Source | Global Coin Research

Translation | Baize Research Institute

Throughout history, there has been an ongoing struggle for the democratization of financial power. The stories of the financial industry are filled with examples of a minority exercising power over the majority. From medieval merchant guilds that controlled trade and excluded outsiders, to 20th-century Wall Street giants who often acted as gatekeepers of wealth, the financial world has been characterized by persistent power imbalances.

A new chapter has arrived, as investment DAOs (Decentralized Autonomous Organizations) have started to gain traction in recent years. Their goal is to democratize investment, break down the barriers of traditional finance, and empower the majority rather than the minority. Through blockchain technology, these DAOs pool resources and collectively invest, providing individuals with a new and more inclusive way of investing.

- Discussion on the Market Pattern of Investment DAO Can Everyone be a Venture Capitalist? How to Participate?

- Empire Podcast Summary | Conversation with 1confirmation Founding Partner Predicting that the market may become the next market to attract mainstream attention, but has not yet seen the trend of stablecoins as a medium of exchange.

- Coingecko Decentralized Exchange Market Share Report Uniswap occupies 64.6% of the market share, LianGuaincakeSwap performs the best in the second quarter.

In this article, we will delve into various aspects of investment DAOs and their potential, revealing the future of decentralization, inclusivity, and democratic investment.

Why Do We Need Investment DAOs?

To truly understand the revolution brought about by investment DAOs, we must first grasp their unique characteristics and benefits.

Venture capital (VC) and investment DAOs each have their own distinct styles and serve different functions within the financial ecosystem.

VC represents the traditional investment model, characterized by centralized decision-making. The advantages of this model are quick decisions and expertise. However, the limitations of VC are evident, as its members are typically limited to accredited investors, excluding a large portion of potential contributors.

In addition, VC decisions lack the diverse insights that investment DAOs can provide, potentially overlooking many opportunities in niche areas. Furthermore, the traditional VC model requires significant time and capital investment from both investors and the invested companies, further limiting its scope.

Investment DAOs represent a shift towards decentralization. Unlike traditional VC, power is not centralized, and all members can participate in investment decisions through voting. As a result, these DAOs leverage collective wisdom to discover promising opportunities in emerging industries.

The following image compares the characteristics of VC and investment DAOs:

What Categories of Investment DAOs Exist?

Investment DAOs can be categorized based on their focus areas.

Generalist Investment DAOs can invest in various types of assets, such as tokens, equity in startups, NFTs, etc. The main features of Generalist Investment DAOs are their flexibility and wide range of investment opportunities.

Leading Generalist Investment DAOs include:

• Global Coin Research: Focuses on the Web3 ecosystem and regularly publishes research reports within the community. Notable projects they have invested in include Manta Network, Mysten Labs (Sui), etc.

• Metacartel Ventures: Focuses on early-stage projects in the Ethereum and broader Web3 ecosystem. In addition to making large investments in well-known projects, it also funds a large number of small projects through “grants,” including Zapper and Odyssy.

• SLianGuaiceship DAO: Focuses on early-stage companies and emerging crypto networks in the Web3 ecosystem. Its portfolio includes EigenLayer, Argus, and Arcadia.

• BitDAO: Currently has the largest DAO treasury (approximately $2.1 billion) and has invested in EduDAO, Game7, and others. It is currently merging with the L2 network Mantle and establishing a $200 million Mantle ecosystem investment fund to invest in high-potential projects within the Mantle ecosystem.

• LAO: Focuses on early-stage projects in the Ethereum and Web3 ecosystem. Invested in well-known projects such as Snapshot, POAP, ondo, and NFTFi.

An investment DAO that focuses on a specific field is dedicated to investing in that particular field. These DAOs leverage the collective knowledge of their members to make informed investment decisions within their chosen field.

Examples of field-specific investment DAOs include:

• Seed Club Ventures: Focuses on investing in early-stage projects at the intersection of Web3 and other industries, such as “Web3 + AI” and “Web3 + social.” Invested in well-known projects such as Lens Protocol and Stability AI.

• Layer2DAO: Focuses on investing in Ethereum Layer 2 networks and ecosystem projects. Invested in Velodrome, Acre Finance, Sperax, and others.

• ZeroDAO: Focuses on investing in projects based on zero-knowledge proof technology. Invested in Risc Zero and Lagrange.

• BeakerDAO: Focuses on investing in decentralized science (DeSci) projects. Invested in VitaDAO, LabDAO, and others.

• Hydra Ventures: Focuses on investing in other investment-oriented DAOs. Invested in ZeroDAO and BeakerDAO mentioned above.

