Author: Jie Xuan Chua, Binance Research

Compiled by: Deep Tide TechFlow

Various Bots tokens on Telegram have recently attracted attention with astonishing price increases. Although prices have since fallen, the narrative of being in the early stages of volatility is still worth paying attention to.

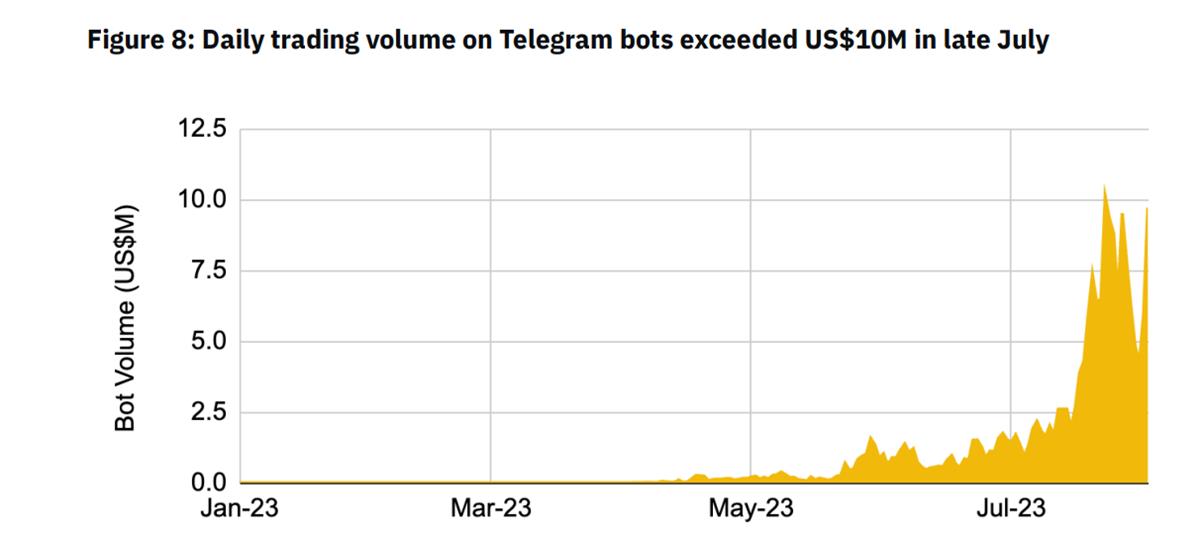

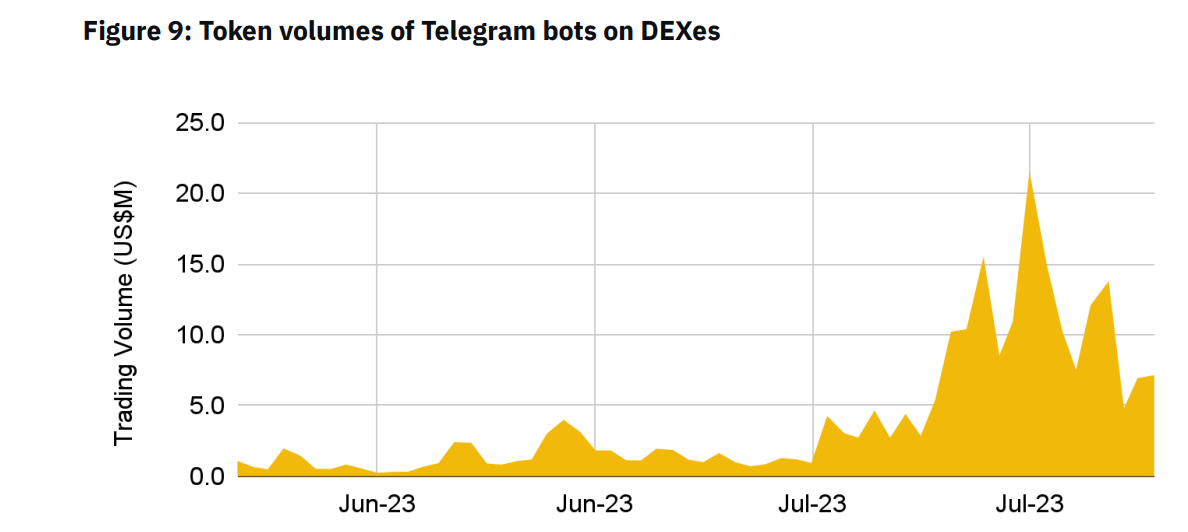

Binance Research has released a research report on Telegram Bots, pointing out that the cumulative trading volume of Telegram bots has exceeded $190 million, with a daily trading volume of up to $10 million.

