Today’s News Highlights:

Hong Kong legislators propose accelerating the launch of retail-level digital Hong Kong Dollars to encourage private institutions to issue compliant Hong Kong Dollar stablecoins

Tencent, Baidu, and 11 other AI big model products will be gradually launched starting today through generative artificial intelligence filing

Robinhood’s Web3 wallet now supports Bitcoin and Dogecoin networks

- Beyond Ethereum, how much have the ambitions of new public chains been realized?

- Data Reveals the Battle of New Public Chains Who Can Surpass Ethereum?

- Endless Scalability Exploring the Significance of Consensus Layer ZK-Rollups for Ethereum

Judge rules in the Uniswap class-action lawsuit that “Ethereum is a commodity, not a security”

Coinbase CEO shares his top ten innovations in the crypto industry, including Flatcoin, on-chain reputation, and RWA

Binance reminds users to convert BUSD to other stablecoins before February 2024

HashKey Capital launches its first secondary crypto market fund with less than 50% investment in Bitcoin and Ethereum

Data: Upbit surpasses Binance as the largest holder of CYBER, holding 33% of the token’s circulating supply

Regulatory News

US SEC Chairman Gary Gensler to testify before Congress twice in September

According to CryptoSlate, Fox Business News reporter Eleanor Terrett said on social media that US Securities and Exchange Commission (SEC) Chairman Gary Gensler is scheduled to testify before Congress twice in September. The first is on September 12 at the Senate Banking Committee, followed by September 27 at the House Financial Services Committee.

Prior to these scheduled hearings, US lawmakers, especially Republicans, have criticized and accused Gensler. Ranking Member of the House Financial Services Committee, Patrick McHenry, criticized Gensler’s approach to regulating digital assets as too aggressive, particularly considering the lack of clear cryptocurrency guidance that specifies which digital assets fall under the SEC’s jurisdiction. McHenry and others express concerns about the nature of the SEC’s regulatory approach, believing that the SEC prioritizes enforcement over clear guidance.

Hong Kong legislators propose accelerating the launch of retail-level digital Hong Kong Dollars to encourage private institutions to issue compliant Hong Kong Dollar stablecoins

Hong Kong Legislative Council member (Technology and Innovation sector) Charles Mok has submitted a policy initiative on economic and technological development called “Three Arrows, Three Circles” in response to the “Policy Address for 2023.” The “Three Arrows” include establishing a venture capital fund to activate private investment in the technology and innovation industry, investing in promising growth-stage technology companies, and improving the ability of small and medium-sized listed companies to raise funds again. The “Three Circles” include issuing tokens to support the development of the Nantian Science and Technology City, expeditiously launching digital Hong Kong Dollars as a pilot application using government funds, and issuing Hong Kong Dollar stablecoins to promote the development of Hong Kong’s virtual asset industry.

The proposal suggests accelerating the introduction of retail-level digital Hong Kong dollars, launching a “Hong Kong dollar stablecoin” sandbox, and providing policy incentives to encourage private institutions to issue compliant Hong Kong dollar stablecoins, among other suggestions. It hopes to leverage market forces to drive accelerated economic recovery in Hong Kong and create more new momentum through comprehensive promotion of digital economy and Web3 development.

He also proposed the formulation of a comprehensive digital infrastructure development plan, the establishment of sound Web3 regulatory system, and the formulation of data industry development strategies and plans. In terms of alleviating the shortage of technology talents, he suggested that the government launch a “digital work visa” (DigiLianGuaiss) specifically for technology companies, allowing tech professionals in the Greater Bay Area who hold this type of visa to freely travel between Hong Kong and mainland cities in the Greater Bay Area.

In addition, regarding the proposal to issue tokens to support the development of Xin Tian Science and Technology City, Qiu Dagen explained that about 23% of the total land area in the first phase of Xin Tian Science and Technology City is “ancestral land,” and the ownership of these lands is owned by the entire clan. Under the mechanism of Asset-Backed Tokens (ABT), the land can be divided in token form, which will help solve the difficulties of reclaiming “ancestral land.” ABT also gives token holders the voting rights on relevant land decisions and allows token holders to retain rights similar to those enjoyed by past “ancestral” members.