• Komorebi Collective: The first investment DAO dedicated to female founders and non-binary founders.

An NFT-focused investment DAO is dedicated to investing in NFTs or NFT projects. These NFTs can represent various tangible and intangible items, ranging from digital art and music to virtual real estate and even rare physical artworks.

Examples of NFT-focused investment DAOs include:

• PleasrDAO: A DAO made up of dozens of crypto investors that has been collaborating to purchase popular high-value NFTs.

• PunkDAO: Invests in early-stage projects in the NFT space, including Lens Protocol, Argus, Tribe, and others.

• Flamingo DAO: Invests in early-stage projects in the NFT space.

• Fingerprint DAO: A DAO composed of artists aimed at creating and collecting well-known art NFTs.

These DAOs often make headlines due to their high-profile NFT purchases and innovative approaches to managing NFTs.

A game-focused investment DAO is dedicated to investing in blockchain games. Its investment targets include game development companies, in-game assets, and game infrastructure.

Examples of investment DAOs with a focus on gaming include:

• Dark Horse DAO: A DAO based on the digital horse racing game Red Run, aiming to acquire and manage NFTs in the game to maximize returns.

• Ready Player DAO: Invests in the game economy through asset acquisition, strategic partnerships, and guild development, with investments in over twenty blockchain gaming projects such as Petaverse, Pixion, and Avalon.

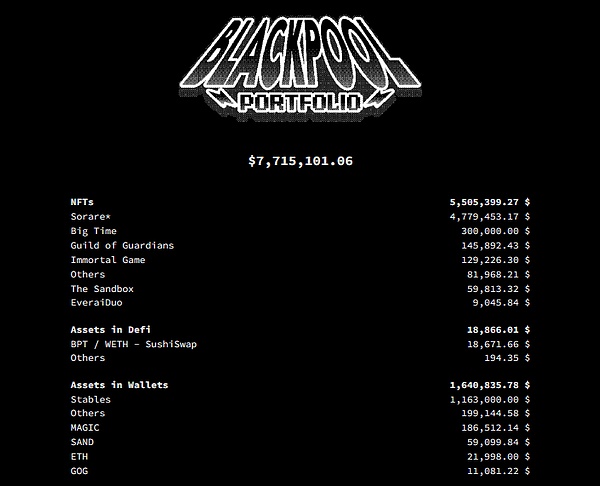

• Blackpool DAO: Owns and manages a range of digital assets, from in-game items to virtual land in the metaverse.

There are also region-focused investment DAOs that concentrate their investments in specific geographic areas. These DAOs recognize the unique markets and opportunities in different regions and invest accordingly.

Examples of region-focused investment DAOs include:

• Glimmer DAO: Focuses on NFT collectibles in Asia.

• Upside DAO: Focuses on investments in Australian cryptocurrency projects.

• Afropolitan: An investment DAO currently focused on creating a “digital nation” to enable all Africans to live prosperous lives.

However, it’s worth noting that while these DAOs have a regional focus in their investments, their members are usually global in nature.

How to participate in current investment DAOs?

