Author: jk, Odaily Star Daily

Although traditional Internet giants often increase their holdings of Bitcoin for the purpose of diversified asset allocation (alternative investment), industry insiders often view it as a bullish signal for crypto and even follow suit with the idea of “following smart money”.

However, the recent financial reports have revealed the following situation – in the bear market of cryptocurrencies, the Bitcoin positions of large companies are also mostly in floating losses; different companies have different investment strategies, either reducing holdings and taking profits at the right time, holding and not selling (HODL), or firmly buying and lowering the average holding cost.

Odaily Star Daily has summarized the business overview, stock price performance, latest developments, and Bitcoin holdings information (current quantity, average cost, profit and loss situation) of these seven companies: Microstrategy, Galaxy, Tesla, Block Inc., Hut 8, Marathon Digital Holdings, and Meitu. It is worth noting that financial reports have lagging information and should not be used as a single investment reference indicator.

- A Brief History of Airdrops The Birth, Evolution, and Future of the Lure Culture

- Revisiting the valuation logic of exchange platform tokens BNB, OKB, and BGB, which one is worth hoarding the most?

- Legal dispute between the two co-founders of the blockchain gaming project Gala Games, involving over $700 million worth of GALA tokens.

Microstrategy

MicroStrategy is an enterprise that provides highly specialized business intelligence, mobile software, and cloud solutions. The company was founded in 1989 and is headquartered in Tyson’s Corner, Virginia, USA. MicroStrategy provides a variety of analytic and mobile software solutions for data visualization, reporting, and dashboards. These solutions are often used to help companies better understand, monitor, and leverage their data.

The company’s latest product, MicroStrategy ONE, is a comprehensive, modern, open, and cloud-driven analytics platform designed to be a single solution for all analytic use cases. From self-service data analysis and business reporting to advanced applications and embedded solutions, the platform aims to “unleash the power of data” and help companies gain a competitive advantage.

Under the leadership of CEO Michael Saylor, MicroStrategy has also become one of the companies that invests in Bitcoin on a large scale, using it as an asset reserve strategy.

According to the Q2 2023 financial report, the company recognized $24.1 million in impairment expenses for its Bitcoin holdings in the second quarter, compared to $917.8 million in the same period last year and $18.9 million in the first quarter of this year. The impairment of the company’s digital assets reflects the decline in the price of Bitcoin relative to the acquisition price.

MicroStrategy CFO Andrew Kang said in a statement, “As of July 31, 2023, we held 152,800 bitcoins, an increase of 12,333 bitcoins during the second quarter of this year, the largest quarterly increase since the second quarter of 2021. We effectively raised funds through our market equity program and continued to increase our Bitcoin on our balance sheet using operating cash. We did this against the backdrop of increasing institutional interest, progress in accounting transparency, and increasing clarity in Bitcoin regulation.”

Currently, Microstrategy’s average price of Bitcoin is about $29,668.

According to Coingecko’s data, Microstrategy’s total cost of holding Bitcoin is $4.127 billion, and the current value of these Bitcoin is about $3.97 billion, accounting for approximately 0.728% of the total Bitcoin supply. The data shows that 46% of MicroStrategy’s Bitcoin assets were acquired in 2020. In the third and fourth quarters of 2020, MicroStrategy purchased 38,250 BTC (average price of $11,151) and 32,220 BTC respectively. As of August 17th, these BTC accounted for 46.12% of MicroStrategy’s Bitcoin assets.

As of the current date, MicroStrategy’s total market value is $4.951 billion, with a stock price of $351.48 per share. Compared to approximately $246.91 six months ago, the stock price has significantly increased by about 42%. However, the stock has also experienced fluctuations during the year, with the highest point occurring in early July when the stock price reached approximately $475.09. Since the highest point of the year, the stock price has fallen back. This price fluctuation may reflect the market’s multi-faceted evaluation of MicroStrategy’s strategy in business intelligence and Bitcoin investment.

Galaxy Digital

Galaxy Digital is a financial services and investment management company based in New York City, specializing in digital assets and blockchain technology. Since its establishment in 2018, the company has been building a comprehensive financial platform, including three complementary operating businesses: global markets, asset management, and digital infrastructure solutions. Galaxy Digital aims to combine financial complexity with technological expertise, connecting institutions with Web3 innovation.

The company offers a range of financial services, including trading, lending, strategic consulting services, institutional investment solutions, proprietary Bitcoin mining and custody services, network validation services, and the development of enterprise custody technology. Galaxy Digital has multiple offices worldwide, including North America, Europe, and Asia.

Founded and led by experienced hedge fund manager and former Goldman Sachs partner Mike Novogratz, the company has been at the forefront of driving the application and acceptance of cryptocurrencies and blockchain technology in the mainstream financial world. Through its diversified business portfolio and global influence, Galaxy Digital aims to provide comprehensive cryptocurrency and digital asset-related services to retail and institutional investors.

