Written by: STEVEN SHI

Translated by: Deep Tide TechFlow

Since the emergence of Ethereum, Layer 1 (“L1”) blockchain has been one of the most popular investment areas in the cryptocurrency field. More than half of the native tokens of L1 blockchains are among the top 20 cryptocurrencies by market capitalization. In fact, the concept of “new public chains” (alt L1) was one of the key narratives adopted during the cycles of 2017 and 2021. Due to the huge demand for Ethereum block space, many investors and users have flocked to new L1s with higher capacity and lower fees.

- Data Reveals the Battle of New Public Chains Who Can Surpass Ethereum?

- Endless Scalability Exploring the Significance of Consensus Layer ZK-Rollups for Ethereum

- Exploring the Future of Universal Finance The Current Situation and Opportunities of NoFi

However, even after the alt L1 concept reached its peak a few years after 2021, Ethereum remains the de facto dominant L1 blockchain. Many other L1s appear to be ghost towns, with stagnant or declining user growth.

Nevertheless, new L1s continue to emerge. Aptos and Sui are two large L1s launched in the past year, with a current total valuation of over $12 billion. In addition, there are several upcoming projects, some of which have valuations in the nine or ten digits in the private funding rounds. Furthermore, some existing L1s still have strong communities that believe they can grow and compete with Ethereum.

Debates about alt L1s still exist. Therefore, we want to answer a question that readers often ask: Is there any Layer 1 blockchain that can surpass Ethereum?

Overview of L1s

To answer this question, we reviewed the history of L1s and Ethereum’s leading position. In this report, we define the scope of L1s as broad, permissionless smart contract blockchains, also known as “ETH killers”.

The rise of L1s can be said to stem from the limitations of Bitcoin. The original purpose of Bitcoin was to effectively function as a trustless peer-to-peer electronic cash system. As Bitcoin itself gradually gained recognition as a legitimate currency, developers began to attempt to create alternative digital currencies and other decentralized applications on top of Bitcoin. However, due to Bitcoin’s limited scripting language and the reluctance of the social layer to add complex functionality to the network, Bitcoin was not suitable for supporting the development of other applications. Previous attempts to create applications on Bitcoin had been stagnant.

The launch of Ethereum filled this gap. It was the first widely recognized blockchain with a Turing-complete programming language, greatly expanding the design space of decentralized blockchains.

Like Bitcoin, Ethereum’s core culture places decentralization above scalability. Therefore, as the adoption of Ethereum grew, such as during the ICO boom in 2017 or the DeFi Summer of 2020-2021, the network quickly reached throughput limits. The network could be congested within hours, gas fees soared, and many users could not afford it. Sometimes, a simple token transfer could require a transaction fee of $150. Developers were reluctant to increase the throughput limit to avoid the risk of “centralization creep” in the protocol.

