Author: duoduo, LD Capital

The GMX V2 version was officially launched on August 4, 2023. This article reviews the development and existing issues of GMX V1, compares the modifications in V2, and analyzes the potential impacts.

1. GMX V1: an effective model for derivative DEX protocol

GMX V1 was launched at the end of 2021, using the GLP model, which provides a concise and effective trading model and creates the concept of “realized yield” in the derivative DEX protocol, holding an important position. Many projects have forked the model of GMX V1.

- An Analysis of Unibot Driving the Telegram Trading Revolution

- Quick look at the open-source project AI Town released by a16z Introducing virtual town where AI characters can socialize and live.

- Analyst If spot ETF is approved, BTC may soar to over $150,000.

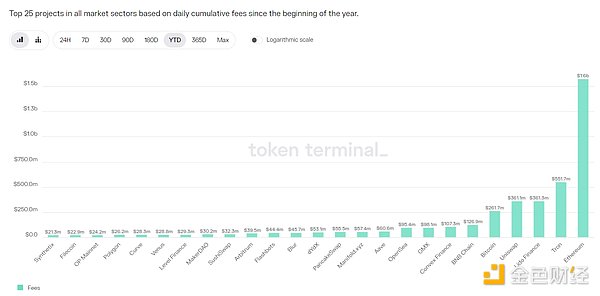

GMX V1 protocol captured a large amount of fees. Since 2023, the revenue of GMX V1 protocol has reached $98.1 million, ranking eighth among all projects and first in the derivative DEX track.

Source: token terminal

However, GMX V1 also has limitations, including:

1. Imbalance of open interest (OI) leading to higher risks for LP providers

The fees of GMX V1 include opening and closing fees and borrowing fees, without funding rates. The borrowing fees incur costs for holding positions, thus avoiding unlimited occupation of liquidity. In addition, the dominant party needs to pay more fees. However, since both long and short sides are charged fees and there is no arbitrage opportunity, the open interest contracts cannot be quickly rebalanced through arbitrage.

If this imbalance is not addressed, in extreme cases, the GLP pool will face huge losses, and LP providers will suffer losses, leading to the collapse of the protocol.

2. Limited tradable assets

GMX V1 only offers 5 tradable pairs: BTC/ETH/UNI/LINK and AVAX. Meanwhile, DYDX and Synthetix can provide dozens of trading pairs. Gains offers forex trading pairs. The new platform HMX provides commodities and US stocks.

3. Higher fees for small and medium-sized traders

The opening and closing fees of GMX V1 are both 0.1%, which is relatively high. In the case of intensifying competition within the derivative DEX track, the fees of many protocols are below 0.05%.

2. GMX V2: ensuring protocol security and balance

1. Core

The core of GMX V2 is to ensure the security and balance of the protocol. This is achieved by modifying the fee mechanism to maintain a balanced long and short position, reducing the probability of systemic risks occurring in GMX in the face of severe market fluctuations. By setting up isolated pools, high-risk trading assets are increased while controlling overall risks. By partnering with Chainlink, more timely and effective oracle services are provided, reducing the probability of price attacks. The project also considers the relationship between traders, liquidity providers, GMX holders, and the continuous development of the project, and makes adjustments and balances in the distribution of protocol revenue.

2. Fee Adjustment: Increase Funding Rate and Price Impact Fee

GMX V2 has made significant adjustments to its fee structure, focusing on how to balance long and short positions and improve capital utilization efficiency. The specific fee structure is as follows:

– Reduce opening/closing costs.

Previously, the fee was 0.1% and it has been reduced to 0.05% or 0.07%. The fee will be charged based on whether the opening position is favorable to balance long and short positions. If it is favorable, a lower fee will be charged.

– Increase funding rate, with the stronger side paying the funding rate to the weaker side.

The funding rate will be adjusted in segments. When the long/short position reaches 0.5-0.7, the funding rate will be at a lower level. When it reaches 0.7, the funding rate will be increased to a higher level, increasing arbitrage opportunities and encouraging arbitrage funds to enter, thus restoring the balance between long and short positions.

