Author: Mary Liu

At around 5:30 AM Beijing time on Friday, Bitcoin suddenly plummeted by more than 8%, falling to $25,409 at one point. The Bitcoin price on the Bitfinex cryptocurrency exchange even dropped lower, reaching a low of $24,715 at one point before rebounding to above $26,000. This decline caused the market capitalization of Bitcoin to fall below $500 billion for the first time since June 16th and hit the lowest point since June 20th.

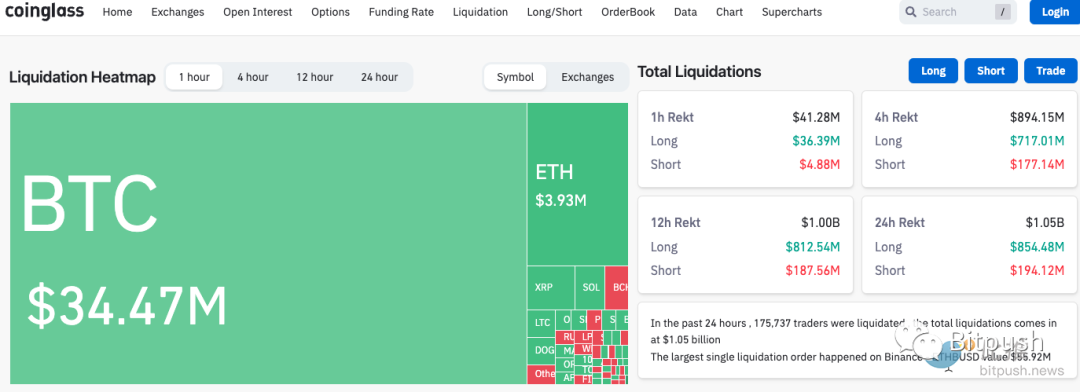

CoinGlass data shows that as of the time of writing, the plunge led to over $1 billion in liquidations in the past 24 hours, including $472 million in Bitcoin liquidations and $302 million in Ethereum liquidations. The majority of the affected positions were long positions.

- Will next year be a bull market for cryptocurrencies?

- After Binance’s exit, Coinbase enters the Canadian market.

- Why hasn’t crypto achieved mass adoption yet?

Reasons for the decline?

The crypto community attributes part of the decline to a report by The Wall Street Journal, which stated that SLianGuaiceX’s balance sheet wrote down $373 million worth of Bitcoin recorded between 2021 and 2022. Musk mentioned that SLianGuaiceX owns Bitcoin in a speech in 2021, but since the company is private, it did not disclose the specific amount.

Musk has always been a long-time enthusiast of cryptocurrencies, with the popular Dogecoin symbol “Д featured in his X social media profile. It is well known that any news related to Musk will have an impact on the market.

Another piece of news that may have stimulated selling is that Chinese real estate developer Evergrande has filed for bankruptcy protection in the United States, causing concerns among investors that problems in the Chinese real estate market could spread to other areas of the global economy.

In recent weeks, the price of Bitcoin has been declining, erasing nearly half of the gains since BlackRock applied for a Bitcoin ETF on June 15th.

According to Bloomberg, one of the macro factors behind the sell-off is the continued surge in global interest rates, particularly in the United States, where the 30-year Treasury yield has risen to 4.42%, the highest level since 2011. The 10-year Treasury yield is 4.32%, only one basis point below the 15-year high. This not only suppresses cryptocurrency prices but also impacts risk assets in traditional markets.

Shiliang Tang, Chief Investment Officer at crypto investment firm LedgerPrime, said, “Earlier this week, people were optimistic that the decision on the Grayscale Bitcoin ETF would be announced this week, but the decision was ultimately postponed without any result. In addition, the traditional market has been weak throughout the week, with the S&P 500 index and tech stocks being sold off, 10-year rates reaching highs, the US dollar rising, and weak Chinese credit and economic data, all of which are unfavorable for risk assets.”

Derivatives Market Bearish on Bitcoin

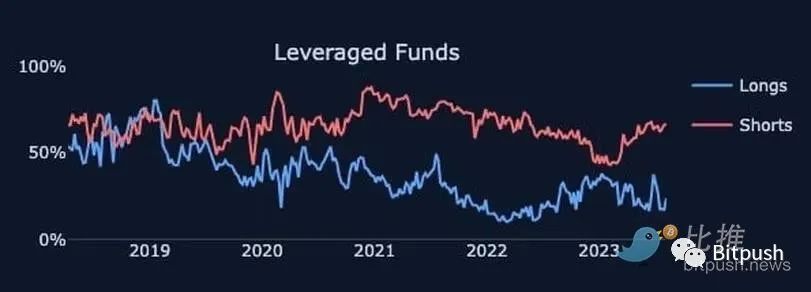

A report from the U.S. Commodity Futures Trading Commission (CFTC) on Commitments of Traders (COT) shows that as of the week ending August 8th, leveraged funds – hedge funds and commodity trading advisors – increased their bearish bets on cash-settled Bitcoin futures listed on the Chicago Mercantile Exchange (CME).

Lawrence Lewitinn, Content Director at cryptocurrency analytics firm The Tie, stated in his weekly newsletter, “Two-thirds of their positions are short (displayed in red), while one-third are long (displayed in blue). This is the largest position since April 2022.”

Lewitinn believes that although the cryptocurrency space continues to show improving trends and fundamentals, it is now more important to focus on the potential spillover effects from macro to broader risk assets and even cryptocurrencies.

Prior to this decline, Bitcoin had been trading within a narrow range for several months. According to data compiled by Bloomberg, the indicator measuring the volatility of the original cryptocurrency has been on a downward trend, reaching its lowest level since 2016 this week. Analysts at cryptocurrency market intelligence firm Glassnode wrote in a recent report, “The digital asset market continues to trade within historically low volatility ranges, with several indicators suggesting that investors have reached extreme indifference and exhaustion within the range of $29,000 to $30,000. A very boring, volatile, sideways market may still exist.”

Brian D. Evans, CEO of venture capital firm BDE Ventures, stated in a tweet, “I think Bitcoin is primed for a major squeeze, all technical indicators suggest that Bitcoin will experience some kind of significant squeeze, either up or down. We’ve seen this pattern before. Bitcoin trades sideways for a long period of time, volume contracts, then there’s a 10% bounce or pullback, either inducing panic or exciting the market.”

Cryptocurrency analyst Will Clemente pointed out in his tweet that this year’s implied volatility for Bitcoin has seen its largest single-day increase, and analysts predict that selling pressure will intensify as the price continues to decline until support is found.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!