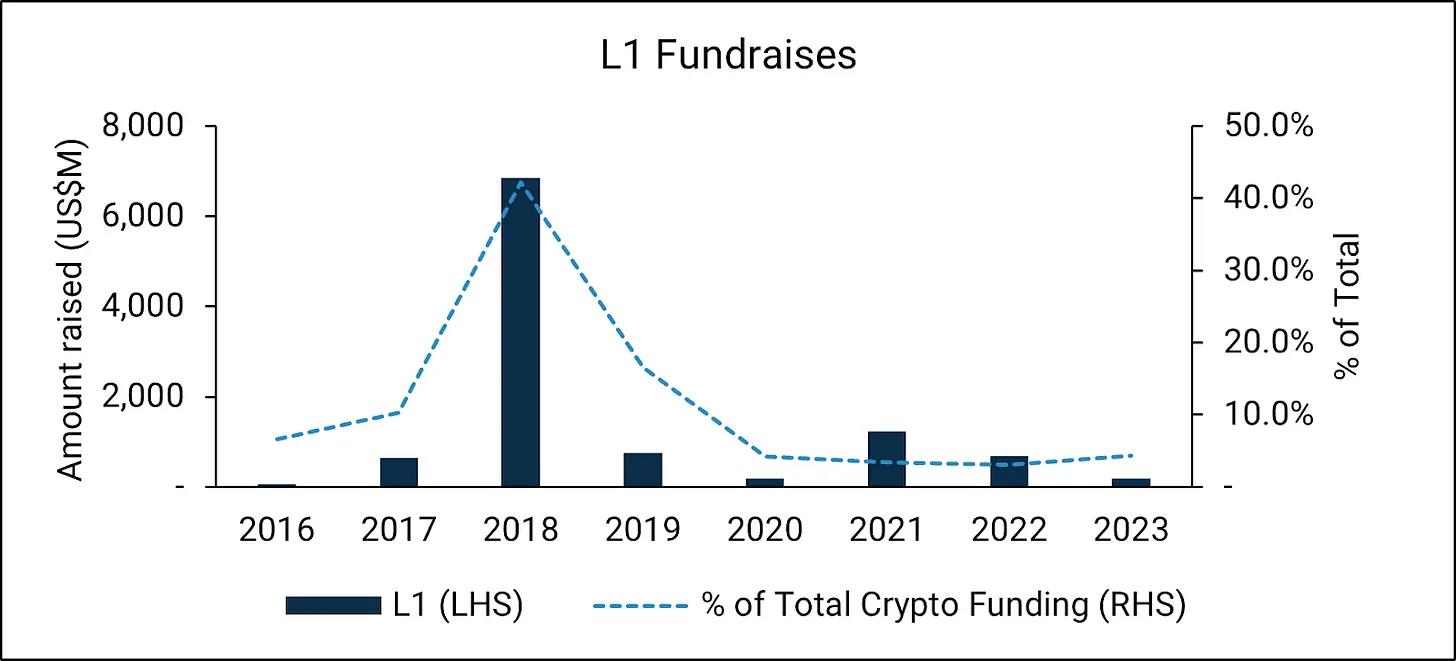

Therefore, when Ethereum faces scalability issues, the hype around new public chains emerges. During the ICO frenzy, blockchain projects like EOS, Tezos, and Cardano raised hundreds of millions of dollars, promising faster L1 architectures. In 2021, this pattern also occurred to a lesser extent. As shown in the figure below, the peak of L1 fundraising coincided with the strong adoption of cryptocurrencies.

Market Status

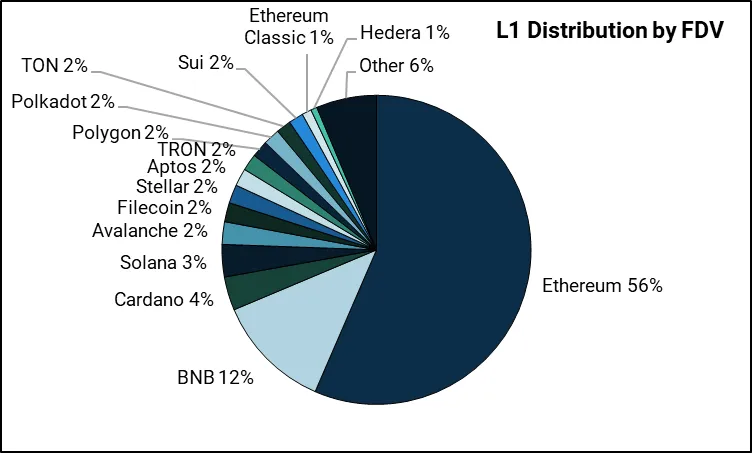

Although there have been hundreds of L1 competitors since the launch of Ethereum, Ethereum is still considered the de facto L1. Clearly, Ethereum is the leader in terms of market capitalization. Among the top 50 L1 blockchains, Ethereum’s market share exceeds 55%. But in what aspects does Ethereum still lead? And what drives Ethereum’s premium valuation?

Users – Cheaper and Faster L1 Wins

Users are generally considered the driving force behind valuation, as the value of a network is believed to grow super-linearly with the number of users (Metcalfe’s Law).

Due to the lack of anti-sybil systems and the relative ease of creating new addresses, it is difficult to measure the number of real active users in cryptocurrencies. Nevertheless, active addresses can provide a good initial approximation of user adoption for each blockchain.

