MakerDAO offers high interest rates, but it is expensive to play. Besides buying government bonds, it also provides small loans. Ondo, on the other hand, only deals with government bonds but cannot be purchased easily. The KYC process is troublesome, and there is a lack of liquidity in the market. Currently, there is a need for a pure asset that can be provided to the general public. TProtocol V2 is a product created for this purpose. This article will analyze the pain points of current RWA government bond tokens and the problems solved by TProtocol.

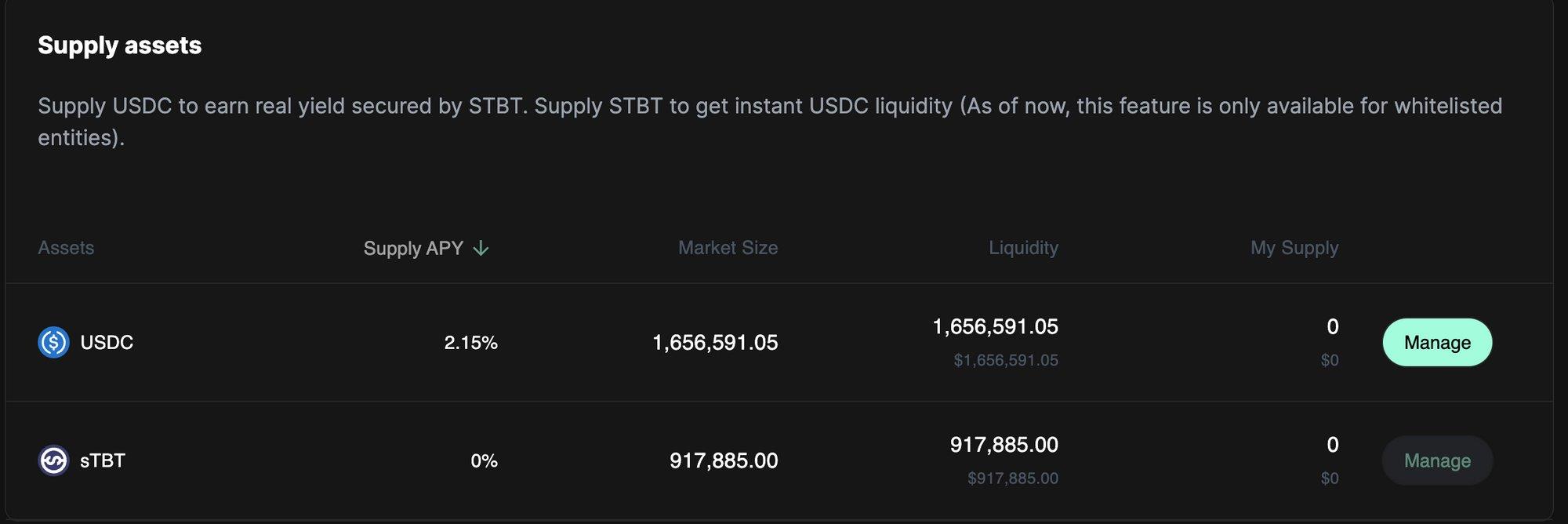

At first glance, TProtocol appears to be a lending product. For example, Matrixdock pool, which is supported by the initial release, allows Matrixdock, one of the top three RWA TVL ranking projects, to use its issued government bond token STBT as collateral to borrow USDC. Users who deposit USDC will receive rUSDP, a interest-bearing token similar to AAVE’s aUSDC.

- Why have government bonds become the only landing point for mid-term and short-term RWA?

- The ‘fur-raising ecosystem’ in the encrypted winter Project parties adept at PUA, while small and medium-sized studios are complaining incessantly.