- PoW seems outdated, but innovation has not stopped.

- Decoding the Major Updates Designed by Arbitrum Unpermissioned Verification with BOLD

- What legal qualifications are required for operating a consortium blockchain in compliance with Chinese regulations?

What is the trading mode of these bots, how will the entire track develop in the future, and what are the potential risks?

Key points:

Telegram bots allow users to participate in crypto activities through mobile devices in a more user-friendly manner by providing functions such as trading and airdrop brushing.

The cumulative trading volume of Telegram bots has exceeded $190 million, with a daily trading volume of up to $10 million.

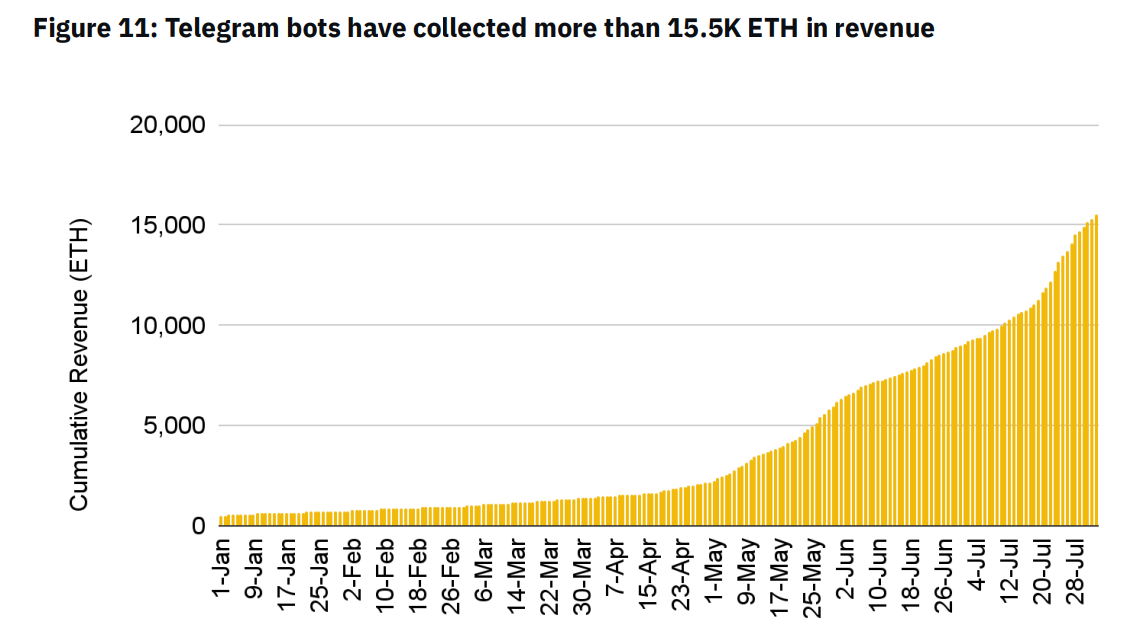

Telegram bots make profits by charging transaction fees and “taxes” on token buying and selling. Total revenue has exceeded $28.7 million.

It is currently difficult to determine the real demand, and the current hot trend is largely driven by the rise in token prices. However, this field will continue to develop in the short term.

