Author: Nancy, LianGuaiNews

On September 4th, the encrypted gambling platform Stake.com was attacked by hackers, with losses potentially reaching $41.3 million. Stake.com did not disclose the exact amount stolen, only stating that user funds are safe and all services have been restored.

The massive hacker attack has shocked the cryptocurrency community, and people are curious about Stake.com’s asset reserve strength. How was Stake.com able to fully cover the stolen losses in such a short period of time? What is the true income situation of this leading blockchain gambling platform?

A total of over $41 million stolen, and all services restored just five hours later

On the evening of September 4th, blockchain security organization PeckShield stated in a post that the encrypted gambling platform Stake.com was suspected to have been attacked. According to ZachXBT, the losses were approximately $15.7 million (including 6,000 ETH, 3.9 million USDT, 1.1 million USDC, and 900,000 DAI). Subsequently, blockchain detective ZachXBT sent another message stating that Stake.com had another $25.6 million transferred on the BSC and Polygon chains, bringing the total stolen amount to $41.3 million.

- Cryptocurrency is property, how should disposal issues be resolved in judicial practice?

- From the perspective of developers, why is it said that OP Rollup outshines ZK Rollup?

- Overview of the current status of Bitcoin holdings of 7 listed companies Most are in losses, but all continue to hold.

According to SlowMist founder Cosmos, the theft of Stake.com is related to issues with private keys. It may not necessarily be that the private keys were stolen, but it could also be that interfaces or services related to the private keys were maliciously exploited.

However, Stake.com’s official response to the theft incident seems particularly calm, only stating in a post that unauthorized transactions occurred in the ETH/BSC hot wallet, without providing detailed explanations of the incident. But the platform stated that user funds are safe and that BTC, LTC, XRP, EOS, TRX, and all other wallets are still operating normally.

Meanwhile, Stake.com co-founder Ed Craven tweeted, “For these reasons (the theft), Stake always reserves a portion of cryptocurrency in the hot wallet for emergencies. All affected wallets should be able to resume operations soon.” Additionally, Stake.com co-founder Bijan Tehrani stated, “When we can, we will share more information.”

Just about five hours later, Stake.com announced that all services have been restored and that deposits and withdrawals for all currencies are open again.

Annual revenue exceeds $2.6 billion, once accounting for 5.9% of total Bitcoin transactions

