Author: Mary Liu

The cryptocurrency industry is currently facing the most difficult regulatory period to date. BlackRock, the world’s largest asset management company, may become the “savior” of the industry and bring unexpected benefits to some participants. Matt Hougan, the chief investment officer of Bitwise Asset Management, commented in a tweet: “The future of cryptocurrency is more about BlackRock than Binance.”

BlackRock’s New Initiative

- Profile of Vitalik Buterin: Both a Lone Island and a Signal Tower

- BlackRock’s Bitcoin ETF: “Lifesaver” or “Competitor” for the Cryptocurrency Industry?

- Wall Street institutions are positioning themselves in the cryptocurrency business. Bitcoin has broken through $29,000 for the first time since the end of May.

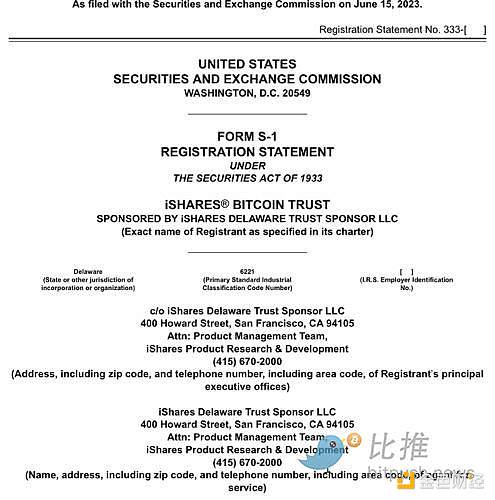

The US Securities and Exchange Commission (SEC) has rejected all previous applications for spot Bitcoin ETFs. Including applications from Fidelity, CBOE Global Markets, and NYDIG. Recently, it defended itself in a lawsuit brought by Grayscale Investments, which operates the $17.5 billion Grayscale Bitcoin Trust (GBTC) and has been seeking to convert it to an ETF.

The trading price of GBTC has always had a large negative premium compared to the value of its held Bitcoin-this year’s average is about 40%. The conversion will allow traders to arbitrage, releasing billions of dollars in value.

Since BlackRock submitted its document, the negative premium of GBTC has narrowed from around 44% in mid-last week to around 34% currently, indicating that investors believe that the likelihood of a successful ETF conversion is greater. Bitwise Asset Management and WisdomTree have also followed suit and submitted similar applications again.

It is not easy to change the SEC’s mind, but there is some reason to be optimistic. At first glance, BlackRock’s proposal is roughly similar to previous proposals, which is to create a trust that owns Bitcoin and can create and redeem shares in exchange for Bitcoin. These Bitcoin ETFs operate in a similar way to physically backed commodity ETFs such as gold.

But BlackRock’s application has at least one thing to be appreciated. In the 36th page of its 19b-4 document, the company stated that in order to reduce market manipulation, it will introduce a supervision sharing agreement signed by Nasdaq and the operator of Bitcoin spot trading platform. The supervision sharing agreement allows sharing of information about market trading activities, clearing activities, and customer identities. In other words, exchanges can obtain confidential information about buyers, sellers, and prices, and the possibility of market manipulation is almost zero.

Polymesh Association’s tokenization lead, Graeme Moore, said that BlackRock’s proposed monitoring sharing agreement, called the “Spot BTC SSA,” makes the application stand out and highly likely to be approved.

The potential manipulation of spot Bitcoin prices has been a significant reason why the SEC has so far rejected Bitcoin ETF applications. If this monitoring sharing platform is Coinbase, it could be significant because Coinbase is one of the exchanges for the CME CF Bitcoin Reference Rate, which BlackRock’s ETF will use.

Will BlackRock’s application be persuasive enough to convince the SEC to make a different decision? Excluding the issue of futures versus spot, how regulators evaluate whether a market is “of significant size” and/or sufficiently “regulated” remains an open question.