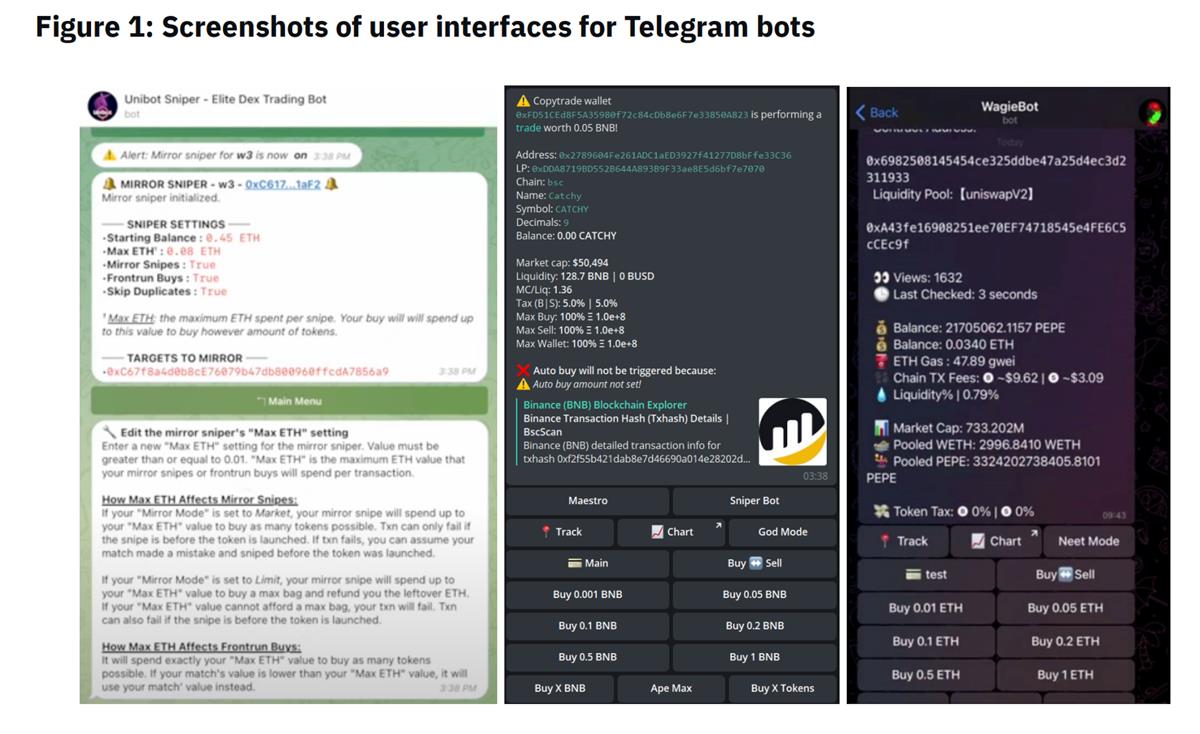

General process of Telegram bot trading

Users enter commands in the channel of the Telegram bot, and the bot will generate a main menu.

Users can set up a new wallet or connect an existing wallet in the menu and recharge the wallet with the provided address.

Then execute different types of transactions, such as buying and selling tokens, airdrop brushing, copy trading, etc.

Evaluation:

Compared to existing DeFi frontends, Telegram bots provide a more user-friendly and convenient user experience (for beginners).

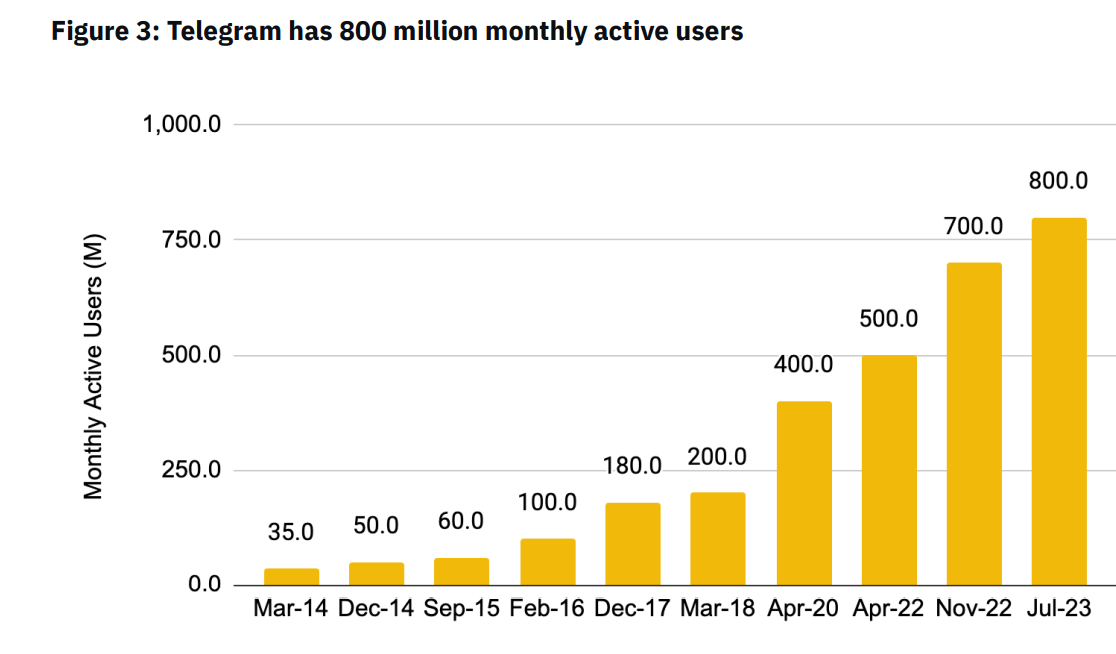

Telegram has 800 million monthly active users, and those users who are exposed to Telegram but have not entered the industry are actually a good choice.

