Highlights of this Issue

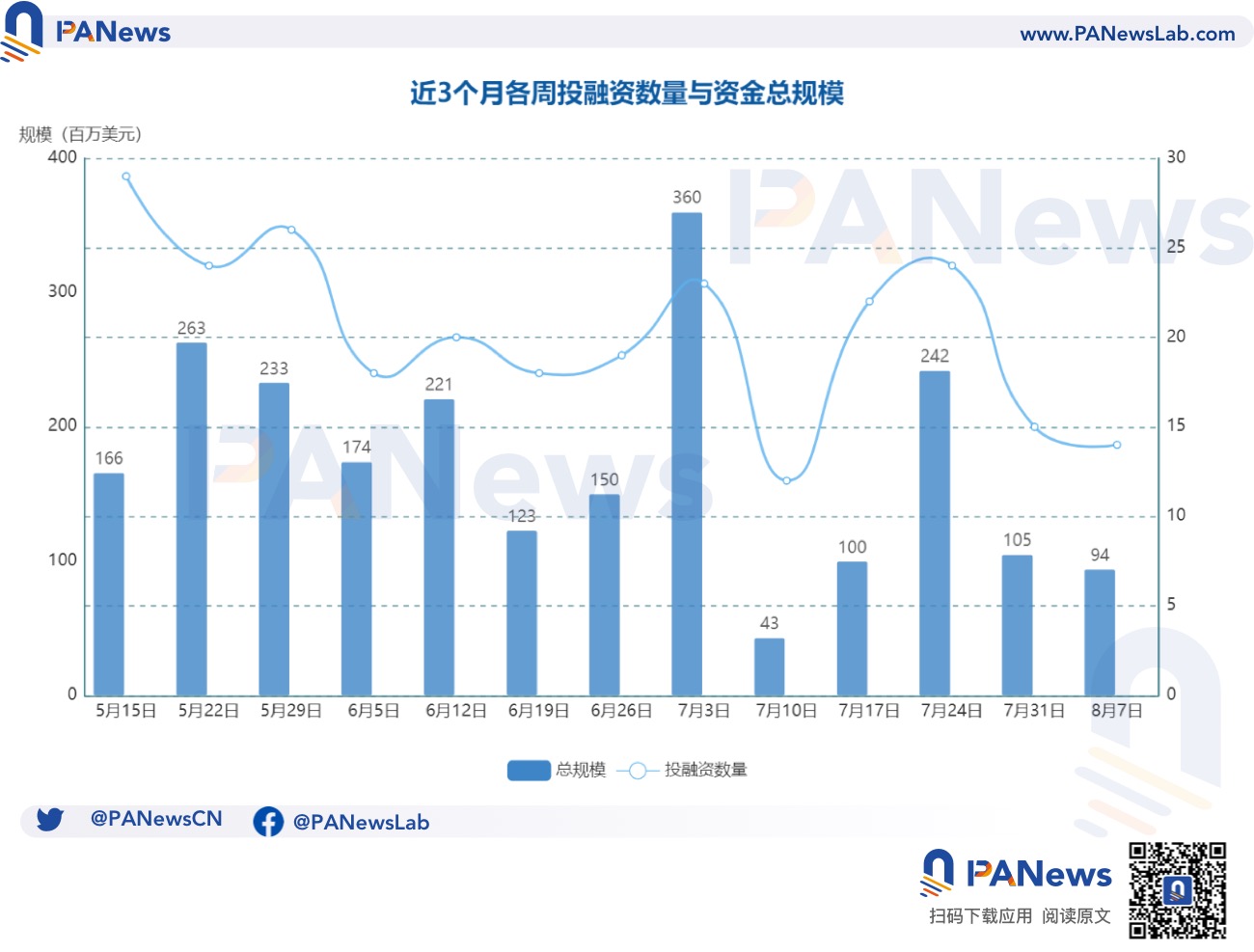

According to incomplete statistics from LianGuaiNews, there were 14 blockchain investment and financing events globally last week (July 31-August 6), with a total funding size exceeding $95 million, slightly lower than the previous week. The overview is as follows:

- DeFi: There was 1 investment and financing event: Solv Protocol completed a $6 million financing round, with participation from Laser Digital, a subsidiary of Japanese banking giant Nomura Securities;

- NFT and Metaverse: No investment and financing events were announced in these areas;

- Blockchain Gaming: There were 2 investment and financing events, including Mahjong Meta, a Web3 Mahjong eSports project, announcing a $12 million financing round, with Dragonfly Capital and Folius Ventures as the lead investors;

- Infrastructure and Tools: There were 9 financing events in this field, including Orbital, a multi-asset/blockchain payment platform, raising £5 million (approximately $6.4 million) in its first institutional financing round, with Golden Record Ventures as the lead investor;

- Other Web3/Crypto-related Projects: There were 2 financing events in this field, including Xgminer, a US blockchain “mining-as-a-service” ecosystem platform, securing $20 million in a new financing round.

