Author: polynya, Crypto KOL; Translation: Felix, LianGuaiNews

Earlier this year, crypto KOL polynya listed various demand drivers for ETH and explained the importance of each driver. The author believes that the most important demand driver for crypto assets is “long-term reserve assets,” which means believing that assets are an alternative store of value. Combining economic collateral and related “currencies” (collectively referred to as “currency premiums”), the author believes that this accounts for at least 90% of the value of a crypto asset. The value of “on-chain transaction fee destruction,” which is considered important by many, is not as important in the author’s view. This article uses three of the top 10 crypto assets (BTC, ETH, TRON) as examples to explore why this situation occurs.

BTC is still the dominant asset in the crypto field and has been in existence for 14 years. For emerging and rapidly developing blockchain technology, this is a considerable amount of time. BTC is valued at $572 billion and is entering a mature stage. Nowadays, some people believe that BTC’s market value will reach $1 trillion or possibly higher. However, the reality is quite different. Since 2017, BTC’s return on investment has been significantly declining. It can be seen that all hopium predictions like S2F (note: referring to false or unrealistic optimism) have failed.

- The SEC is expected to give the green light to Ethereum futures ETF it is expected to be listed as early as October, with a total of 16 applications pending approval.

- Macro Weekly Report on August 14th A Week Full of Events, Lacking More Marginal Positive Factors

- Worldcoin in the Polkadot ecosystem? Analysis and interpretation of another UBI project Encointer

The Bitcoin network and the wider community have little activity, but this is also rarely needed. Bitcoin has value because people collectively believe it is the best “long-term reserve asset” or alternative store of value. Based on this, Bitcoin still dominates the industry and is the only demand driver, which is why the author believes that whether it is a “long-term reserve asset” has the highest impact on the value of an asset.

Currently, BTC is valued at 2.5 times ETH. For ETH to surpass BTC, it needs to convince the collective belief that ETH is a better long-term reserve asset. Regardless of how active, innovative, and widely adopted the Ethereum chain is, ETH will not be more valuable than BTC. The market simply believes that ETH is a better cryptocurrency. Of course, the currency premium of ETH has been growing.

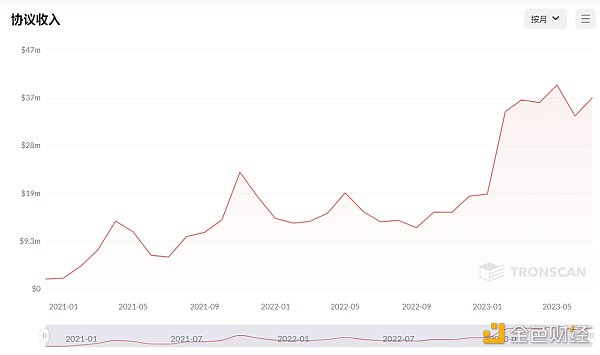

The author recently wrote an article about Tron, explaining how TRON has become one of the most active blockchains economically with the help of USDT. The fees collected and destroyed by the Tron network rank second, only after Ethereum L1. On average, in terms of USD, the amount destroyed on the Tron network is more than 25% of Ethereum’s. However, TRON’s market value is only 3% of ETH’s. TRON has not been favored by the crypto industry and has not been able to gain the esteemed status and related premiums like SOL, ADA, DOGE, and XRP tokens.

If the encryption market values these tokens through burning volume and on-chain activity, then TRON’s market value will be about 10 times higher. But that’s not the case, so TRON’s ultimate deflation rate will be 10 times higher than ETH’s. From another perspective, if ETH had TRON’s adoption rate, then ETH’s value would be around $200, and the important thing is the activity on ETH and its Layer 2. Obviously, most of ETH’s value comes from other demand-driven factors. For Bitcoin, almost all of its value comes from substitutability/speculative value storage.

It is worth noting that although the burning volume is not the most important demand-driven factor, it is still an important factor. That’s why even though TRON is not optimistic and has a low market position, TRON is one of the best-performing alt-L1 tokens in this bear market, second only to BTC and ETH, more than 10 times higher than some similar tokens such as SOL, DOGE, or ADA. For similar reasons, it can also be seen that ETH performs better than BTC in a bear market.

By observing BTC, ETH, and TRON at the same time, we can see how the encryption market views and values these assets:

1. The belief in long-term reserve assets as a substitute value storage method is still the determining factor in the valuation of encryption assets. This belief can come from various ways, no matter how unreasonable you think it is.

2. Protocol income and burning will have a certain degree of impact, but the realization value of its impact is at least 10 times lower than the currency value.

3. For assets whose majority of value comes from the currency basket, the goal should be to minimize protocol fees. If it can be used to expand established demand-driven factors in the currency category, subsidize it. For example, for Ethereum, it means that L2 fees should be as close to zero as possible, and in the long run, so should L1 fees. In the short term, a substantial reduction in L2 fees can be achieved through EIP-4844, in the medium term through danksharding, and in the medium to long term, L1 fees, including statelessness and zkEVM technologies. Seeking to expand ETH as a currency’s use throughout the industry, a 1% inflation rate of $5,000 ETH may be more valuable than $2,000 ETH with a -0.2% inflation rate.

4. However, if the assets of the protocol do not have significant currency premiums, the use and fee income of the protocol cannot be subsidized, and economic sustainability should be the first priority.

5. Encryption assets can have two broad demand-driven factors: currency and income. If the goal is a currency basket, then prioritize protocol income. On the other hand, if it is not aimed at currency, then income is crucial for sustainable development.

6. Encryption assets are not necessarily one or the other. It is obvious that tokens like BTC heavily favor currency premiums, tokens like TRON heavily favor income, and ETH is somewhere in between. Users can have L2 and dapp tokens that combine both, not limited to L1 tokens. In fact, the WLD token is an example (just an example, the token economics of WLD are very poor), WLD is mainly focused on income while primarily operating on its L2.

Note: The author obtained the data from Token Terminal, Coinmetrics, and Tronscan. The author has cross-checked repeatedly and believes it to be accurate. Many people are skeptical about Tron’s astonishing revenue, but it is indeed real.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!