Author: Cookie

The Ordinals ecosystem during the holiday seems relatively flat, with the main dynamics being:

– Casey Rodarmor, the founder of the Ordinals protocol, listened to community opinions and promised to commit to maintaining the stability of positive numeral inscriptions. The dispute over the variability of “numeral inscriptions” has come to an end.

– Although Casey is uncertain whether creating a new FT protocol for Bitcoin is good or bad and has a negative attitude towards FT, he still took action. Casey created a GitHub page for the Rune protocol, and relevant discussions have been launched on it.

- Bitcoin Inscriptions and Serial Numbers Important Data, Impact on Bitcoin, and Latest Developments

- Bitcoin Inscriptions and Serial Number Research Report Important Data, Impact on Bitcoin, and Latest Developments

- Messari Q3 2023 Cryptocurrency Industry Investment and Financing Latest Status Report

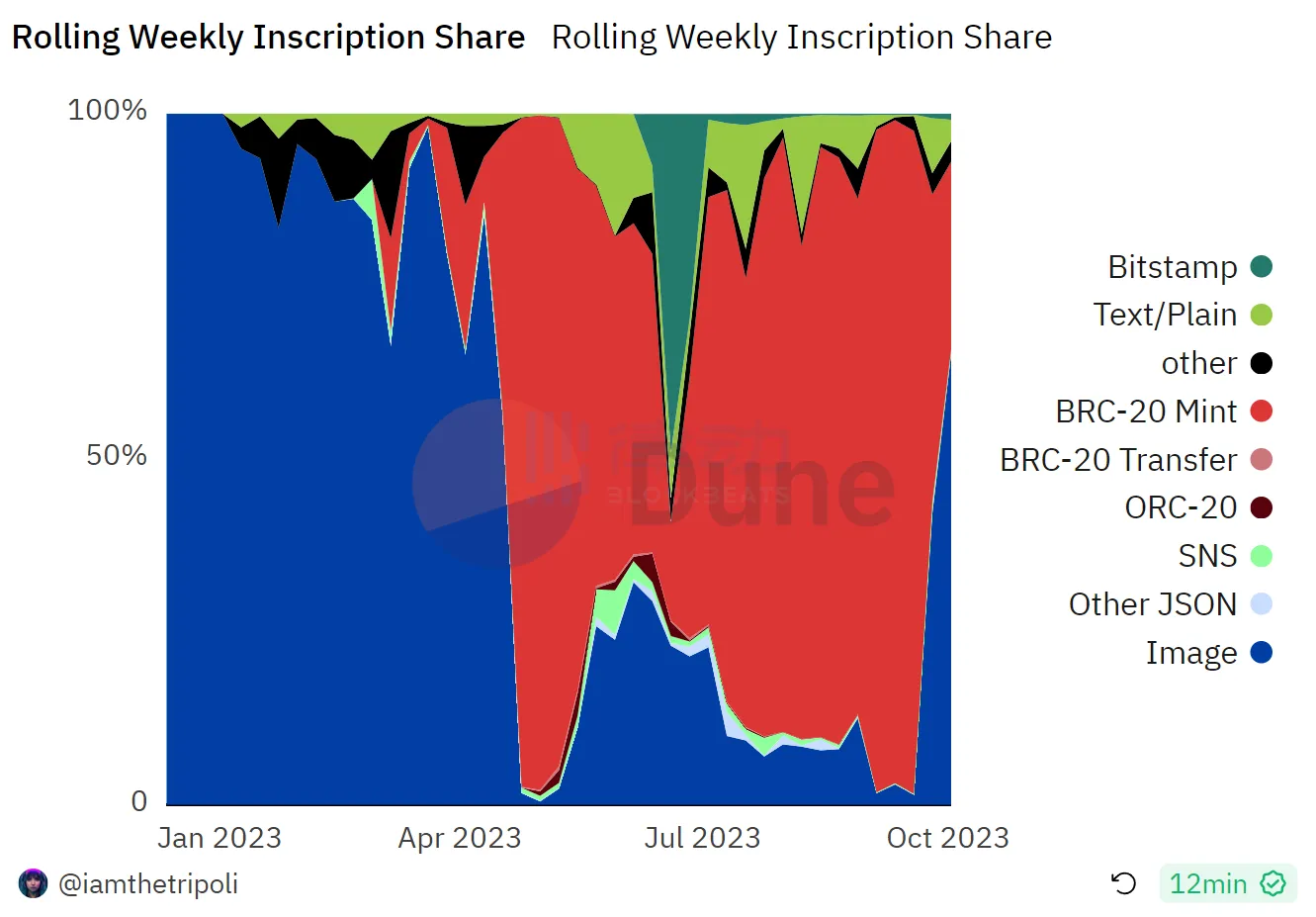

But the most interesting thing is that during the week from September 25th to October 2nd, the cost of forging image-type inscriptions finally accounted for more than 50% of the total forging cost of all inscriptions that week, reaching 65.2%. This is the first counterattack of image-type inscriptions against BRC-20 minting inscriptions since the end of April.