DeFi

DeFi protocol Solv Protocol completes $6 million financing

- Glassnode Latest Research Report Leading Projects Performing Well, Is DeFi Making a Comeback?

- Interpreting Binance Research’s Telegram Bots Report How will the future of robot trading evolve?

- PoW seems outdated, but innovation has not stopped.

Solv Protocol, a DeFi protocol headquartered in Singapore, has completed a $6 million new financing round. Laser Digital, a subsidiary of Japanese banking giant Nomura Securities, participated in this round of financing. Other investors include DHVC, Mirana Ventures, Emirates Consortium, Matrix Partners, Apollo Capital, HashCIB, Geek Cartel, and Bytetrade Labs. The new funds will help the company expand its team and continue to focus on the technical development of its platform. According to data from DeFiLlama, since its launch in the second quarter of this year, Solv Protocol’s total locked value has grown to $2.8 million, serving over 25,000 users and facilitating over $100 million in transactions.

Blockchain Gaming

Web3 game Mahjong Meta completes $12 million financing, led by Dragonfly and Folius

Mahjong Meta, a Web3 Mahjong eSports project, has completed a $12 million financing round. Dragonfly Capital and Folius Ventures jointly led this round of financing, with participation from Meteorite Labs, Find Satoshi Labs, LianGuaiParallel Ventures, and Emoote. The funds raised in this round will be used to drive product development for Mahjong Meta and expand the Web3 gaming ecosystem, enhancing player experience and increasing its global influence.

Conductive.ai, a Web3 game participation platform developer, completes seed financing led by Animoca Brands

Conductive.ai, a developer of Web3 game participation platforms, has completed seed financing led by Animoca Brands. Other participants include Kraken Ventures, Bixin Ventures, Sound Ventures, etc. The amount of financing has not been disclosed. It is reported that Conductive.ai is solving the problem of stagnant game revenue growth with its proprietary platform. The solution it launched has increased player engagement in games and provided developers with additional tools such as player reward distribution systems and analytics suites, enabling them to jointly formulate strategies to encourage player retention. The Conductive.ai platform includes a “Zero-Click” import tool that simplifies the creation and login of Web3 accounts, eliminating much of the friction commonly found in platforms that use Web3 technology.

Infrastructure & Tools

Open-source software security solution Socket completes $20 million Series A funding, led by a16z

Open-source software security solution Socket has completed a $20 million Series A funding round, led by Andreessen Horowitz (a16z), with participation from Abstract Ventures, Wndrco, Unusual Ventures, as well as angel investors including Box co-founder Aaron Levie and Figma co-founder Dylan Field. Including the previous $4.6 million seed funding, Socket has raised a total of $24.6 million. Unlike traditional static analysis tools, Socket’s open-source code security vulnerability detection service provides actionable feedback related to dependency risks, rather than hundreds of meaningless alerts. In addition, Socket has recently launched a ChatGPT connector that summarizes potential issues in software packages, identifying “uncommon” code patterns. Socket’s current clients include Metamask, Brave, Magic Eden, Figma, and Vercel.

Blockchain payment platform Orbital raises nearly $6.4 million, led by Golden Record Ventures

Multi-asset/blockchain payment platform Orbital has raised £5 million (approximately $6.4 million) in its first institutional funding round, led by Golden Record Ventures, with participation from New Form Capital, GSRV, Psalion, and Luminous Futures. Orbital is a licensed provider of a suite of traditional payment and global forex solutions, and has obtained a cryptocurrency payment license, particularly focusing on stablecoin use cases in cross-border payments. Orbital combines fiat and cryptocurrency business accounts, enabling traditional global enterprises, especially those operating in emerging markets, to integrate stablecoins and other major cryptocurrencies with traditional currencies into existing payment flows. Its API further serves as an embedded financial solution for stablecoin payments.

Blockchain cloud company Common Computer raises approximately $6.3 million in Series B bridge financing

Blockchain cloud company Common Computer has raised KRW 800 million (approximately $6.3 million) in its Series B bridge financing, attracting strategic investments from healthcare company InBody worth KRW 500 million and existing investors such as HB Investment. Through this investment collaboration, the two companies plan to advance AI chatbots, providing a natural language experience for over 10 million InBody users, validating the potential of large-scale models and creating service cases.

Cybersecurity company Hushmesh raises $5.2 million, led by LianGuailadin Capital Group

Key management digital infrastructure Hushmesh has raised $5.2 million in funding, led by LianGuailadin Capital Group with participation from Akamai Technologies. Hushmesh will use the funding to develop the Mesh key management program, a global information space with built-in automated security features, allowing individuals and organizations to operate online without worrying about malicious attacks or data leaks. Mesh automates encryption key management, providing an unlimited number of keys to protect an unlimited amount of personal or entity data for every individual and non-individual entity.