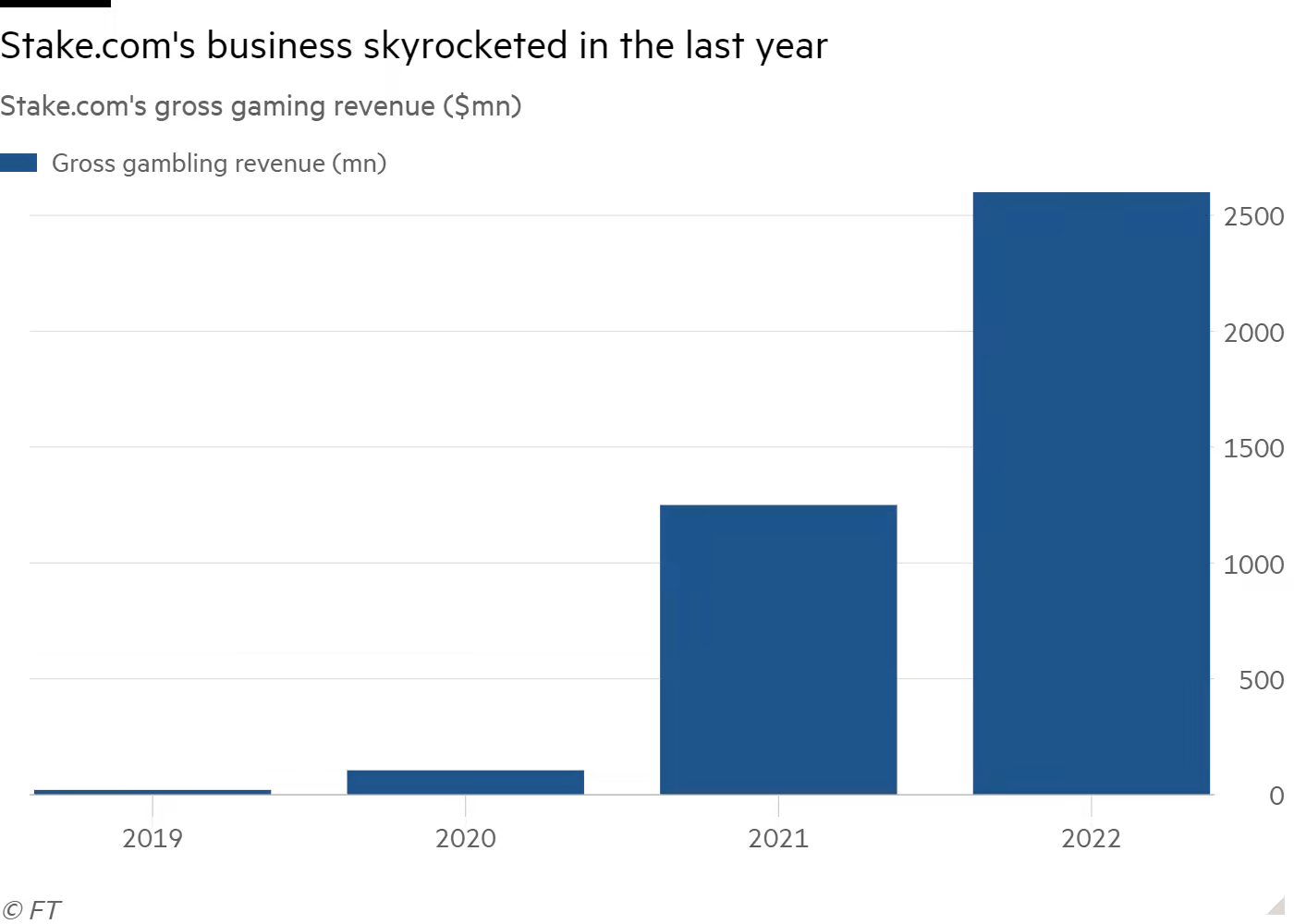

Stake.com is the seventh largest global gambling website located in Melbourne, Australia, with 600,000 regular users and 6 million registered accounts, mostly from “gray” areas in Brazil, Japan, and other Southeast Asian countries. According to consulting firm Regulus LianGuairtners, its annual revenue in 2022 alone reached nearly $2.6 billion, approximately double the total revenue of 2021 and nearly 26 times that of 2020, surpassing well-known gambling platforms such as DraftKings and 888.