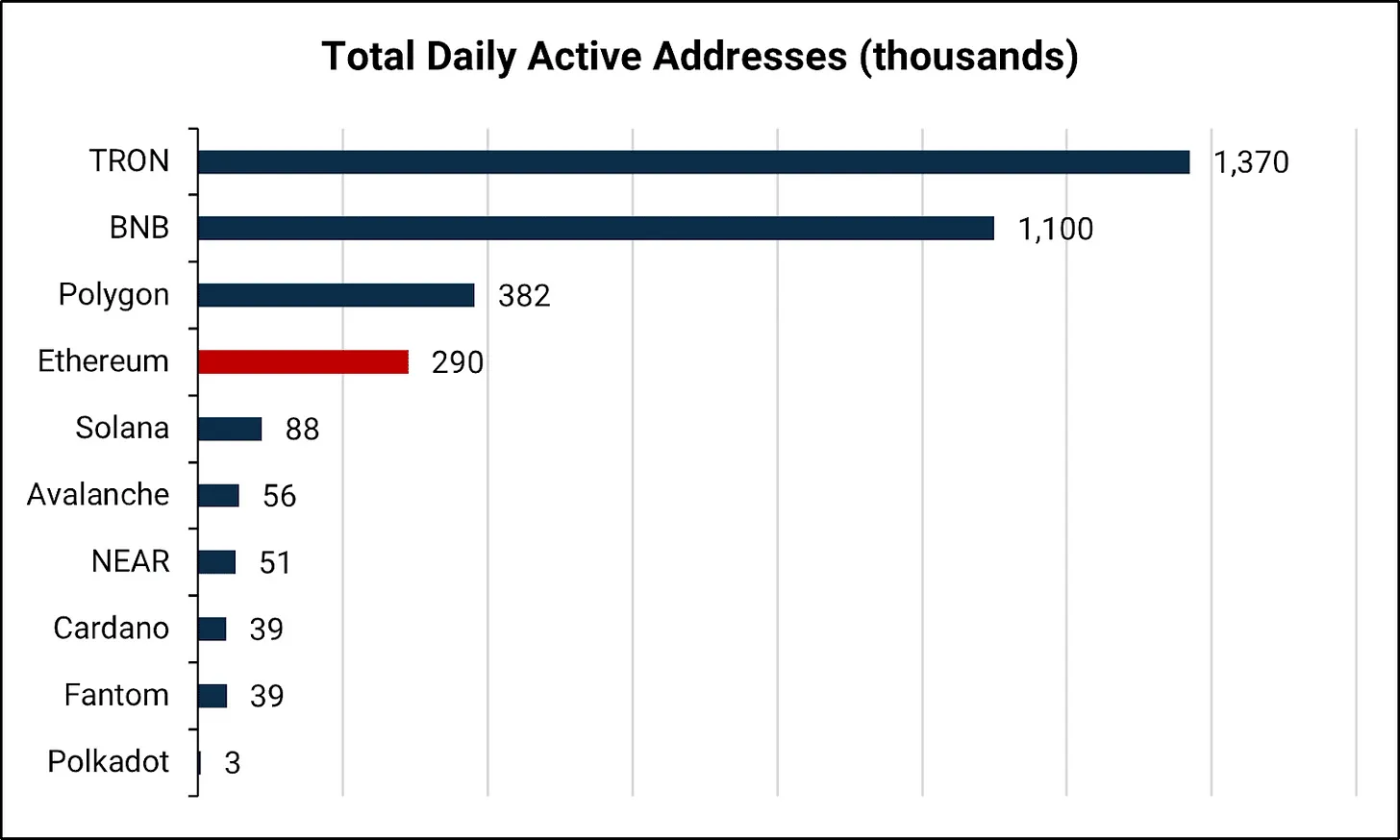

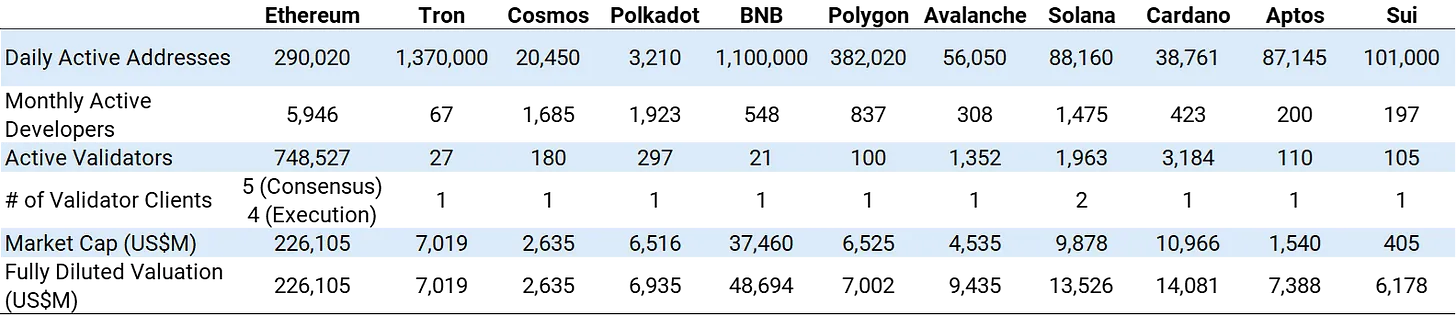

Clearly, Ethereum lags behind in terms of active users. Its valuation premium does not come from the number of users. Cheaper blockchains like Tron, Binance Coin (BNB), and Polygon have more users. And some networks, like Polkadot and Cardano, have relatively high valuations despite having few active users. Therefore, in terms of the headline question, multiple L1s have surpassed Ethereum in the number of users.

Developers

Developers are also another indicator of network health. Developers not only maintain and improve the protocol layer but also build use cases on L1. They can serve as leading indicators of future value creation.

