In 2023, there were approximately one bank collapse every 90 days in the United States. Regional and smaller banking institutions in the United States were hit by deep-rooted vulnerabilities, regulatory errors, market instability, risk management failures, and other factors. This caused chaos in regional and global financial markets. This article will explore in depth the causes, effects, and possible solutions to the 2023 bank crisis.

The following is the table of contents for this article:

-

What is the 2023 bank crisis? Timeline of the U.S. banking crisis

-

Causes of the 2023 bank crisis

-

Effects of the 2023 bank crisis

-

The Role of Technology and Social Media in the 2023 Bank Crisis

-

Responding to the 2023 Bank Crisis: Solutions?

-

Lessons Learned from the 2023 U.S. Banking Crisis

-

Economic Recovery After the U.S. Banking Crisis

-

Crisis or Cure: What is the Long-Term Outlook?

1. The 2023 Bank Crisis

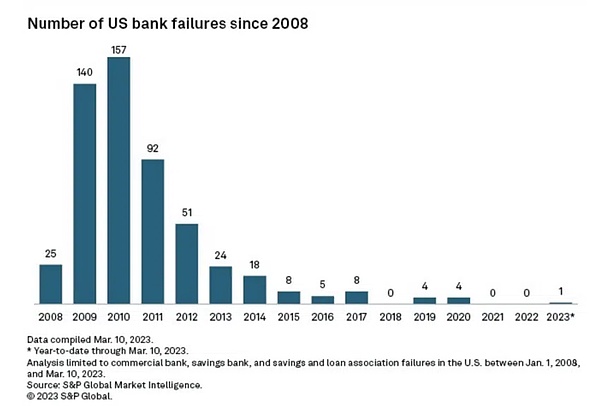

The 2023 bank crisis refers to the sudden collapse of regional banks in the United States, which had a serious impact on the global banking industry, although to some extent this collapse was predictable. A series of bank failures created a domino effect, and this crisis is different from the 2008 financial crisis, which mainly affected Wall Street giants. This crisis rendered the phrase “too big to fail” meaningless because large banks like Lehman Brothers and Bear Stearns could not withstand the storm.

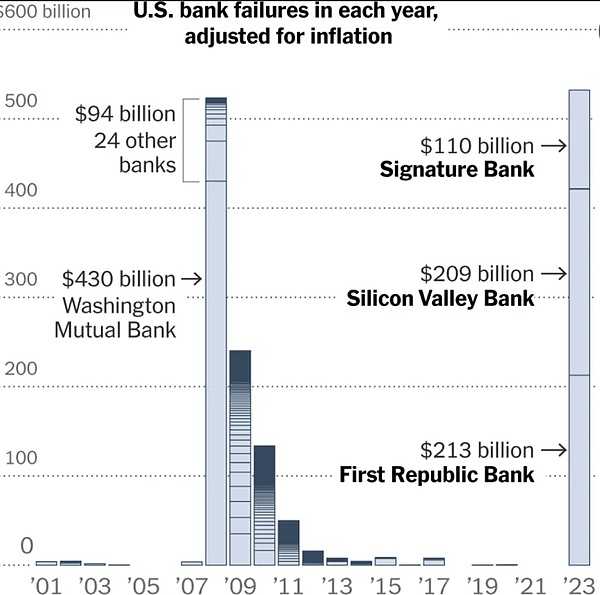

This US banking crisis affected smaller financial institutions such as Signature Bank, Silicon Valley Bank, Silvergate Bank, and First Republic Bank.

