A Brief History of Bitcoin Cross-Chain

When it comes to the concept of Bitcoin cross-chain, it may not be familiar to everyone. But when it comes to wBTC, everyone is definitely not unfamiliar. wBTC is a way to cross-chain Bitcoin to Ethereum. So why use wBTC on Ethereum instead of using Bitcoin itself? The main reason is that the Bitcoin network does not support smart contracts. Bitcoin ($BTC) can only be used for transfer and payment within the Bitcoin network, lacking the various applications available on networks like Ethereum. At the same time, compared to the various altcoins in the Ethereum network, $BTC is considered “digital gold” with a wider consensus, and users are more willing to use $BTC for various applications.

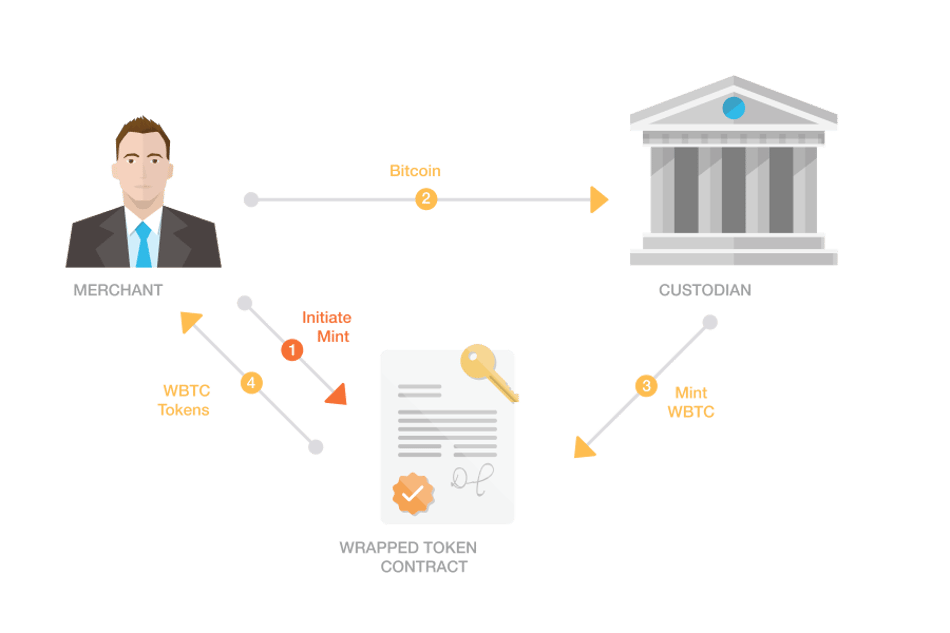

In response to this demand, Bitgo launched wBTC in 2019. wBTC, short for Wrapped BTC, is a solution that locks users’ $BTC on the Bitcoin network and issues an equivalent amount of wBTC on the Ethereum network to prove the users’ assets on the Bitcoin network. At the same time, users can also redeem their wBTC for $BTC on the Bitcoin network at any time.

Specifically, the issuance and redemption of wBTC involve users, underwriters, and custodians. Users are the consumers of wBTC. Custodians are responsible for storing the $BTC held by users on the Bitcoin network when using wBTC. Currently, Bitgo is the only custodian. Underwriters serve as intermediaries between users and custodians, responsible for selling and redeeming wBTC to users. Becoming an underwriter for wBTC requires approval from Bitgo. Well-known underwriters include CoinList and imToken, among others.

- LD Capital Are the recent hot crypto bots a flash in the pan or a new investment track?

- Self-realization beyond rules Let’s talk about the autonomy of agents, DAOs, and autonomous worlds separately.

- Why is Stake.com so strong that it can recover withdrawals of over $40 million stolen in just a few hours?

This system appears simple but is cleverly designed. First, a user’s $BTC is stored by the underwriter before wBTC is issued to the user via the smart contract on Ethereum. This avoids the double-spending problem and ensures the scarcity of $BTC, thus establishing the value of wBTC. Second, underwriters are responsible for KYC of customers, charging fees for wBTC issuance, and gaining more customers through wBTC. As a custodian, Bitgo both avoids the work of KYC and auditing qualifications and gains channels as a custodian. It can be said to be a win-win situation. However, the most fatal problem lies here. Bitgo, as the issuer of wBTC and the only custodian of $BTC, also holds the decision-making power for underwriter applications, bringing about an unavoidable centralization risk.