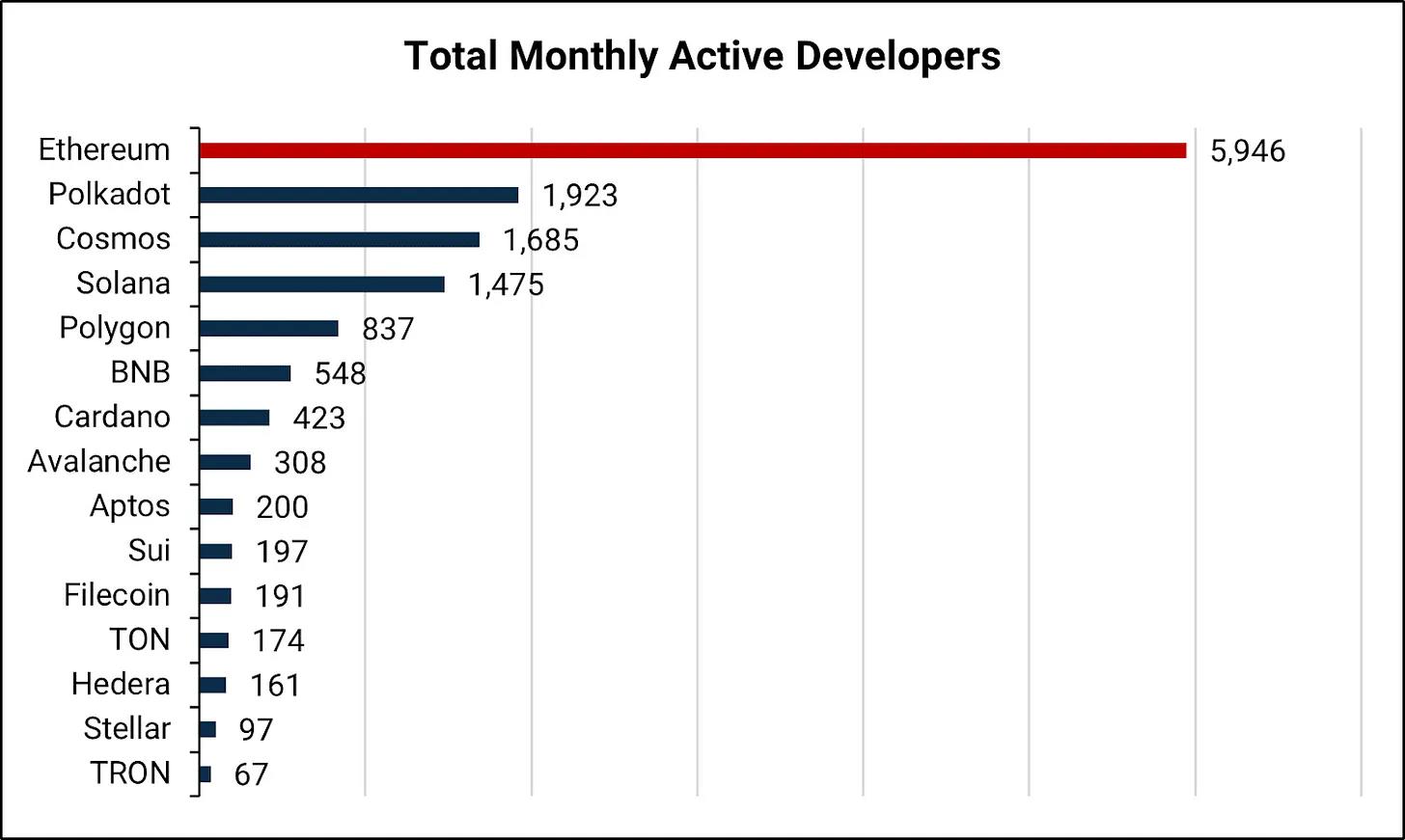

According to Electric Capital’s developer report, Ethereum stands out in terms of total active developer count.

The number of developers in Polkadot, Cosmos, and Solana is impressive as they have their own unique programming languages. Considering that Aptos and Sui were recently launched, their developer counts are also prominent.