NFT

LianGuairaSLianGuaice and LianGuairallel Finance to merge into Web3 super app LianGuairaX

NFT lending protocol LianGuairaSLianGuaice announced on the X platform that LianGuairaSLianGuaice and lending protocol LianGuairallel Finance will merge and rebrand to create a more comprehensive blockchain platform, LianGuairaX, which will be a Web3 super app supported by account abstraction and zkVM. It is reported that the LianGuairaX ecosystem is built on top of the existing LianGuairaSLianGuaice and LianGuairallel products, covering account abstraction, meta user interface, zkVM, etc. The two teams are currently exploring three new ideas for building mini applications in the LianGuairaX ecosystem: a full-chain yield optimizer, full-chain lending, and multi-underwriting mode lending, for which they are building a zkVM infrastructure called “LianGuairaVM.”

LianGuairaSLianGuaice stated that after the deployment of LianGuairaX, all functions of LianGuairaSLianGuaice on the Ethereum mainnet will be gradually phased out by September 30, 2023. Polygon, zkSync, Arbitrum, and Moonbeam products will continue to operate normally and will be gradually deployed on these networks in the next 1-2 months. Migration requires transactions and gas fees, and according to calculations, the estimated migration cost for regular users when the gas price is below 20 Gwei is about $50-200. LianGuairaX will also launch “LianGuairaX Medal” NFT, limited to the first 2000 users who migrate to LianGuairaX within a limited time. More details will be announced soon, and for eligible users, the NFT will be airdropped directly to their LianGuairaX accounts.

LianGuairallel Finance stated that parallelization in LianGuairaX will be simplified; users do not need to migrate any assets on Polkadot temporarily. The LianGuairallel wallet and extension will be renamed to LianGuairaX wallet. When LianGuairallel Finance transitions to the new LianGuairaX platform, there will be airdrops for LianGuaiRA and HKO holders, the quantity of which will be determined based on the number of LianGuaiRA and HKO tokens held and future on-chain activities, more details will be released later.

Artificial Intelligence

Tencent, Baidu, and other 11 AI big model products will gradually go live through generative AI filing, starting today

According to Cailian News, it was learned from multiple independent sources that 11 big models in China will gradually be filed under the “Interim Measures for the Administration of Generative Artificial Intelligence Services”. The first batch will be opened to the public starting from August 31. Among them, 5 in Beijing, 3 in Shanghai, 2 in Guangdong Province, and 1 in other provinces and cities will be opened successively.

It is reported that the approved companies in Guangdong are Huawei, Tencent, and other products from iFlyTek in other regions. The 5 big model products in Beijing are Baidu’s Wenxin Yiyi, Douyin’s Yunque, Baichuan Intelligent’s Baichuan big model, Zhipu Huazhang under Tsinghua AI, and Zidong Taichu under the Chinese Academy of Sciences. The 3 big model products in Shanghai are Sensetime’s “SenseChat”, MiniMax’s ABAB big model, and Shusheng’s general big model in the Shanghai Artificial Intelligence Laboratory.

Project Updates

Robinhood’s Web3 wallet now supports Bitcoin and Dogecoin networks

According to Blockworks, users of Robinhood’s self-custody Web3 wallet can now host, send, and receive cryptocurrencies on the Bitcoin and Dogecoin networks. Prior to launching support for the Bitcoin and Dogecoin networks on Wednesday, it also added support for Arbitrum and Optimism.

In addition, Robinhood has enabled in-app trading on the Ethereum network. Starting from Wednesday, selected users can use over 200 tokens. The platform said it will make these services available to everyone in the coming weeks. Previously, Robinhood wallet users could only trade cryptocurrencies on the Polygon network through the decentralized exchange aggregator 0x API. The company said Robinhood wallet users can exchange without holding Ether (ETH) as the network fees will be automatically deducted from the tokens they already hold.