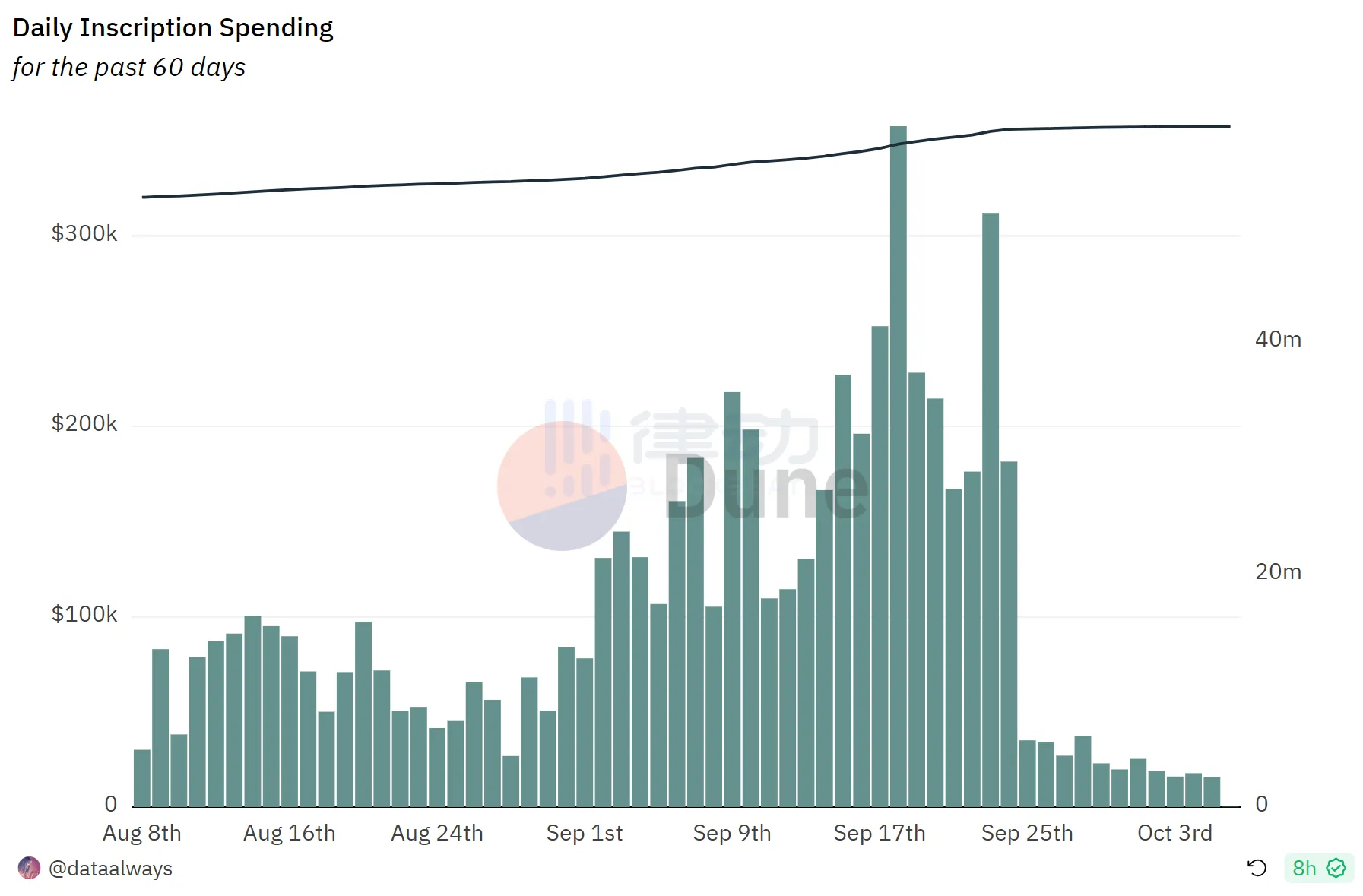

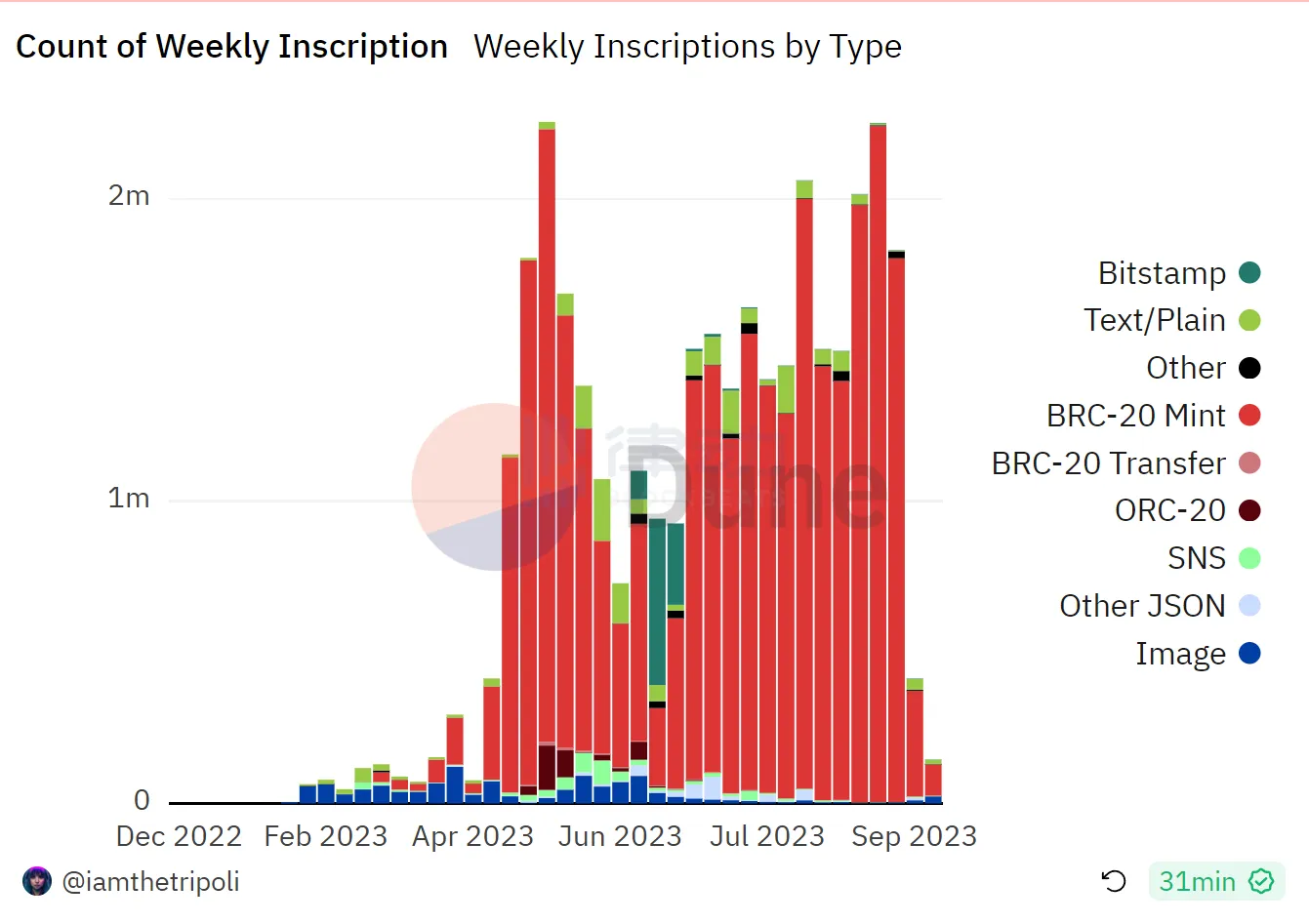

The minting of BRC-20 Token $SATS, which lasted for more than half a year, finally came to an end. As a “social experiment” with high expectations, $SATS consumed over tens of millions of dollars to complete all minting, but the final market performance was disappointing. Lack of new hotspots, coupled with the impact of Casey’s proposed Rune protocol on BRC-20, finally cooled down BRC-20.