Liquidity

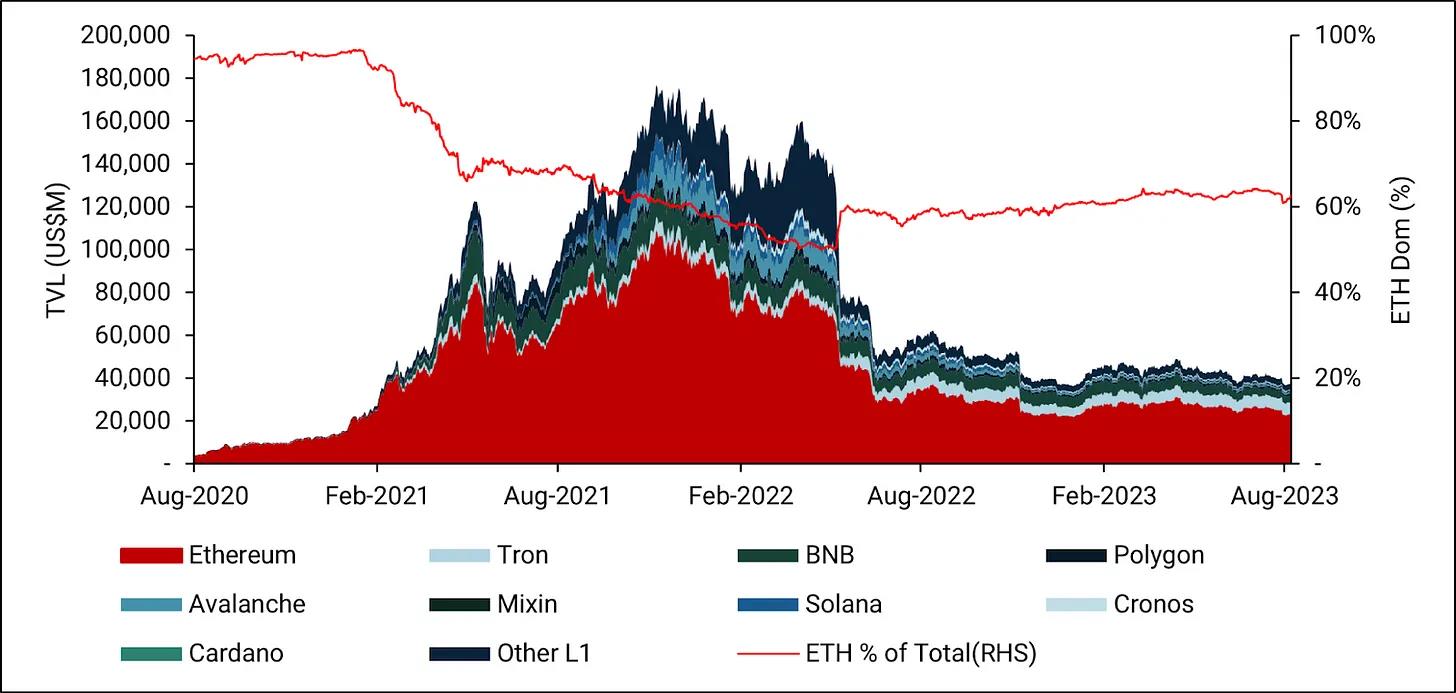

Ethereum’s liquidity on the network is clearly ahead of all other L1s, which can be measured by metrics such as Total Locked Value (TVL), decentralized exchange (DEX) trading volume, and the number of trading pairs. Since the summer of 2022, Ethereum’s TVL market share in other L1s has remained stable at around 60%, coinciding with the collapse of Terra.

Ethereum is leading, but not without exceptions

To limit the scope of this article, we only focus on some key indicators. There are many other factors to consider. However, Ethereum’s valuation leadership clearly does not come from user adoption. BNB and Tron win in these categories with a clear advantage. On the other hand, Ethereum is clearly leading in liquidity and capital flow. The market obviously gives a considerable premium to capital.

Factors for analyzing L1s

What drives the above indicators? Why do certain chains have more users? What drives capital flow between L1s? Why do some L1s remain strong after multiple bear markets while others are marginalized? Below, we provide some frameworks and models to help answer these questions.

Decentralization

We must first consider the fundamental attribute of blockchain: decentralization. Decentralization has multiple benefits. First, greater decentralization at scale improves resistance to censorship and helps the network withstand malicious attacks. It also increases the resilience and security of the network, giving users confidence to store and transact value on L1 networks. We believe that the higher the degree of decentralization, the higher the premium on L1s.

Decentralization itself is an abstract concept that is difficult to measure. It may be something you know when you see it. Nonetheless, we can use some factors to measure the degree of decentralization of a network:

- Number of nodes and node distribution. Nodes actively participate in the network, maintain the blockchain state, and validate and propagate transactions in the network based on their type. Therefore, more nodes generally contribute to the resilience and security of the network. If the nodes are geographically and organizationally more dispersed, it becomes difficult for a single participant to exert influence over the network. It is also important whether the nodes run on the same infrastructure (e.g., the same cloud provider) or operate independently with dedicated hardware.