Common functions and comparisons of Telegram bots

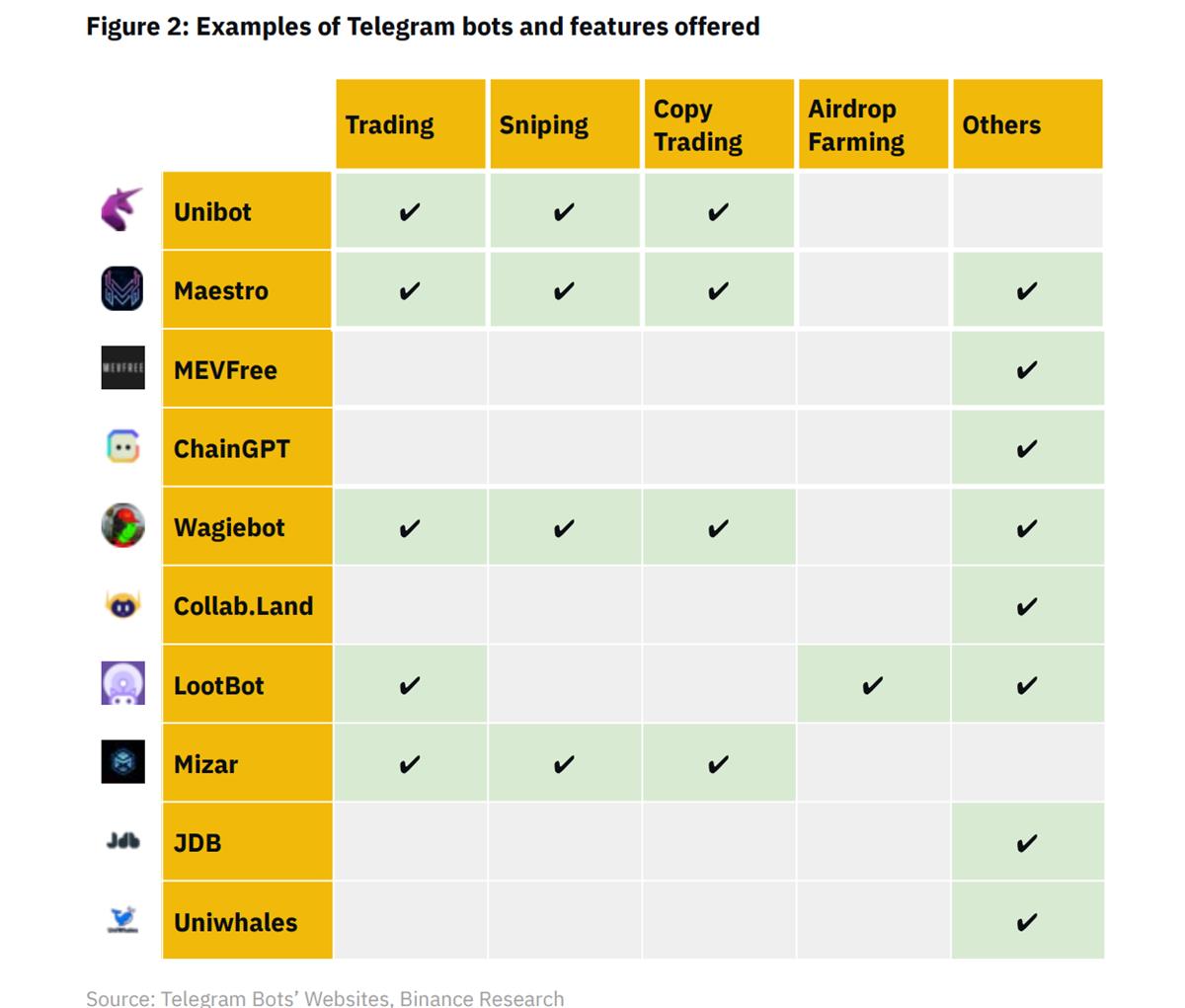

Trading: Can buy and sell tokens directly through Telegram.

Sniping: Can automatically buy tokens when they are listed.

Copy trading: Can simulate the trades of other traders.

Airdrop farming: Can automatically execute a series of operations to increase the chance of receiving airdrops.

Other functions: Such as analysis or wallet tracking, etc.

The typical functions provided by bots are basically a trade-off among the above functions.

