Author: Adi, former employee of Alameda Research; Translation: Luffy: Foresight News

The story of Alameda Research causing a market flash crash due to a “fat finger” trade had a global impact, but at that time the public did not know the truth behind it. (Translator’s note: “Fat finger” refers to the phenomenon where in the rapidly changing electronic financial market, traders must act quickly, and the combination of high-intensity work and immense pressure may lead to keystroke errors.)

This incident happened a few weeks after I joined Alameda. I had just mastered the company’s engineering workflow and started to understand the trading system. At a high level, Alameda’s trading operates in two modes:

- ERC-7512 Standard an attempt to enhance the overall security of the blockchain industry

- Bear Market Gold Mining Battle-tested Strategies from Chinese DeFi Degen in the Crypto Community

- ERC-7739 Draft Introduction Supports adding user intents to account abstract wallets.

The main one is our semi-systematic strategy, where traders set model parameters to control complex automated trading systems. This way, traders do not engage in actual trading, but fine-tune algorithms to determine how to execute these trades at high frequency.

However, from time to time, traders need to manually execute trades. Typically, if our automated trading system malfunctions due to market fluctuations, or if there are arbitrage opportunities where we have not set up automated trading, manual operation may be required.

Our automated trading system handles the majority of Alameda’s trades. Therefore, we perform sanity checks to ensure that the orders sent are reasonable relative to the current market prices. But the situation is different for manual trading, as it is essentially discretionary.

The tricky thing about risks is that they are usually invisible until they suddenly appear and bite you in the ass.

Well, on October 21, 2021, an Alameda trader had a slip of the hand.

The trader tried to sell a batch of BTC based on news and placed an order through our manual trading system. They misplaced the decimal point by a few places and sold bitcoin not at the current market price, but at a cheaper price.

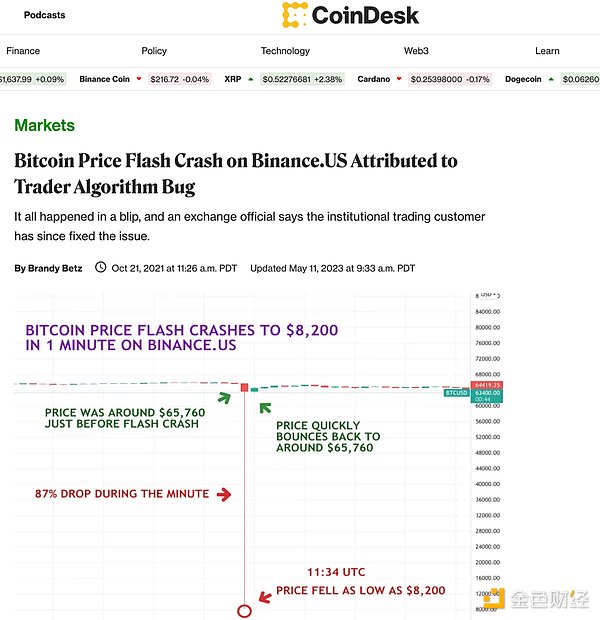

The result was immediate. In some trading venues, the price of Bitcoin plummeted from a high of $65,000 to a low of $8,000, but it was quickly recovered by arbitrageurs.

The sudden price movement ignited discussions on Crypto Twitter, with traders rushing to figure out what had happened:

The news media also started paying attention to the matter. Binance US, one of the main venues for this flash crash, issued a statement claiming that it was caused by one of their “institutional traders” whose “trading algorithm had a flaw.”

I guess Caroline called them.

Alameda lost tens of millions of dollars in the “fat finger” trade. But since it was an unintentional mistake, nothing was done except implementing additional sanity checks for manual trading.

The usual way of working at Alameda is to wait for a problem to arise and then fix it quickly. That’s why we took so long to implement integrity checks – any “traditional” trading company would never start trading without doing so.

Afterwards, everything returns to normal. According to SBF, the profits we have gained through quick action outweigh the occasional costs we incur due to risk oversights, hacker attacks, and other reasons. This is SBF’s working philosophy, which drives the corporate culture he has created at Alameda and FTX.

In the past two years, the Bitcoin flash crash event has been a mystery in the public’s mind. Now you know who should be responsible for it and what happened behind the scenes.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!