1. Project Introduction

Linea is a Layer2 solution developed by ConsenSys, aimed at improving the scalability and efficiency of Ethereum. As a zkEVM, Linea utilizes zero-knowledge proofs with EVM equivalence, allowing developers to easily build scalable dapps or migrate existing dapps.

1. Team

Linea is a product under ConsenSys, which was founded in 2014 and headquartered in Brooklyn, New York. It has good relationships with government organizations (Inter-American Development Bank, European Commission, South African Reserve Bank) and business giants (Microsoft, JPMorgan). It is a leading member of industry committees such as the Ethereum Alliance.

ConsenSys initially started as a venture capital business and underwent restructuring in 2020, splitting the company into two entities: ConsenSys Mesh and ConsenSys Software. ConsenSys Mesh serves as the investment entity, while Software focuses on blockchain product development. Its flagship products include the native crypto wallet Metamask, with over 30 million monthly active users, making it the largest entry point for blockchain traffic. It also includes Infura, a blockchain development tool for developers, with over 400,000 users. It is one of the most influential and powerful companies in the Ethereum ecosystem.

Currently, Metamask has been spun off from ConsenSys as a separate entity. The members of the Linea team still belong to ConsenSys, with 837 registered employees on LinkedIn. Linea can seamlessly integrate with other products under ConsenSys. For example, Linea is a default option in the Metamask wallet plugin, eliminating the user’s experience barrier of manually adding networks.

- Focus on MEKE New business opportunities in decentralized derivative trading have arrived

- Analyzing the newly established $crvUSD/ $fFRAX pool by Curve in this crisis What is its role?

- A review of the entire incident of Curve being attacked, has the potential impact on DeFi just begun?

2. Financing

Linea has not conducted separate financing. Its parent company, ConsenSys, has conducted four rounds of financing from 2019 to 2022, with a total financing amount exceeding $700 million. The participating companies include top crypto investment institutions such as Dragonfly and Coinbase Ventures, as well as traditional financial giants such as Microsoft, SoftBank, and Temasek.

Linea benefits from ConsenSys’ rich industry resources and the large user base of Metamask, bringing industry attention.

2. Technical Implementation

1. SNARK Proof Technology Based on Vortex

Linea adopts the SNARK proof technology based on Vortex. Vortex is a polynomial commitment scheme designed for recursive technology and is mainly used for proof generation systems. It can batch generate proofs for batch verification, effectively improving proof efficiency and ensuring transaction privacy and security.

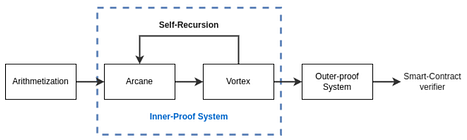

The above is the internal proof system process of Linea. To prove the occurrence of a transaction, Linea starts with arithmetization, converting a computer program into mathematical expressions that zero-knowledge proofs can understand. This process transforms transactions into traces and a set of constraints that verify the accuracy of calculations.

Then Linea uses internal proof systems Vortex and Arcane, which recursively reduce the size of proofs, continuously improving the efficiency and compactness of proofs through optimized calculations and specific algorithms.

Finally, through the recursive optimization of the internal proof system, the proof is further compressed into the external proof system gnark, achieving verifiability on the Ethereum platform.

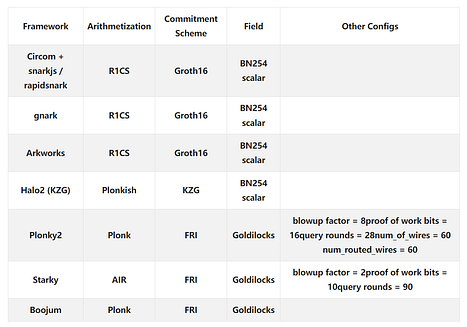

With the surge in zero-knowledge proof projects, the main difference between projects based on SNARKs technology lies in the different proving systems. Based on the maturity of the proving systems and the adoption by developers, LianGuaintheon has summarized the following representative frameworks:

The above proving systems are mostly based on improvements to Groth16 and Plonk. LianGuaintheon conducted benchmark tests on Linux Server (20 cores) and Mackbook M1 Pro (10 cores) devices in terms of constraint quantity, proof generation time, memory load, and CPU utilization. The research found:

1) In terms of constraint quantity: Plonk framework is better than Groth16 framework, with gnark having the most constraints and Boojum having the least.

2) In terms of proof generation time: Groth16 framework generates proofs faster than Plonk framework, with gnark being the fastest.

3) Memory load: There is not much difference.

4) CPU utilization: gnark and Rapidsnark show the highest CPU utilization on the Linux Server device, with excellent parallelization capabilities.

Linea’s use of gnark shows excellent overall performance, with superior proof generation speed and parallelization capabilities.

The complete research results can be found in “The LianGuaintheon of Zero Knowledge Proof Development Frameworks”.