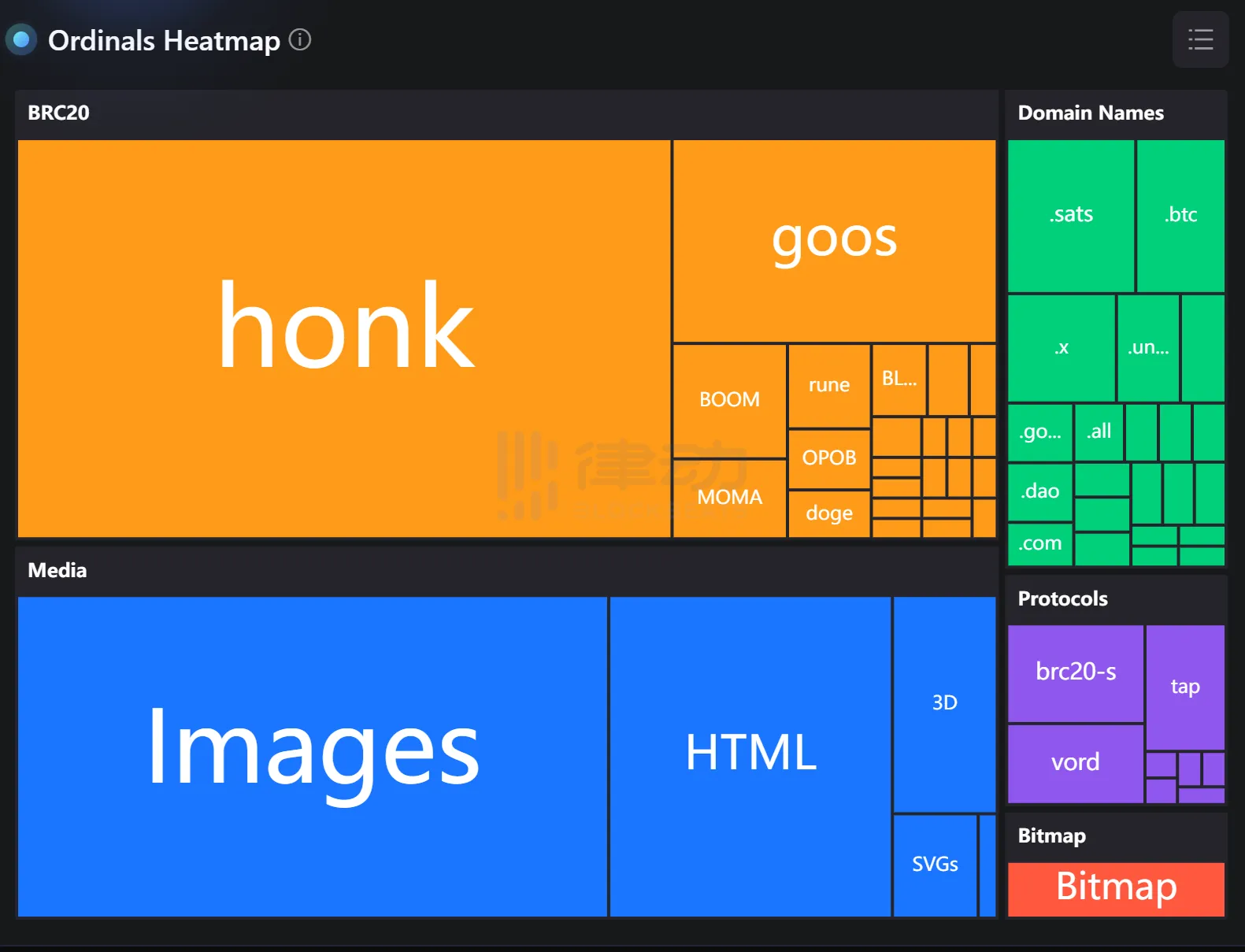

The cooling of BRC-20 also caused an overall cooling of the Ordinals ecosystem. From the data, it is obvious that BRC-20 is the biggest contributor and “engine” for the Ordinals protocol to go mainstream.

After $SATS was fully minted on September 24th, the daily gas consumption of the Ordinals protocol quickly decreased. Compared with the gas consumption on September 24th, it dropped by more than 90% at its highest.

From September 25th to October 2nd, the ratio of cumulative new BRC-20 minting inscriptions to cumulative new image-type inscriptions narrowed to approximately 4.38:1, which is the closest ratio since late April.

Regarding this on-chain situation, Casey said, “This is recovering healthily.” It seems that the statement I made in the article introducing the Rune protocol, saying that Casey’s firing at BRC-20 was a “painful treatment,” was quite accurate…

Of course, if it is only based on the temporary one-sided cooling of BRC-20, it cannot be declared that the Ordinals ecosystem has achieved a “victory of art.” In addition to the above data, there are 2 interesting phenomena worth our attention:

– The “Prints” feature on the Bitcoin NFT trading platform Gamma.io is receiving increasing attention.

– The popularity of Bitcoin NFT projects has led to the emergence of new BRC-20 Tokens.

Gamma.io’s “Prints”