- Blockchain Games 101 Precompiled Contracts

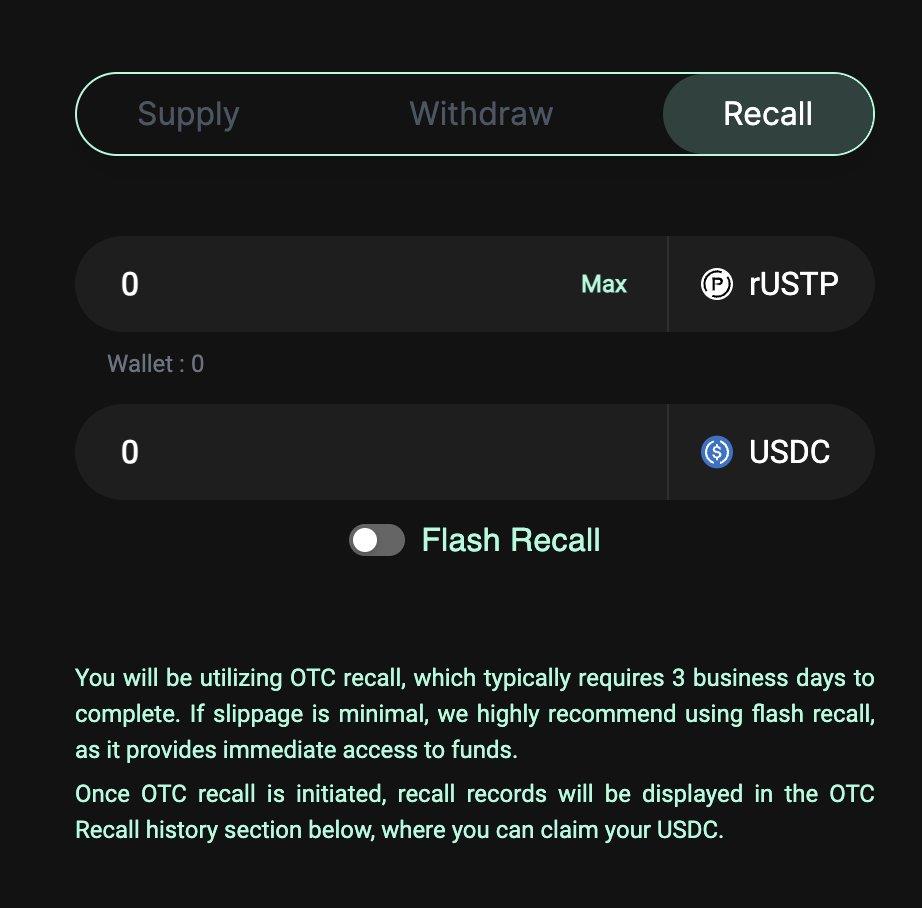

The highlight is that the LTV (Loan-to-Value) of STBT lending is as high as 100.5%. In extreme cases, if the utilization rate can reach 99.5%, it means that 99.5% of the government bond yield can be given to rUSDP holders. With such a high utilization rate, how is a large withdrawal handled? It adopts an OTC model similar to the one used by borrowers, which allows Matrixdock a certain amount of time to sell government bonds and repay the loan. Small withdrawals can be made through normal withdrawals or selling USDP on DEX.

For compliance reasons, tokens like Ondo-OUSG/Matrixdoc-STBT are only available to qualified investors. Even the recently launched USDY, which has more relaxed conditions, still requires KYC and a minting period of up to two months. The value contributed by TProtocol is to maximize the interest of government bond tokens by using the institutional mortgage lending model and transfer it to USDC depositors, allowing ordinary users to enjoy government bond yields.