- Token holder distribution. The risks of highly concentrated token holder distribution are evident. Under highly concentrated distribution, a few token holders can dictate the development of the entire network and prevent users from transacting on the network.

- Client diversity. Client diversity refers to the number of software clients that can be used to run nodes. Multiple clients enhance the network’s resilience to attacks and errors. If a network runs only on one client, client errors can threaten the entire blockchain.

- Nakamoto coefficient. The Nakamoto coefficient measures the number of entities or nodes required to achieve a majority (usually 51%) in the system. A higher coefficient indicates better decentralization, as it means more entities are needed to compromise or control the system. However, this is a single metric that may overlook many nuances. For example, Lido occupies a 32% share of all staked Ethereum. But Lido distributes the staking among 30 node operators and cannot control the operations of the operators on its staking (i.e., cannot enforce malicious collusion).

- Governance model. Off-chain governance involves decision-making beyond the blockchain through community coordination, while on-chain governance embeds governance directly into the protocol, allowing for token-based automated voting for changes. The impact on decentralization varies. Off-chain governance is not influenced by concentrated token holders but is prone to political centralization and potential high barriers to participation.

- Culture. Culture is an underestimated aspect of decentralization in blockchain. A culture with strong values can help resist the risks and threats of centralization that blockchain faces, such as Bitcoin’s cultural defense against application development or Ethereum’s unified push for improving client diversity.

Network Effects

The network effects in blockchain cover many aspects. One of the most obvious network effects is the interaction between users and developers, with many similarities to Web2 platforms. User growth attracts developers to join the network, which usually leads to the emergence of new applications, further creating use cases, and attracting more users to join the network, and so on.

