Source/kitco Compilation/Octopus Brother

Tokenization of Real World Assets (RWA) has become one of the most powerful use cases of blockchain technology worldwide, as it is expected to bring higher efficiency and security to financial markets in the digital age.

To gain a deeper understanding of the development of RWA in 2023, Kitco editor had a conversation with Benjamin Stani, the Business Development Director of Matrixport.

“With the compression of on-chain yields and the rise of the Federal Reserve interest rates, there has been a significant divergence between on-chain and off-chain interest rates,” Stani said. “RWA may be able to bridge this gap.”

- Base Introduction to the open-source monitoring system Pessimism – Embracing optimism with pessimism

- Is the concept of ‘full-chain gaming’ really the direction of the future?

- Layer2 expansion solutions Why is the challenge mechanism of OP-Rollup so important?

He pointed out that while the stablecoin market is the cornerstone of the crypto ecosystem, the underutilization of these stable assets has always been a persistent problem, and RWA can solve this problem. It has become a disruptive force in 2023, unlocking the potential of this asset class and fundamentally changing the way value is created, transferred, and stored.”

The tokenization of regulated financial instruments has shifted the industry’s focus towards driving risk-free real world yields. Treasury bills, real estate, precious metals, and artworks are seen as the most feasible tokenized assets.

The launch of Matrixdock’s tokenized short-term Treasury bills (STBT) has received very positive feedback, raising $123 million in just over five months. Stani pointed out that driven by the Federal Reserve’s interest rate hike, people want risk-free rates while avoiding the hassle of traditional trading execution and settlement for bonds. STBT meets this demand, and the same logic applies to other real world assets as the industry develops.

With the widespread adoption of tokenized government bonds, exploring other liquid listed securities in a similar form is conceptually not much different. In short, RWA can extend to real estate, corporate bonds, and fine wines. The RWA industry is expected to become a major theme in the digital asset ecosystem in the coming years, adding trillions of dollars to the market.”

RWA will greatly enrich the scale and types of on-chain available assets. With the expectation of rising risk-free rates, it is expected that in the next few quarters, institutions will adopt tokenized bills due to economic incentives, while there will be further DeFi innovations in market products.

Although RWA is still in the early stages of the tokenization cycle, interest from both cryptocurrency natives and traditional financial participants is growing.

Stani said, “The industry has seen some notable progress, including the successful use of DeFi in the wholesale financing market, forex trading, and government bond trading experiments by the Monetary Authority of Singapore’s Project Guardian, as well as Deutsche Bank testing tokenized funds on the Ethereum public network. The adoption rate of RWA is rapidly increasing. Continuous innovation in settlement strategies and smart algorithms is driving this momentum, and significant progress is expected by the end of the year.”

Advantages and Disadvantages of Tokenization

One of the biggest advantages of tokenization is that it democratizes the financial market by eliminating intermediaries, speeding up transactions, and reducing costs. It also opens up investment opportunities that were previously only available to high net worth individuals.

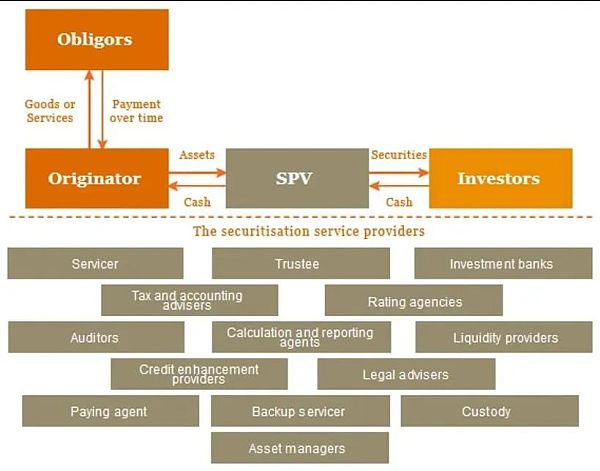

Prior to the emergence of Real World Assets (RWA), the main limitations of the market were focused on user experience, particularly in terms of liquidity. Tokenization has the potential to completely change the financial landscape, creating new sources of income and even new markets. We can get a glimpse of its complexity from the visual representation of the typical combination of external parties and service providers in traditional securitization provided by PwC.

Source: PwC

The orange boxes above the dotted line represent the main parties involved: the debtor (mortgage borrower), the originator (lender creating the mortgage), and the investor (buyer of the pooled mortgages). The core function of securitization is to pool cash flows from the underlying debtors, slice it, and distribute the cash to investors.

The costs associated with each step are cumulative, and the overall cost of securitization is estimated to increase by 1%. While this may seem insignificant, even a 0.50% reduction in interest rates on a $500,000 mortgage can save $2,500 per year, which is a significant expense for most people.

Compared to traditional lending, blockchain-based lending offers several key advantages over real-world assets, including greater international accessibility, accessibility to encrypted financial instruments, and a more democratic decision-making process. These factors help make lending more inclusive, transparent, and convenient for a wider range of borrowers and lenders, while also promoting stability and reducing risk in the lending ecosystem. As the industry evolves, we may see the convergence of TradFi and DeFi, creating conditions for a smarter, more programmable global economy.

One of the biggest obstacles to RWA currently is regulatory uncertainty. Legal frameworks are struggling to keep pace with the rapid development of tokenization technology. This is particularly evident in the realm of RWA infrastructure integrated with DeFi, where regulatory agencies must grapple with blockchain scalability issues to accommodate the capacity of the TradFi market.”

To help overcome this obstacle, Stani suggests taking a progressive regulatory approach, focusing on establishing a comprehensive framework that is fully compatible with DeFi standards. Such frameworks must strictly enforce risk management protocols to enhance transparency and security. The success of Singapore’s pioneering stablecoin regulation demonstrates the power of clear, robust guidelines. They not only protect investors but also create a favorable environment for issuers and financial institutions to innovate and explore new investment channels.

The technological aspect is actually easier to upgrade and develop because viable solutions already exist. The bottleneck is more in the regulatory and compliance aspects, where we need clarity on what constitutes a security and how to handle on-chain ownership off-chain. Some jurisdictions are more progressive than others, and naturally, we will see the push for innovation in progressive jurisdictions.

The biggest obstacle may be that internal compliance teams want to overlay the same framework on these new asset classes, but it is clear that many things on the chain have low relevance (such as retaining audit trails) or are even impossible to achieve (such as reversing transactions).

Currently, regulatory compliance issues have caused delays in the adoption of RWA, but Stani believes that these obstacles will eventually be overcome, allowing RWA to thrive globally.

Conclusion

There is a strong demand for deep on-chain liquidity in the future, especially for large protocols. Although STOs have restrictions and licensing requirements, using securities as underlying assets for other products will provide some flexibility. The industry is exploring these possibilities and striving for innovation.

Once RWA has reached a sufficient scale within the industry, the ultimate result will be the integration of TradFi and the cryptocurrency world into a single financial domain, which is different from the trend of past bull markets and will be astonishing.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!