According to the second quarter 2023 financial report, Galaxy Digital has performed well in the face of ongoing uncertainty and regulatory pressures. Novogratz stated that the company is moving towards long-term growth due to prudent risk management practices and a strong balance sheet.

In terms of finances, the net loss for the second quarter was $46 million, a significant decrease compared to the net income of $134.2 million in the first quarter of 2023. Operating expenses in the second quarter were $85.2 million, a decrease of 6% compared to the previous quarter and a decrease of 34% compared to the same period last year. The company’s partner capital (equity) at the end of the quarter was $1.5 billion, a 3% decrease from the end of the first quarter, but liquidity remains strong at $696 million as of June 30, 2023.

In terms of business, Galaxy Global Markets (GGM) generated trading revenue of $59.5 million, a decrease of 54% compared to the previous period, mainly due to a decline in net realized gains from digital assets and derivatives. Investment banking revenue amounted to $45,000, primarily due to a slowdown in merger and capital raising activities. Galaxy Asset Management (GAM) recorded asset management revenue of $33.8 million, a 619% increase compared to the previous period, mainly driven by increased net realized gains from investments on its venture capital platform. Galaxy Digital Infrastructure Solutions (GDIS) generated mining revenue of $15.4 million, a 51% increase compared to the previous period, primarily due to increased revenue from proprietary mining activities.

Currently, Galaxy holds approximately 12,545 bitcoins, with a current value of approximately $326 million.

Compared to other companies, Galaxy has relatively small fluctuations in its stock price, which is currently $5.08. In the past year, the lowest price was $3.33, and the highest price was $8.3.

Galaxy stock price in the past year. Source: Yahoo Finance

Tesla

As familiar to car consumers, Tesla, Inc. is an American electric vehicle and clean energy company, with Elon Musk serving as CEO and major shareholder. The company was founded in 2003 and initially started with the production of high-performance electric sports cars but gradually expanded into a broader consumer market, introducing various electric vehicle models such as Model S, Model X, Model 3, and Model Y.

In addition to electric vehicles, Tesla also ventures into renewable energy products, including solar panels, solar roofs, and residential and commercial energy storage solutions such as Powerwall, PowerLianGuaick, and MegaLianGuaick. The company’s goal is to accelerate the world’s transition to sustainable energy.

In the second quarter of 2023, Tesla’s financial performance exceeded Wall Street’s expectations. The company reported a 20% increase in net income to $2.7 billion, mainly driven by cheaper raw materials, which helped offset the decline in vehicle prices. On the other hand, although new vehicle deliveries increased by 83% during the April to June period, revenue growth was not as strong, rising only 47% to $24.9 billion. However, this revenue figure still exceeded the average analyst expectation of $24.2 billion according to FactSet surveys.

Tesla also attracts significant attention in the stock market. Its stock price has experienced significant fluctuations but overall shows a strong upward trend, making it one of the highest-valued global automakers. From $108.1 at the beginning of the year to the current $245.01, Tesla’s stock price has undergone significant volatility in 2023 but overall shows an upward trend. The stock reached a peak of over $290. This growth reflects the market’s positive view of Tesla’s continued innovation and market leadership in the electric vehicle and renewable energy sectors. Currently, the company’s market capitalization has reached $77.7659 billion.

In the field of cryptocurrency, Tesla has been continuously followed for its large-scale holdings of Bitcoin, support for cryptocurrency payments, and Elon Musk’s status as a key opinion leader (KOL) in the industry. Tesla has not bought or sold Bitcoin for four consecutive quarters and currently holds 10,500 Bitcoins, with a current value of approximately $272 million, accounting for about 0.05% of the total Bitcoin supply.

However, Tesla has suffered losses due to its Bitcoin investment: the total cost of Tesla’s Bitcoin purchases is $336 million, exceeding the current value by 23.5%.

Block Inc.

Block Inc. (formerly known as Square Inc.) is a multinational technology conglomerate founded in 2009 by Jack Dorsey and Jim McKelvey. The company launched its first platform in 2010 and went public on the New York Stock Exchange in November 2015, with the stock symbol SQ.

Block Inc. initially started as a payment platform primarily targeting small and medium-sized businesses, allowing them to accept credit card payments and use smartphones or tablets as point-of-sale (POS) payment terminals. Although the company has been renamed Block Inc., its flagship product for small businesses is still called “Square”.

With the expansion of its business, Block Inc. now has multiple business segments. Cash App is a mobile application that allows users to transfer money between each other and between users and businesses. AfterLianGuaiy is a “buy now, pay later” service. Weebly is a website hosting service, and Tidal is a subscription-based music, podcast, and video streaming service that offers audio and music videos.