Blindly betting on the approval of BlackRock’s spot Bitcoin ETF could be reckless, but if it is approved, it will have a huge impact on the struggling crypto industry.

Once BlackRock’s spot ETF successfully passes the regulatory hurdles, other ETFs can adopt the same mechanism. If an exchange successfully applies for a listed spot Bitcoin ETF, the process usually becomes easier for other exchanges. Grayscale may lose some market share, but will benefit from the first-mover advantage. However, more directly, GBTC holders will benefit from the end of negative premiums, and the broader user base can typically push up Bitcoin prices.

Another winner could be Coinbase. On the one hand, an easily tradable spot ETF could take some market share from individual investors who might otherwise trade cryptocurrencies on their platform. On the other hand, Coinbase is also the custodian for both BlackRock’s proposed trust and Grayscale’s trust for Bitcoin and earns fees as a result – which is a more stable source of income than volume-based fees – and institutional business could become the center of the market makers trading around spot ETFs.

Traditional institutions “grabbing”?

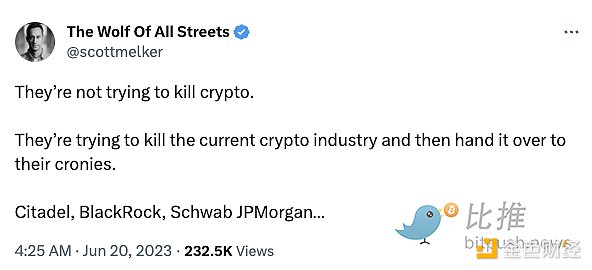

Although the entry of large-scale, strictly regulated traditional institutions into cryptocurrencies seems to be good news, not everyone is optimistic about it. Concerns about “hostile takeover” and handing over keys (whether symbolic or encrypted) to institutions are spreading in the community.

Mark Yusko, founder of Morgan Creek Capital Management, suggests that Xapo, the institutional-scale cryptocurrency custody tool acquired by Coinbase in 2019, could be the regulatory “white glove.” He said in a tweet: “What if BlackRock could take over Xapo? If they have most of the funds, regulators can shut down the Coinbase exchange, the SEC can put on the ‘unlicensed gambling hall’ hat, and transfer the Xapo department to BlackRock.”

Some also believe that the collective layout of large financial institutions in the cryptocurrency business is no coincidence. Caitlin Long, a Wall Street veteran and CEO of digital asset bank Custodia Bank, wrote: “Suddenly, these Wall Street giants entered the cryptocurrency field after the runway was cleared, and it is difficult not to be associated with it.”

Long cited the SEC’s indictment of Coinbase this month as a typical example of law enforcement action, suspecting that this may clear the obstacles for the launch of the new exchange EDX.

Investor Adam Cochran commented in a tweet: “BlackRock, Citadel, Deutsche Bank, and Nasdaq are all starting to enter the cryptocurrency field. They bully participants so that they can grab cheap tokens. The development trajectory of cryptocurrencies has never been so clear.” He said that regulators are more inclined to veteran companies entering the cryptocurrency field rather than companies focused on digital assets from the beginning.

The Twitter account @The Wolf Of All Streets with more than 900,000 followers said: “They don’t want to kill cryptocurrency. They just want to kill the current cryptocurrency industry and hand it over to their cronies. Citadel, BlackRock, JPMorgan…”.

It is worth noting that the SEC has not provided any official timetable for approving BlackRock’s Bitcoin ETF or any other pending ETF proposals. Its approval process is not completely transparent, and even if the proposal is approved, the entire process may be quite complicated, even if BlackRock has hopes of getting insider information. Sumit Roy, senior analyst at ETF.com, said in his blog post that even if BlackRock has hopes of getting insider information, the entire process will be quite complicated due to the Coinbase indictment and the approaching court date with Grayscale.

Can BlackRock ultimately bring huge adoption waves to Bitcoin? In the current regulatory fog, it is difficult for us to predict, but at present, this Wall Street giant undoubtedly has the highest odds.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!