2. Timeline of the U.S. Banking Crisis

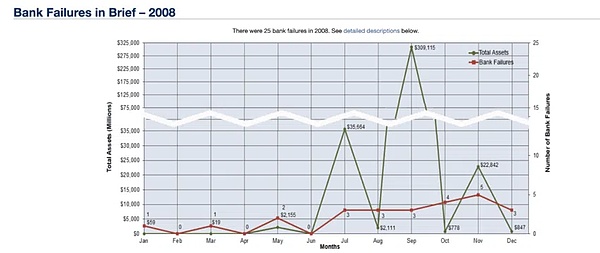

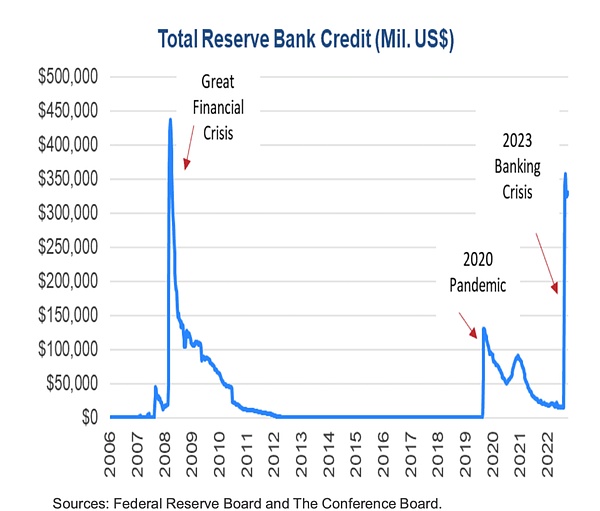

Although the US banking crisis was mainly concentrated in 2023, the broader timeline can be traced back to 2019. Let’s take a closer look:

1. 2019 and early warning signals

The Fed changed its stress test specifications or custom rules for banks, lowering liquidity standards for institutions holding less than $100 billion in assets. We will see how this further drives the spread of the banking industry in 2023.

2. October 2022 triggers a chain reaction

Global interest rates soar, making it even harder for banks and even investors to borrow. This is the first spark that ignites the “crisis”.

3. January 2023

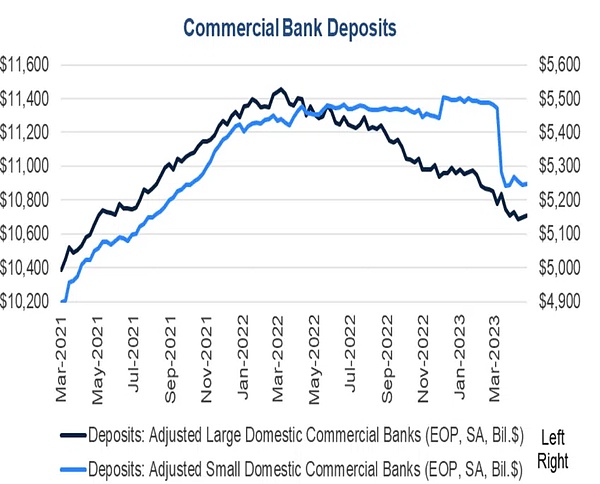

Banks like FRB and Signature Bank begin to experience massive capital outflows as investors begin to withdraw funds for standard operations. This further exacerbates the instability of the financial markets and shows the early signs of a liquidity crisis.

By this time, the rising interest rates have already had a negative impact on bond rates, causing bond-heavy banks like SVB to suffer unrealized losses. And the liquidity crisis means they can’t even sell investments to deal with capital outflows. The situation is starting to deteriorate.

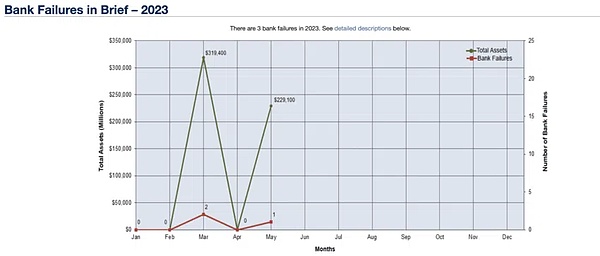

4. March 2023

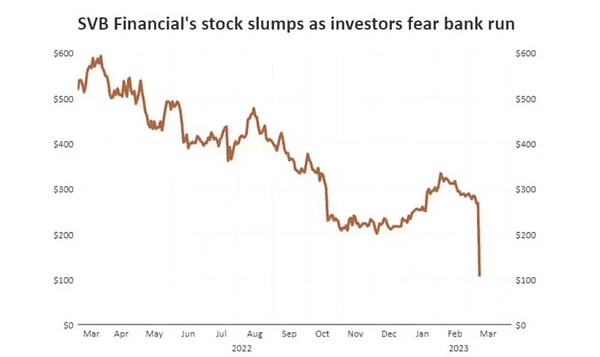

On March 8th, Silvergate Bank had to announce the closure of its business due to inability to meet withdrawal demand. Silicon Valley Bank also announced its $1.8 billion loss, as it had to sell part of its bond-dedicated investments to meet the increased withdrawal demand. After this news broke, SVB Financial, the parent company, was downgraded by Moody’s.

