Author: Matt Huang; Source: LianGuairadigm; Translation: MarsBit, MK

Author Matt Huang is the co-founder and managing partner of LianGuairadigm. Previously, Matt was a partner at Sequoia Capital, focusing on early-stage venture capital, including leading the company’s cryptocurrency work.

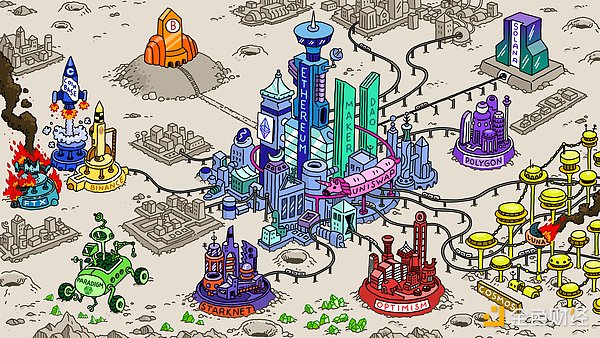

We can think of cryptocurrency as a new planet that is being colonized.

Many critics see it as a barren and worthless planet, even considering it a dirty casino. However, optimists see the potential of this untapped land: a place where more advanced financial systems and internet platforms can be built.

- Comprehensive Overview of Decentralized Stablecoin Landscape

- Philippines SEC collaborates with US SEC to combat cryptocurrency fraud

- NFT Blind Box Mechanism Seeking Certainty in Uncertainty

The newcomers are diverse, with adventurers attracted by cutting-edge technology and some unscrupulous speculators. Innovators and researchers are attracted by new possibilities, and ordinary people, especially those marginalized on Earth, are also joining their ranks.

Governance is still in an uncertain stage, with some jurisdictions on Earth prohibiting their citizens from going to the new planet, while others are seeking a foothold in this new world.

The history of this new planet has been marked by cycles of speculation and speculation, which has made many people doubt its future direction. Today’s cryptocurrency frenzy is just a self-starting process. Just as the gold rush in 1849 turned San Francisco from a quiet village into a major port (eventually becoming a center of technological innovation), today’s cryptocurrency boom is also attracting settlers and promoting the construction of infrastructure, transforming it from a barren planet into a prosperous cryptocurrency civilization.

A new cryptocurrency planet has been born. Bitcoin is the first group of settlers, and exchanges such as Coinbase and Binance allow you to easily travel to and from this planet. Ethereum has become the largest city, with Uniswap being the best transportation…

Why choose cryptocurrency?

Settling on a new planet undoubtedly requires tremendous effort. But is it really worth it?

In places where existing systems fail, what we need most is a new property rights system. BTC, ETH, and stablecoins have been adopted globally, especially in countries like Argentina, Turkey, and Ukraine, where they are more widely accepted by ordinary people.

While many are still waiting for the “killer app” of cryptocurrency, it has actually arrived. It’s just that this transformation may not be easily noticeable to those living in the first world. If you ask an Argentine about cryptocurrency, they will tell you its use without hesitation. Today, cryptocurrency is not only a useful tool, but also a speculative high-end market. It is developing rapidly and becoming a typical example of disruptive innovation, becoming more and more useful to more people.

Cryptocurrency is just the first “killer application”, and it won’t be the last. Cryptocurrencies will give rise to a set of more transparent, programmable, and open financial services. It is a cheaper, more convenient, and more inclusive solution for those who cannot afford banking services due to high costs, or for those who distrust increasingly centralized banking systems. We see the rapid rise of stablecoin payments, and loans can also be obtained through simple coding rather than complex banking or brokerage procedures. Systemic risks can even be reduced by globally tracking collateral.

Looking ahead, with the expansion of cryptographic infrastructure, we can anticipate new consumer applications becoming possible. Creators will have more rights in their creations, and users will have better control over their identities.

From a more macro perspective, this new world offers us an opportunity to reshape existing systems and upgrade them to more advanced and flexible systems. Cryptography can not only do this for currency, finance, and digital assets, but also do everything that the Internet does for information and media.

More importantly, cryptography provides a means to counteract the increasingly centralized world. In a world where “big” is becoming mainstream, we are slowly losing our focus on individual and diverse forces. By promoting the collaboration of small and diverse forces, cryptography has become an important force against centralized power, and a driving force for freedom, protecting us from the control of big corporations and governments.

