Author: The DeFi Edge; Translation: Luffy, Foresight News

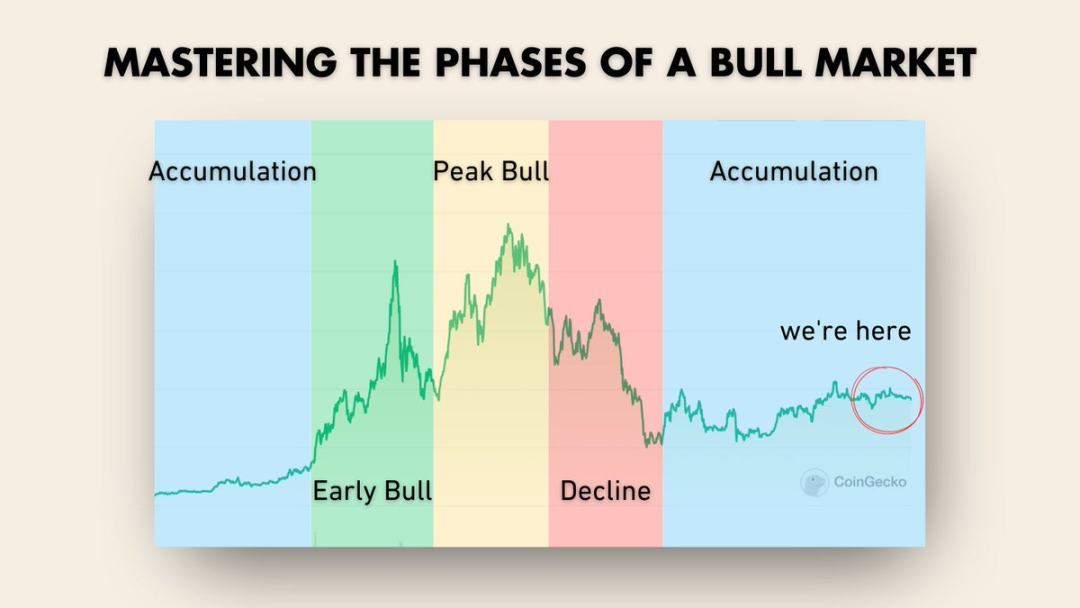

There are four stages in a cryptocurrency bull market, and we are at the end of the first stage. This article will tell you how to take advantage of market cycles so that you don’t miss an opportunity to create generational wealth.

How can you seize the opportunity? You need to do three things:

-

Master the various stages of a bull market

-

Maximize profits

-

Avoid the most common pitfalls

Stage 1: Accumulation Stage

This is the situation we have been in for the past year. After the Terra crash, the collapse of FTX, and the panic of USDC decoupling, the market bottomed out and rebounded.

It is obvious that the worst is over (unless there is a major incident with Binance/Tether).

The current cryptocurrency prices are stable and boring. Even major news like LianGuaiyLianGuail launching a stablecoin has only a minimal impact on prices. Currently, there is no new liquidity entering the market, and the market lacks volatility. It’s like a PVP game between 500 degens, all trying to enter the next narrative before the other.

This is the preparation stage of the bull market, where the pieces are just being placed on the chessboard. And this is also the best time for sowing.

Action Guide:

-

Accumulate good projects. Look for projects that you think will flourish in the upcoming bull market. These projects need to meet certain criteria: product/market fit, competitive advantage, a team that is still under development, a reliable roadmap, and sound financial indicators.

-

Save ammunition. It is tempting to rush into some old projects. They seem worth investing in because they have dropped 90% from their all-time highs. But the reality is that most of the projects that will perform well in the next cycle have not yet been born. People usually prefer to be the “early birds” in a brand new project rather than buying into old projects.

-

Don’t overtrade. Don’t get caught up in hamster races and games like Bald that could leave you with nothing. You have to survive first to win in the end. Don’t join bad games out of boredom, patiently wait for good hands.

-

Fill your knowledge gaps. A bull market is not the time to learn. A bull market is the time to pick up money from the field. And now is the time to learn. If you don’t want to hear about a new protocol built on GMX, then you must spend a week during the bull market to understand the basics of GMX.

-

Monitor liquidity. Pay attention to the influx of funds into CEX, the deployment of stablecoins, the growth of DeFi TVL, and the overall market cap of cryptocurrencies. More liquidity means things are changing.

Phase 2: Early Bull Market

In this phase, cryptocurrency prices start to rise, and the bears find it hard to believe. They come out every two months, talking about Bitcoin reaching $12,000.

People become doubtful and suffer from a condition called “Post-Traumatic Bear Market Disorder (PTSD),” which hinders their ability to profit. Ironically, the earlier you are in the cycle, the greater the risks you face before the crowd arrives.

What triggers a bull market?

-

Major events such as the approval of a Bitcoin or Ethereum ETF, or a new country adopting Bitcoin as legal tender.

-

The Bitcoin halving scheduled for 2024. Although the past cannot guarantee the future, if enough people believe…

-

New cryptographic primitives. The previous cycle had DeFi and NFTs. What will be hot this cycle? GambleFi? Telegram bots? NFTs making a comeback? Blockchain gaming? Or RWA? They are likely to be areas we haven’t even begun to imagine yet. Think of something like Axie Infinity or Stepn, combined with better mechanisms.

-

Macroeconomic changes. The Fed stopping interest rate hikes will bring more liquidity into the crypto market.

-

Regulatory changes. The US and other regions may provide more transparent and crypto-friendly frameworks.

-

Reduced friction. For the average person in the crypto space, user experience is still painful. Better wallets, account abstractions, and dApps suitable for beginners will help.