On March 9th, SVB’s stock price plummeted. This also resulted in a market capitalization loss of $52 million for Bank of America, JPMorgan Chase, Citigroup, and Wells Fargo. And on March 10th, regulators announced the takeover of SVB, which fell alongside Silvergate. In addition, on March 12th, regulators took over Signature Bank, making concerns about systemic risk real and legitimate.

However, on March 12, 2023, regulatory agencies announced that customers of affected banks will receive a refund of their deposit funds. And on March 11th and 12th, some startups were also in trouble raising funds to manage daily operations. In addition, a new loan program focusing on banks also emerged, which we will discuss later.

5. Bank crisis spreads outwards, mid-March 2023

On March 15, 2023, the crisis began to spread outward (across the Atlantic), and Credit Suisse’s stock price hit a new low. The stock prices of European banks such as BNP Paribas and Deutsche Bank also fell. Although three banks had already collapsed, at this point, we saw the credit rating of the First Republic Bank downgraded to “junk” status by S&P Global Ratings.

On March 17, 2023, SVB Financial applied for bankruptcy protection. Between March 18 and 27, UBS completed the acquisition of Credit Suisse. JPMorgan plans to stabilize First Republic Bank, whose stock price surprisingly rose by 30%, while the Federal Deposit Insurance Corporation (FDIC) mentioned that most of SVB’s assets will be transferred to First Citizens BancShares.

6. April 2023

April is characterized by the impending bankruptcy of First Republic Bank. First, the bank suspended dividends and mentioned that its deposits had decreased by about $100 billion in March. In April, the stock price of First Republic Bank began to plummet.

7. May 2023

On May 1, 2023, regulators took over First Republic Bank. Subsequently, other regional banks such as First Horizon and BlockingcWest also experienced chain reactions, with the latter reporting a 9.5% drop in the value of its deposits on May 11.

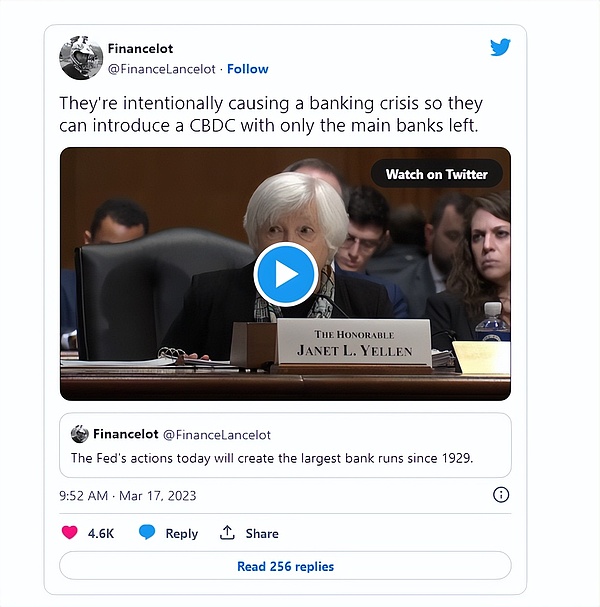

Financial experts on Twitter believe that the bank crisis is not over and that there are many unstable factors in the market. Others believe that this crisis may have been intentional in order to organically introduce central bank digital currencies (CBDCs) into the economy. However, all of these are speculative views.

III. Causes of the 2023 Bank Crisis

The causes of the 2023 bank crisis cannot be attributed to a single factor. Some experts even call it a debt crisis or a sovereign debt crisis, rather than a true banking crisis.