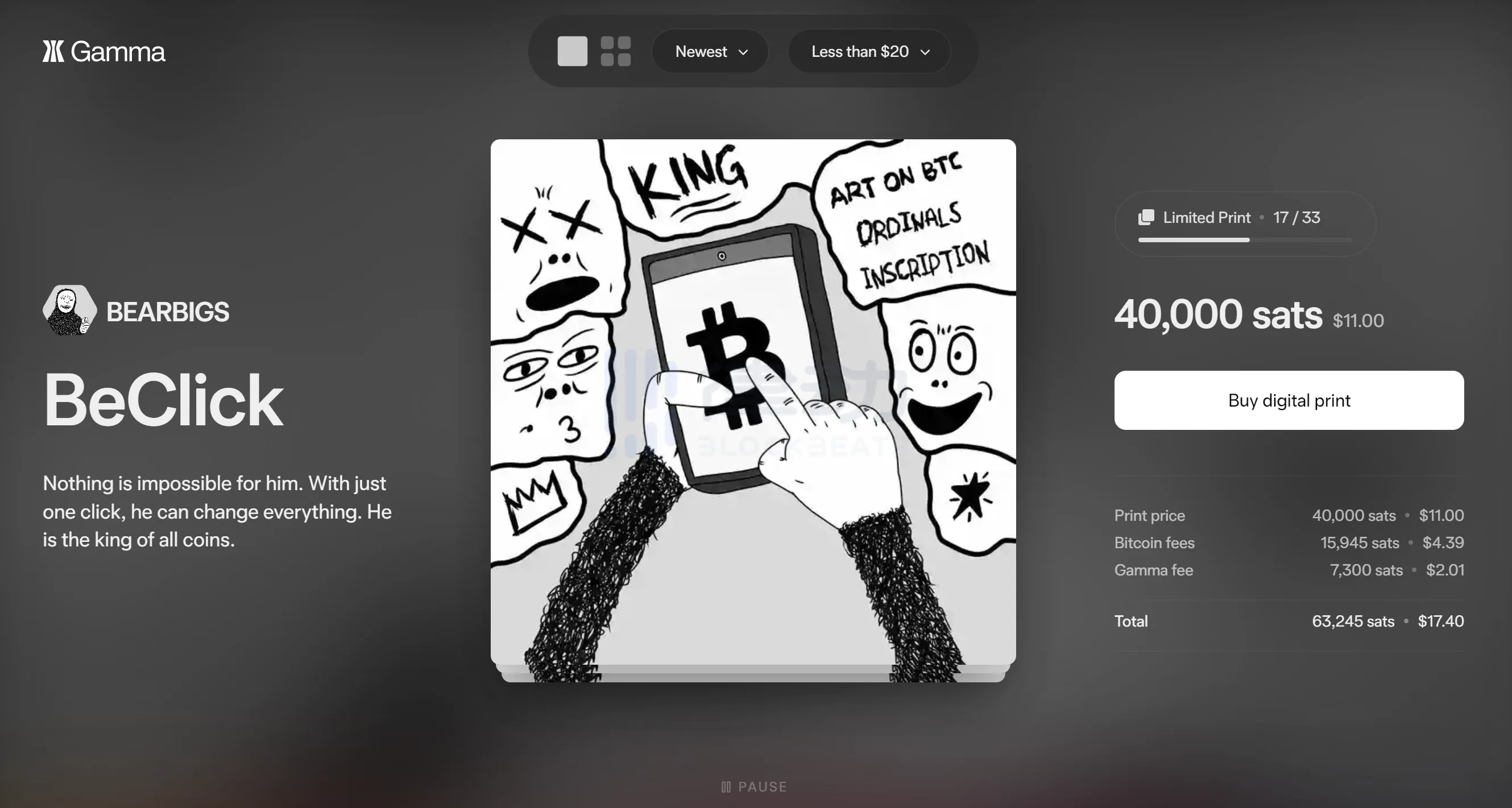

Let’s talk about Gamma.io’s “Prints” feature. I have always been looking forward to a platform on Bitcoin that allows creators to quickly issue Open Edition NFT series, similar to Zora/Manifold. Gamma.io’s “Prints” feature basically achieves the same user experience as Zora/Manifold for collectors.

Gamma.io's "Prints" feature

For creators, in order to use the “Prints” feature, they need to apply to participate in Gamma.io’s artist collaboration program. Once selected for the program, creators can use the “Prints” feature to issue Open Editions on Bitcoin, and Gamma.io will provide a series of support from promotion to offline exhibition activities.