Coinbase to add support for PYUSD

Coinbase announced that it will add support for LianGuaiyLianGuail USD (PYUSD) on the Ethereum network (ERC-20 tokens). If liquidity conditions are met, trading will begin on September 1, 2023, at 12:00 AM Beijing time or later.

Native USDC is about to launch on the Optimism mainnet

According to official news, Native USDC is about to launch on the Optimism mainnet. To distinguish it from Native USDC, the Ethereum bridged USDC will be renamed to USDC.e. The OP mainnet cross-chain bridge will not change immediately and will continue to operate normally. According to previous reports, Circle will launch Native USDC on the Base mainnet next week.

Gemini opposes Genesis’ proposed bankruptcy plan, calling it “lacking in detail.”

According to CoinDesk, Gemini, along with two other creditor groups, has opposed the bankruptcy settlement agreement proposed by Genesis. Gemini’s lawyer stated in a new filing submitted on Wednesday that Genesis’ proposed bankruptcy plan does not provide enough details and does not provide any guarantees for some of the largest debtors. The other two special creditor groups also opposed the plan for similar reasons. Gemini stated in the filing, “On August 29, 2023, the debtor disclosed a ‘principle agreement’ between the debtor, the committee, and DCG, but the details of this agreement are scarce. The debtor has repeatedly promised to soon develop a plan to resolve DCG’s claims and has repeatedly sought extensions for the mediation period, hearing dates, and bid deadlines. DCG has not paid any of the approximately $630 million due in May 2023, exacerbating the harm to Gemini.” According to previous reports, DCG has reached a preliminary agreement with Genesis creditors, and unsecured creditors are expected to recover 70%-90% of the equivalent assets in USD.

Curve Finance has integrated with Base and currently offers three liquidity pools.

According to official sources, Curve Finance announced the integration with Base and currently offers three liquidity pools: 3c: USDbC / axlUSDC / crvUSD, cbeth: ETH / cbETH, and tricrypto: crvUSD / tBTC / ETH. The router (trading interface) will be launched soon, but users can also trade in the pools. In addition, Base is adding bridging support for CRV and crvUSD.

A judge in the Uniswap class-action lawsuit ruled that “Ethereum is a commodity, not a security.”

Bill Hughes, a lawyer from ConsenSys, tweeted that a judge in the Southern District of New York ruled on August 29th that Ethereum is a commodity, not a security, in the collective lawsuit against Uniswap. Additionally, the judge implied that Wrapped BTC is a commodity but did not explicitly state this. According to previous reports, a judge in the Southern District of New York dismissed a collective lawsuit against Uniswap, LianGuairadigm, and others. The plaintiffs had attempted to hold the defendants responsible for selling “fraudulent tokens” on the Uniswap AMM.

The founder of Uniswap welcomes the ruling on the collective lawsuit regarding “fraudulent tokens” appearing on Uniswap.

Thailand plans to distribute digital assets worth approximately $290 per person to all citizens aged 16 and above to promote the national economy.

According to Blockworks, the Pheu Thai Party in Thailand will use “utility tokens” in its upcoming digital wallet program to stimulate the national economy. This program was promised by the party during the election period and will provide 10,000 Thai baht ($290) in digital assets to all Thai citizens aged 16 and above. These tokens must be used within six months at local businesses within a 4-kilometer radius of the registered address and cannot be exchanged for cash or used to pay off debts. Although based on blockchain technology, it is not yet clear whether it will operate in a permissioned or permissionless ecosystem. It is expected that the government will also issue these tokens specifically for consumer transactions, and these tokens will not be eligible for trading on digital asset exchanges.

It is estimated that taxpayers will spend about 560 billion Thai baht (15.4 billion US dollars). The funds are expected to come from tax revenues in the fiscal year 2024, as well as tax increases from economic expansion and borrowing. Thailand’s plan is expected to launch before the Songkran Festival in April 2024, but the specific timing is still uncertain due to the complexity of the plan.

The Cosmos community is voting on the “v12 upgrade” proposal, which plans to enable the liquidity staking module.