“The bond crisis is not just a banking crisis. The sovereign debt crisis is not just a bond crisis.” – Balaji Srinivasan, former CTO of Coinbase

Let’s dive in and better understand these reasons:

1. Global “economic” environment

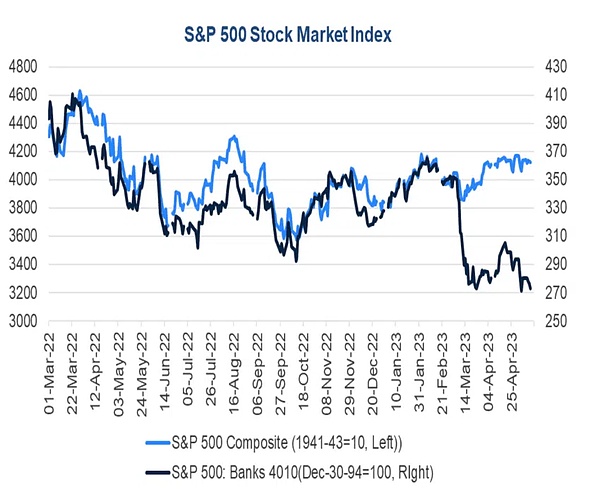

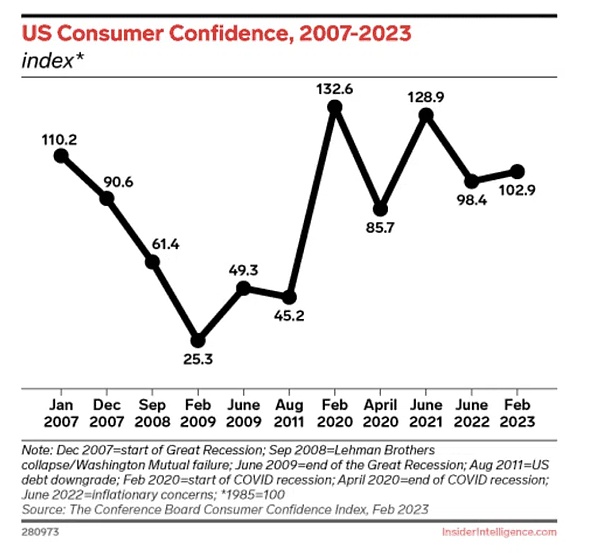

The global growth rate has slowed down after the pandemic. Every high-beta asset from cryptocurrencies to stocks entered bear market territory in 2022. While this brought many consequences, the most unsettling was the sudden drop in interest rates associated with long-term debt securities or bonds.

The drop in long-term bond yields has resulted in massive value erosion of bank investment portfolios like Silicon Valley Bank, as the bank had significant exposure to these long-term bonds.

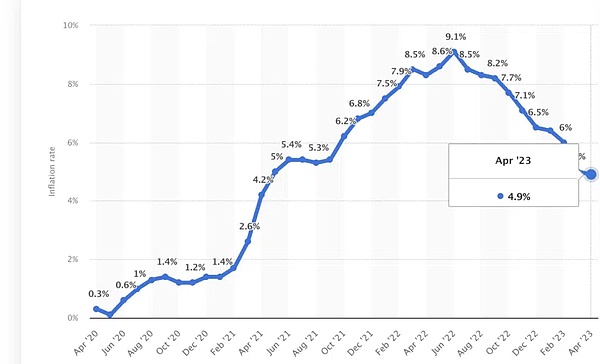

For those who are not familiar, inflation is typically associated with rapid financial growth, driving up the value or interest rates associated with long-term bonds. As the Federal Reserve, the European Union, and other global institutions begin to raise rates to combat inflation – lowering the rate of economic growth in the process – long-term bond yields fall and the value of bank investments declines. When banks are forced to liquidate these investments at a loss due to rapid withdrawals (also due to rising interest rates), the situation quickly deteriorates.

2. Regulatory neglect and obstacles

The 2008 financial crisis led regulatory bodies to implement the Dodd-Frank Act, which restricted banks from using investor funds for speculative investments through the Volcker Rule and established the Financial Stability Oversight Council and Consumer Financial Protection Bureau.

While we need to detail all aspects of the Dodd-Frank Act separately, you must know that factors such as non-alignment with vertical areas of the law (such as the Volcker Rule), insufficient enforcement, and limited space for small banks led to the 2023 US banking crisis.