Source: chaos labs

Retain borrowing fees to prevent unlimited occupation of liquidity.

Introduce price impact fee, where the larger the position, the more unfavorable it is to balance long and short positions, and the more fees will be charged.

The price impact fee simulates the dynamic process of price changes in the order book trading market, meaning the larger the position, the greater the impact on the price. This design can increase the cost of price manipulation, reduce price manipulation attacks, prevent flash crashes or spikes, and maintain a balanced long and short position, ensuring good liquidity.

The following chart shows the price impact fee rates faced by different opening position scales in a simulated state. It can be seen that the larger the position, the higher the fee rate. The horizontal axis represents the opening position scale (in millions of dollars), and the vertical axis represents the fee rate (bps).

Source: chaos labs

In addition, if the opening position is more unfavorable to balance long and short positions, the fee will also be higher. The table below shows the fees charged under different long and short balance states in a simulated state. The first column represents the opening position scale, and the first row represents the initial pool imbalance position scale.

Source: chaos labs

A brief comparison of the fees of several major derivatives DEX protocols:

DYDX: maker 0.02%, taker 0.05%, the larger the trading volume, the greater the discount;

Kwenta: maker 0.02%, taker 0.06%-0.1%;

Gains Network: 0.08% opening/closing fee + 0.04% spread + price impact fee.

It can be seen that the fees of GMX V2 are still relatively high. However, they have been reduced from a high level to a moderate level, with opening/closing costs reduced by nearly 50%. For small and medium-sized traders, V2’s fees are more friendly.

3. Liquidity Provision: Increase Isolated Pool Mode and Synthetic Assets

The liquidity pool of GMX V2 is called the GM pool, and each pool is independent of each other. The amount of funds, funding rate, and fund utilization of each pool can be seen on the official website.

Source: GMX

The advantage of isolated pools is that different token markets can have different underlying support and parameter settings, achieving their own risk control with higher flexibility, thus expanding trading assets while maintaining risk control. For liquidity providers, they can also choose the risk exposure based on risk preference/return expectations. The problem with isolated pools is the fragmentation of liquidity. Some pools may not attract enough liquidity.

Currently, GMX V2 has divided into 3 different types of markets:

l Blue-chip: BTC and ETH. The possibility of price manipulation for these two tokens is low, so the price impact fee can be set at a lower rate, making it more competitive than CEX. Native tokens are used for both.

l Mid-cap assets: Market value ranging from $1 billion to $10 billion, with higher liquidity and trading volume on CEX, but susceptible to price fluctuations caused by external factors, such as regulatory news causing significant price drops. For such assets, a higher percentage of price impact fee will be set, and liquidity will not exceed other external markets, increasing attack costs. LINK/UNI/AVAX/ARB/SOL belong to this category. Native tokens are used for support.

l Mid-cap synthetic assets: Instead of using native tokens, ETH is used as the underlying liquidity support. DOGE and LTC belong to this category.

The problem with these assets is that if the related tokens have a significant short-term increase, the ETH in the pool may not be able to pay all the profits.

For example, if there are 1,000 ETH and 1 million USDC in the pool, the maximum long position limit for DOGE is set at 300 ETH. However, if the price of DOGE increases by 10 times while the price of ETH only increases by 2 times, the profit will exceed the value of ETH in the pool.

To avoid this situation, the function of ADL (Automatic Deleveraging) is introduced. When the expected profit exceeds the threshold set by the market, the profitable position may be partially or completely closed. This helps ensure that the market always has the ability to pay and that all profits at the time of closing can be fully paid. However, for traders, automatic deleveraging may result in the loss of advantageous positions, thereby missing out on subsequent profits.

According to a report issued by Chaos Labs, during the initial operation of V2, the upper limit for open contracts for BTC and ETH is $256 million each, and for AVAX/LINK, it is $4 million each, while for other tokens, it is $1 million each. The limits can be adjusted based on actual operation. However, currently, the total TVL of the GM pool is about $20 million, still far from the upper limit.