Network effects also exist in other aspects. For example, programming languages like Solidity can generate meaningful network effects. As more developers learn Solidity, the Solidity programmer community expands, making it easier to find partners, hire developers, and receive community support for issues. There are also more developer resources such as software libraries, tools, and best practices that make it easier to create powerful smart contracts. It becomes easier to find competent security auditors. All of these improve the innovation cycle within the ecosystem by attracting more developers and accelerating the time to market for applications.

Capital network effects are also crucial since financial applications are a key use case of cryptocurrencies. Liquidity begets more liquidity. New financial primitives are most likely to be launched on networks with the largest market size and highest liquidity. These network effects are also supported by key stakeholders. For example, Coinbase supports deposits/withdrawals, Circle supports native USDC issuance, and Fireblocks supports custody, all of which contribute to improving capital flow.

Lindy Effect

Given the nascent nature of digital assets and the lack of historical data, many people often refer to the Lindy Effect as an appropriate mental model for measuring the success of L1. The longer a blockchain has been in existence and the longer it maintains relevance, the greater the probability that it will continue to remain relevant in the future. This model may apply. L1s that have gone through various challenges (such as technical issues, hacking attacks, market fluctuations, regulatory scrutiny, competition, etc.) and still have strong user attraction are more likely to succeed in future cycles.

This model suggests that more mature L1s that continue to maintain relevance have a better chance of eventually surpassing Ethereum.

Path Dependence

Path dependence is a concept that describes how the state of a system depends on its history. Once a system is set on a certain path, it tends to persist on that path, and deviating from it becomes increasingly difficult the longer the system stays on the trajectory.

Path dependence plays a significant role in understanding several L1s (Layer 1). For example, Ethereum’s early adoption of PoW before transitioning to PoS may have contributed to broad participation and token distribution in the early years. This kind of distribution is difficult to replicate for a new network. Another example is how, despite FTX’s negative impact on the Solana ecosystem in recent years, FTX’s early association may have helped propel Solana into the mainstream and become a top-tier new public chain ecosystem.

From this perspective, Ethereum’s leadership position is not due to technical superiority, but rather the result of its unique historical path, the momentum gained over the past decade, and the compound effects of its choices. Like many other analogies in technological history (such as the commonly cited QWERTY example), Ethereum may primarily maintain its dominant position by being a pioneer and its unique history.

Differentiation

L1 blockchains typically differentiate themselves from Ethereum and other L1 blockchains by offering superior architecture or catering to specific domains. This may involve superior scalability, reduced transaction costs, unique consensus mechanisms, enhanced privacy features, or specialized tools for specific industries. For example, Solana’s differentiation lies in its commitment to a monolithic blockchain architecture to maximize the benefits of composability and liquidity effects. Aptos and Sui offer a more secure and intuitive programming language called Move to reduce the likelihood of unintended code errors.

Monetary Policy

The monetary policy of a blockchain is particularly important for its success, especially for Layer 1 (L1) protocols. This policy dictates the issuance, distribution, and potential destruction of the blockchain’s native cryptocurrency, influencing its scarcity and value proposition. A clear, consistent, and transparent monetary policy can establish trust among participants, attract long-term investors, and stabilize the network’s economic environment. Additionally, it directly affects the incentives of validators or miners, ensuring the security and functionality of the blockchain. When properly balanced, monetary policy can facilitate sustained growth, adoption, and stability, enabling L1 blockchains to differentiate themselves in a competitive market and ensure their long-term viability.

Layer 2 (L2)