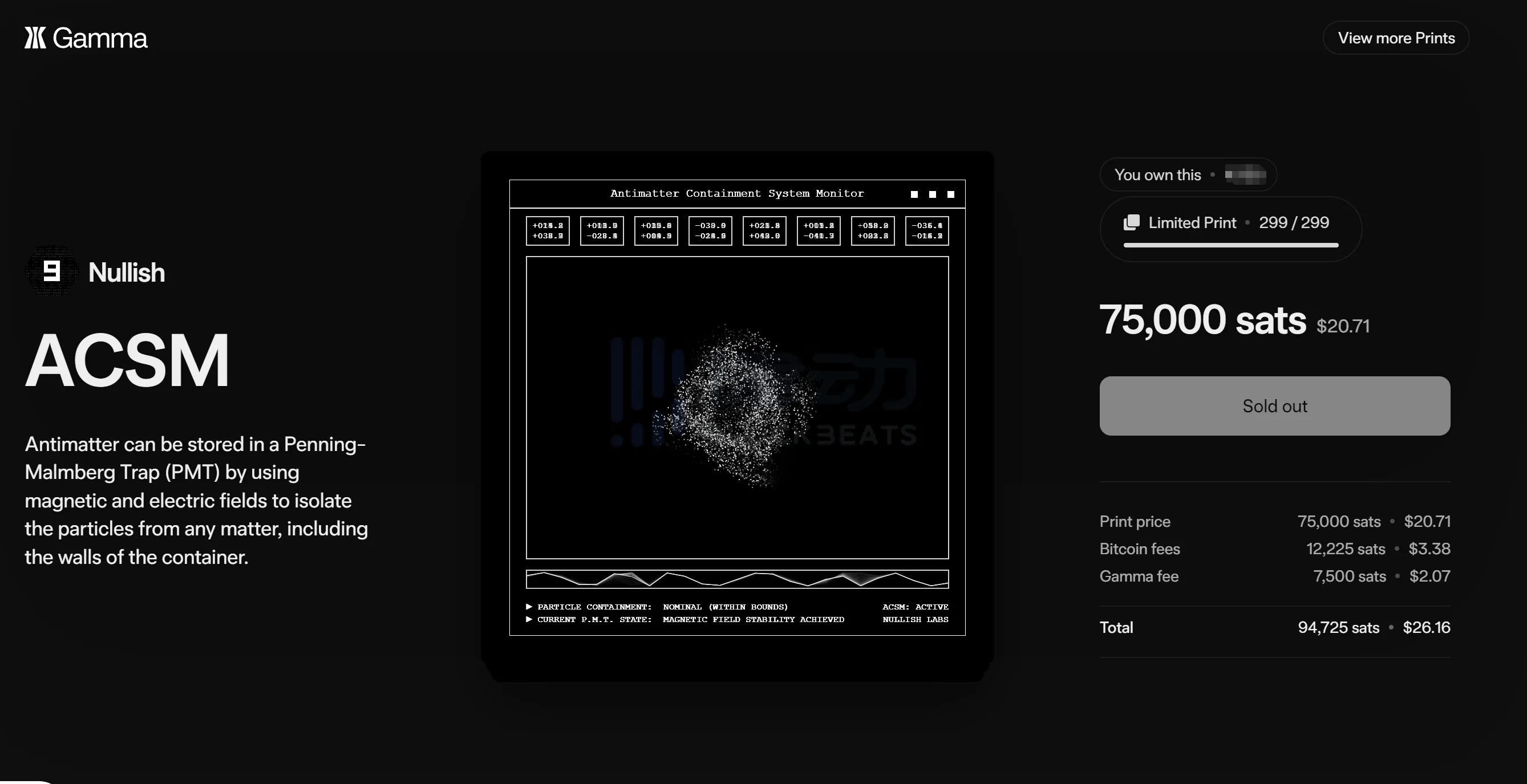

I used the “Prints” feature to buy two artworks, one of which is the ACSM by Nullish, one of the most influential artists in the Bitcoin NFT community. The original version of this artwork was carved on a rare stone and sold successfully for 0.48 BTC. Then, an additional 299 versions were created through the “Prints” feature on Gamma.io, and