Source: Glassnode; Translator: LianGuaiBitpushNews Tracy

The regulatory environment in 2023 has been a tug of war between positive and negative news, with the most affected being altcoins and DeFi tokens. With significant outperformance from MKR and COMP in recent weeks, we explore how to extract information from changes in decentralized exchange (DEX) liquidity.

Executive Summary:

1. Several positive developments in the digital asset industry and progress in the DeFi space have sparked renewed interest from investors in DeFi tokens.

- Financing Weekly Report | 14 Public Financing Events; Open-source software security solution Socket completes $20 million Series A financing, led by a16z.

- Glassnode Latest Research Report Leading Projects Performing Well, Is DeFi Making a Comeback?

- Interpreting Binance Research’s Telegram Bots Report How will the future of robot trading evolve?

2. The increased interest in DeFi tokens has caught the attention of market makers, who have increased liquidity in the corresponding pools, indicating a positive outlook for trading and price activity around these tokens.

3. Further analysis of Uniswap’s trading volume distribution shows that a significant portion of trading activity can be attributed to bots, with these bots primarily focusing on ETH-stablecoin trading pairs.

Are altcoins back in favor?

In the past few months, the altcoin market has been caught in a tug of war between positive and negative news events, driven by several key developments:

In early June, the U.S. Securities and Exchange Commission (SEC) designated 68 cryptocurrencies as unregistered securities, dampening interest in altcoins outside of Bitcoin and Ethereum. Prior to this news, many of these tokens were already underperforming, as we mentioned in our report “Navigating the DeFi Downtrend.”

Financial giants like BlackRock and Fidelity submitting applications for Bitcoin spot exchange-traded funds (ETFs) have boosted market sentiment and spilled over to the broader digital asset space beyond Bitcoin.

Furthermore, the court ruling between Ripple Labs and the SEC in mid-July determined that the crypto company’s sale of its XRP token on public exchanges did not violate federal securities laws, sending a positive signal to other U.S. crypto projects and the industry as a whole. The victory for XRP provided some hope for altcoin investors, suggesting resilience to further regulatory actions.

Especially strong has been the performance of tokens related to the DeFi space, with our DeFi index price rising 56% since the low point on June 11. In comparison, other key market sectors such as GameFi and Staking have underperformed.

Our DeFi index consists of the top 8 DeFi tokens by market capitalization and has established an upward trend against ETH for almost two months. This is the first time since September 2022 that it has performed strongly, with a very similar pattern so far.

However, if we look at these eight DeFi tokens individually, two tokens stand out in driving this trend: MKR and COMP. Upon closer observation, we can see that this performance is likely closely related to the fundamentals of the new projects rather than broader market developments.

On June 28th, Compound’s founder and CEO, Robert Leshner, announced that he would be leaving the lending protocol and launching a new project focused on bringing regulated finance into the blockchain network. Following this announcement, the COMP token saw a surge of up to 83% within a week.

Around the same time, MakerDAO launched its smart burn engine, a buyback program that uses excess DAI held by the protocol to purchase MKR from the Uniswap pool. The expected removal of approximately $7 million worth of MKR within a month led to a price increase of up to 43% for the token within a week.

By analyzing the trading volumes of the top eight DeFi tokens on decentralized exchanges (DEX) and centralized exchanges (CEX), we can see a new wave of interest in DEX activity. In early June, the relative trading volume share of DEX was 3.75%, which has now increased to 29.2%, nearing the highest levels seen in the second half of 2022.

Hybrid type of Uniswap trades

With the growth of DEX activity, we can investigate the impact of these recent developments on DEX activity and the potential implications for stakeholders. Our main focus will be on the leading DEX platform, Uniswap, which has also been the largest consumer of gas in the past week.

In terms of trading volume on Uniswap on the Ethereum network, the current weekly volume is $5.57 billion, which is still significantly lower than previous years. In early 2023, there was a surge in trading volume due to interest in liquidity tokens and a slight increase in “meme” tokens for a period of time, but it gradually subsided afterwards.

From this perspective, we can see that the recent excitement surrounding Bitcoin ETF applications and the Ripple vs. SEC ruling did not lead to a significant increase in trading activity on Uniswap.

By studying the distribution of Uniswap trading volume on different Layer 2 networks, we can get a clearer picture. It is evident that a significant portion of the volume has shifted from the Ethereum mainnet to Arbitrum, attracting up to 32% of the volume in March. This trend has continued in June and July, partially explaining the lower trading volume on Ethereum that we observed earlier.

By studying the distribution of Uniswap trading volume on different Layer 2 networks, we can get a clearer picture. It is evident that a significant portion of the volume has shifted from the Ethereum mainnet to Arbitrum, attracting up to 32% of the volume in March. This trend has continued in June and July, partially explaining the lower trading volume on Ethereum that we observed earlier.

Robots vs. Humans

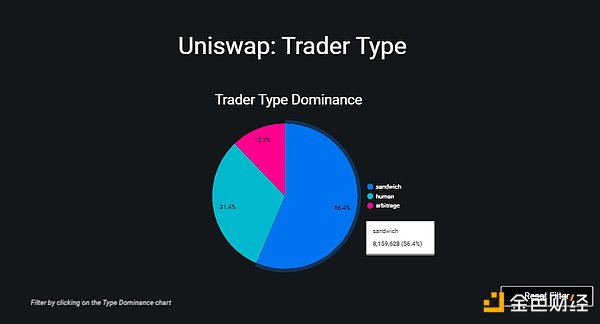

Looking at the background of Uniswap trading activity from another perspective, we can observe the types of traders executing the trades. Since 2019, we have seen various MEV (Maximizing Ethereum Value) robots emerge, which are automated programs that monitor the blockchain to detect profitable trades and exploit them. In this analysis, we will focus on two types: arbitrage robots and sandwich bots.