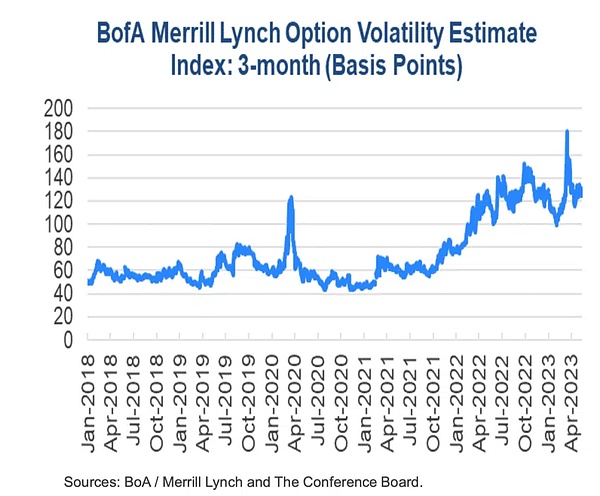

3. Financial markets and instability

As mentioned earlier, fluctuations in bond yields make banks vulnerable. Banks like SVB invest heavily in government-supported long-term bonds, and rising interest rates make the returns on these bonds lower. As banks’ investments lose value, investor withdrawals form bank runs, which are detrimental to economic health. Banks eventually have to sell these bond investments at huge losses, leading to regulatory bodies and bankruptcy issues.

4. Vulnerabilities related to banking business

Although this is just speculation, there are several vulnerabilities in banking business that exist before 2023. These vulnerabilities include banks that are exposed to speculative investments, excessive risk-taking, and issues related to freezing interbank lending. These problems make it difficult for banks to meet withdrawal requests. In addition, this even raises the issue of “systemic risk”, which gradually reveals various threats.

5. Rapid rate hikes and monetary missteps

Although we have discussed this issue before, it is worth repeating here. Since 2022, we have seen rate hikes around the world in response to inflation issues.

All of these have made borrowing more expensive, causing significant damage to start-ups and having a more serious impact on banks as they see a series of withdrawals. Although rate hikes driven by the Fed are to some extent a response to the threat of “price inflation”, rapid and poorly communicated rate hikes are often referred to as monetary policy missteps. These mistakes could become a catalyst for the 2023 banking crisis.

6. Risk management and control mistakes

Banks mostly operate in the area of risk-taking. This leads to the importance of risk management. During the 2008 financial crisis, one aspect of risk management was closely monitored – assessing the creditworthiness of borrowers. In 2023, another risk control and management mistake is excessive exposure to long-term debt securities.

Now that we know the reasons for the crisis, let’s take a look at its impact.

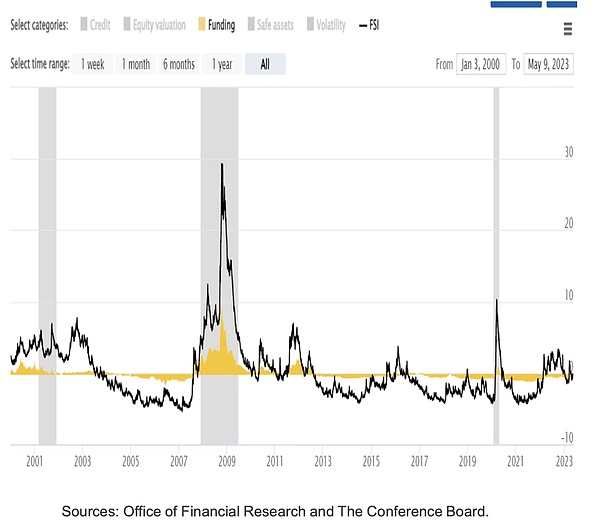

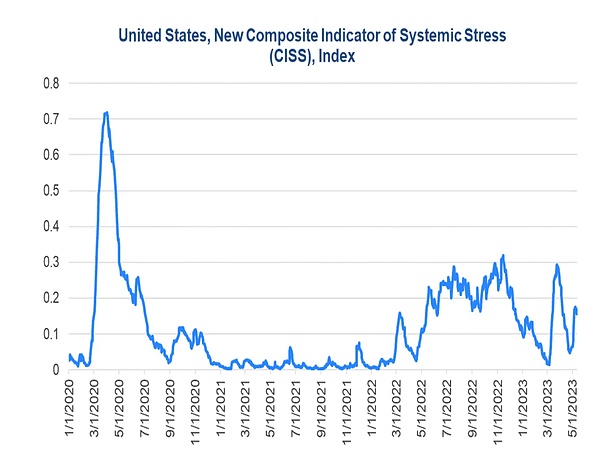

Four, the impact of the 2023 banking crisis

The US banking crisis has had a wide range of impacts, not just limited to the national banking industry. Here is the unfolding situation.