According to the official governance page, the Cosmos community is voting on the “v12 software upgrade” proposal. The Gaia v12 upgrade is a major version that includes the liquidity staking module and updates to other core dependencies. This vote will end on September 8th.

Previously, the Cosmos Hub stated that enabling the liquidity staking module would provide immediate liquidity staking without waiting for the unbonding period. Users will be able to directly stake their already staked Atoms for liquidity. To mitigate liquidity staking risks, LSM introduces governance control parameters. The total amount of ATOMs available for liquidity staking will have an initial upper limit. The limit will be set at 25% of all staked ATOMs and can be changed through governance. As an additional security feature, validators seeking delegation from a liquidity staking provider will need to self-bond a certain amount of ATOMs.

Balancer: Mitigation measures have been formulated for vulnerabilities but affected pools cannot be paused, and the exact loss figures cannot be disclosed at this time.

DeFi liquidity protocol Balancer has released an update on X platform regarding vulnerability risks, stating that mitigation measures have been formulated to reduce risks, but affected liquidity pools cannot be paused. Users are urged to immediately withdraw from affected LPs using the user interface (UI). Due to the vigilance and quick action of Balancer LPs, the majority of initially considered vulnerable liquidity has been withdrawn. However, on August 27th, 5 days after the vulnerability disclosure, malicious actors managed to exploit pool vulnerabilities in the affected pools of Balancer and Beethoven X protocols. The Balancer and Beethoven X communities are taking known measures to thoroughly investigate the situation and actively collaborate with relevant partners, legal teams, and security experts to resolve the issue. User safety remains the highest priority, and if the UI does not prompt to withdraw from a liquidity pool or allow users to enter the pool, the pool is considered safe and without risk.

Balancer states, “We are still gathering information about recent vulnerabilities, so we are unable to disclose exact figures related to the losses at this time. During this period, we will remain vigilant and provide the community with the latest updates as the situation develops. We are still gathering information about recent vulnerabilities, so it is currently not possible to disclose exact figures related to the losses. Due to ongoing investigations into the vulnerabilities and those involved, communication with the community will remain limited until a comprehensive investigation is complete and post-analysis is released.”

Previously, on August 28th, it was reported that Paradigm stated that Balancer losses have exceeded $2.1 million, and multiple on-chain liquidity pools have been affected.

StarkWare has restored user access to funds who have not updated to Starknet version 0.12.1

StarkWare’s parent company, StarkWare, announced on the X platform that there was a major version update on Starknet last week, namely 0.12.1. A few months ago, in preparation for this update, Starknet users were required to make necessary upgrades to their accounts. When 0.12.1 went live, accounts that were not upgraded temporarily lost access, and access to all these accounts (totaling $550,000) has now been restored. Starting today, the upgrade has been re-enabled, allowing users to immediately regain access to their accounts. Due to technical reasons, users of Argent and Braavos may have to wait until tomorrow to regain access.

In addition, according to CoinDesk, there were user complaints on the X platform before StarkWare announced this new measure, stating that their account balances were cleared due to incompatibility between their wallets and the new 0.12.1 upgrade of Starknet. StarkWare had previously warned users that an upgrade was necessary to ensure the availability of funds. StarkWare appears to have changed its policy under the pressure of user complaints.

Bloomberg analyst: The possibility of a Bitcoin spot ETF being approved this week is extremely low, but the possibility of approval within this year is higher

Bloomberg ETF analyst James Seyffart tweeted, “We expect a large number of delayed orders for this week. We believe the likelihood of approval (for a Bitcoin spot ETF) shortly after the court ruling is extremely low.” He also believes that a Bitcoin spot ETF will be launched by the end of 2024, which is almost certain.

Bloomberg analyst Eric Balchunas tweeted earlier today, “Analyst James Seyffart and I have increased the probability of launching a Bitcoin spot ETF this year to 75% (the probability by the end of 2024 has increased to 95%).”

