On June 5, 2023, the US Securities and Exchange Commission (SEC) filed 13 charges against Binance and its founder, Changpeng Zhao, in the US District Court for the District of Columbia. The charges include operating an unregistered exchange, broker-dealer, and clearing agency; distorting trade controls and supervision on the Binance.US platform; and issuing and selling unregistered securities, among others.

Plaintiff: US SEC

Defendants: Binance Holdings Limited (“Binance”), BAM Trading Services (“BAM Trading”), BAM Management US Holdings Inc. (“BAM Trading”), BAM Management US Holdings Inc. (“BAM Management”), and Changpeng Zhao (“Zhao”)

- Copycat FTX? How serious are the 13 charges brought against Binance by the US SEC?

- Binance responds to the US SEC: Lawsuit is beyond the authority, will fight it to the maximum extent permitted by law

- 13 Key Points to Understand the U.S. Securities and Exchange Commission’s Lawsuit Against Binance and Changpeng Zhao

Source: US SEC Complaint

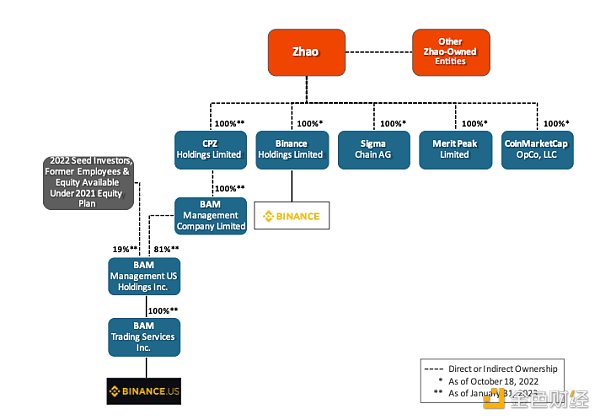

Source: US SEC Complaint

Blocking summarized the 17 major points of the US SEC complaint:

1. The cause of this case is that the defendants flagrantly disregarded federal securities laws and the investor and market protections those laws provide. In so doing, defendants placed investors’ assets at enormous risk while pocketing billions of dollars for themselves.

2. Defendants illegally solicited US investors to buy, sell, and trade securities in digital assets through online unregistered trading platforms, Binance.com (“Binance.com Platform”) and Binance.US (“Binance.US Platform”) (collectively, “Binance Platform”). Defendants engaged in a variety of unregistered offerings and sales of securities in digital assets and other investment plans. Defendants BAM Trading and BAM Management deceived stock, retail, and institutional investors with so-called supervisory and control functions over manipulative trading on the Binance.US Platform, which in fact did not exist.

3. First, Binance and BAM Trading illegally provided three basic securities market functions – exchange, broker-dealer, and clearing agency – on the Binance Platform without registering with the US Securities and Exchange Commission, under Zhao’s leadership and control. Defendants knew full well that US law requires registration for these functions, but they chose not to register, thus evading important regulatory oversight designed to protect investors and markets.

4. Second, Binance and BAM Trading illegally engaged in unregistered offerings and sales of securities in digital assets, including Binance’s own digital assets called “BNB” and “BUSD,” as well as profit-generating plans called “BNB Vault” and “Simple Earn,” and a so-called “staking” investment plan on the Binance.US Platform. In so doing, they deprived investors of critical information, including risks and trends affecting the enterprises and these securities investments.

5. Third, BAM Trading and BAM Management made false statements to investors about the control measures they claim to have implemented on the Binance.US platform, while raising approximately $200 million from private investors of BAM Management and attracting billions of dollars in trading volume from investors (including retail and institutional investors) seeking to trade on the Binance.US platform.

6. Starting in 2018 or earlier, to evade registration requirements under federal securities laws, the defendants – under Zhao’s control – designed and implemented a multi-step plan to surreptitiously evade U.S. laws. As Binance’s Chief Compliance Officer (“Binance CCO”) admitted, “we never want to be [Binance].com under regulatory scrutiny.”

7. As part of their plan to evade U.S. regulation of Zhao, Binance, and the Binance.com platform, Zhao and Binance created BAM Management and BAM Trading in the United States, publicly claiming that these entities independently controlled the operation of the Binance.US platform. However, behind the scenes, Zhao and Binance were closely involved in guiding the U.S. business operations of BAM Trading, and providing and maintaining cryptocurrency asset services for the Binance.US platform. Employees of BAM Trading referred to Zhao’s and Binance’s control over BAM Trading’s business as “shackles,” which often left BAM Trading’s employees unable to understand and freely conduct the business of operating the Binance.US platform – to the point that in November 2020, BAM Trading’s then-CEO told Binance’s CFO that she “felt like her whole team had been tricked into being a puppet.”

