Author: Pomelo, ChainCatcher

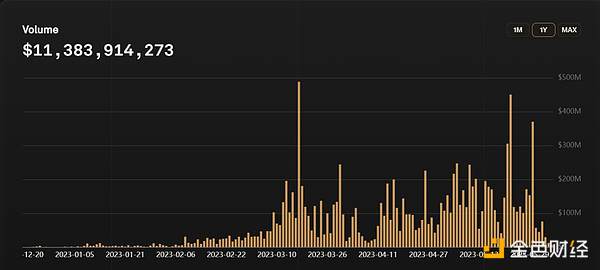

On May 25th, the total trading volume of Synthetix Perps (perpetual contract) officially exceeded 10 billion US dollars, reaching a new milestone. According to DUNE data, from the release of Perps V2 in December 2022 to June 7th, the total trading volume of Synthetix’s perpetual contracts was 11.278 billion US dollars, and the captured transaction fee was nearly 8.897 million US dollars.

In addition, in the past month, the average daily trading volume of Synthetix Perps has surpassed GMX, ranking second in the decentralized derivatives field (with dYdX being the first).

Since the release of Perps V2 half a year ago, Synthetix has earned nearly $9 million in revenue. Such outstanding performance has brought Synthetix, an old DeFi application, back into the spotlight. Synthetix is no longer positioned as a synthetic asset platform as originally intended. Its main business has shifted from the front-end to the back-end.

- Informal Systems, the core developer of Cosmos, has raised $5.3 million in funding with CCMC Global as the lead investor.

- Competition among L1 public chains is weakening, and L2 public chains will become the next focus of competition.

- Evening Must-Read | SEC Launches Final Battle Against Cryptocurrency

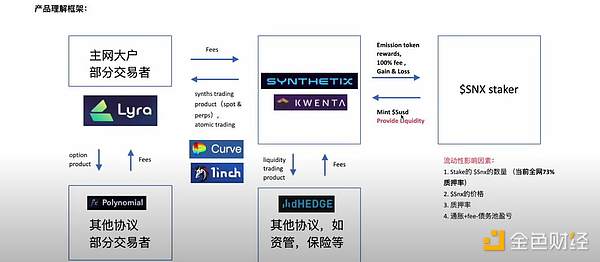

Among them, the Synthetix perpetual contract product is not aimed at retail users, but presented in the form of a back-end product. Developers or DeFi derivative products can integrate this function, and users can interact with Synthetix Perps contracts through the integrated DeFi products instead of directly using or interacting with them.

Currently, the trading volume of Synthetix’s perpetual contracts is mainly contributed by the spot and derivatives trading platform Kwenta, which is a decentralized contract product oriented towards trading users built on the Synthetix Perps component. In addition to Kwenta, other derivative platforms, such as Lyra, Polynomial, Decentrex, and dHEDGE, which are built on Synthetix, have also integrated DeFi derivatives applications.

Synthetix has completed its strategic transformation from a front-end product to a DeFi product liquidity infrastructure that supports the integration of any derivative and trading product. So, how did Synthetix gradually approach its goal of becoming a DeFi liquidity infrastructure? What has it been through in the meantime?

Flagship product Kwenta trading volume has surpassed GMX

Kwenta, as the first front-end product built on Synthetix Perps, supports users to trade cryptocurrencies, futures, and other products, contributing more than 98% of the trading volume of Synthetix Perps. Since May, Kwenta’s contract trading volume has performed well, with a highest daily trading volume of 450 million U.S. dollars on May 24th.

In terms of contract trading volume and market share, Kwenta’s recent data performance has far exceeded GMX, becoming the second-largest platform in the decentralized contract field.

According to DUNE data, Kwenta’s total trading volume over the past month was $4.46 billion, while GMX’s total trading volume over the same period was only $3.67 billion. On May 23, Kwenta’s daily trading volume reached $450 million, while GMX’s trading volume for the day was only $110 million.

Kwenta trading data changes

In fact, according to official backend data, Kwenta’s trading data has shown an upward trend since February of this year, and reached a historic high of $480 million on March 17. What drove the growth of Kwenta’s trading data? This is mainly due to the fact that on February 11, Kwenta announced that it had launched Synthetix Perps V2, which supports users to open new positions in the V2 version.

It can be seen that the growth of Kwenta’s trading data cannot be separated from the assistance of Synthetix Perps V2. What is Synthetix Perps V2? What new changes has it brought to Kwenta?