Block Inc. is not only committed to providing financial and payment solutions but also continuously entering emerging fintech fields, including cryptocurrency. Overall, the company aims to simplify the payment process and make it more seamless and convenient through its diversified and comprehensive financial solutions.

Block Inc. stock price in the year. Source: Yahoo Finance

Block Inc.’s stock price has shown significant volatility this year. It has dropped from $64.64 at the beginning of the year to the current $58.17, with a market capitalization of $35.488 billion. It is worth noting that the stock reached its highest point in early February, around $88, but has since declined. Despite the overall downward trend from the beginning of the year to the present, the overall trend is somewhat correlated with the U.S. stock market, with less correlation with cryptocurrency than other stocks. Its market capitalization remains relatively stable, indicating that the market still has confidence in this diversified fintech company.

Block Inc. performed well in the second quarter of 2023, especially in a challenging economic environment. The company’s net income for these three months was $5.3 billion, an increase from $4.4 billion in the same period last year, and exceeded Refinitiv’s estimate. The financial technology company’s gross profit increased by 27% year-on-year, reaching $1.87 billion. In addition, the company raised its EBITDA forecast for 2023 from the original $1.3 billion to $1.5 billion.

The main business of Block, Cash App, saw a 37% increase in gross profit, reaching $968 million. At the same time, the gross profit of Square’s business also grew by 18% to $888 million. Jack Dorsey, the chairman of the company, stated that the company will continue to focus on expanding into international markets, but also seek cost control, including reviewing stock-based compensation. He also mentioned that the company has started to recruit more precisely, focusing on key roles and paying more attention to performance management. Adjusted, Block’s earnings per share in the second quarter were 39 cents, surpassing analysts’ forecast of 36 cents.

According to Coingecko’s data, Block currently holds 8,027 bitcoins, with a cost of $220 million, which is now worth about $209 million, with a relatively small loss.

Hut 8

Hut 8 Mining Corp. is a Canadian Bitcoin mining company that focuses on Bitcoin mining using advanced hardware and data center resources. The company is one of the largest publicly traded Bitcoin mining companies in North America and has considerable computing power. Hut 8 is not only a Bitcoin mining company, it also provides other services and solutions related to cryptocurrencies, such as high-performance computing.

Hut 8 typically sets up its mining facilities in areas with low energy costs, such as some remote areas in Canada, to reduce operating costs and improve efficiency. This enables the company to remain competitive in the highly competitive cryptocurrency mining market.

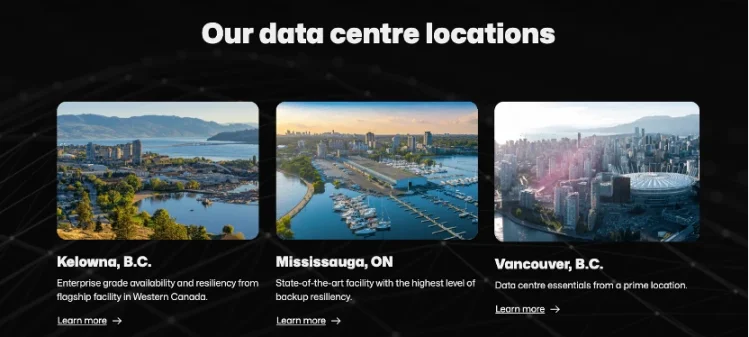

Hut 8's data center location. Source: Hut 8 official website

From $0.818 at the beginning of the year to the current $2.37, Hut 8’s stock price has shown significant volatility in 2023, but overall it is on an upward trend. The stock reached a yearly high of about $4 in mid-July and then declined. Nevertheless, compared to the beginning of the year, the stock price still has considerable growth. This price dynamic reflects investors’ views on the company’s performance and potential in the Bitcoin mining field. Currently, Hut 8 has a total market value of $526.7 million.

In the second quarter of 2023, Hut 8’s revenue dropped to $19.2 million, a significant decrease compared to $43.8 million in the same period last year. During this period, the number of bitcoins mined by the company also decreased by nearly 58%, totaling only 399. The main reasons include the increase in the difficulty of the Bitcoin network, the suspension of the North Bay facility, and ongoing power supply issues at the Delaney facility. Its high-performance computing (HPC) business also declined slightly, generating only $4.2 million in monthly recurring revenue, a decrease from $4.7 million in the same period last year. At the end of the quarter, the company’s hash rate reached 2.6 EH/s (excluding the North Bay facility), and it held 9,136 self-mined bitcoins. In this quarter, the company realized $14.7 million in revenue through the sale of 396 bitcoins.

Currently, Hut 8 has a Bitcoin market value of approximately $242 million.