Speculation and Cryptocurrency

Although cryptocurrency has its advantages, is its speculative nature really necessary? In fact, speculation is not only necessary, but can also be highly valuable.

Speculative investment is the cornerstone of technological revolutions. From the rise of telecommunications and the Internet to the spotlight of railways, electricity, and automobiles, breakthroughs in new technologies are often intertwined with speculation and asset bubbles. As documented in detail by Carlota Perez, they become inseparable in the process of mainstream adoption. In the field of cryptocurrency, speculation has driven attention and awareness, investment flows, talent aggregation, infrastructure construction, academic research, and the acceptance of existing companies.

Furthermore, there is a deeper connection between speculation and cryptocurrency: it is the “Hello World” of digital asset rights. When people have the opportunity to create rare assets, they tend to trade them. Give a group of children some Pokémon cards and see what happens. The true value of a new property rights system lies in its ability to reliably record the transfer of property, which is why people naturally begin to experiment and test it. If this new system has not yet been widely recognized, it may move towards a diverse future, where price fluctuations and trading activities will be more speculative in nature.

Remember in the early stages of Bitcoin, people thought it was a fantasy to achieve the legal status and value it has today. I witnessed the early participants mining, contributing, experimenting, and even buying pizza with joy. Now, more than a decade has passed, BTC and other cryptocurrencies like ETH are steadily transitioning from speculative assets to global commodity currencies.

Speculation also plays a crucial role in the process of cryptocurrencies becoming a decentralized financial system. Many financial products have obvious “practical value” for one party in a transaction, but speculation is needed to meet the needs of the other party. For example, someone may need a 30-year mortgage to buy a house, but there is no inherent demand to provide this 30-year loan. Our modern financial system mediates between such practical needs and more abstract financial return needs. In the cryptocurrency field, a similar system is being established that includes speculative traders, infrastructure providers, market makers, MEV searchers, blockchain builders, DeFi protocols, stablecoin issuers, Uniswap arbitrageurs, and other participants. Building such an N-party market is not easy, it takes time to develop. But over time, participants become more mature, liquidity is enhanced, and blockchain-based financial markets will become stronger.

The “casino” aspect of speculation has its dark side

While some criticisms of cryptocurrencies may lack creativity, some of them are reasonable. The casino can serve as a useful tool for launching projects, but it can also bring unwanted consequences and counterforces.

Innovation relies on capital and labor being used in valuable experiments. Excessive speculation, airdrop farming, and other mischief can generate noise and disrupt price signals that could have guided beneficial innovation. Even the most well-intentioned entrepreneurs can be misled by incorrect price information or distracted by short-term profits, thus slowing down the actual development process needed for cryptocurrencies.

Short-term speculation is essentially a zero-sum game where seasoned traders extract value from newcomers, which can cause lasting harm to them. A free market should embrace various participants as long as their behavior is legal and ethical. But if we view the adoption of cryptocurrencies as part of a social coordination game, choosing the optimal timeframe can become a prisoner’s dilemma. Through long-term cooperation, we can achieve a more satisfactory result.

Ultimately, bad behavior is not uncommon: scammers, fraudsters, and hackers continue to pose threats. Imagine a world full of rogues who “welcome” newcomers through violence and robbery – that was the cryptocurrency field in San Francisco. Just like the early days of the internet or the gold rush era, this frontier open field has nurtured both innovation and illegal activities. Although the good participants still prevail – for example, we have been fortunate to witness the rise of a group of world-class white hat security experts – this field still needs more self-regulation and standards.

Why is Progress So Slow?

Cryptocurrency has been around for almost 15 years. Shouldn’t it have already become popular and mainstream by now?

In reality, pioneering a new field takes time, and most people are only willing to migrate to a new field when the infrastructure is complete and no longer socially excluded. Technological progress also has its limits and can only be fast to a certain extent. The social dissemination of new ideas often encounters setbacks instead of going smoothly. Due to the speculative nature of assets, they experience periodic and drastic fluctuations. At one moment, people have high hopes for the future of cryptocurrencies and believe it is everything, but the next moment, they claim it has lost its vitality.

