Author: Mobile Payment Network

Mobile Payment Network News: Recently, Singapore has cracked a major money laundering case with a total value of about 1 billion Singapore dollars (about 5.37 billion Chinese yuan), which has attracted the attention of many payment professionals in China.

According to reports, 3 of the 10 arrested individuals are Chinese citizens. What is most noteworthy is that all 10 individuals are originally from Fujian, China. There are more detailed reports stating that they are all from Anxi, Quanzhou, Fujian.

What does it mean to make a profit of 5 billion from money laundering?

- Looking at the latest developments of THORChain from the perspectives of optimism and pessimism liquidity exchange and lending.

- LianGuai Daily | HashKey will start retail trading of Bitcoin and Ethereum in Hong Kong from August 28th.

- LianGuai Daily | PEPE claims former member stole multi-signature tokens for cash; Hashdex applies to hold spot bitcoin in its bitcoin futures ETF.

-

In the “Duobao Payment” money laundering case cracked at the end of 2022, the fee rate was 0.14% – 0.3%, which means money laundering amounted to 3.4 trillion to 1.6 trillion when calculated based on this fee rate.

-

In May 2022, the “Run Score” money laundering case cracked in Shandong, with a fee rate of 0.8%, which means money laundering exceeded 600 billion when calculated based on this fee rate.

-

In 2020, the “Flying Payment” money laundering case cracked in Guangxi, with a fee rate ranging from 1% to 4%, which means money laundering amounted to 100 billion to 500 billion when calculated based on this fee rate.

Generally speaking, the fee rate for money laundering in underground banks is between 3% and 5%, so the amount of money laundered would also be in the trillions.

In comparison, China’s cross-border e-commerce import and export scale only exceeded 20 trillion for the first time in 2022, so one can imagine the scale of this money laundering case.

Keywords such as Fujian people, forged documents, money laundering, etc. are all connected. This case that happened in Singapore may also have a profound impact on the Chinese payment industry.

Fujian in the Payment Industry

Due to its developed foreign trade and proximity to Taiwan, telecom fraud has always been a major problem for local security in Fujian, accompanied by a significant amount of financial crime.

Looking at the anti-fraud penalties that the banking industry has been concerned about this year, in February of this year, after the implementation of the “Anti-Fraud Law”, Xiamen Bank received the first penalty in the banking industry for “inadequate management of accounts involved in fraud”.

-

In May, the former China Banking and Insurance Regulatory Commission Xiamen Supervision Bureau issued a penalty for Guangda Bank Xiamen Branch involving fraud.

-

In June, Bank of China Fujian Branch was warned and fined by the Fuzhou Central Branch of the People’s Bank of China for illegal acts such as inadequate management of accounts involved in fraud.

-

In August, the Fuzhou Central Branch of the People’s Bank of China imposed penalties on Quanzhou Bank and Fujian Fuqing Huitong Rural Commercial Bank for illegal acts of “inadequate management of accounts involved in fraud”.

This year, the penalties for anti-fraud incompetence in the financial system are mainly focused on banks in Fujian, indicating the severe anti-fraud situation in the region.

Prior to this, payment institutions were cautious about POS applications from Fujian, and banks would repeatedly verify the authenticity of opening accounts for individuals from Fujian.

With the development of the Internet in recent years, telecommunications fraud cases have been on the rise across the country, and the “Fujian Gang” has gradually faded away. However, Fujian’s prosperous foreign trade still breeds financial crimes such as money laundering.

The Vulnerability of Cross-Border B2B E-commerce

One detail of this money laundering case is that the gang used suspected forged documents to prove the source of funds in a Singaporean bank account. For cross-border payment regulation, it is a headache to identify forged information, as it is difficult for information between countries to be universally recognized, providing space for forged information.

Forged information also poses a threat to the healthy development of a new form of cross-border trade that has emerged in recent years, which is cross-border B2B e-commerce.

Prior to the outbreak, many merchants around the world liked to come to economically developed coastal areas in China, such as Guangdong, Fujian, and Jiangsu and Zhejiang provinces, to purchase goods. This type of procurement is often a transaction between domestic and overseas merchants. After completing on-site inspections, overseas merchants would complete the payment through methods such as bank cards and cash.

However, after the outbreak, due to epidemic prevention and control measures, overseas merchants found it difficult to enter China, resulting in fundamental changes to this business practice. A series of actions such as product comparison, logistics arrangement, and payment processes all had to be completed online, or they may choose not to buy Chinese goods.

In order to stabilize foreign trade, the General Administration of Customs issued Announcement No. 75 in 2020, “Announcement on the Pilot Implementation of Enterprise-to-Enterprise Export Supervision for Cross-Border E-commerce Enterprises”, piloting two export modes for cross-border B2B e-commerce, namely 9710 (enterprise-to-enterprise mode) and 9810 (export to overseas warehouses mode).