they were sold at a price of 75,000 satoshis (about $20). They were sold out in just over a minute.

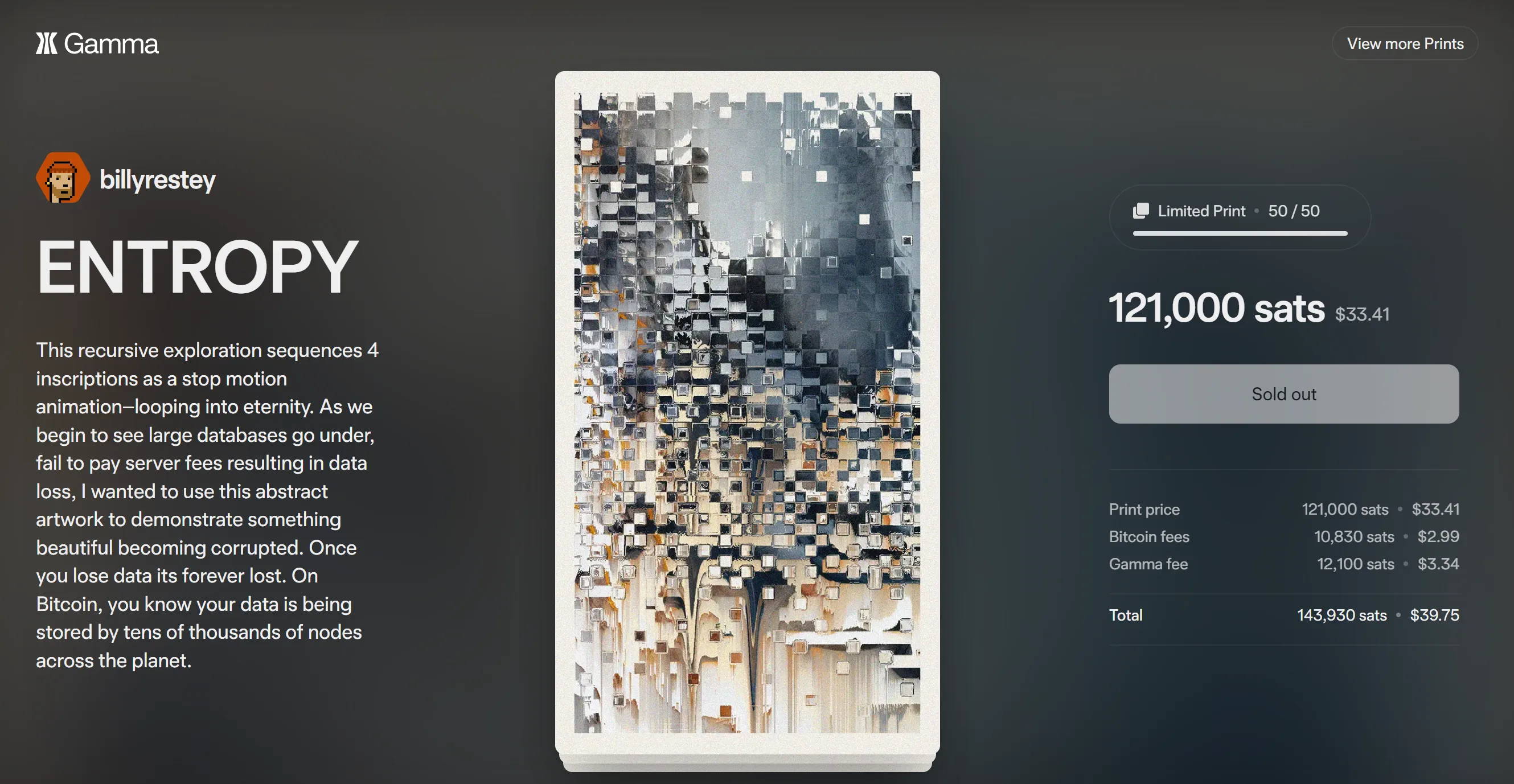

Another influential artist in the Bitcoin NFT community, @billyrestey, followed suit and released “ENTROPY” on Gamma.io with a total supply of 50 copies, each priced at 121,000 satoshis (about $30). It also sold out successfully.