The mBTC Solution by Merlin Protocol

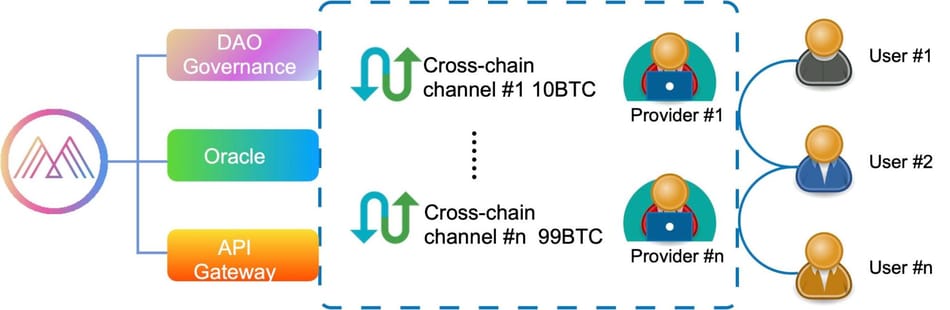

In response to the centralization risk faced by wBTC, Merlin Protocol has issued mBTC and proposed a decentralized solution for Bitcoin cross-chain, hoping to solve the centralization problem encountered by wBTC through decentralized cross-chain channel service providers.

Specifically, mBTC is similar to wBTC, both of which are issued on other networks as proof of users holding $BTC on the Bitcoin network. However, the mBTC system combines underwriters and custodians into one entity. They are responsible for issuing and redeeming mBTC, as well as safeguarding the $BTC pledged by users on the Bitcoin network. These service providers are referred to as “cross-chain channel service providers” in the mBTC system. In addition, the entry requirements for cross-chain channel service providers are different from those for wBTC underwriters. Becoming a cross-chain channel service provider for mBTC does not require permission, thereby avoiding the centralization risk of a single admission license.

When users need to subscribe for new mBTC, they can apply to any cross-chain channel service provider and pledge their $BTC on the Bitcoin network. After receiving the user’s $BTC, the cross-chain channel service provider issues an equal amount of mBTC and sends it to the user’s specified Ethereum address. Similarly, when redeeming, users only need to perform the reverse operation. This design not only saves the communication costs between the acceptance merchant and the custodian in the wBTC system, but also solves a series of centralization issues caused by a single custodian.

Some people may ask, isn’t this just spreading the trust risk from a single custodian to multiple cross-chain channel service providers? Essentially, users still have to bear the default risk of the fund custodian. When designing mBTC, this issue was also taken into consideration, and a margin mechanism similar to a loan agreement was proposed. Specifically, cross-chain channel service providers need to pledge a portion of the margin through the mBTC smart contract on the Ethereum network, currently supporting $ETH, $USDT, and $USDC. Based on the amount of the margin, the service provider will receive 2/3 of the mBTC issuance quota in terms of the margin value. And as the mBTC quota is used, the margin and the price of $BTC, the service provider needs to maintain the value of the margin at more than 105% of the value of the issued mBTC. Otherwise, the service provider’s collateral assets on Ethereum will be liquidated and used to compensate for the losses of mBTC users. In order to obtain real-time prices of the margin and $BTC, the mBTC system introduces an oracle. For this purpose, Merlin Protocol has also joined the Chainlink BUILD program.

In order to incentivize more cross-chain channel service providers to join the mBTC system, when users redeem mBTC, service providers can receive a 1.5% fee. By introducing economic incentives, the mBTC system is interrelated and achieves decentralized Bitcoin cross-chain. At the same time, mBTC redefines the production relations of Bitcoin cross-chain business. mBTC is not just a simple cross-chain tool, but a decentralized system. It does not require anyone to maintain it, and each role involved can spontaneously maintain the operation of the mBTC system.

It is worth mentioning that with the development of Ethereum Layer-2, the demand for Bitcoin cross-chain on Layer-2 is also growing. mBTC also plans to gradually launch cross-chain functionality from the Bitcoin network to Layer-2 in the future.

Final Thoughts

In fact, after the release of wBTC in 2019, it happened to coincide with a series of applications such as DeFi, and the circulation of wBTC continued to increase, currently accounting for 94% of Bitcoin cross-chain on Ethereum. Although competitors such as hBTC and imBTC have also emerged after wBTC, these solutions fundamentally have not escaped the operation mode of centralized custody and have not been able to shake wBTC’s dominant position. Whether mBTC’s decentralized solution can break through and make a difference remains to be seen.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!