Establishing social consensus around cryptocurrencies is even more challenging than creating network effects around communication protocols or social networks. People can quickly recognize the practical value of WhatsApp or Instagram because they can communicate with a small group of familiar friends through these platforms. However, for a new property rights system, it is about how to safely transact with those who you are not very familiar with or do not fully trust, which requires broader recognition and legitimacy. We still have a long way to go, but it is encouraging that today you can already trade with over 100 million people using BTC, ETH, or stablecoins.

Looking Beyond the Casino

Many technologies that we take for granted today were once considered impossible to achieve, useless, dangerous, or fraudulent. Today, Apple has become the most valuable company in the world, but when it went public in 1980, its stock sales were banned in Massachusetts due to perceived high risks. Cryptocurrencies have faced similar skepticism. Since 2010, there have been voices every year claiming that Bitcoin is dead.

However, human history has repeatedly shown that we often oppose reforms by sticking to the status quo, especially when these reforms are disruptive. Cryptocurrencies touch on profound concepts of money, value, governance, and human collaboration. We need to maintain an open mindset, explore the possibilities of building better things, and not reject cryptocurrencies simply out of skepticism.

We must go beyond the speculative nature of cryptocurrencies and recognize it as the guiding mechanism of one of the most important technologies of the present. We need to delve into the new world of cryptographic technology, think about its substantive construction and real uses, rather than just chasing speculative hotspots.

Appendix

If we compare cryptographic technology to a new planet, what does that mean?

Cryptocurrency Community

The crypto field represents a comprehensive ecosystem that we should all work together to build. There are more common ideas than differences between the different cities on this new planet. Instead of internal extremist conflicts, it is more important to convince the residents of Earth to settle on this new planet or protect it from improper regulations from Earth.

As Vitalik said, it is important to think about how to build a complete system for encryption. The new planet cannot always rely on the infrastructure of the Earth. Currently, the network systems we rely on include Google, Twitter, Github, and the credit card system, and there is also an independent network system in China, including WeChat, Alipay, Weibo, and DCEP. And we need to build an encrypted independent system that operates like the Chinese system, but more open and guarantees autonomy.

Having a unique culture is beneficial for a new planet. We may not want encryption technology to disappear in the background or make the new planet highly similar to Earth.

Builders

Building products in the encryption field is not just a technical problem (“What can be built on the new planet?”), but also a social problem (“Do the residents of the new planet really need this?”).

A good way to find ideas for encryption entrepreneurship is to consider what early settlers on the new planet may need. Do they need food or shelter? Then consider providing such services. Another good method is to consider the uniqueness of the new planet and develop unique products based on it. Perhaps the way gravity works is different, which could give rise to new products.

Some products are best built for settlers on the new planet, such as decentralized finance (DeFi); others can be seen as bridges between the new planet and Earth, such as centralized finance (CeFi); and others can use the technology of the new planet to serve Earth, such as financial technology products that utilize stablecoins.

A common failure pattern is to build products for mainstream users before they are ready to migrate to the new planet. A wiser approach is to focus on those who have already adapted to the new planet’s environment or are preparing to go to the new planet. At the same time, another failure pattern is to overly focus on building for early settlers and neglect the large number of potential new users.

Existing Businesses

Existing businesses on Earth can also play a role. The most natural way is to act as a bridge between the new planet and Earth, and also to try to build localized products.

Encryption can be seen as an emerging market. It is not just about adopting new technologies, but about entering a new realm with its own culture. Just as restaurants adjust their menus according to different countries, or companies hire local managers, it is very helpful to adjust your team and products according to the characteristics of the new planet.

A common failure pattern is to misunderstand the uniqueness of the new planet. For example, there was a time when banks were enthusiastic about “blockchain instead of Bitcoin”. It’s like just putting a new shell on the bank to make it look more like the new planet, but completely losing its essence.

Policymakers

Contrary to intuition, encryption technology may ultimately benefit the US dollar. Stablecoins denominated in USD have become one of the most popular currencies on the new planet, with a far greater influence than any other Earth currency.

Witnessing the disorder and savagery on the new planet may tempt people to take excessive and aggressive actions, such as prohibiting travel to the new planet or strictly restricting activities there. However, this would prevent the new planet from progressing from its current primitive stage to a stage that could potentially generate long-term innovation.

A better approach is to maintain a long-term perspective, preserving safe havens and unrestricted freedom. Punish criminals for their criminal behavior, but at the same time, maintain an open attitude towards those who engage in good deeds and innovation.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!