Evaluation:

Doesn’t it feel like you have a bunch of apps, where you used to go to A for e-commerce, B for financial management, and C for offline life, and now you have one WeChat that encompasses everything?

With a huge influx of traffic and integrated functionalities, although bot functionalities are still in the early stages, it is a clear method that is distinct from most DeFi applications to create a “one-stop” article in the traffic pool.

Racing Track Panorama Analysis

Total Potential: According to reports, Telegram has over 800 million monthly active users and can now perform cryptographic activities through mobile devices in a different way.

Market Value and Project Situation:

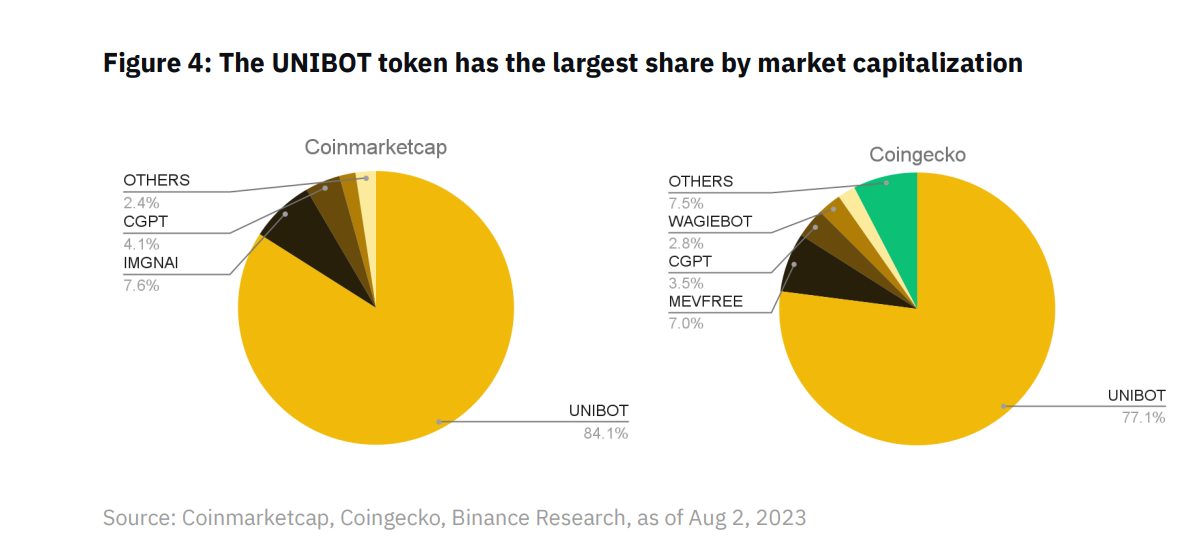

At the time of writing this article, the market value of robot-related tokens exceeded $150 million, and many tokens have grown several times in a short period of time.