Coinbase CEO shares his top 10 innovations in the crypto industry, including Flatcoin, on-chain reputation, and RWA

Coinbase CEO Brian Armstrong shared his current top 10 ideas for the crypto industry on the X platform, which are: 1. Flatcoin (a stablecoin designed to overcome inflation and pegged to the cost of living); 2. On-chain reputation (suggests tracking entity reputation on the blockchain to combat fraud); 3. On-chain advertising (enables charging advertisers only when specific actions are completed); 4. On-chain capital deployment (tracks the net accumulation of capital goods such as equipment, tools, transportation assets, and energy, providing fundraising opportunities); 5. Decentralized labor market (uses cryptocurrencies for cross-border salary payments); 6. Layer 2 privacy (introduces privacy to L2 transactions on projects like Arbitrum, Optimism, and Polygon); 7. Fully on-chain P2P exchange (built on auditable smart contracts and serves as an anti-censorship solution); 8. Web3 gaming economy (allows users to truly own in-game NFT assets); 9. Tokenization of real-world assets (improves market liquidity through standardized metadata encoding); 10. Network state tools (allows network states to function like DAOs).

Binance releases important updates on BETH and WBETH: expanding WBETH use cases and reducing support for BETH.

Binance has released important updates on BETH and WBETH. BETH will continue to be used for ETH staking rewards, while WBETH can be used for trading, as collateral for Binance’s lending platform, and for participating in DeFi projects outside of Binance. Binance will continue to support BETH, and users can still deposit BETH on the platform. Users who hold BETH in their spot wallets will continue to receive ETH staking rewards daily. Users can redeem BETH for ETH at any time, wrap BETH into WBETH, or unwrap WBETH into BETH tokens. WBETH holders will receive the same ETH staking rewards as BETH holders.

Regarding spot trading, Binance will delist and cease trading for the following BETH trading pairs on October 11th at 16:00: BETH/ETH, BETH/USDT, and BETH/BUSD.

Regarding Binance Earn: Starting from October 10th at 16:00, BETH subscriptions will no longer be available, and existing subscription assets will be automatically redeemed to users’ spot wallets. Users can choose to redeem these assets in advance.

Regarding Binance Savings: Starting from September 8th at 10:00, Binance Savings will no longer support single and portfolio purchase plans for BETH. Binance reminds users to adjust their plans and convert them from BETH to WBETH.

Regarding Binance Loans: Starting from September 7th at 16:00, new Binance Loans or VIP Loans applications will no longer support BETH as collateral. However, BETH can still be used as collateral for existing loan orders.

Regarding liquidity mining: Starting from September 8th at 16:00, the annual interest rate for the WBETH liquidity pool will gradually increase, while the annual interest rate for the BETH liquidity pool will decrease. From October 2nd at 12:00, users will no longer be able to add liquidity to the ETH/BETH or BETH/USDT liquidity pools. The ETH/BETH and BETH/USDT liquidity pools will be removed after October 6th at 12:00. Users holding positions in these liquidity pools will automatically receive their deposited assets in their spot wallets after October 6th at 12:00.

In addition, starting from August 31st at 17:00, BETH tokens in Binance wallet addresses starting with 0xF977 and 0xF68a will be gradually burned. This will not affect users’ existing BETH or ETH staking positions on the Binance platform, as well as BETH tokens held in self-hosted wallets.

ZA Bank becomes the first settlement bank for HashKey Exchange, providing fiat deposit and withdrawal services to users

According to official sources, ZA Bank, a licensed virtual asset retail exchange in Hong Kong, has announced that it has become the first settlement bank for HashKey Exchange. ZA Bank account holders can now transfer Hong Kong dollars and US dollars to HashKey Exchange via the ZA Bank app and conduct transactions on the platform. They can also withdraw Hong Kong dollars and US dollars from HashKey Exchange to their personal ZA Bank bank accounts.

Currently, ZA Bank does not provide virtual asset retail trading services. The bank holds a Type 1 regulated activity (securities trading) license issued by the Securities and Futures Commission and provides fund investment services to users.

Earlier today, HashKey announced its support for Hong Kong dollars: Hong Kong dollar trading pairs will be launched in the next few weeks.