Last week, Hut 8 announced that it will be merging with U.S. Data Mining Group, Inc. (operating under the business name “US Bitcoin Corp” or “USBTC”). This transaction is expected to create a new company called “New Hut” with its headquarters based in the United States. The new company will focus on cost-effective Bitcoin mining, diversified revenue streams, and industry-leading environmental, social, and governance (ESG) practices.

Jaime Leverton, CEO of Hut 8, expressed that they anticipate receiving approval from the U.S. Securities and Exchange Commission (SEC) for the registration statement of “New Hut” in the near future. Leverton believes that after completing this merger, the new company will become a stronger and more dynamic business entity. This entity will be supported by a significant amount of fiat currency revenue generated from Bitcoin and a robust network of hosting, mining infrastructure, and high-performance computing operations across North America.

Marathon Digital Holdings

Marathon Digital Holdings (formerly Marathon LianGuaitent Group) is a U.S. company primarily focused on Bitcoin mining. The company was established in 2010 and initially operated as an intellectual property (IP) company, but later transitioned into an enterprise dedicated to cryptocurrency mining and related activities.

Marathon Digital Holdings operates large-scale Bitcoin mining facilities and has multiple data centers across the United States. These data centers are equipped with high-performance mining hardware designed to mine new Bitcoins by solving complex mathematical problems and participate in maintaining the Bitcoin network.

The company’s goal is to become one of the largest and most efficient Bitcoin mining enterprises in North America. Due to its significant power demands, Marathon Digital Holdings also focuses on finding sustainable and cost-effective energy solutions.

In the mid-year financial report, Marathon’s Chairman and CEO Fred Thiel stated:

“We held approximately $113.7 million in unrestricted cash and cash equivalents at the end of the quarter, along with approximately 12,538 Bitcoins, which were valued at approximately $380 million as of June 30th. While our cash position decreased by $11.2 million from the first quarter, we added 1,072 Bitcoins, which were valued at approximately $32.7 million as of June 30th.”

“We made significant progress in the second quarter, significantly improving our hash rate and efficiency… In the second quarter, we increased our effective hash rate from 11.5 EH/s to 17.7 EH/s. By growing our hash rate faster than the rest of the network and increasing our uptime, we also increased our Bitcoin production. In the second quarter, we mined a record 2,926 Bitcoins, representing approximately 3.3% of the available Bitcoin network rewards during that period.”

However, Marathon’s profits and revenues fell short of analysts’ expectations. Currently, Marathon holds approximately 12,964 Bitcoins valued at around $336 million. However, its acquisition cost was only $189 million, resulting in a return of approximately 78%.

As of now, the stock price of Marathon Digital Holdings is $12, which is significantly higher compared to the beginning of the year at around $4.09, almost tripling in value. The highest point reached during the year was $19.88. The current market capitalization of the company is $2.091 billion. Such fluctuations in stock price and market capitalization may reflect the market’s high attention to the company’s strategies and performance in Bitcoin mining and cryptocurrency investments. Despite a slight decline from the year’s peak, the company’s stock price remains strong compared to the beginning of the year, which may indicate investors’ optimistic outlook on its long-term prospects. However, considering the volatility of the cryptocurrency market, this stock price performance could change at any time.

Meitu

Meitu is a Chinese technology company listed on the Hong Kong Stock Exchange, specializing in the development of mobile applications and smartphones. The company was founded in 2008 and is headquartered in Xiamen, Fujian Province. Its most well-known product is the photo editing and beautifying application called Meitu Xiuxiu, which has hundreds of millions of users worldwide. In addition to basic photo editing functions, the app also provides various beauty filters and AI-driven photo enhancement tools.

In 2010, Meitu established its R&D center, MT Lab, focusing on artificial intelligence and image innovation in fields such as computer vision, deep learning, and computer graphics.

As of December 2022, Meitu has reached a monthly active user (MAU) count of 243 million, with nearly 80 million coming from international markets. These international users are distributed across 22 countries and regions, each with 10 million or more users, including Indonesia, Thailand, Brazil, Pakistan, the United States, Vietnam, Japan, Bangladesh, the Philippines, South Korea, Malaysia, Iran, Mexico, Nigeria, Canada, Turkey, Russia, Myanmar, South Africa, the United Kingdom, and Nepal.

In April 2021, Meitu announced a cryptocurrency holding of nearly $100 million. According to the latest financial report, in the exchange filings for July, Meitu reported holding approximately 940 Bitcoins and 31,000 Ether, with total costs of $49.5 million and $50.5 million, respectively. Compared to the reported scale in 2021, Meitu’s cryptocurrency assets have decreased by more than $40 million. This reduction is double the size of the previous quarter.

Among them, the Bitcoin, which cost nearly $50 million, is now worth only about $24.45 million.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!