Fintech company Emtech raises $4 million, led by Matrix LianGuairtners India

African CBDC infrastructure provider Emtech has completed a $4 million seed round of financing, led by Matrix LianGuairtners India, with participation from BTN, Vested, Equity Alliance, LoftyInc Capital, and others. Emtech plans to use the new funds to further develop its CBDC stack and regulatory technology solutions. Founder Carmelle Cadet stated that Emtech will deploy its first version of the CBDC platform this year.

Web3 startup Naval completes $4 million seed round of financing, led by BlockTower

Web3 startup Naval has completed a $4 million seed round of financing in July, with BlockTower as the lead investor. It is reported that Naval is led by the University of Cincinnati, Kroger, GE, and Matt Schoch, and is building a Web3 wallet usage platform that allows organizations to securely use digital assets such as NFTs in the Web3 space.

Privacy protocol zkLianGuaiss raises $2.5 million in seed round of financing, with participation from Binance Labs, Sequoia China, and others

Privacy protocol zkLianGuaiss has raised $2.5 million in a seed round of financing, with investors including Binance Labs, Sequoia China, OKX Ventures, dao5, Susquehanna International Group, Cypher Capital, Leland Ventures, and Blockchain Founders Fund. The funds will support the development of its pre-alpha testnet, which has a waiting list of 190,000 registered users. zkLianGuaiss combines three technologies: zero-knowledge proofs, multi-party computation, and secure third-party transmission.

Web3’s first membership aggregation platform VIP3 raises $2 million in seed round of financing, with participation from IOBC Capital and others

Web3’s first membership aggregation platform VIP3 has raised $2 million in a seed round of financing, with participation from IOBC Capital, Ankr, LianGuaiKA, and others. VIP3, as the first membership aggregation platform in the Web3 space, uses SBT (Soulbound Token) as an on-chain membership card, allowing users to enjoy various rights and benefits from numerous Web3 projects on the VIP3 platform. Currently, VIP3 has established membership partnerships with more than 30 platforms, including Binance, HashKey Exchange, OKX, TP Wallet, Ankr, and Mahjong.

Decentralized user data infrastructure Terminal 3 completes Pre-Seed round of financing, with participation from CMCC Global and others

Hong Kong-based decentralized user data infrastructure service provider Terminal 3 has completed an oversubscribed Pre-Seed round of financing, with participation from 500 Global, CMCC Global, Consensys Mesh, Bixin Ventures, BlackPine, DWeb3, Hard Yaka, Bored Room Ventures, and Mozaik Capital. The specific amount of financing has not been disclosed. Terminal 3 aims to replace centralized data storage models and uses decentralized storage and zero-knowledge proofs to help enterprises solve compliance and security issues related to user data, allowing for free combination of user data while maintaining complete privacy and security.

Others

Cryptocurrency Mining:

Blockchain mining-as-a-service platform Xgminer raises $20 million in financing

U.S. blockchain “mining-as-a-service” ecosystem platform Xgminer has raised $20 million in a new round of financing, with specific investor information undisclosed. Currently, the Xgminer platform supports cloud mining services for multiple algorithms and cryptocurrencies. The new funding will be used to expand fixed investments in equipment, personnel, and other aspects, while further enhancing the mining machine’s computing power.

Digital Assets:

Diversified Digital Asset Fund Platform Solv Protocol Completes $6 Million Financing

Solv Protocol, an all-in-one, diversified digital asset fund platform, has completed a $6 million financing round. Investment institutions such as Laser Digital (backed by Japanese banking giant Nomura Securities), UOB Venture Management, Mirana Ventures, Emirates Consortium, Weiying China, Bing Ventures, Apollo Capital, HashCIB, Geek Cartel, and Bytetrade Labs have participated in the investment. Solv V3 is committed to introducing billion-dollar revenue assets to the industry through its fund platform. Solv has raised a total of $14 million in funding and has previously received support from institutions such as Blockchain Capital and Binance Labs.

Venture Capital Institutions

Coatue Management’s Fund Completes $331 Million Financing, 34% Lower Than the Target

New York-based investment firm Coatue Management’s latest fund has raised $331 million, 34% lower than the target amount. Coatue Management has previously invested in crypto startups such as MoonLianGuaiy, Chainalysis, and Fireblocks. Last year, three general partners of Coatue Management, including Luca Schmid, who led some well-known crypto and fintech investments at the company, left the firm.

Futureverse Launches $50 Million Web3 Technology Fund “Born Ready”

Aaron McDonald and Shara Senderoff, co-founders of AI metaverse startup Futureverse, announced the establishment of a $50 million Web3 technology fund called “Born Ready.” The fund will provide investments ranging from $250,000 to $2 million for companies building Futureverse’s Web3 infrastructure and content network. The Born Ready portfolio already includes startups such as FCTRY Lab, a sports shoe company, and Walker Labs, a Web3 game studio. The Born Ready fund will also launch an accelerator to support the growth of portfolio companies. Previous reports stated that AI metaverse company Futureverse raised $54 million in Series A funding, led by 10T Holdings with participation from Ripple Labs.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!