Under this policy, cross-border B2B e-commerce payment collection has risen. A banking insider revealed to Mobile Payment Network that during the three-year period of the epidemic, the average annual transaction volume of a representative cross-border B2B payment collection enterprise increased by more than 100%.

The advantages of cross-border B2B e-commerce business are that it solves the pain points brought by the epidemic, improves procurement efficiency, and various regions have also introduced a series of tax reduction policies to encourage the development of this business form. However, the disadvantages of cross-border B2B e-commerce are also quite obvious, such as the difficulty in ensuring the authenticity of the entire transaction process, which may pose money laundering risks through false orders.

Difficulty in restoring transaction authenticity. Compared to cross-border e-commerce platforms, the payment collection form based on overseas warehouses is more complex, with credit cards, electronic payments, and cash all possible payment methods, which brings about the problem of mismatch between payment flow, information flow, and logistics. In addition, overseas warehouses are located abroad, making it difficult for Chinese regulations to effectively reach them, and the authenticity of their information is difficult to guarantee, making it more difficult to restore transaction authenticity.

Risk of overseas companies and false orders. Many cross-border e-commerce companies will establish overseas companies and apply for overseas accounts. This facilitates seamless interaction with domestic companies and takes advantage of export tax refund benefits. At the same time, establishing accounts overseas allows merchants to have more freedom in fund management and facilitates overseas procurement. However, this also creates a regulatory gap where foreign exchange is retained overseas.

The “multiple-to-one” model of overseas warehouses brings difficulties in consolidating three orders into one. Small and medium-sized foreign trade companies with insufficient strength often choose to use a “one company representing multiple companies” approach for overseas warehouse transactions. A batch of goods involves multiple companies or multiple transactions, which leads to confusion in the exporting party, making it even more difficult to consolidate the three documents into one. The ambiguity of transaction information also gives rise to a certain gray area.

Compared to cross-border e-commerce platforms for foreign trade, namely cross-border e-commerce B2C, such as opening a store on Amazon, it is easier to forge transaction information in cross-border e-commerce B2B.

It is worth mentioning that before the action by the Singapore police, there had been communication with the Chinese embassy. Therefore, if the falsified information in the 5 billion Singapore dollar money laundering case involves the emerging format of cross-border e-commerce B2B, it may face a wave of strict regulation in the future.

Payment in Singapore

In recent years, Singapore, as an international financial center, has increasingly gained favor from our country’s payment companies. On the one hand, Singapore, as an independent country, has a more complete financial regulatory system. On the other hand, Singapore as a whole is more inclined towards the Western financial system, serving the Eastern market, and is a bridge connecting the Eastern and Western markets.

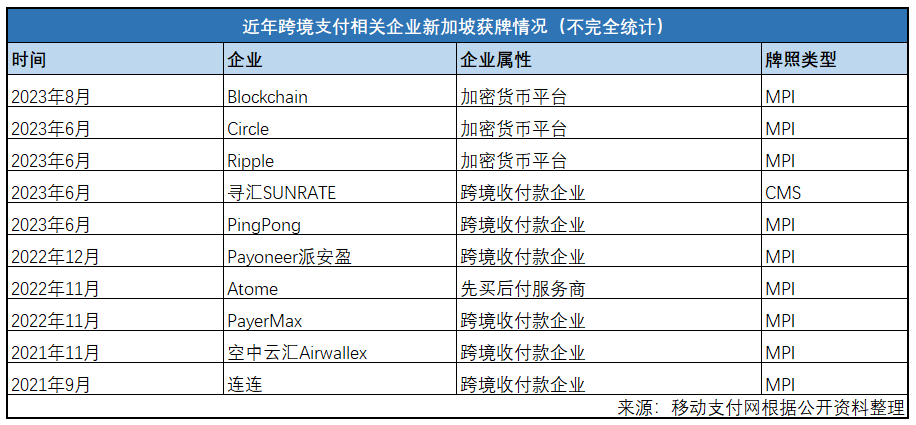

Therefore, in recent years, payment companies serving the Chinese market mostly choose to apply for Singapore’s payment license and accept supervision from Singapore regulatory authorities.

After this money laundering case occurred, the Monetary Authority of Singapore also stated that it takes a strict view of this case and maintains contact with financial institutions that may have illegal funds. More assets may be seized, bank accounts may be frozen, and prohibition orders may be issued.

The financial institutions involved include Citibank, through illegal means, a large amount of funds were transferred to Citibank accounts, and the funds are suspected to be used for illegal activities such as gambling and drugs.

Citibank is the bank where many cross-border e-commerce payment companies open their deposit accounts. Through a similar “major merchant” model, it provides overseas bank account services for domestic cross-border sellers. Once the Singapore regulatory authorities conduct a more in-depth and comprehensive review of Citibank, it may also affect such accounts.

The 5 billion money laundering case is just the prelude, perhaps a new storm is brewing.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!