1. Global economy and impact

Some countries, such as Germany, have had negative GDP growth for several months, indicating that the economy is in recession. Some European banks, including Credit Suisse and Societe Generale, have had to bear the impact of the 2023 banking crisis.

And that’s not all. Here are other aspects that may be affected by this ongoing crisis:

-

Market volatility: According to the Merrill Lynch Option Volatility Estimate (MOVE) Index, the bond market continued to show high volatility after the banking crisis.

-

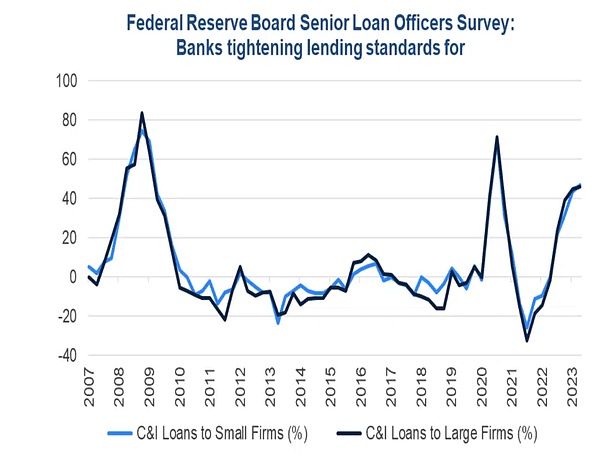

Credit tightening: As credit tightening continues and even banks struggle to find funds, credit tightening on the US coast could impact the global economy, especially developing countries that rely on external financing.

-

Decrease in specific corporate investments: With inflation becoming a global issue, it is expected that the US will take measures to restrict spending, which could slow global corporate investment.

Compared to the global economy, the impact of the 2023 banking crisis on the US economy appears to be more direct. Here are possible impacts:

2. Recession

With bank bankruptcies, blocked credit channels, and increasing government debt, even economists at the Fed predict that the US market is about to experience a recession. This expectation or concern was emphasized at the monetary policy meeting in March.

3. Unemployment rate

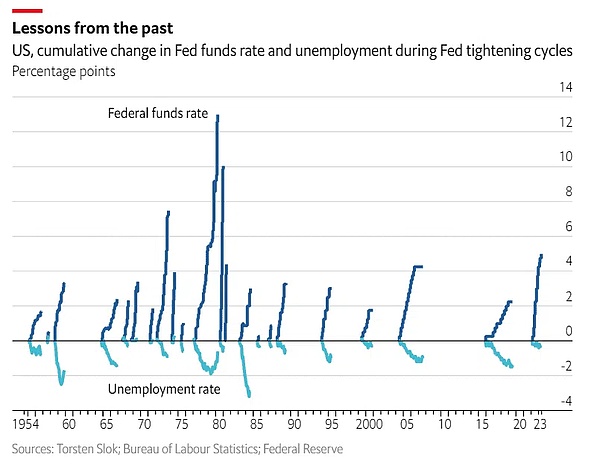

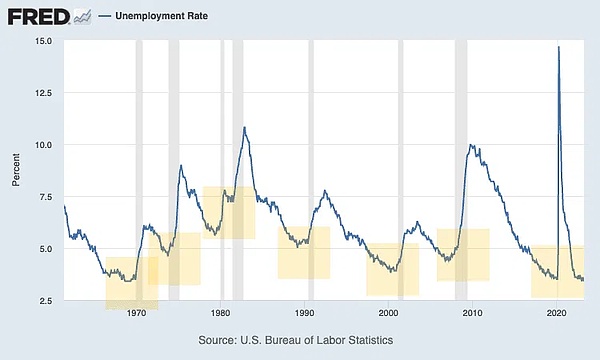

The US unemployment rate is currently low, which is good news in the banking crisis, right? However, data shows that once the credit tightening cycle begins, the unemployment rate typically takes about 14 months to reach its peak.

Note that a recession often inadvertently occurs after the lowest point of unemployment (local bottom). This is indeed a lagging indicator.

