Tracking dormant addresses is a good practice because their behavior can affect the price of $ETH.

Original author: 0xScope Labs

Original source: medium

Original title: 9 years and 10000x gain, exploring the Journey of Ethereum ICO Addresses

- Vitalik reveals that every Layer2 has a backdoor. Is security better or is centralization better?

- Decoding Rollup Economics How is revenue currently generated? Can we build a Rollup Alliance in the future to achieve interoperability?

- What types of projects are worth long-term investment?

The first token issuance (ICO) of Ethereum in 2014 marked the beginning of this revolutionary blockchain platform. Early believers obtained their ETH shares in the genesis block. Interestingly, some of these users’ addresses have remained dormant, not moving their initially held ETH for 9 years, resulting in a 10,000x gain. In this article, we will delve into their stories and provide you with some insights.

1. Dormant Ethereum ICO addresses

Among the many addresses that received ETH during the ICO, a considerable number of addresses have never moved their holdings. Currently, there are 678 addresses in this dormant category, collectively holding 1,529,755 ETH.

Why is it important to track the behavior of these addresses?

-

This demonstrates the early believers’ confidence in $ETH and its future value growth.

-

Tracking dormant addresses is a good practice because their behavior can affect the price of $ETH.

It is worth noting that the top-ranked dormant address currently holds 250,000 ETH. This entity repaid $75,250 in 2014, which is now worth $460 million.

2. When was the first transfer of ETH from Ethereum ICO addresses?

By examining the year of the first transfer of ETH from addresses, we can understand the activity patterns of ICO participants.

Most ICO participants transferred (possibly sold) their $ETH holdings before 2018 when the price of Ethereum reached $1300. Specifically, 4,119 (46.66% of the total) Ethereum ICO addresses made their first transfer in 2016, 2,159 (24.46% of the total) in 2015, and 1,438 (16.29% of the total) in 2017.

3. Tracking the remaining ETH balance of ICO addresses

Among the 8,891 addresses that received ETH in the genesis block, there are still some addresses holding a large amount of ETH. The current total balance of all ICO addresses is 1,847,631 ETH, which is equivalent to 3% of the initial ICO amount.

Several addresses hold a significant amount of ETH. Out of the top 10 addresses, 6 are dormant, 3 have balances exceeding their ICO amounts, and the second address purchased 560,000 ETH during the ICO and still holds 243,300 ETH.

4. Small investment, big potential

A total of 1,157 (13%) addresses spent less than $30 to buy less than 100 ETH during the ICO. They received a total of 53,850.53 ETH, worth about $100 million, with an average of about $85,000 per address.

Among all these small investment addresses, 224 addresses are still in dormant status, holding a total of 9,674 ETH.

5. Recent dormant awakening events

Occasionally, addresses that have been dormant for a long time will suddenly become active. Here are two noteworthy dormant awakening events.

For example:

The first event involves the address 0x8b505E2871F7dEb7a63895208e8227dcAa1Bff05, which transferred 61,216 ETH to another address, and that address deposited all the funds into Kraken.

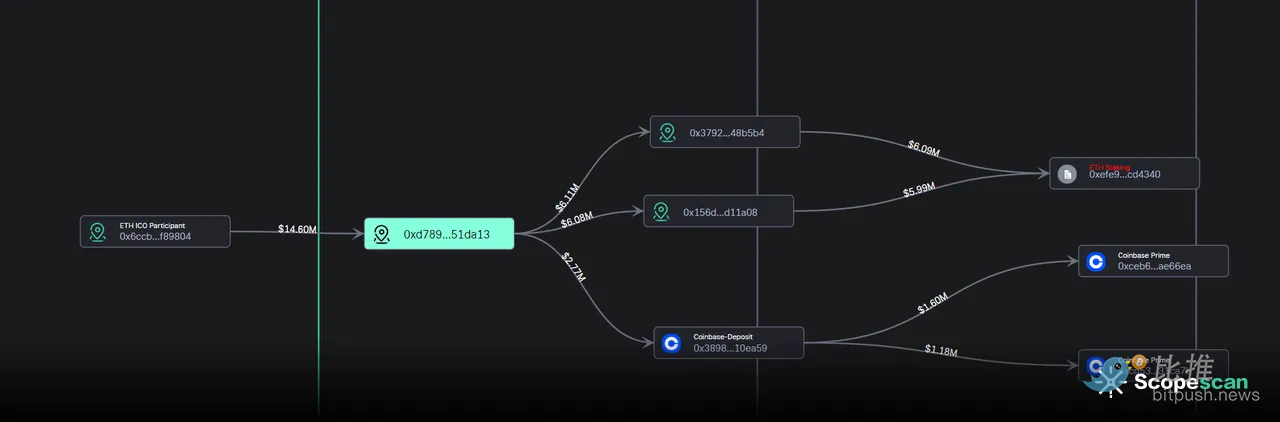

The second event is an address transferring its held assets to Coinbase for Ethereum staking.

Conclusion

Over the past 9 years, the journey of Ethereum ICO addresses has been inspiring and symbolic of the early adopters’ confidence in this transformative blockchain platform. Many of these early investors (678 addresses) have held their initial investments even through the ups and downs of the cryptocurrency market.

While it is true that most ICO participants took action before the significant price surge of $ETH in 2018, the untapped wealth in some dormant accounts demonstrates the enduring confidence in Ethereum’s long-term potential. For anyone passionate about digital currencies, it will be interesting to see what these early buyers will do next.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!