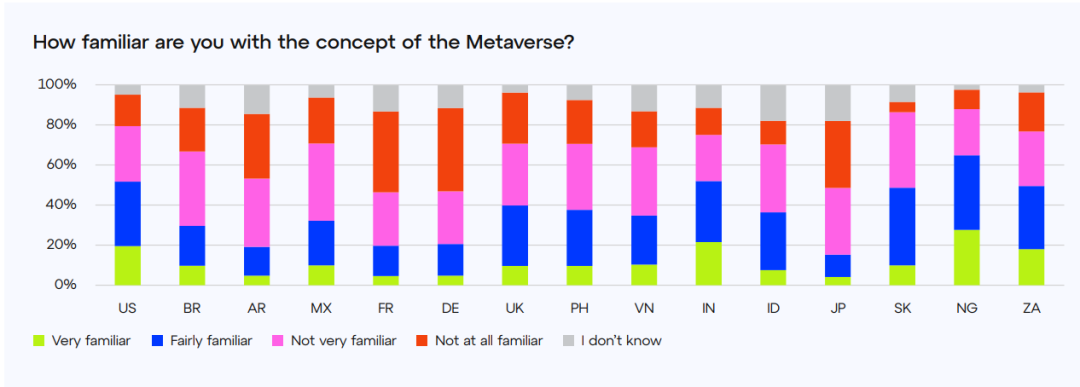

In different countries, these trends show important differences. Respondents from the US, India, South Korea, Nigeria, and South Africa are the most familiar with the metaverse, while respondents from Europe, Latin America, and Japan are the least familiar.

How familiar are you with the concept of the metaverse?

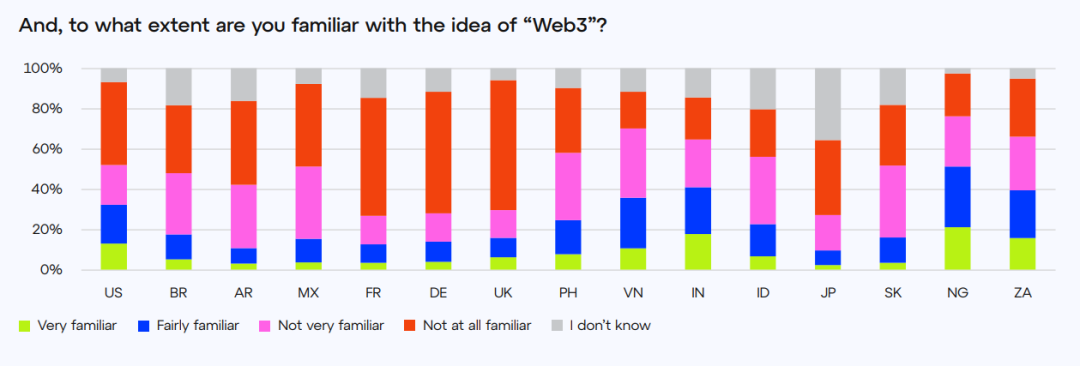

Web3 is seemingly the least known concept globally. However, Nigerians and Vietnamese respondents are very familiar with this concept. Specifically, one quarter of Nigerians claim to be very familiar with the concept. Conversely, European countries and Japan tend to exhibit lower levels of familiarity, with the only exception being UK respondents who tend to be more familiar, with men having higher familiarity.

How familiar are you with the concept of Web3?

Regarding familiarity with NFTs, the United States, India, and South Africa, and especially Nigeria are the most familiar countries. Conversely, the proportion of respondents who are unfamiliar with it is highest in South America, European countries, and Japan.

How familiar are you with the concept of NFTs?

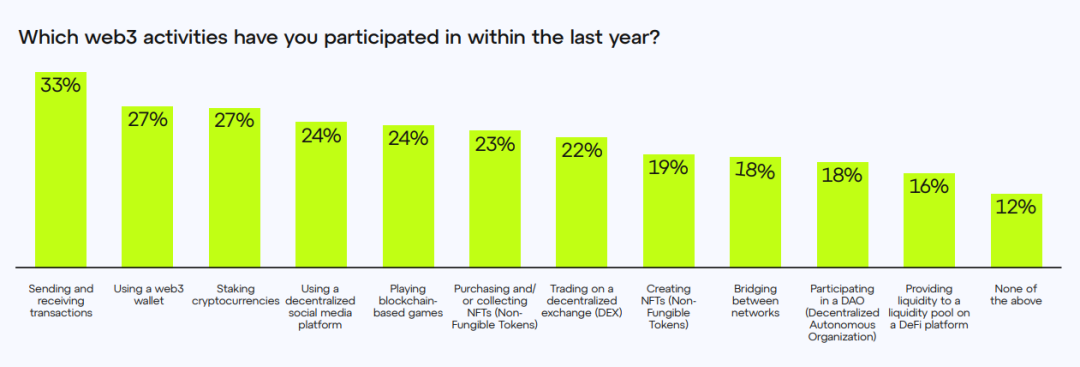

Globally, the most common web3 activity is sending and receiving transactions, with one third of respondents familiar with the web3 concept engaging in this task. The next most common activities in the ranking include using a web3 wallet and staking crypto assets, both at 27%. The latter two activities in the top five are using decentralized social media platforms and playing blockchain-based games.