Changes in Stake.com's Revenue from 2019 to 2022

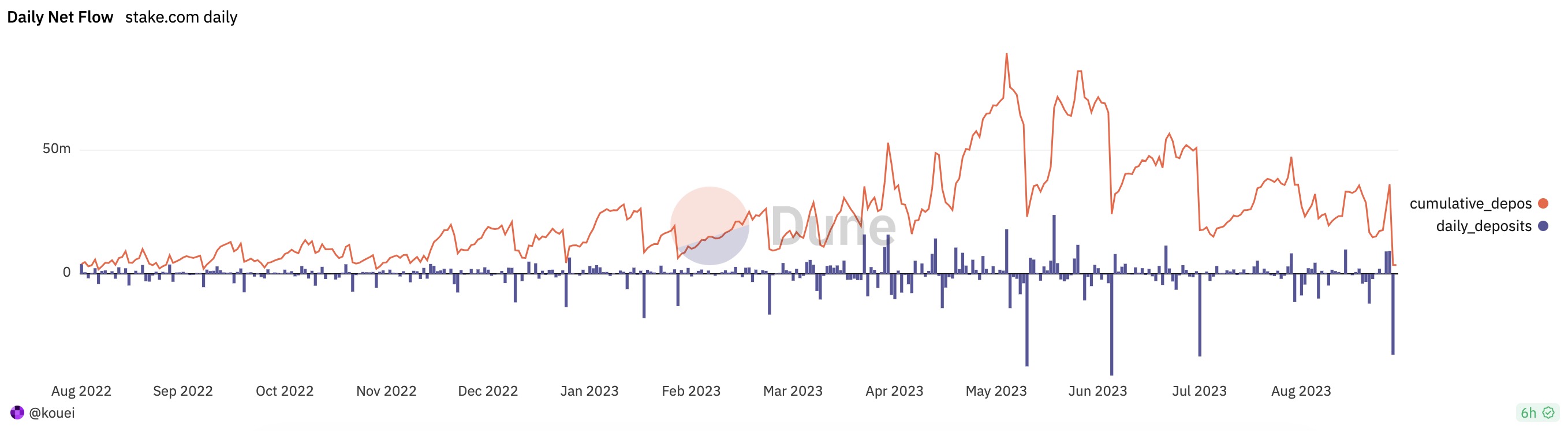

According to Dune data, since August 2022, Stake.com has accumulated customer deposits exceeding $2.16 billion, with a total of over 429,000 users.

It is worth mentioning that according to a tweet by Ed Craven, as of December 2022, Stake.com accounted for 5.9% of the total Bitcoin trading volume, 12.3% of the total Dogecoin trading volume, and 15.1% of the Litecoin trading volume.

Stake.com’s revenue of up to $2.6 billion far exceeds many other cryptocurrency platforms, such as Circle with annual revenue of $150 million in 2022, Bitdeer with a net income of over $333 million in 2022, and MakerDAO with a total revenue of $65 million in the 2022 fiscal year. It even surpasses the 2022 revenue of Rollbit, a recently popular gambling platform of the same type, which is $350 million. Based on these disclosed data, Stake.com is more than capable of covering the stolen funds.

The huge profits of Stake.com are attributed to the leadership of Ed Craven and Bijan Tehrani. Among them, Ed Craven is also one of the youngest self-made billionaires in the world. He ranked fifth on the 2022 Australian Financial Review Young Rich List with a net worth of $1.1 billion. Previously, he also made headlines for buying two Toorak mansions for over AUD 120 million.

According to the Financial Times, Ed Craven and Bijan Tehrani met through the game RuneScape and co-founded the first Bitcoin gambling website Primedice in 2013, which allowed players to place bets using cryptocurrencies. According to their recollection, the price of Bitcoin was less than $20 at that time, and the unexpected returns from early cryptocurrency investments provided abundant funds for their business.

In 2017, Ed Craven and Bijan Tehrani established Stake.com, primarily providing online casino games and sports betting services, supporting players to place bets using cryptocurrencies such as Bitcoin, Ethereum, Dogecoin, Litecoin, and Bitcoin Cash.

“Significant marketing expenses are crucial for a platform that combines cryptocurrency and gambling businesses, as it will help build user trust, especially in the face of some very strong competitors.” For this reason, Stake.com has invested a large amount of money in advertising. In addition to being sponsors of English football clubs Everton FC, Watford FC, and Everton FC, Stake.com has also signed a $100 million annual endorsement agreement with Canadian rapper Drake and reached a partnership with the UFC (Ultimate Fighting Championship), among others.

Canadian rapper Drake with Stake.com

Regarding the success of Stake.com, Nigel Eccles, the founder of the gambling company FanDuel, believes that Stake.com’s success is due to its active marketing and being “the first truly global, cryptocurrency-accepting gambling website”.

According to Ingo Fiedler, co-founder of the Blockchain Research Lab, the platform is largely attributed to the fact that cryptocurrency and gambling are “natural allies”, both attracting risk-taking customers. “Day traders who speculate with cryptocurrencies are a very similar group to typical gamblers, and the downturn in the cryptocurrency market after the major crash last year may have prompted more traders to turn to gambling platforms.”

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!