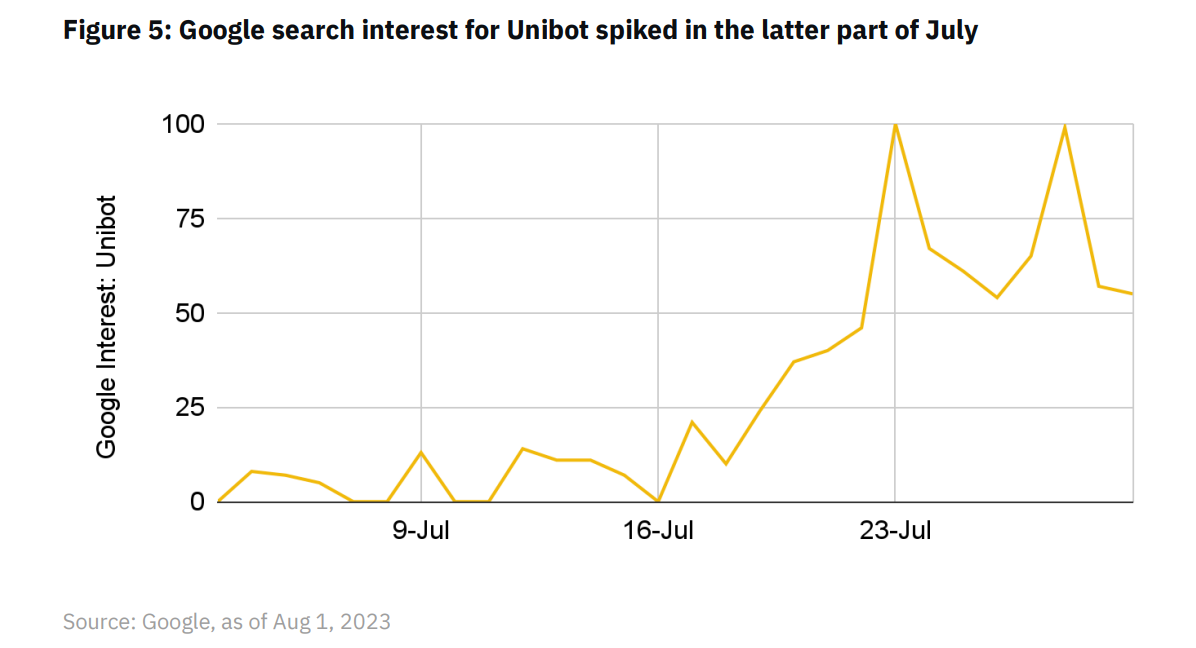

The key contributor is the UNIBOT token, which occupies over 77% of the market share. Interest on Google searches continues to increase using Unibot as a proxy.

Evaluation:

According to the process of general users’ psychological and attention transfer, the price often rises first, and then they search on search engines. Therefore, the more the price rises, the more people search for it, but in reality, the proportion of users who actually use robots for trading is not very large.

A more accurate analysis of the churn rate is not provided in Binance’s report, but we can understand it as a normal process of new narrative development, from a few people paying attention to price increases, to more people searching, and then the price starts to fall.

User Adoption:

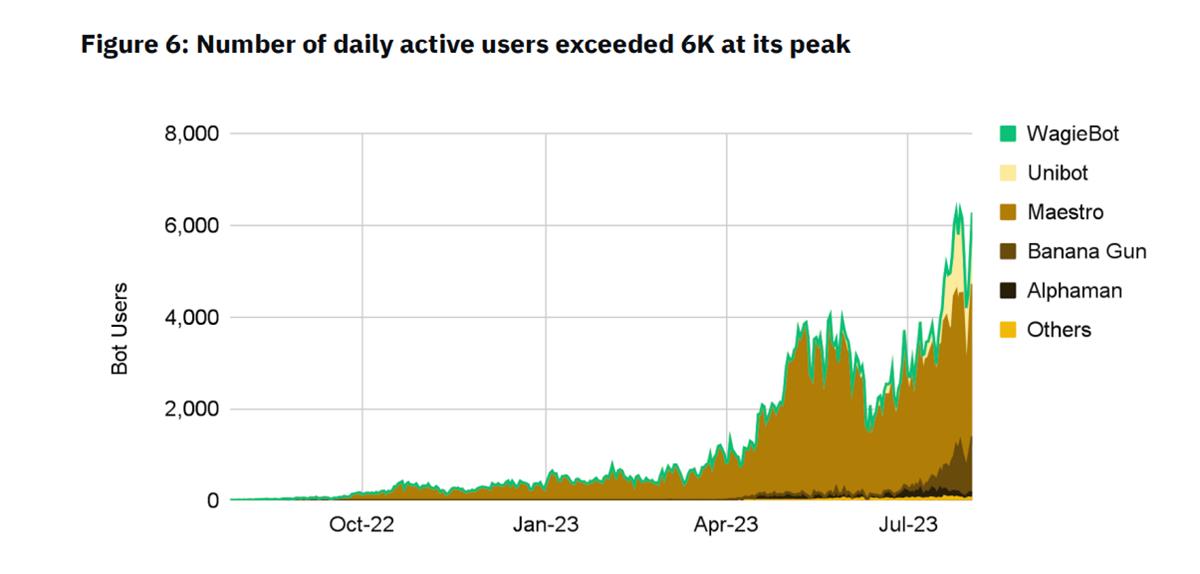

User indicators reached a new high in July, with daily user numbers exceeding 6,000.