4. Improve User Experience: Increase Coin-Based Contracts, Faster Execution Speed, and Lower Slippage

In GMX V1, traders can only open U-based contracts. Regardless of the asset used to open a position, the position value is calculated in USD based on the opening price, and the profit is equal to the closing USD value minus the opening USD value.

In GMX V2, coin-based contracts are added. Traders can deposit relevant trading assets as collateral without converting them to USD. This will meet the diverse needs of traders and provide a more diverse investment portfolio.

In addition, the oracle system of GMX V2 will price each block, and orders will be executed at the latest prices as much as possible, resulting in faster execution speed and lower slippage.

5. Allocation Model

In order to maintain the long-term development of the project, the protocol income of GMX V2 has also been adjusted. 8.2% will be allocated to the protocol treasury for project operations and other matters.

GMX V1: 30% allocated to GMX stakers, 70% allocated to GLP providers.

GMX V2: 27% allocated to GMX stakers, 63% allocated to GLP providers, 8.2% allocated to the protocol treasury, 1.2% allocated to Chainlink. This allocation has been approved by the community through voting.

III. GMX V2 Operation Situation

GMX V2 has been in operation for about 2 weeks, with a TVL of approximately $20 million, an average daily trading volume of $23 million, an average daily protocol income of $15,000, outstanding contracts worth $10.38 million, and approximately 300-500 daily active users. As a starting point, the performance is acceptable without adopting trading incentives.

Some V1 users have migrated to V2. The trading volume and daily active users of V2 are roughly 40% -50% of the trading volume of V1. The comparison of trading volume, protocol income, and users between V1 and V2 is shown in the following figure:

Source: dune

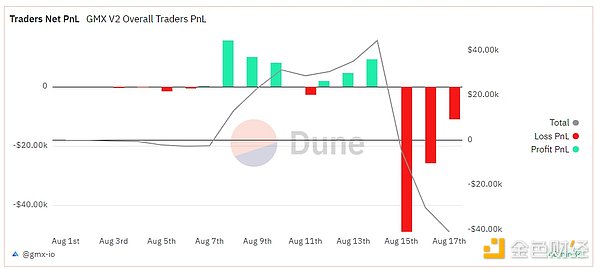

GMX V2 traders are currently in a net loss position, with a cumulative net loss of $40,000.

Source: dune

In terms of yield, GMX V1 has had a consistently low yield recently. The GMX staking yield this week is 1.44%, the GLP (arbitrum) yield is 3.18%, and the GLP (Avalanche) yield is 8.09%. In comparison, the yield of GMX V2 is higher, as shown in the list below:

Source: GMX

After the launch of GMX V2, the market enthusiasm is not high, and the response of funds is average. The main reason is that the recent market volatility has fallen to historically low levels, overall trading volume has shrunk, and the competition within the industry has intensified, resulting in a weak growth in protocol income.

IV. Conclusion

GMX V1 is a successful model in the derivative DEX race with a large number of followers. The delivery of GMX V2 also meets market expectations, demonstrating that the GMX team has strong protocol design capabilities. In terms of mechanics, V2 improves the balance of liquidity pools, expands the types of trading assets, and provides multiple collateral positions. For liquidity providers and traders, there are more investment options, better risk balancing, and lower fees.

However, from the initial stage, there is a liquidity fragmentation issue due to the use of independent pools, and some assets may have insufficient liquidity. In addition, the GMX project has not taken market marketing actions and trading incentive measures, which have not had a significant impact on the protocol’s new users and trading volume in the short term.

Essentially, GMX V2 focuses more on protocol infrastructure, protocol security, and balance. In the current bear market environment, focusing on the construction of the underlying architecture, ensuring the security of the protocol, and using accumulated data for better risk parameter design may be more helpful for the future development of the project in a bull market. At that time, it can provide higher open interest contract capacity, a more diverse trading market, and can also launch more marketing measures and acquire more new users in line with market trends.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!