Musk: X is about to launch video and audio calling features

Musk posted: “Video and audio calling is coming to X. This feature is available on iOS, Android, Mac, and PC; no phone number is required; X is an effective global address book.”

Binance reminds users to convert BUSD to other stablecoins before February 2024

Binance announced that it will gradually stop supporting BUSD due to LianGuaixos ceasing the issuance of new BUSD tokens. Binance platform will continue to support multiple stablecoins and other digital assets. The platform reminds users to convert their BUSD assets to other assets supported by the Binance platform before February 2024.

Binance emphasizes that the assets of users are safe, and BUSD will always be anchored to the US dollar at a 1:1 ratio.

Unibot launches stablecoin swaps feature

Unibot announced the launch of the stablecoin swaps feature. Users only need to use the standard buy and sell options in the main menu. Enter the appropriate USDC or USDT contract address as needed.

Offchain Labs launches Arbitrum Stylus to support smart contract development in multiple languages

Offchain Labs, the development team behind Arbitrum, announced the launch of a new technology implementation called Arbitrum Stylus, which supports smart contract development in various programming languages on Arbitrum, including Rust, C, C++, and Solidity. The EVM and WASM virtual machines are fully interoperable. Stylus and Solidity contracts are composable. The code and testnet of Arbitrum Stylus are now open, and Offchain Labs has submitted it to the Arbitrum community for voting to expand the scope of Ethereum-compatible smart contract development.

LianGuaincakeSwap expands to the Base network

According to The Block, decentralized exchange platform LianGuaincakeSwap has expanded to the Base network. LianGuaincakeSwap was initially built on the BNB Chain and now supports Linea supported by Ethereum, Aptos, Polygon zkEVM, zkSync Era, Arbitrum One, and Consensys.

HashKey Capital launches its first secondary market fund, with less than 50% of investments in Bitcoin and Ethereum

According to Reuters, HashKey Capital announced the launch of its first secondary market fund, which will invest most of its assets in secondary cryptocurrencies with the goal of outperforming Bitcoin. The fund will allocate less than 50% of the investment to Bitcoin and Ethereum, the two largest cryptocurrencies, and will also diversify its portfolio by investing in some “altcoins.” Part of the fund’s holdings will also be in cash. The fund has already attracted potential clients, mainly high-net-worth individuals and investment firms serving affluent Asian families, and HashKey Capital is also developing distribution channels with some offshore Chinese financial institutions.

HashKey Capital manages over $1 billion in assets and previously stated that its goal is to raise $100 million for this fund within 12 months.

Important Data

Data: A dormant whale transferred 12,087 ETH to Binance last night, equivalent to $20.61 million.

According to on-chain analyst Yu Jin, a dormant whale transferred 12,087 ETH (equivalent to $20.61 million) to Binance 11 hours ago in two transactions.

This address had previously withdrawn 52,000 ETH from Kraken in December 2018 to January 2019 at an average price of $110 (approximately $5.73 million at the time); through this transfer, all 52,000 ETH from this address have been transferred to CEX.

Huang Licheng bought approximately 487,000 APE tokens in the past 3 days, accumulating a total of 3.53 million APE tokens in August.

According to Lookonchain, Taiwanese singer Huang Licheng’s address (Machi Big Brother) spent 423 ETH to purchase 487,519 APE tokens in the past 3 days and has accumulated a total of 3.53 million APE tokens in August (equivalent to $5.20 million).

In addition, another whale withdrew 650,000 APE tokens from Binance an hour ago, equivalent to $956,000.

Data: Upbit surpasses Binance to become the largest holder of CYBER, holding 33% of the token’s circulating supply.

Scopescan stated on X platform that Korean investors have driven the recent price increase of CYBER. Since the launch of CYBER on the Korean cryptocurrency exchange Upbit on August 22, Upbit’s wallet address has held approximately 3.6 million CYBER tokens, worth about $32.43 million. Upbit has now surpassed Binance to become the largest holder of CYBER, accounting for 33% of the token’s circulating supply.

Santiment: Nearly 30,000 BTC transferred to CEX before Grayscale’s victory.