4. Inflation

Although the inflation rate in April 2023 dropped below 5%, concerns about inflation did not dissipate. As the debt crisis gradually becomes apparent, currency printing seems to be an option, and the core inflation rate may still be in trouble. But this could be a double-edged sword. The banking crisis may reduce people’s purchasing power, and rising prices may further reduce consumer spending. This could have a greater impact on the economy.

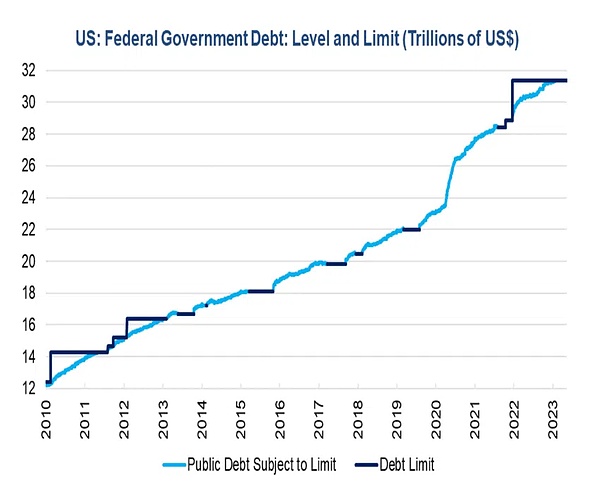

5. Debt Increase

The 2023 bank crisis may increase national debt, which is a way to offset the economic instability caused by bank collapses. Additionally, it appears that we have already reached the debt ceiling.

Five, How are Financial Institutions Affected?

Although four banks have already collapsed, the crisis may not be over yet. Financial institutions may still feel the following impacts:

1. Bankruptcy and Saving

The collapse of most banks is due to shrinking profit margins, loss of deposits, and ineffective risk control. These factors may cause other banks that are still operating to worry. Additionally, these concerns may shake the confidence of investors, putting other banks at risk of bankruptcy.

2. Resource Shortage

The US bank crisis has tested the staffing capabilities of institutions such as the FDIC, which has been passive since then. Any additional burdens may affect the resolution process and exacerbate the impact of this ongoing crisis.

Six, Impact on Individuals and Businesses

Assessing the impact on businesses and individuals may be more challenging. However, here are the most concerning aspects:

-

It is rare to obtain credit in the form of loans.

-

Decreased investment may lead to reduced exposure to high-risk assets such as stocks and cryptocurrencies.

-

Due to reduced consumer spending, uncertainty for businesses is becoming widespread.

-

Although the impact may be speculative, these concerns are real.

Seven, The Role of Technology and Social Media in the 2023 Bank Crisis

Social media and technology played a certain role in triggering the US bank crisis. Here are the specific impacts:

The modern era has witnessed the connection of capital between global banks. Therefore, when a regionally but large-scale bank in the US fails, most of the world’s financial institutions feel the shock. Some basic technologies responsible for inter-bank communication for the unfamiliar include SWIFT (Society for Worldwide Interbank Financial Telecommunication) and cloud computing.

Furthermore, it is worth noting that some tech startups (such as Roblox and ROKU) are associated with SVB, leading investors to lose confidence in the entire industry. Even cryptocurrencies have caught the attention of experts, with some believing that banks’ exposure to blockchain-based assets is one of the reasons for the crash.

Social media has also added fuel to the chaos, with experts and influencers publishing arbitrary theories about the crisis. All of this plays a role in a feedback loop, further exacerbating the crisis.

Eight measures to solve the banking crisis in 2023

Addressing the negative impact of the 2023 banking crisis may not be that simple. Multiple institutions – financial institutions, governments and the Federal Reserve System, businesses, and international organizations – need to work together.

The following are some possible measures that may be underway:

1. How can financial institutions help?

Financial institutions, especially banks, can focus on risk management in the future. Improving liquidity management, diversifying funding sources, holding high-quality liquid assets (HQLA), better predicting cash flow, and establishing adequate liquidity buffers are some feasible strategies.