8. As part of Zhao’s and Binance’s second plan to protect themselves from U.S. regulatory scrutiny, they have consistently claimed to the public that the Binance.com platform does not serve Americans, while concealing their efforts to ensure that the most valuable American customers continue to trade on that platform. When the Binance.US platform was launched in 2019, Binance announced that it was implementing controls to prevent U.S. customers from accessing the Binance.com platform. In fact, Binance did the opposite. Zhao instructed Binance to assist certain high-value American customers in evading these controls, and to do so surreptitiously, because – as Zhao himself acknowledged – Binance did not want to be “responsible” for these actions. As Binance’s Chief Operating Officer explained, “On the surface, we can’t be seen to have US users[,] but underneath, it’s like, we should have them through other [creative] means.” In fact, Zhao’s “target” was to “reduce our own losses while not attracting trouble from the U.S. regulators.”

9. The Defendant provided securities-related services to U.S. customers while deliberately evading supervision by U.S. regulatory agencies. This jeopardized the safety of billions of dollars of U.S. investor capital and left it at the mercy of Binance and Zhao. Due to the lack of regulation, the Defendant was free to transfer investors’ cryptocurrency and fiat assets as they pleased, and did indeed mix and misappropriate these assets in ways that properly registered brokers, dealers, exchanges, and clearing organizations could not. For example, billions of dollars in customer funds on the Binance platform were commingled in accounts held by an entity controlled by Zhao (called Merit Peak Limited), which were then transferred to third parties, apparently in connection with the purchase and sale of cryptocurrency assets, through accounts owned and controlled by Zhao and Binance.

10. In addition, the Defendant understood the importance of imposing trading surveillance and controls on cryptocurrency investors to the cryptocurrency trading platform. Zhao himself stated in 2019, “Credibility is the most important asset of any exchange! If an exchange falsifies their trading volume, would you entrust them with your funds?”

11. The Defendant BAM Trading and BAM Management touted their so-called supervision and control to prevent manipulative trading on the Binance.US platform.

12. However, the Defendant did not implement the trading surveillance or manipulative trading controls that BAM Trading and BAM Management sold to investors on the Binance.US platform. As a result, the Defendant failed to meet the basic requirements of a registered exchange – to establish rules designed to prevent fraudulent and manipulative behavior and to have the ability to implement them. The so-called control measures were almost non-existent, and those that did exist did not monitor or prevent “wash trading” or self-trading, which were occurring on the Binance.US platform. Most notably, at least from September 2019 through June 2022, Sigma Chain AG (“Sigma Chain”), a trading company owned and controlled by Zhao, engaged in wash trading, artificially inflating the trading volume of cryptocurrency securities on the Binance.US platform.

13. Part of the purpose of the Securities Act of 1933 (“1933 Act”) and the Securities Exchange Act of 1934 (“1934 Act”), enacted by the U.S. Congress, was to regulate the issuance and sale of securities and the national securities market through registration and corresponding disclosure, recordkeeping, inspection, and conflict of interest mitigation requirements. Binance and BAM Trading – both under Zhao’s control – have engaged in and continue to engage in unregistered offers and sales of cryptocurrency securities and unregistered trading of cryptocurrency securities on the Binance platform. The Binance platform has core securities market functions, but deliberately evades registration and operates under obvious conflicts of interest. In doing so, they have evaded disclosure and other requirements established by Congress and the SEC for decades to protect America’s capital markets and investors, violating the law and continuing to do so.

Which Laws Were Violated:

14. By engaging in the conduct alleged in this Complaint, Binance and BAM Trading engaged in and continue to engage in the illegal offer and sale of securities in violation of Section 5(a) and 5(c) of the Securities Act [15 U.S.C. §§ 77e(a) and 77e(c)].

15. By engaging in the conduct alleged in this Complaint, Binance, as an exchange, broker, and dealer, and as the clearing agency for the Binance.com platform, failed to register as such in any capacity, in violation of Sections 5, 15(a), and 17A(b) of the Exchange Act [15 U.S.C. §§ 78e, 78o(a), and 78q-1(b)]. Similarly, with respect to the Binance.US platform, Binance acted as an exchange, BAM Trading acted as a broker, and Binance and BAM Trading each acted as clearing agencies, without registering as such in any capacity, in violation of Sections 5, 15(a), and 17A(b) of the Exchange Act [15 U.S.C. §§ 78e, 78o(a), and 78q-1(b)]. As the controlling persons of Binance and BAM Trading, as defined in Section 20(a) of the Exchange Act [15 U.S.C. § 78t(a)], due to the violative conduct of Binance and BAM Trading on both Binance platforms, Zhao also violated Sections 5, 15(a), and 17A(b) of the Exchange Act [15 U.S.C. §§ 78e, 78o(a), and 78q-1(b)].

16. By engaging in the conduct alleged in this Complaint, BAM Trading and BAM Management further obtained money or property through materially false or misleading statements, engaged in transactions, practices, and courses of business which operated as a fraud or deceit upon purchasers of securities in the offer and sale of such securities, in violation of Sections 17(a)(2) and (3) of the Securities Act [15 U.S.C. § 77q(a)(2) and (3)].

17. Unless Defendants are permanently restrained and enjoined, they have a reasonable likelihood of engaging in the acts, practices, and courses of business alleged in this Complaint or similar types of acts, practices, and courses of business that violate the federal securities laws.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!