2. zkEVM

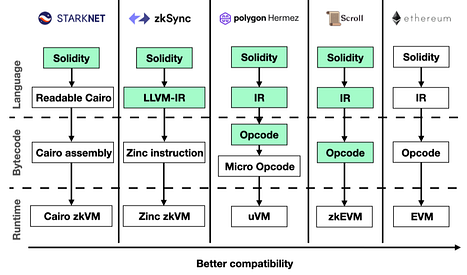

zkEVM is a virtual machine that is compatible with EVM and friendly to zero-knowledge proofs. However, EVM itself was not designed with ZK friendliness in mind, so the overall state transitions of Ethereum need to be reconstructed using zero-knowledge proof technology. If it is more in line with Ethereum’s specifications and standards, developers will find it easier to build applications on it and integrate into the Ethereum ecosystem. Therefore, better compatibility with Ethereum is the goal of most zkEVM-like projects.

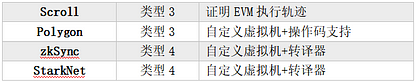

Currently, the industry generally refers to Vitalik’s classification as a reference. Linea is in the type 2 stage, which is fully equivalent to EVM but not completely equivalent to Ethereum. The goal is to be fully compatible with existing applications while optimizing transaction verification time.

It should be noted that there is no distinction between these types, but rather a trade-off in terms of development technology choices and proof generation speed. Because types with lower coding difficulty are more compatible with existing infrastructure but slower in speed, while types with higher coding difficulty are less compatible with existing infrastructure but faster in speed. Types 1 and 2 are easier to implement, but these types can also be transformed.

In the above solutions, the further to the right the solution is, the better the EVM compatibility is, and developers can use familiar contract development languages and tools, but the difficulty of implementing EVM Opcode as a circuit is higher.

The Linea zkEVM solution is relatively easier to implement, and its project goal is to improve proof efficiency as much as possible on the basis of EVM compatibility, so as to better accommodate Ethereum developers and ecosystem, and quickly expand ecosystem traffic.

3. Operational Data

1. TVL

The ConsenSys team proposed a SNARK-based zkEVM in July 2021, and the ConsenSys zkEVM public testnet went online in 2023, and it was renamed Linea. The Alpha version of Linea mainnet was officially launched on July 19.

Currently, Linea has locked 17,631 ETH (worth about $33 million) in the cross-chain bridge, with 117,000 on-chain transactions and 91,000 independent users.

Compared with other Layer2 projects, Linea mainnet has a short online time, and the data is temporarily not comparable. At present, the Optimistic Rollup solution is developing quickly, while the ZK Rollup is limited by factors such as compatibility with Ethereum, proof generation efficiency, and transaction costs, and is developing slowly. The best-developed ZK-based Layer2 is zkSync Era, but its TVL is only 7% of Abitrum, and Linea TVL is only 7% of zkSync Era.

Previously, some users reported that there seems to be a certain delay in the redemption of Layer2 to Layer1 (Ethereum) through the official cross-chain bridge of Linea. The cross-chain bridge interface claimed that the entire process takes 8 to 32 hours, but several users reported that it takes 4 days to retrieve the funds.

The official explanation is that in order to carefully monitor the transactions and protect user asset security, the team initially added a withdrawal delay of at least 8 hours to Linea Mainnet Alpha. As the system matures, this delay will gradually be reduced and eventually eliminated. However, due to the rapid increase in bridged assets, the withdrawal time on Ethereum has temporarily increased. The team is working hard to accelerate the transactions of bridged assets from L2 to L1, and it will be restored to the target of 8-32 hours in the next few days. All pending transactions will be processed.

2. Linea Voyage

Linea launched the testnet Voyage (Odyssey) event on May 2nd, which lasted for 9 weeks and attracted over 300,000 addresses to participate. Since the start of the event, the activity level of on-chain funds has significantly increased due to the anticipation of airdrops.

On the day of the mainnet launch, Linea announced NFT rewards for users participating in the Odyssey event, a total of 352,000 NFTs were airdropped to users. The NFTs are divided into 5 tiers, with the first four tiers directly airdropped to user wallets, and the fifth tier requires manual minting, which is now open for a limited time of one month. Users can obtain different tier NFTs based on their Odyssey points.

3. Social Media

Four, Ecosystem

Linea’s mainnet currently has 56 integrated ecosystems, with an additional 106 ecosystems to be integrated. According to defillama data, the current TVL scale is $15.04 million. This section will provide a brief introduction to the native protocols with a certain scale:

1. LineaBank

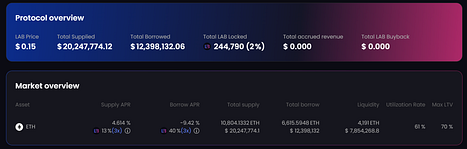

LineaBank is a native lending protocol built on Linea, focusing on privacy protection and scalability. The protocol gives users full control over their assets and eliminates intermediaries through decentralized markets, providing users with competitive interest rates. According to defillama data, LineaBank is currently the project with the highest TVL on Linea, with a fund size of $8.44 million.