Which web3 activities did you participate in last year?

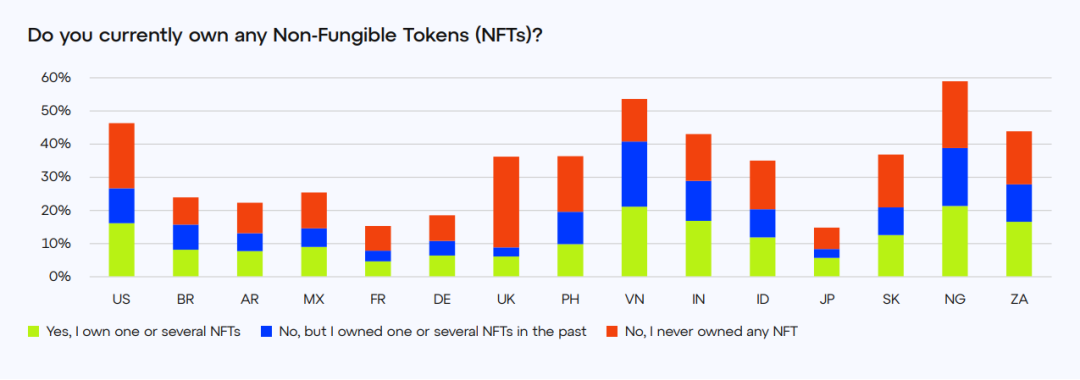

Vietnam, India, and South Africa are the countries with the most NFT owners among respondents; while European countries have the fewest. However, these figures are limited by the limited level of awareness in most countries.

How many NFTs do you own now?

05, Summary

-

While global awareness of cryptocurrency is relatively strong, awareness of web3 is low.

-

Overall, the majority of people (92% globally) are aware of cryptocurrency. However, there are still differences between countries, with Nigeria, South Africa, and Brazil being the most aware. Despite the high global awareness of cryptocurrency, only 8% of respondents consider themselves very familiar with the concept of web3. This highlights the disconnect between public awareness of web3 and its potential as a solution for today’s internet privacy, identity, and digital ownership issues.

-

People crave more ownership and data privacy.

-

Despite many respondents not being familiar with web3, many people support the potential of Tech Crypto and the ecosystem. 50% of people feel they add value to the internet, and 67% feel they should own what they make on the internet. Additionally, 62% of global respondents feel their creative contributions are not adequately compensated.

-

Furthermore, concerns about data privacy are prominent, with 83% of respondents prioritizing data privacy, 70% of people feel they should share in profits companies make from their data, and 79% want more control over their online identity. These findings highlight the importance of helping people understand how web3 can give them more ownership over their identity and ownership on the internet, as well as providing users with greater privacy assurances and sharing profits companies currently make from users’ online activities.

-

Regional differences

-

Another clear divide emerged when comparing opinions across countries. European countries show a greater degree of skepticism towards cryptocurrency, a behavior also reflected in countries like Japan and South Korea. In these countries, there is a stronger association of cryptocurrency with negative concepts like illicit use. By contrast, most countries in Southeast Asia, South America, and Africa generally show a more enthusiastic attitude towards crypto and web3. Therefore, in these countries, there is a stronger association with concepts like future currency, digital ownership, or alternatives to traditional financial ecosystems.

Additionally, in countries with unstable fiat currencies such as Argentina and Nigeria, crypto is seen as an important way to access global capital and mitigate inflation.

-

From “User” to “Builder”: A Paradigm Shift

Survey results show an encouraging shift in mainstream attitudes, with people hoping the internet can provide more control over the data we share online and a fairer share of profits with creators. However, there is a significant gap between understanding of crypto and practical understanding and utilization of web3 technology. This disconnect provides a valuable opportunity for mainstream web3 applications to address the agency gap in today’s internet landscape.

We see an opportunity for internet users to adopt “builder” thinking, realizing they can use web3 products to address issues of network ownership, identity, privacy, and creator tokenization.

Therefore, this is why web3 builders need to focus on rebuilding connections with the public around Tech Crypto, and the industry needs to build trust and understanding of web3 potential by appropriately understanding the public’s perceptions and attitudes towards Tech Crypto.

Original title: The State of Web3 perception around the world

Full report link: https://4795067.fs1.hubspotusercontent-na1.net/hubfs/4795067/Reports/Consensys-Global-Report-on-Crypto-and-Web3.pdf

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!