Synthetix Perps V2 is an upgraded version of the contract launched by Synthetix. Through the new off-chain oracle system and adjusted funding rate mechanism, trading costs are reduced and capital utilization is improved.

In short, Perp V2 ensures the balance of long and short positions through dynamic funding rates. For example, when there are more short positions than long positions, the short positions need to pay funding fees to the long positions at regular intervals to maintain a balance of positions, similar to a centralized exchange. However, Perp V2 will dynamically adjust every hour.

In addition, Perps V2 introduces the off-chain oracle system provided by Pyth Network, which reduces trading delays, lowers the risk of front-running trading and arbitrage, and reduces trading costs to 0.05%~0.1%.

Kwenta’s current trading fees are only 0.02% to 0.06% (GMX trading fees are about 0.1%). In addition, when Kwenta launched the V2 version in February, it added 22 encrypted asset trading pairs, and since then, trading volume has increased significantly.

In addition to the improvement of product experience and performance, Synthetix also provides additional OP token rewards to traders on the Perps V2 platform, which is an incentive in addition to the KWENTA token of the Kwenta platform itself. Starting from April 19, Synthetix will provide a total of 5.31 million OP rewards to traders on the integrated Synthetix Perps platform in 20 weeks, with a maximum of 300,000 OP rewards per week.

Meanwhile, Synthetix has also partnered with Kwenta, with the Kwenta platform offering an additional 600,000 OP tokens to its traders, with all traders receiving rewards based on the trading fees paid.

Synthetix and Kwenta rewards

In summary, the increase in Kwenta’s trading volume is due in part to Synthetix’s support. First, the release of Synthetix Perps V2 reduced trading fees and increased the number of tradable assets. Secondly, the additional OP incentive measures provided by Synthetix have encouraged an increase in trading volume.

With Synthetix’s support, the Kwenta platform has already established itself in the derivatives race, and its growing popularity has already benefited the Synthetix platform.

Synthetix provides liquidity by modularizing debt pools into DeFi applications

The success of the Kwenta platform also suggests that the Synthetix platform has successfully transitioned from an early synthetic asset platform targeting retail users to a behind-the-scenes product that provides liquidity for DeFi applications.

From its current product positioning, Synthetix is attempting to integrate liquidity into the backend of a wider range of DeFi applications and build a suite of products for users to interact with their synthetic assets.

Image source: Youtube

Currently, products built on Synthetix not only include Kwenta, but also option platform Lyra, option liquidity aggregator Polynomial, and contract platform Decentrex. These platforms all use Synthetix’s sUSD asset and liquidity provided by Synthetix.

In fact, Synthetix not only supports the integration of DeFi derivative products with liquidity, but also supports the integration of spot trading products. Atomic swaps, launched by Synthetix last year, belong to spot trading, with platforms such as Curve and 1inch already integrated.

Atomic swaps support users to execute multiple transactions in different Dapps through a packaged single transaction. The reason why Synthetix is used to complete spot trading is that it allows users to mint and trade various synthetic assets without slippage, and trading between synthetic assets has no specific counterparty, but rather destroys one token through a smart contract and mints another. Swapping USDC for DAI and continuing to swap that DAI for ETH may yield better results.

If Xiao Ming wants to buy ETH for 100,000 USDT, the usual way is to use a DEX platform to buy ETH directly with 100,000 USDT. The trading process is roughly USDT-DAI, DAI-ETH, and this process will have transaction slippage. Through the integrated Synthetix DEX platform, the trading process may become USDT exchanged for sUSD first, sUSD exchanged for sBTC, and then sBTC exchanged for BTC. Since sUSD/sBTC is a synthetic asset exchange without slippage loss, and USDT/sUSD and sBTC/BTC are both exchanges of similar assets, there is no slippage.

The liquidity of Synthetix-integrated products is ultimately provided by its platform’s innovative debt pool.

The dynamic debt pool is an innovation of the Synthetix platform and the mechanism for issuing synthetic assets Synths. Users mortgage SNX to mint sUSD, which is a stable coin pegged to the US dollar at a 1:1 ratio. The value of sUSD is considered a liability of the system, and when sUSD is traded for sToken, the debt will increase or decrease as the sToken price rises or falls to maintain the stability of the sUSD price and the prices of other sTokens, as well as to avoid slippage during the transaction.