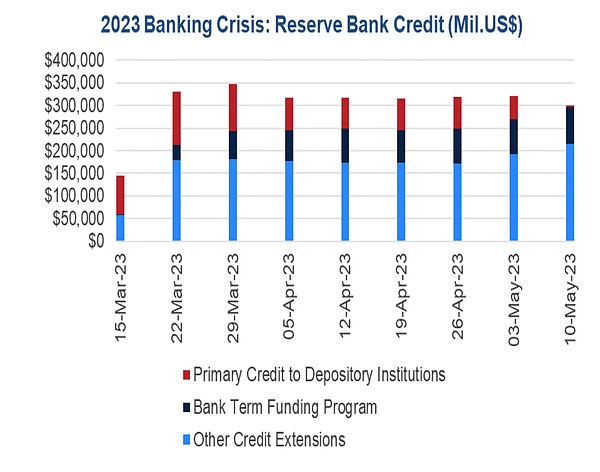

The Federal Reserve and the government have taken some coordinated measures to minimize the impact of the banking crisis. These include:

2. Rescue plan

Unlike past crisis events, closed banks did not receive direct assistance. Instead, the focus was on helping depositors, with support from the Federal Deposit Insurance Corporation (FDIC). One example is the FDIC’s use of Systemic Risk Expectations (SRE), which focused on Signature and SVB and provided a backup claim on uninsured depositors. Although there was an outflow of loans totaling $400 billion, there was no direct bank bailout, but measures were taken to protect depositors.

3. Policy changes

One of the most important policy changes in the ongoing crisis wave is the introduction of BTFP or the bank term funding facility. This Fed-led policy focuses on improving liquidity associated with banks by providing one-year mortgage loans. However, BTFP is more like a government response to a liquidity crisis than a direct bank bailout.

4. Stress Testing

The Federal Reserve’s stress test scenario for 2023 was announced well before the crisis hit. This set of tests will run from the first quarter of 2023 until 2026, focusing on 28 variables. Although the Fed has included so-called “exploratory market shocks” in the test scenario, it has not actually considered rapid rate hikes. Now, with the impact of the crisis spreading, new stress tests or scenarios that target capital structure vulnerability may emerge.

In addition to the above solutions, here are some other methods that may already be in place:

5. Support from International Central Banks

-

Individuals and businesses adopt cryptocurrencies to minimize banking risks.

-

Digital payments and other types of digital technologies are adopted at the individual and business levels to reduce excessive reliance on the banking system.

9. Lessons Learned from the 2023 US Banking Crisis

The banking crisis of 2023 was not only eye-opening, but also a reality check, and here are the lessons we learned:

1. Financial market and banking reforms are critical

Bank failures exposed regulatory loopholes and inaction. The concept of asset-liability maturity emerged due to the long-term decline in bond yields, which opened up a new door for liquidity management. Another lesson learned by everyone is that over-investing in one industry or sector is never a good thing for banks as investors. Finally, only strict financial reforms can eliminate all of the above problems.

2. Economic resilience is essential

Regardless of the reforms, it all boils down to banks’ ability to withstand shocks such as bank runs. When withdrawal requests start pouring in, everything starts to fall apart, which is where even banks need to understand that investing in only one asset class is not a good practice. It is also worth noting that the introduction of BTFP is a step towards building economic dependence.

Aside from these important lessons, the crisis even emphasized the role of technological adaptation, which may include using machine learning and artificial intelligence for risk assessment.

10. Economic Recovery Following the US Banking Crisis

What else the government, the Federal Reserve, and policymakers can do to promote economic recovery remains to be seen, but here are some ideas that may already be in the works:

-

Strengthening the banking space

-

Being more cautious about raising interest rates

-

Restoring people’s confidence in the banking system

-

Stimulating economic trends through relevant fiscal policies

-

Promoting overall financial stability through international cooperation

Finally, it is most important to increase transparency and focus on the bank’s balance sheet, which is what the “explanatory market shock” stress test scenario is designed to consider. Additionally, the banking industry seems to still be somewhat unconventional, and it may still be too early to say that the banking crisis is over.

11. Crisis or Healing: What are the Long-Term Prospects?

Whatever the approach, it all comes down to building a strong financial system. The worst part of the 2023 banking crisis may already be over, or it may not have arrived yet. It is worth noting that as of late May/early June 2023, the pressures on financial markets have not eased, and credit spreads remain small. While the raising of interest rates continues, the Federal Reserve seems to be cautious about such measures. However, the 2023 US banking crisis is a highly complex space, covering issues such as bond rates, interest rates, credit limits, and bank runs.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!