-

Development in Asia. Crypto Twitter (CT) has extreme bias towards the US. That’s why most CT doesn’t “get” why Tron is so popular (it is widely used in Asia). Don’t underestimate the power of Korean degens, and Hong Kong is becoming more crypto-friendly.

It only takes one major event to trigger a domino effect. Some “fallen” individuals accumulate wealth, experience a qualitative leap in their lives, and tell everyone around them. Then, such stories slowly spread on the internet.

Action Guide:

-

Reduce losing positions and increase profitable positions. Do not have emotional attachments to your portfolio. Just because a project has achieved a 5x return doesn’t mean it can’t achieve a 10x return. Cut your losing positions ruthlessly based on data, momentum, and sentiment indicators.

-

Take profits during an uptrend. No one can perfectly time the top. Don’t try to squeeze every penny out of a trade. Create a take-profit system and strictly follow it.

-

Be cautious of excessive risk. People use leverage, borrow against their property/retirement funds, or sell their Bitcoin and Ethereum to buy garbage coins. You can take risks, but be mindful of your limits.

-

Lower your IQ. Some projects with the best fundamentals are the worst performers. Tokenomics can be a complete joke. But remember this: prices only go up when others buy. And people are too foolish to understand high IQ plays.

-

Cult leaders. Cult leaders start to show their power. They know how to pump tokens and influence sentiment. It’s inevitable that cult leaders eventually seem to die out. You can join early and exit with profits before the collapse, or completely avoid them.

-

Don’t ignore retail investors. It’s easy to get trapped in the echo chamber of Crypto Twitter DeFi, where everyone debates “actual yield curve vs flywheel effect.” Retail investors don’t understand these things at all. So go where they hang out, like Reddit and YouTube comments.

-

Stay focused. Trying to keep up with the entire market is impossible. Miss some early opportunities, then enter too late and become liquidity for the exits; it won’t affect the big picture. You can choose to build a small team to complement your knowledge gaps.

Stage 3: Bull Market Peak

This is the stage where retail investors start pouring in. They are entering the third stage out of four (but in their minds, they believe they are entering the second stage out of five).

The bull market is self-reinforcing. As prices rise, FOMO sentiment intensifies, and the positive spiral keeps pushing prices higher and higher.

Everything is going up. A $10,000 shitcoin can turn into life-changing profits. People talking about cryptocurrency will be everywhere, whether you’re getting a haircut or taking an Uber.

FOMO and euphoria start to appear, and the music seems like it will never stop. All common sense is thrown out the window.

People start quitting their jobs to become full-time cryptocurrency traders. Others sell their houses to invest in cryptocurrencies.

Everyone is in a great mood.

Can you find the most important signals?

-

Mainstream media starts reporting on cryptocurrencies. You’ll hear stories repeatedly about someone trying to find a hard drive with 8,000 bitcoins or buying 2 pizzas with 10,000 bitcoins.

-

Financial YouTubers like MeetKevin, Max Maher, and Graham Stephen will start uploading more than 3 cryptocurrency videos per day.

-

Mainstream brands like Pepsi and McDonald’s will start mentioning cryptocurrencies to gain influence. Mainstream celebrities try to make money by sponsoring or launching their own NFT series.

-

Everyone is trying hard. When you see a lot of big talk on your Twitter feed, your Spidey sense should disappear.

Everyone will try to make you believe that this time is different, and you must fight against your instincts.

The most important thing in this stage is to consider your exit plan. Keep a clear head and realize that the music will eventually stop.

Take your chips off the table, and future you will be praying that you weren’t a fool. If you don’t take profits, the market will take back your gains.

Stage 4: Bear Market

What goes up must come down – the peak of the bull market has arrived. Now everyone wants to know if this is the peak or if it will continue into a “super cycle”.

They will try to tell you that this time is different – we have finally become mainstream! Pay attention to discussions about the super cycle, Bitcoin lengthening theory, etc. Will this cycle last for years?

Remember, everyone has an economic incentive to keep the party going. The audience must be encouraged to invest more, and more liquidity must be injected into shitcoins.

Moments of brilliance and hope appear from time to time. Bitcoin peaked in November 2021, but OHM forks, FTM/Solidly, and Luna are still rising.

Once the price plummets, the bears who missed out on the bull market cycle and generational wealth two years ago will jump out and say, “I told you so.”

What makes me so confident that there will be another bull market?

I have bet my career and the next ten years of my life on DeFi, and I have a firm belief in this field.

I will make things simple.

For ordinary people, life is tough, and it’s getting worse.

-

Credit card debt reaches a historic high

-

Everyone’s debt reaches a historic high

-

Student loan repayments are about to begin

-

Credit card interest rates reach a historic high

-

Debt interest payments reach a historic high

-

New car average monthly payments reach a historic high

-

Don’t let me start talking about housing prices

Society and culture have turned everyone’s lives into an incredibly difficult pattern. Going to college, finding a job, and having a family are not enough to ensure survival. The cost of living continues to rise, and the middle class is disappearing.

All of this is happening while societal pressures for success keep increasing.

The new generation is not interested in having a huge 401(k) (U.S. retirement savings plan) wealth at the age of 65. They want to get rich now. Everyone wants instant gratification. Everyone’s dopamine receptors are fried. Everyone craves to flaunt a wonderful life and show everyone that they are the protagonist, and that’s where the pressure comes from.

Humans are greedy, and insatiable in their greed.

Cryptocurrencies are not just selling new financial infrastructure, they are selling dreams. For people, there is no faster way to achieve dreams than cryptocurrencies.

Cryptocurrencies are our best opportunity to achieve this goal.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!