When Recursive Engravings first came out, the first thing that came to my mind was a new solution for Open Editions on Bitcoin. Now, Gamma.io has the potential to break through the competition in the Bitcoin NFT trading market and catalyze the creator ecosystem of Bitcoin NFTs through the “Prints” feature.

“Goose” Comes Before “Goose Coin”

“Goose” is actually a typical Ordinals speculative model – information asymmetry, concentrated chips, and almost risk-free profit after splitting (the cost of engraving is very low). Since the Ordinals ecosystem is still relatively cold, players who have been tracking it in this circle for a long time often have a feeling of “it’s difficult to start, but once it starts, it can last for three years”.

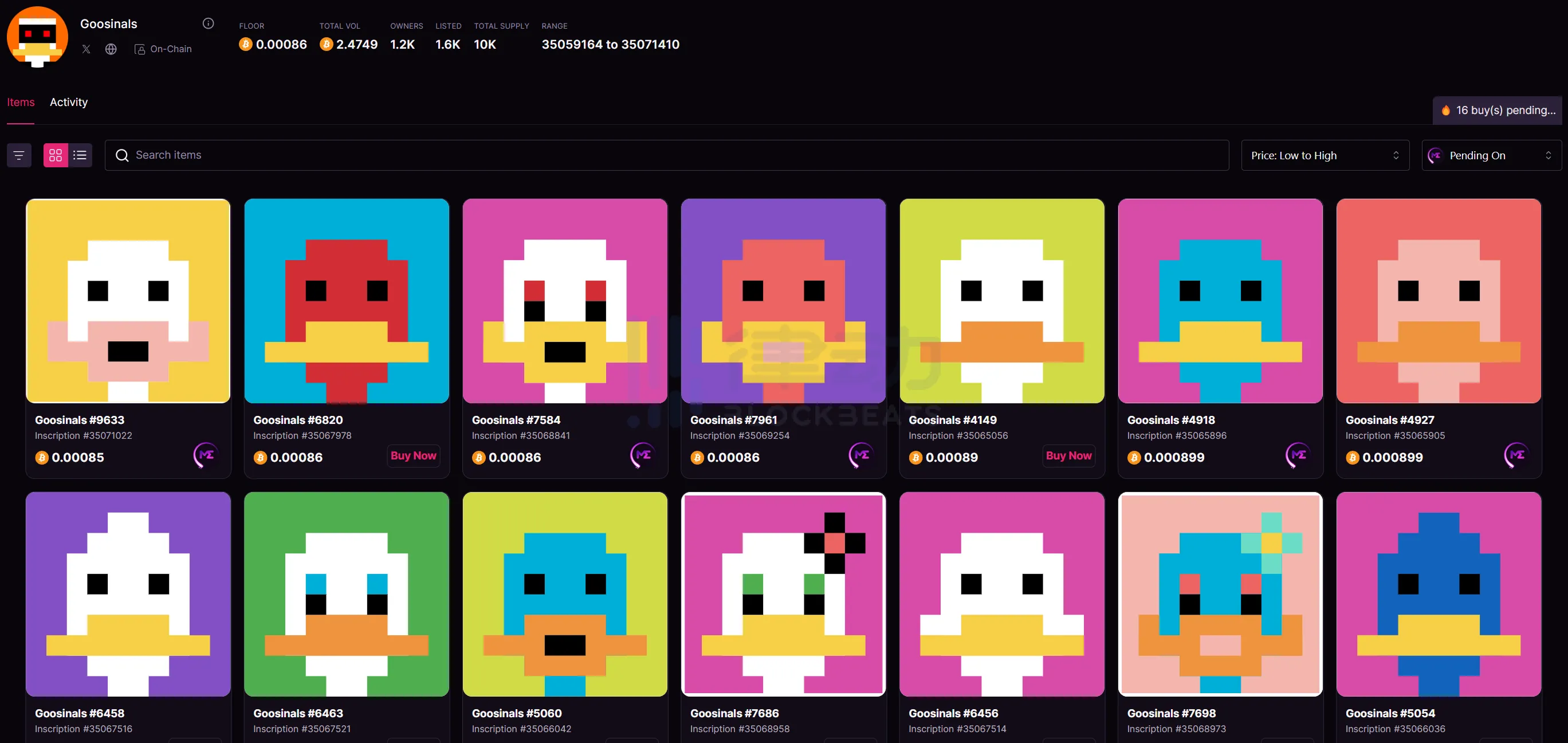

"Goose", the cost can be as low as less than 1 U, and at its peak, it can be worth more than 40 U. Look at this series with a total supply of 10K, but only 1.2K holders...

“Goose” is not a specific NFT project issued by an artist on Bitcoin, in fact, it is not an NFT project issued by an artist on a specific chain.