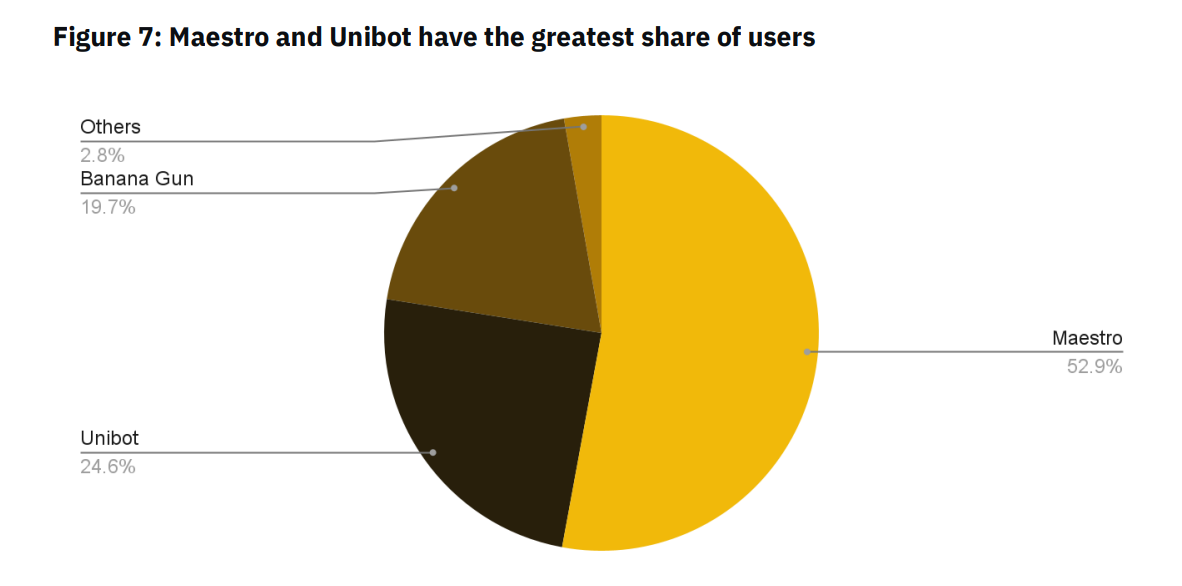

Maestro maintains its lead with approximately 2,000-3,000 daily active users. Unibot is catching up, and the gap has significantly narrowed in recent weeks; the daily active users increased from about 400 to 1,700 at its peak in July.

Daily trading volume on the robots reached a record high, exceeding $10 million. The total trading volume over the entire lifecycle has also exceeded $190 million. Note that the actual amount may be higher as not all data is immediately available.

Token Influence:

The trading activities of tokens have the ability to influence community participation, especially for new narratives.

Rising token prices and trading volume attract attention and discussions, and vice versa.

Although still at a high level, we have noticed that the trading volume of these robot-native tokens has slowed down in the past few days, coinciding with a decline in robot users and the overall number of robots.

Evaluation: Speculation is the primary productive force. However, whether this narrative has ended and whether there will be another round of speculation remains uncertain.

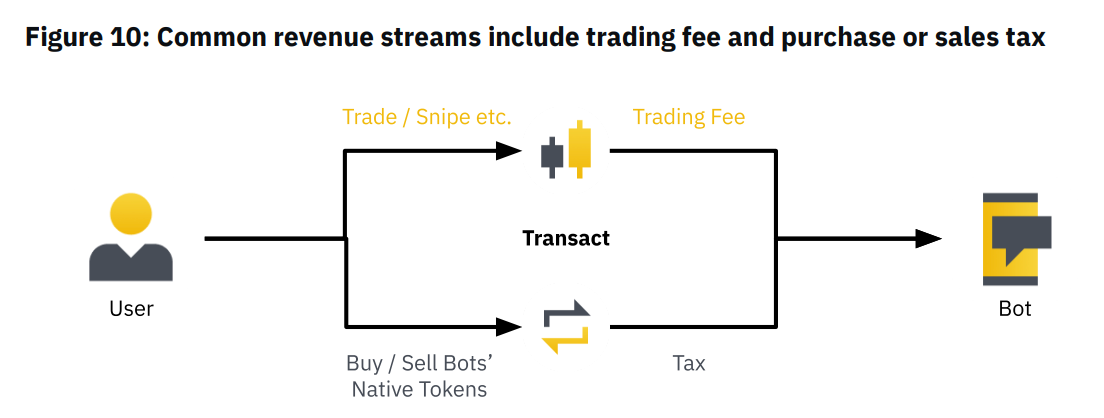

Revenue Model of Robot Projects

The revenue of robot projects is determined by transaction volume and taxes:

1. Users engage in transactions through robots;

2. The protocol earns transaction fees;

3. Users buy/sell tokens related to robots;

4. The protocol levies taxes on behavior 3.

For example, Unibot has collected a total of 4.3K ETH (about $8 million), of which approximately 86% comes from taxes on purchases or sales, rather than transaction revenue.

-

The Telegram robot has collected over 15,000 ETH (equivalent to $28.7 million) in revenue from this year to July.