The arbitrage robot aims to profit from the price differences between different decentralized exchanges (DEXs) and centralized exchanges (CEXs) for the same token pairs.

The sandwich robot inserts its trades in front of the target trader (assuming the buyer), resulting in executing the trades with a larger price difference. Afterwards, the sandwich robot sells the assets again to close the price difference, maximizing value for both parties.

The chart below shows the ratio of trading volume from robot trades and human trades in Uniswap transactions on Ethereum.

We observe that sandwich robots typically account for over 60% of the daily trading volume. The trading volume share of arbitrage robots has decreased from around 20% at the beginning of the year to 10%. Meanwhile, since early July, the trading volume share created by human traders has increased to 30%, coinciding with the period of increased interest in DeFi tokens.

Please note that this classification is the result of the first iteration of the heuristic algorithm newly developed by Glassnode, which is still actively under development. For this iteration, we have set relatively conservative criteria for labeling robots, especially for arbitrage robots.

In addition, please note that different types of robots create different numbers of trades and trading volume. For example, sandwich robots execute at least two trades, generating twice the trading volume of human traders in a single trading action.

Due to the potential different ways in which different types of robot attacks may exaggerate trading volume, the daily number of trades by trader type provides another comparative perspective.

Due to the potential different ways in which different types of robot attacks may exaggerate trading volume, the daily number of trades by trader type provides another comparative perspective.

We can see that human traders are very active during major events such as USDC unlocks or meme token frenzy. As price volatility intensifies and “target traders” enter the market, arbitrage robots and sandwich robots also follow closely behind, increasing their activity levels two to three times during peak periods of increased human trading activity.

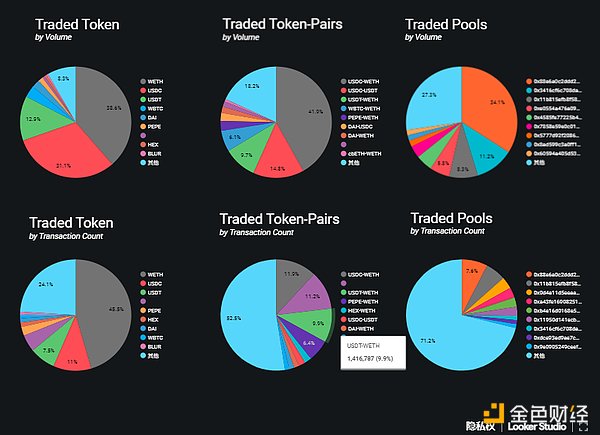

The interactive chart below shows the tokens and trading pools preferred by each type of trader, and all three types of traders clearly prefer the largest and most liquid trading pairs ETH-USDC and ETH-USDT.

Liquidity Pools as Information Markets

Since the launch of Uniswap V3, liquidity providers can allocate liquidity within specific price ranges in the pool. Unlike spreading liquidity across an infinite price range, liquidity can be more efficiently concentrated around the price range where investors expect the highest trading volume (to capture fees).

Since the announcement of the Maker buyback program, the most successful Maker liquidity pool on Uniswap V3 is the MKR/WETH pool, which has experienced significant growth in liquidity.

Although the pool traditionally primarily holds MKR funds, the liquidity depth of WETH has grown by over 700%. This indicates that liquidity providers are signaling higher trading volumes for the MKR-WETH trading pair.

When reviewing the composition of the pool, we can clearly see that the share of WETH has increased, now accounting for 21.2% of the total. This is the result of traders increasingly using WETH to purchase MKR, indicating a significant increase in demand for MKR since early June.

Finally, we propose the idea of how Uniswap liquidity pools can serve as an information market to reflect the expected price development of tokens. If we carefully observe the portion of the MKR-WETH liquidity pool that exceeds the range, we can clearly see liquidity rising at price points far above the MKR/ETH exchange rate.

When liquidity providers move funds to higher price ranges, they are effectively expressing call options on income at higher price points. Under the assumption that liquidity providers are rational participants pursuing profit, their liquidity movements may provide insights similar to options markets for predicting the expected volatility and range of tokens of interest.

Summary and Conclusions:

In 2023, the regulatory environment for digital assets has been constantly changing with positive and negative news intertwined. In recent weeks, especially DeFi tokens have experienced extraordinary performance, with MKR and COMP leading the way. However, by examining trading activities on Uniswap, we find that these price increases have not been reflected in the trading activities on decentralized exchanges.

This can be explained by the growth of trading volume on second-layer solutions like Arbitrum, while the involvement of human traders is relatively low. Due to fewer human trades, arbitrage and sandwich bot activities are correspondingly reduced.

Regarding MKR, in the Uniswap liquidity pool, the increase in liquidity provided by market makers is significant, indicating their expectation of increased trading volume. Based on this, we propose a concept that the distribution of liquidity may provide information for the expected trading range of the discussed token.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!