“Goose Father” is the well-known generative artist Dmitri Chernia, also the creator of one of the star projects on Art Blocks, “Ringers”. In June of this year, Ringers #879 was sold at Sotheby’s auction for a hammer price of $5.4 million (a total price of $6.2 million including buyer’s commission), creating the second-highest transaction volume for a generative artwork in history. Its new owner is the well-known crypto collector @punk6529, and its previous owner, well, is the bankrupted 3AC. The auction of Ringers #879 is part of the liquidation of 3AC NFT assets.

Ringers #879 is also known as "The Goose", you see, does it look like a lovely goose?

But “The Goose” is valuable not because of the rarity system of PFP-type NFTs, but because the randomness and unpredictability of generative art have made “The Goose” a crystallization of countless wonderful coincidences.

To commemorate Ringers #879 “The Goose”, Dmitri Chernia set up such a creative theme in the MoMA Postcard project – if you were to design a simple, 10 x 10 pixel, 10K PFP with “Goose” as the theme for MoMA, what would you create? Other artists in the project use the generator he provided to create “Goose”.

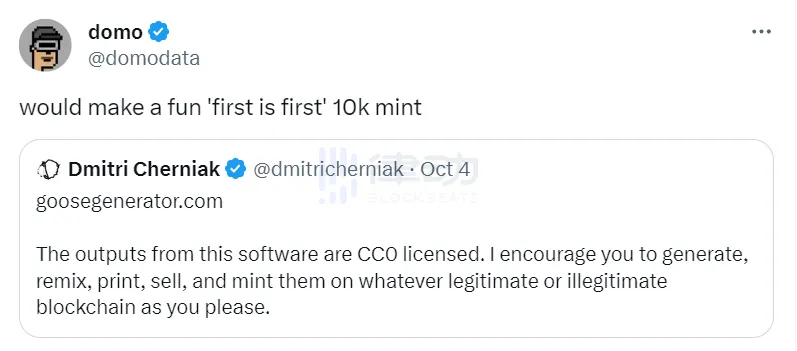

“Goose” is hot, but what really turned it into something tradable in the Bitcoin NFT space is because the founder of BRC-20, @domodata, tweeted – it would be interesting to create a 10K “Goose” series called “First is First”.

“Goose” is CC0, so it’s completely fine to generate a bunch of “Goose” using the generator provided by Dmitri Chernia and sell them. As for why “Goose” has risen so much? To be honest, I think it’s because of the information asymmetry that has caused FOMO. People still have too little understanding of NFT art (including myself)… I did see many friends who directly jumped in thinking that “Goose” was created by a famous artist, without really understanding the origin of this thing.

But then again, if you understand everything before getting in, we wouldn’t be Degen anymore. Just grasping the simple logic of domo’s “call” is enough to navigate correctly in the ambiguity and be the first to run out of the battlefield with loot amidst chaos.

“Goose” has sparked a hot trend, leading to several BRC-20 tokens, with $HONK and $GOOS as the leaders. The popularity of the Bitcoin NFT project has spilled over into the emergence of new BRC-20 tokens. The last time we saw a situation like this was when Taproot Wizards caused FOMO for $WZRD. It’s been a while since we’ve seen that…

First came the “goose,” then came “goose coins.” In the attention economy, whether it’s a picture or a token, as long as there is popularity, there is space. Some say that the trading volume of the 10K “goose” series on Bitcoin is much higher than the 879 “goose” series on Ethereum, so Bitcoin NFT has won this time. I just want to say, if you think of the 10K “goose” as a BRC-20 token, it can prevent excessive optimism. Many artists on Ethereum have created themed artworks for the “goose.” Although it didn’t create such a high wealth effect this time, the continuously accumulating and still growing culture of encrypted art is the core competitiveness of Ethereum NFT.

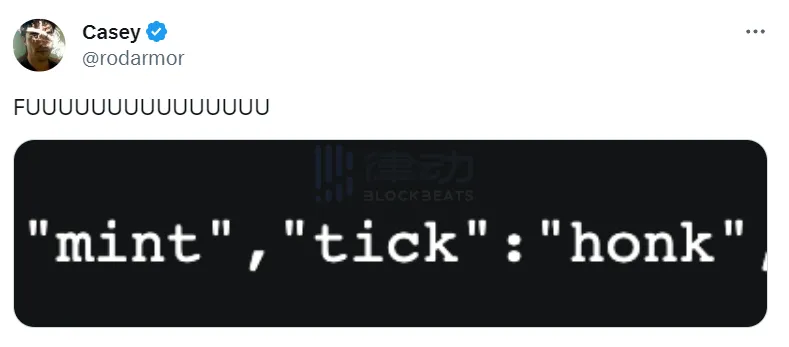

The last interesting thing is that domo advertised the 10K “goose” series, and Casey tweeted something that is equivalent to advertising for $HONK. Did these two buddies swap souls?

Conclusion

Is the Bitcoin NFT ecosystem returning from the “casino” to the “art gallery”? This is definitely temporary. However, at least it has become more interesting than the dullness of the past few months…

What we should pay attention to:

– The progress of the Runestone Rune Protocol?

– Will Gamma.io’s “Prints” help new encrypted artists who focus on Bitcoin NFTs stand out?

For someone like me who firmly believes that “creators are the core competitiveness of the NFT ecosystem,” Bitcoin NFT still has a long way to go, but it seems to have finally made a good start.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!