-

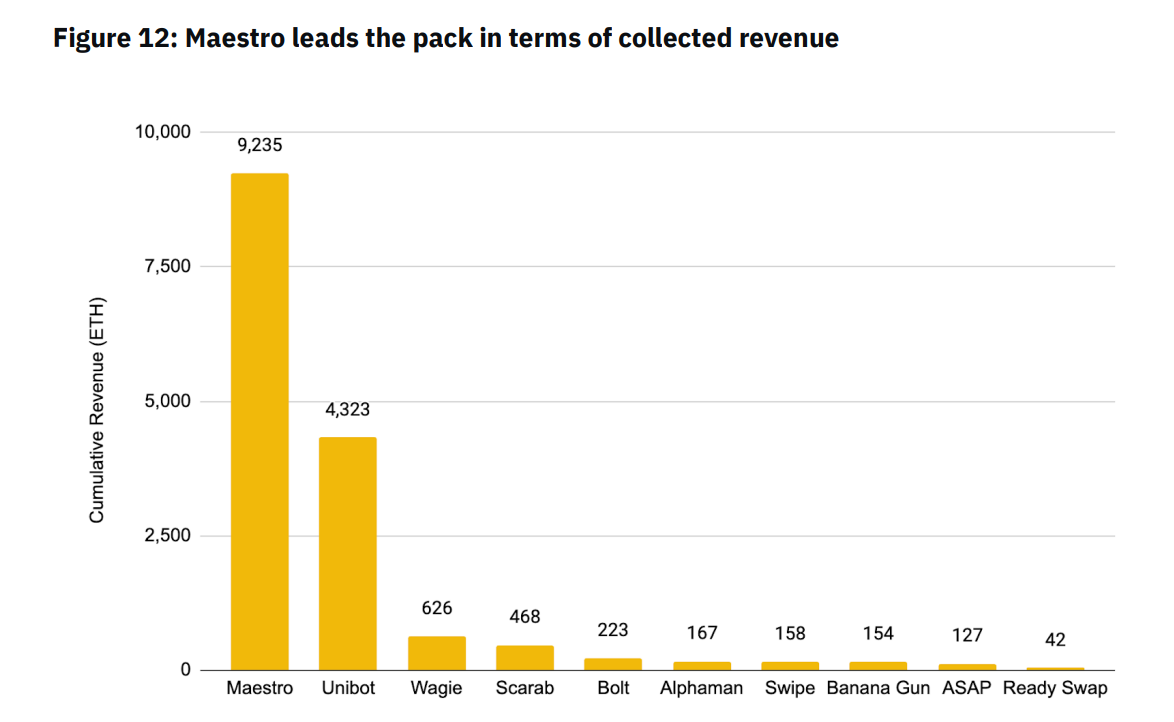

Maestro is currently leading in cumulative revenue, with Unibot ranking second, but the difference in revenue between the two is more than double.

In addition, a relatively high number of daily active users, about 2,000-3,000 people, allows Maestro to achieve stable transaction revenue.

Transaction revenue comes from Maestro charging a 1% transaction fee for each successful buy or sell order through the application.

Prospects and Risks in the Industry

Ongoing and potential development directions:

-

Expansion to other platforms: Many robots have already expanded from Telegram to other platforms, such as Discord. This allows them to reach more users and provide another place for executing transactions.

-

Increasing product portfolio: While some robots may choose to focus on a single area (e.g., sniping new listings), we speculate that more robots will try to develop new features to cover more areas and become one-stop shops. Users only need to access one robot to execute various types of transactions.

-

Cross-chain expansion: We have observed robots expanding across different blockchains, not just the Ethereum blockchain. This allows them to provide convenience for users to transact between different blockchains.

-

Price wars: The fees of most Telegram robots are currently not cheap. When the industry matures and there is almost no product differentiation among established players, lower fees can be used to attract users.

Possible risks:

-

Asset security: Robots have different setups, but they usually allow users to create dedicated wallets or connect existing wallets. In both cases, the robots will have access to private keys, which may pose risks.

-

Smart contract risks: Considering the operation of robots, interaction with smart contracts is inevitable. Although audits are not comprehensive enough, projects with rigorous audits enable developers to identify and address critical issues.

User suggestions:

-

Smaller scale transactions;

-

Keep wallet funds to a minimum;

-

Create a new wallet instead of using the main wallet when interacting with robots.

Conclusion

It should be noted that a significant portion of some robot’s income may come from sales or purchase taxes on transactions, rather than from robot trading revenue.

At this stage, it is too early to determine whether Telegram robots can continue to attract user interest.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!