Economic Model

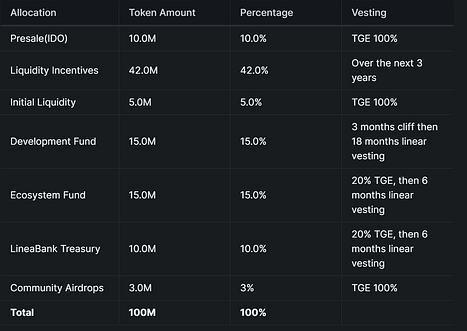

The total supply of LAB tokens is 100 million, and the token distribution is shown below. LAB will be airdropped to the community, and the tokens allocated to initial liquidity participants and the IDO portion will be fully unlocked after TGE, while the tokens allocated to other stakeholders will have different lock-up periods.

The reserve ratio of LineaBank protocol income is 80%, which means that 20% of the protocol income will be distributed to liquidity providers, and 80% of the 80%, which is 64%, will be distributed weekly to LAB stakers. However, when LAB stakers claim their share of the protocol income, they can only claim LAB tokens because the protocol will automatically use assets such as ETH or USDC to buy back LAB tokens and distribute them to users.

LineaBank will conduct an IDO from August 7th to August 14th, distributing a total of 5 million tokens with a target fundraising of 400 ETH. Based on the current price of $1864/ETH, it is $0.15/LAB.

LineaBank held a “pre-mining” event after its launch on the Linea mainnet, which took place from July 19th to August 11th. Participants of the event could receive 3,000,000 $LAB tokens (3% of the total supply, equivalent to $450,000). These tokens can be claimed after the IDO.

2. HorizonDEX

HorizonDEX is a centralized liquidity decentralized exchange that allows users to allocate liquidity within a customized price range, maximizing efficiency and reducing slippage for traders. As a native project on the Linea blockchain, HorizonDEX currently has a TVL of $2.26 million.

On July 19th, HorizonDEX launched the “Loyalty Program” to incentivize trading and provide yHZN token rewards to traders and liquidity providers. The program will last for 14 days until August 2nd. Participants of the Loyalty Program will share a total of 900,000 HZN tokens based on their points.

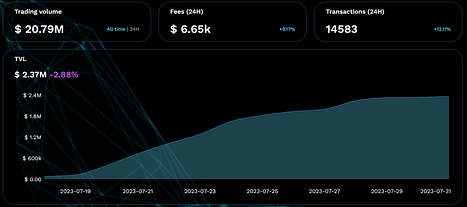

According to data from the HorizonDEX official website, the current DEX trading volume is $20.79 million, with a 24-hour accumulated trading fee of $6,650 and approximately 15,000 transactions. It has been steadily growing since its launch without experiencing a rapid growth phase.

Economic Model

The total supply of HZN tokens is 100 million, with 15% allocated for the IDO, 8% for team allocation, 15% for project development, 12% for marketing, and 35% for liquidity mining. The specific allocation is shown below. Except for the IDO tokens, which are fully unlocked immediately after TGE, the remaining tokens have a lock-up period of either 6 months or 24 months. The genesis unlock totals 42.25 million tokens.

HorizonDEX conducted private and public rounds from July 26th to July 31st, becoming the first project to launch an IDO on Linea. The private round has ended with a target of raising 135 ETH, ultimately raising 143.5 ETH. The private sale token price was 0.000052942 ETH/HZN, which, based on the current $1864/ETH price, is $0.099/HZN.

The public round aims to raise 870 ETH, with a total fundraising of 240.9 ETH. The public sale token price is 0.000059036 ETH/HZN, approximately $0.11/HZN.

3. EchoDEX

EchoDEX is a decentralized trading platform built on the Linea Consensys network and is also a native project on the Linea blockchain. It is the first decentralized exchange (DEX) to launch on Linea.

Economic Model

The total supply of ECP tokens is 100 million, and the specific token allocation is as follows, all with different locking periods. Currently, the token only has staking functionality and will soon launch a loyalty program.

The native protocols prioritized for launch in the Linea ecosystem are DEX and lending, but the economic model designs are similar. In the early stages, token incentives are needed to attract liquidity. Currently, LineaBank’s incentive method may be more attractive to users, but it is still speculative liquidity. Whether it can leverage the first-mover advantage to retain users is still unknown, and it will also face competition in incentives from established DeFi platforms like Aave and Sushi.

References

1. “ConsenSys Leads, Linea Makes Its Debut: Breaking ZK Rollup Limits, Achieving Full EVM Compatibility”

2. “The LianGuaintheon of Zero Knowledge Proof Development Frameworks”

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!