For example, if the original debt pool has 100 sUSD and Xiao Ming uses these 100 sUSD to buy sBTC, when Bitcoin rises by 20%, the debt of the entire debt pool will rise to 120 sUSD; when sBTC is exchanged back to sUSD, 120 sUSD can be received; if Bitcoin falls by 20%, the debt of the entire debt pool will decrease to 80 sUSD, and when sBTC is exchanged back to sUSD, only 80 sUSD can be received.

In Synthetix Perps, the debt pool is the counterparty for contract trading to provide liquidity. In atomic spot trading, liquidity is provided by the assets in the debt pool to execute asset trading.

That is to say, Synthetix actually modularizes the debt pool of synthetic assets and becomes a separate liquidity layer infrastructure that supports DeFi application integration. With Synthetix, some new DeFi applications can complete asset transactions even if there is no fund pool on the platform, without worrying about liquidity issues.

Synthetix V3 has realized the evolution from synthetic assets to liquidity infrastructure

The predecessor of Synthetix was the stablecoin protocol Havven, which issued stablecoin nUSD by collateralizing the native token HAV on the chain. It was renamed Synthetix in 2018, and later appeared as a synthetic asset identity. Users can mint synthetic assets (sUSD) Synths by pledging SNX, which not only supports synthetic stablecoins, but also tracks the prices of foreign exchange, stocks, commodities and other assets with synthetic assets.

In 2021, Synthetix launched the Perp contract feature, supporting DeFi derivatives developers to integrate the application, and deployed products such as Kwenta and Lyra.

In 2022, the Atomic Swaps feature was launched, supporting spot DEX integration of liquidity.

However, during this process, the team did not publicly state that Synthetix’s positioning had changed from a synthetic asset platform for C-end users to an infrastructure that provides liquidity to B-end users such as DeFi applications and developers. It wasn’t until March of this year, when Synthetix V3 was deployed on Ethereum and Optimism, that users truly realized that Synthetix had completed its transformation.

V3 focuses on four areas: the liquidity layer of DeFi derivatives, supporting new protocols built on Synthetix; increasing the types of collateral assets; EVM compatibility, supporting cross-chain deployment; providing more friendly tool components for developers, etc.

-

DeFi derivatives liquidity layer– Synthetix’s goal is clear: to become a protocol focused on liquidity as a service, to build a permissionless derivatives liquidity platform, and to provide the source of power for the next generation of DeFi products.

-

Increasing the types of collateral assets, improving the market size and increasing the liquidity depth of Synths. Currently, because Synths can only be minted by SNX pledgers, this means that the overall size of Synths is limited by the value of SNX, with a circulation of about 300 million SNX and a market value of about $700 million at a price of $2.3. Calculated at a 400% collateralization rate, the market size of Synths is limited to $170 million. Therefore, V3 created a universal treasury that is independent of the type of collateral, with each treasury supporting a single collateral asset, which will be combined and docked to one or more market liquidity pools. Different treasuries have different incentive structures to guide liquidity.

-

EVM compatibility, supporting cross-chain deployment– Synthetix V3 will be able to be deployed on any EVM-compatible chain to support synthetic assets on any chain.

-

Developer tools– Synthetix will provide more component support for developers to make it easier to build applications based on Synthetix.

Synthetix V3 fundamentally improves the operational efficiency of the Synthetix system, making its future positioning clearer, mainly aimed at B-end developers and users. The V3 version will be released in stages in the coming months, and the functions will gradually become available.

In fact, Synthetix’s positioning as a DeFi liquidity infrastructure can be traced back to founder Kain’s views on the future development direction of DeFi in 2021-“ DeFi is not really facing users. We once thought it was because we have only been interacting with crypto enthusiasts since 2018. But in the future, ordinary users are more likely to interact with DeFi infrastructure through mobile wallets, rather than directly. “

It is through this incremental product iteration and functional optimization, finding its own advantages and characteristics, and continuously deepening them, that Synthetix products have been upgraded from B2C products to B2B products, attempting to seek their own characteristics and differentiation in the homogenized DeFi track.

In fact, not only Synthetix, but also old-fashioned DeFi applications are trying to find new growth points and differentiated narrative routes, such as Curve launching its native stablecoin crvUSD, Frax Finance launching frxETH, Aave launching the stablecoin GHO, etc., trying to cultivate products and extend new narratives in the current fund stock market to build their own exclusive moats.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!