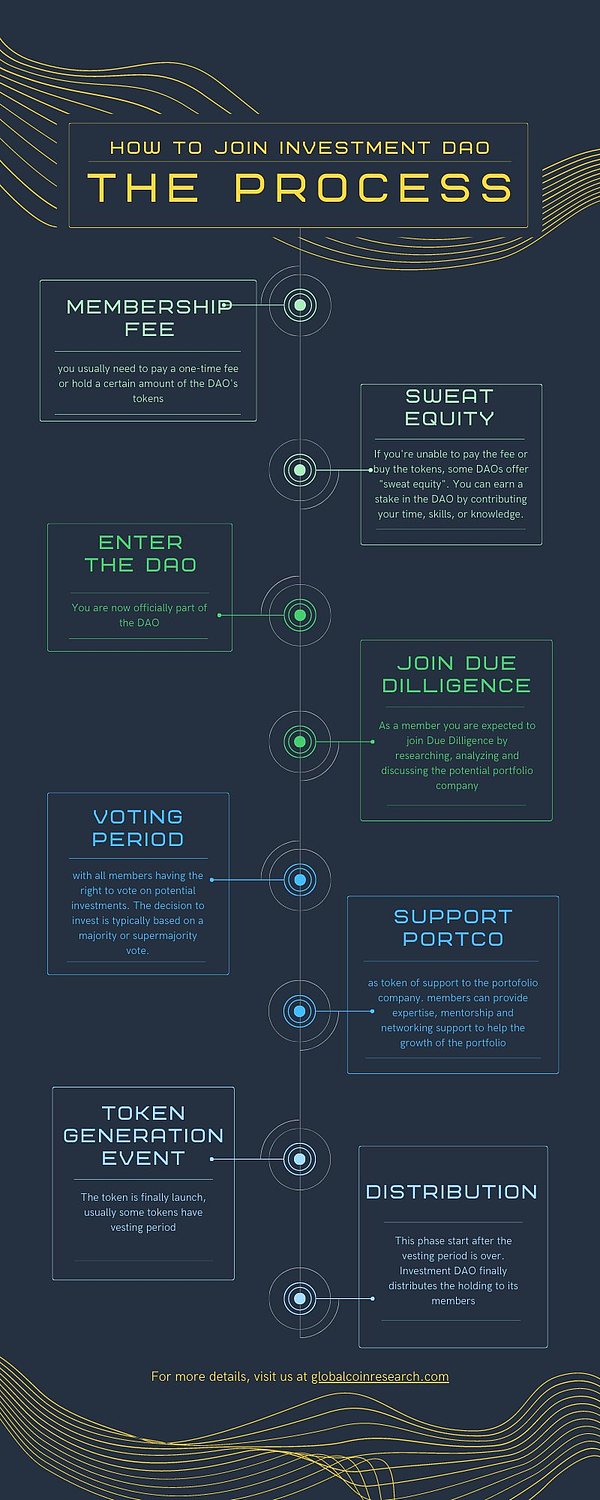

Investment DAOs leverage the power of decentralization and blockchain technology to create a new investment structure where everyone can participate and contribute to decision-making.

There are usually two types of participation requirements for investment DAOs:

• Membership fee only: You must pay a one-time fee, contribute your assets (NFTs), or hold a certain amount of DAO tokens. Examples include Global Coin Research, Blackpool DAO, BitDAO.

• Membership fee + contribution: You must pay a one-time fee and contribute to the DAO in some way. Typically, joining these DAOs requires a review process, and some have contribution incentives. Examples include ZeroDAO and Hydra Ventures.

As a DAO member, you will be involved in the research for investment projects. You have the right to speak and vote on whether the DAO should invest in a particular project, and some DAOs even allow you to invest your personal capital into projects.

Some DAOs allow members to customize their membership fees, where higher fees result in a larger share. This is demonstrated by Hydra Ventures, Seed Club Ventures, and Flamingo DAO.

During participation in a DAO, members can help the invested projects succeed by providing marketing, recruiting, and other support, further enhancing profitability.

Opportunities and challenges for investment DAOs

While investment DAOs are revolutionary, they also face a range of challenges. After in-depth research, we have identified six key issues that, if addressed, can greatly enhance their functionality and impact.

• Risk management: Like any VC, investing in a DAO also comes with risks. However, in the world of DAOs, these risks are amplified due to their decentralized nature and the inherent volatility of the crypto market. Therefore, a robust risk management strategy tailored to DAOs is needed.

• Dynamic voting power: In the current system, voting power is static and based on token holdings. But what if we can implement a dynamic system where the size of voting power is influenced by members’ contributions to the DAO? How would that affect the outcomes? Successful investment advice or active participation in governance could give you more say in DAO decision-making.

• Cross-DAO reputation system: Imagine a reputation system operating across multiple DAOs, incentivizing good behavior and deterring malicious actions. Members can earn reputation points for positive contributions and lose them for negative behavior. It’s like your credit score in the world of DAOs.

• DAO incubator: Experienced DAO members can provide guidance and support to new DAOs, helping them navigate common challenges and avoid potential pitfalls.

• DAO-to-DAO services: DAOs can develop services to offer to other DAOs, ranging from technical services to governance consulting. This helps create a vibrant DAO ecosystem where DAOs support each other and grow together.

• DAO legal toolkit: A resource toolkit that includes legal document templates, relevant legal and regulatory guidance, and resources on “how to operate an investment DAO” could be beneficial for DAO developers and potentially lead to a surge in DAO investments.

The exploration of investment DAOs has opened up new frontiers in the financial world. While there are still many unknowns on this journey, it has the potential to completely transform the investment landscape. The prospects are promising, and we are excited about it.

Risk Disclaimer:

The above projects and opinions should not be considered as investment advice. DYOR. According to the notice issued by the central bank and other departments on “Further Preventing and Dealing with the Risks of Virtual Currency Trading Speculation,” the content of this article is for informational purposes only and does not endorse or promote any business or investment activities. Readers are advised to strictly comply with local laws and regulations and not engage in any illegal financial activities.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!