According to data from Santiment reported by CoinDesk, nearly 30,000 BTC (worth about $822 million) were transferred to addresses related to centralized trading platforms before Grayscale’s crucial ruling with the SEC. This ruling caused a 6% surge in the price of Bitcoin, pushing it to $28,000.

Santiment stated, “The supply on Bitcoin’s trading platforms increased significantly before Grayscale’s victory. It can be clearly seen that the relevant authorities knew that this result would inevitably boost the market value of the cryptocurrency market.”

Prior to this news, wallets holding 10,000 to 100,000 BTC accumulated approximately $388 million worth of BTC the day before Grayscale’s victory.

The LianGuaiNews APP Points Mall is officially launched.

Hardcore prizes are available for free redemption: imKeyPro hardware wallet, First Class Cabin research report monthly card, Ballet REAL series wallet, AICoin membership, various peripherals, and hundreds of selected research report collections. First come, first served, experience now!

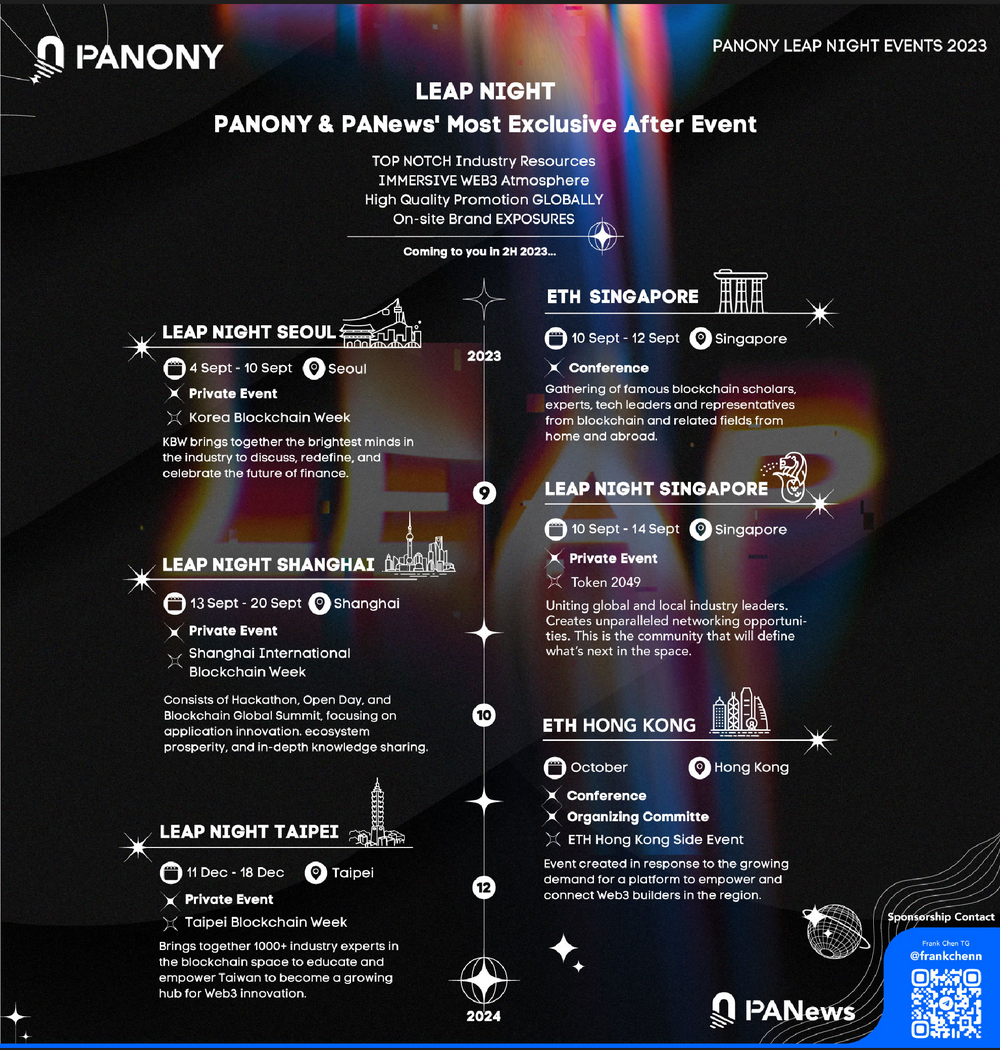

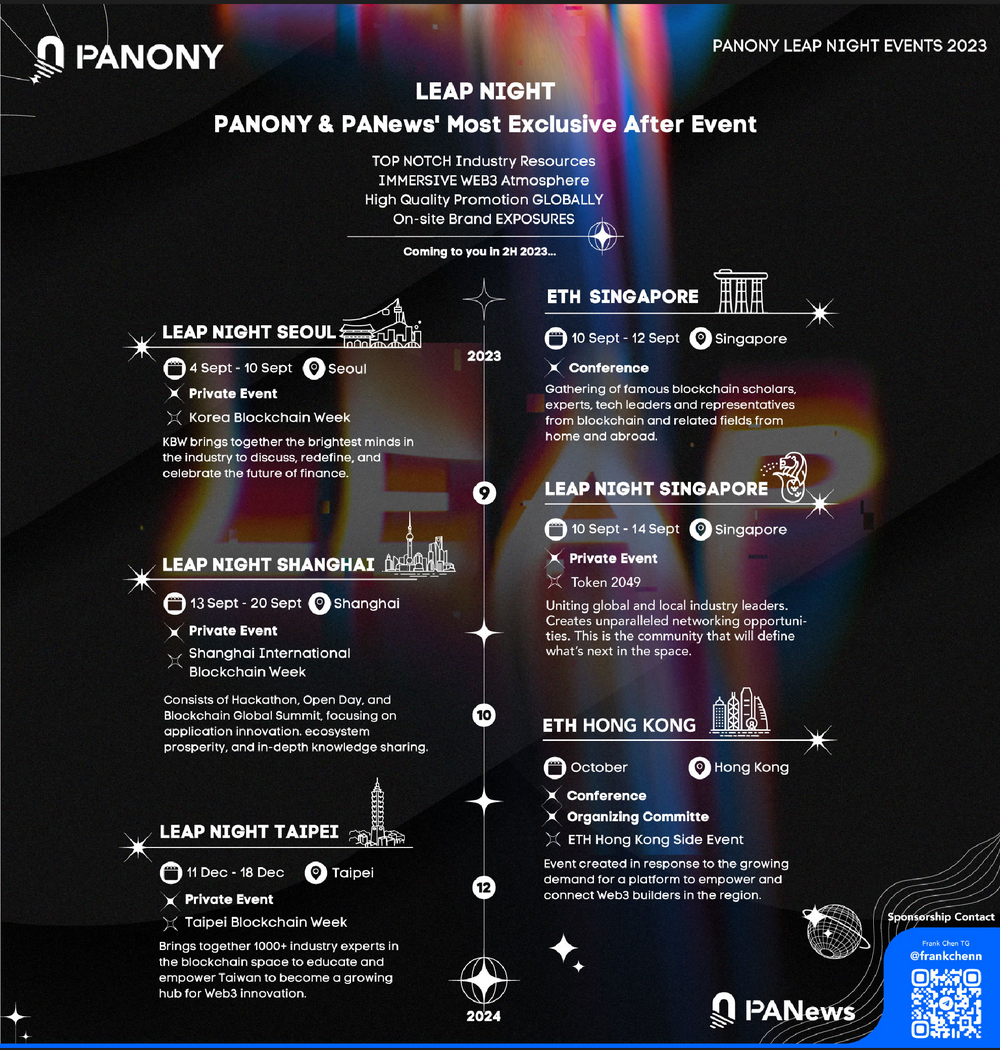

LianGuaiNews launches the global LEAP tour!

Korea, Singapore, Shanghai, Taipei, September to December, multiple locations gather to witness a new chapter of globalization!

📥Multiple activities are being jointly developed in various locations. Welcome to communicate!

Translated:

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!