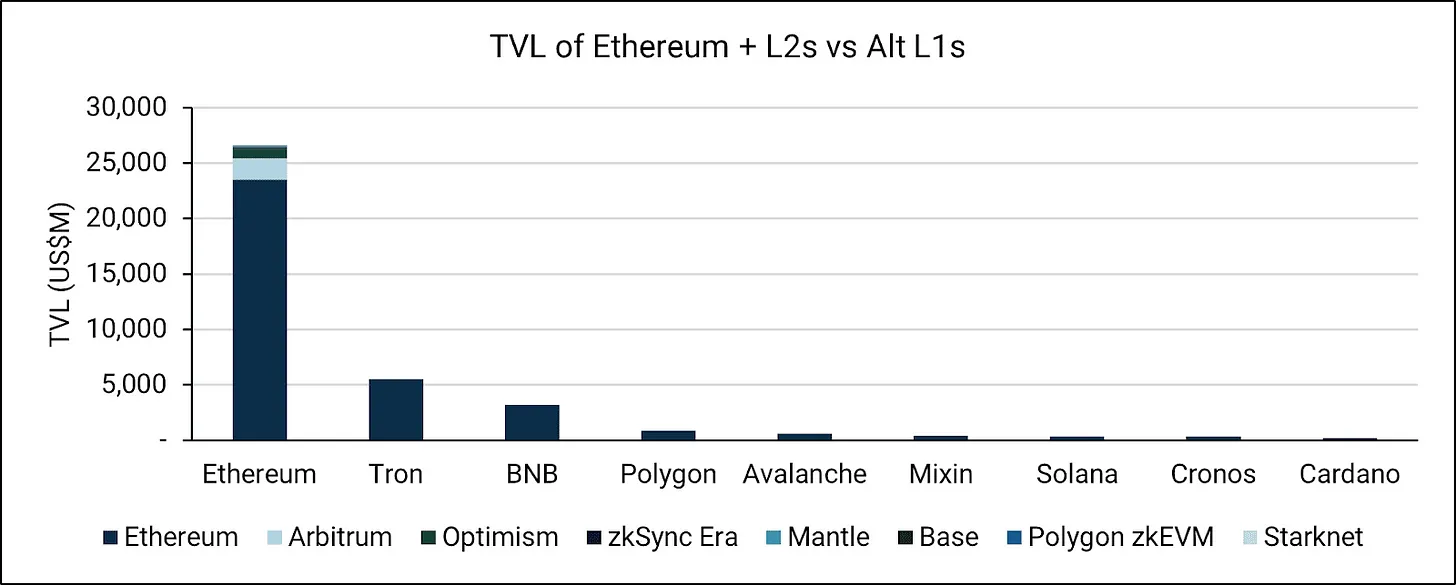

New public chain solutions are no longer the only viable scaling solutions. Roll-ups became Ethereum’s unofficial official scaling roadmap in October 2020. Since then, they have gradually gained market share from other new public chains. In fact, Arbitrum and Optimism – both Optimistic Roll-ups – have more active users and TVL than most top-tier L1s. Recently, Coinbase’s Optimistic Roll-up Base has also gained attention rapidly. In the coming years, ZK Roll-ups are also likely to follow suit.

In a broader context, Optimistic Roll-ups, ZK Roll-ups, and application-specific Roll-ups are all part of the Ethereum ecosystem. When these networks are incorporated into Ethereum itself, the barriers to “beyond Ethereum” become higher. From this perspective, Ethereum’s leadership position is not due to technical advantages, but rather its unique historical path, the momentum gained over the past decade, and the compound effects of its choices.

Conclusion

In the field of technology, especially in emerging areas like cryptocurrency, it is constantly evolving and full of uncertainty. This question also implies zero-sum thinking, that the success of one L1 implies the failure of another L1. As Warren Buffett aptly said, “Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future.”

If forced to give an answer, it seems that Ethereum will maintain its leadership position in the L1 space in the foreseeable future. It is leading in the most important indicators, especially in decentralization. As active participants in the cryptocurrency, we also see the most active innovation around cutting-edge technologies in the Ethereum ecosystem, such as scaling solutions, ZK technology and applications, privacy solutions, MEV mitigation/democratization, and more.

In the current landscape of new L1s, we believe Solana is the most promising candidate to surpass Ethereum. Its monolithic, high-throughput architecture offers meaningful architectural differences from Ethereum. It is the only L1 with multiple validator clients. The Solana community has experienced significant crashes in the past few years but remains very active and enthusiastic. In this ecosystem, we see unique innovations that have not been seen on other chains, such as xNFTs, state compression, compressed NFTs, Solana mobile stack, and more.

However, the cryptocurrency space is emerging and constantly evolving, and new disruptive technologies may emerge. In this dynamic environment, narrow predictions are meaningless. A more effective approach is to continue observing, remain adaptable, and be willing to change one’s views.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!