Author: @DavideCrapis Translation: Huohuo/Baihua Blockchain

Have you ever wondered how Rollups generate such amazing high returns?

@BuildOnBase achieved over $2 million in revenue in less than 3 weeks… Inspired by @DavideCrapis’s recent post titled “Rollup Economics 2.0,” let’s delve deeper into the economic model of Rollups.

Key points of this article:

- What types of projects are worth long-term investment?

- Roadmap for GMX v2 How to promote the adoption of GM?

- Rollup Economics 2.0 Analyzing the Multilayer Economic Relationships of a Mature Rollup Ecosystem

1) The “old-school” business model of Rollups

2) How Rollup design becomes more complex

3) Interoperability between

4) The role of Layer 3

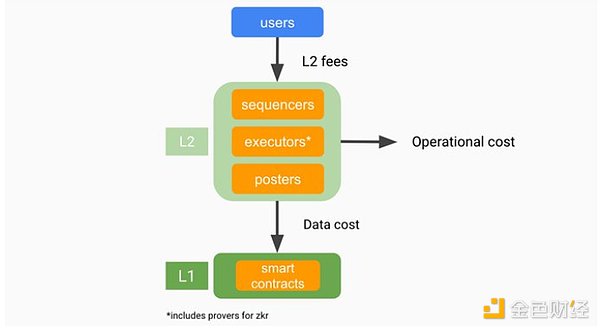

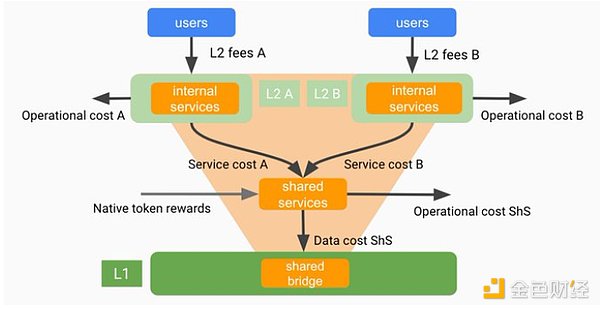

The following image describes the “old-school” model of Rollups as a revenue-generating model. As you can see, there are three main components in the system:

– User

– Rollup operator (serializer, executor, publisher)

– Base layer (L1)

How it works: This flowchart shows users paying L2 fees (gas costs), operating costs (computing costs, servers, etc.), and data costs (processing transactions back to L1).

Therefore, users pay fees to generate revenue, subtracting the costs of operation and data processing, which is the profit.

For Rollups, a dilemma is: Is it about creating a balanced environment or pursuing profit?

Behind each DAO/core team, critical design decisions must be made around optimizing L2 fees, redistributing MEV (Miner Extractable Value), and reducing data costs.

Is it about retaining profits or giving back to the community? ?

This is where Rollups are becoming more complex, striving to increase security through shared governance, increase efficiency through a shared economy, and improve user experience by reducing liquidity fragmentation. For example, @arbitrum has been gradually decentralizing its serializer, but recently, the community discovered that this is not their top priority, as shown below…

In fact, Rollups face trade-offs in three areas:

1) Serialization -> Operating costs of decentralization + costs of incentivizing participants.

2) Data availability -> Costs of publishing data on L1 are high.

3) State verification -> zkRollups have instant finality, but maintaining this feature also requires significant costs.

Teams need to make choices among various trade-offs. As a user, understanding these choices is always beneficial to me.

Security is obviously the most important. But what if your users choose to use another chain that is cheaper and faster but doesn’t prioritize security? This is the builder’s dilemma?♂️

Look, this is why I feel sympathy for the builders in this field. The true decentralization principles of some high-quality teams are often overshadowed by marketing, hype, and short-term vision. That’s life, and it’s a fiercely competitive market. However, we will see who will win in the long run…

Back to this dilemma, and the solution proposed by @DavideCrapis: aggregation.

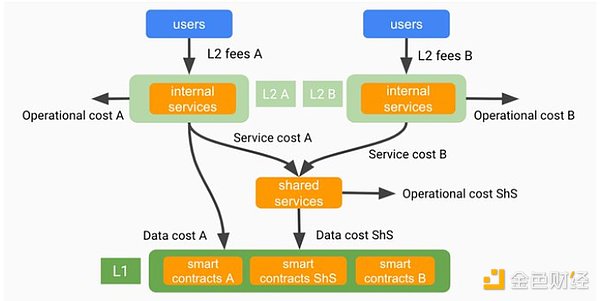

Shared serialization, batch publishing, and verification are at the forefront of optimization. These measures improve efficiency by reducing data costs. For Rollup, future collaboration seems like an undisputed choice.

But does this bring security risks? What if the serializer crashes? Or if the verifier fails to function properly? These are difficult questions. But one thing is certain: collaboration in Rollup can promote economic productivity. Shared services can reduce costs, simplify transactions, and facilitate healthy growth.

The reasoning is simple, as shown in the chart above, you now have two sets of user costs, but only one shared service cost.

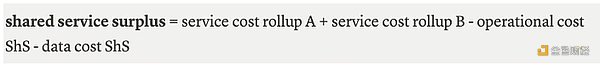

The formula is simple, as described by @DavideCrapis:

The idea of the proposed “Rollup Alliance” is quite exciting. In a perfect world, Rollups within the same “Alliance” would naturally embrace shared services because the cost of direct data publishing would be shared among them.

These Rollup shares bridge with L1, sharing the costs of all services and data publishing. This will become very powerful after EIP4844.

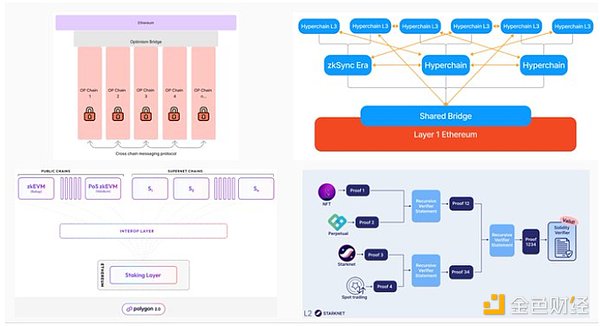

Here are examples of the architecture designs of @zksync’s superchain, @OxPolygonDeFi’s super network, and @Starknet. The core concept is: ‘infinite’ scalability, shared bridging, and cost aggregation among each individual Rollup.

Finally, we have Layer 3. For me, these are very interesting for specific community-specific use cases. For example, games, social media, etc. The reason is that they don’t require the high compatibility of decentralized exchanges (DEX) or money markets. Therefore, they can operate in their own execution environment, enjoying very low costs and high transaction speeds. These Layer 3 (L3) will “roll up” to Layer 2 (L2) and pay the lowest packaging fees (because the gas cost of Layer 2 is very cheap).

As for the economic model, the fees of Layer 3 (L3) become an additional source of income for Layer 2 (L2), increasing their overall revenue.

In addition, more users = more opportunities for teams to leverage sales products, mint NFTs, or create profitable dApps.

As shown in the figure below, more fees are charged:

The costs associated with L2 are similar, including computational/operational costs and data costs.

For L2, there is no doubt that deploying L3 to increase revenue, generate more user-required applications, and create new layers is a wise choice!

In the Rollup field, it is now a very exciting era 🙂

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!