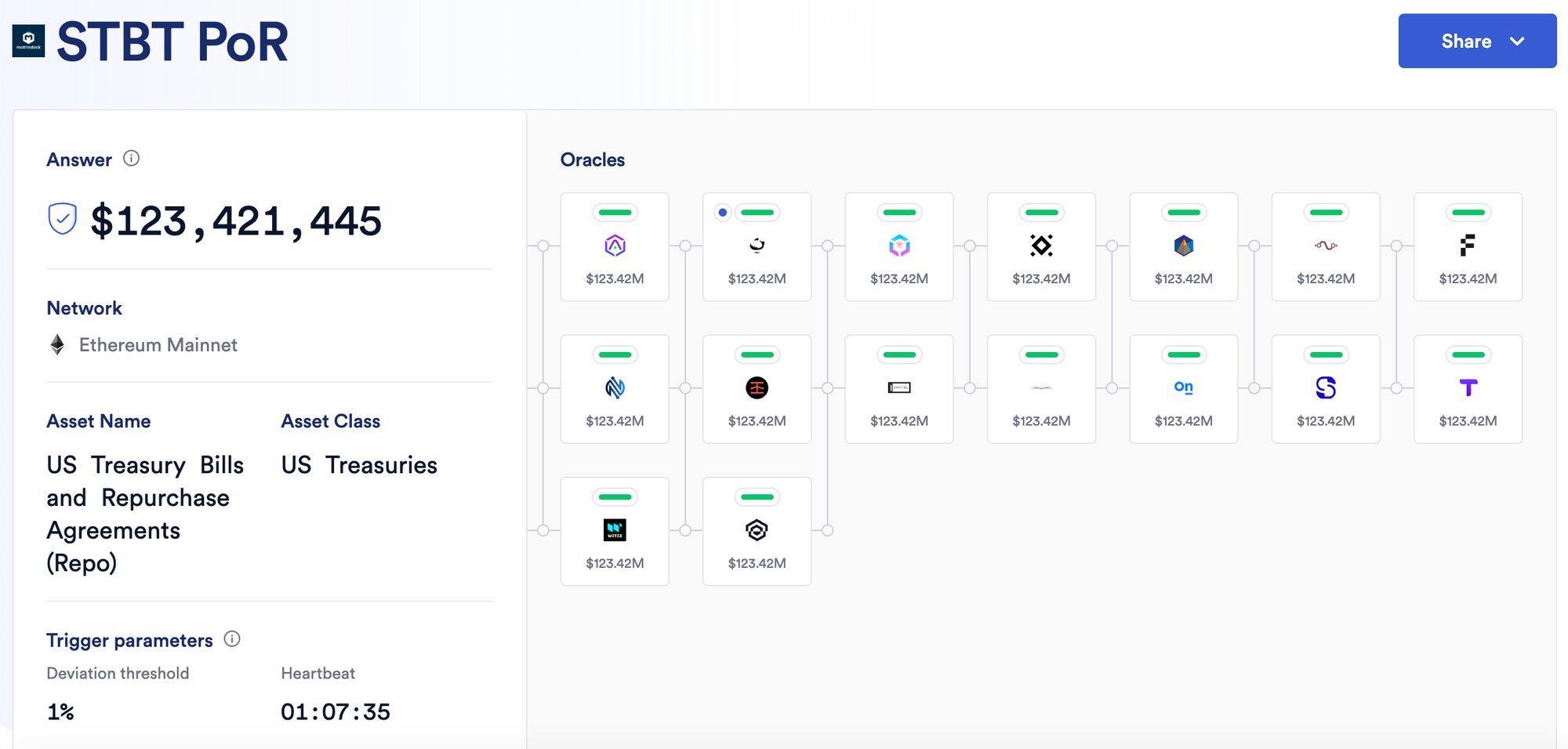

Unlike institutional credit loans that frequently default in the past, TProtocol focuses on dedicated products. For example, the terms of STBT clearly specify that the investment object is short-term government bonds and government bond repurchase agreements. It also regularly publishes asset reports and has collaborated with Chainlink for reserve verification.

Of course, although there is verification, it still relies on trust in the underlying government bond asset custodian. Therefore, TProtocol will launch independent pools to isolate risks for different RWA assets. For example, if there is a collaboration with Ondo in the future, a new Ondo Pool will be created to store USDC for the new token rUSDP-Ondo, thus isolating risks.

The design of Tprotocol is also relatively Degen in other aspects, such as the design of governance tokens TPS/esTPS, which is similar to GMX. The longer they are held, the higher the dividends. In addition, a dual-layer structure of iUSDP/USDP has been designed. Similar to the architecture of sfrxETH/frxETH, iUSDP is the profit-accumulating version of rUSDP, while USDP does not generate profit and is used to provide liquidity on DEX and other platforms.

This model allows Tprotocol to improve capital efficiency and increase the income of iUSDP by bribing other protocols, so that its income can exceed the income of regular government bonds, similar to the income improvement model of sfrxETH.

At present, the competition in the RWA sector is fierce, and MakerDAO has already taken an absolute advantage. However, as an over-collateralized stablecoin, the proportion of assets that MakerDAO can use to purchase government bonds is limited. Previously, MakerDAO used USDC in the PSM module to withdraw and purchase government bonds, but the space for this is not particularly large anymore. If there are too many users storing DAI to earn interest, the interest rate may even drop below the government bond rate.

Summary

Tprotocol uses the model of institutional collateralized RWA asset lending to transfer the pure income of government bond tokens to general users who do not need KYC, and follows the design pattern of sfrxETH/frxETH to give them the opportunity to earn income higher than the basic income of government bonds.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!