Produced by | European Cloud Chain Research Institute

Author | Hedy Bi

The Grayscale Fund, which won a lawsuit against the U.S. Securities and Exchange Commission in August, cleverly used interest rate differentials to attract a large amount of institutional funds into the U.S. BTC market, and has become a “magic needle” in the BTC market in just a few years. In early October, Grayscale pointed out in its monthly market report that Bitcoin performed strongly compared to traditional assets in September, highlighting the diversification characteristics of cryptocurrencies. The author also observed that the correlation between BTC and the S&P 500 has dropped to levels before 2020 and no longer has a significant statistical relationship. In addition, top high-frequency quantitative funds such as Jump have reduced their operations in the market, and BTC seems to have entered a “vacuum” state. (Related reading: “Grayscale September Market Report: Under the turmoil of the global market, BTC demonstrates the dual characteristics of “value storage” and “crisis haven”)

In addition, the report also emphasizes that with the improvement of Bitcoin’s on-chain indicators this month, strong fundamentals have played a key role. On-chain data has become an indispensable indicator for many industry giants. With the increasing attention to on-chain data, more and more companies and investors are using it as an important reference for decision-making and investment. In this article, we will explore BTC in depth based on OKLink’s on-chain data provided by European Cloud Chain.

- New Organizational Paradigm An In-depth Analysis of All Aspects of DAO

- Galaxy Research On-chain RWA Report US Treasury Bonds Drive Yield Growth, a Few Native Crypto Users Lead the Track Demand

- LianGuai Morning News | Report Bitcoin will continue to maintain volatility in October

01. BTC with market elasticity, on-chain data is not so optimistic

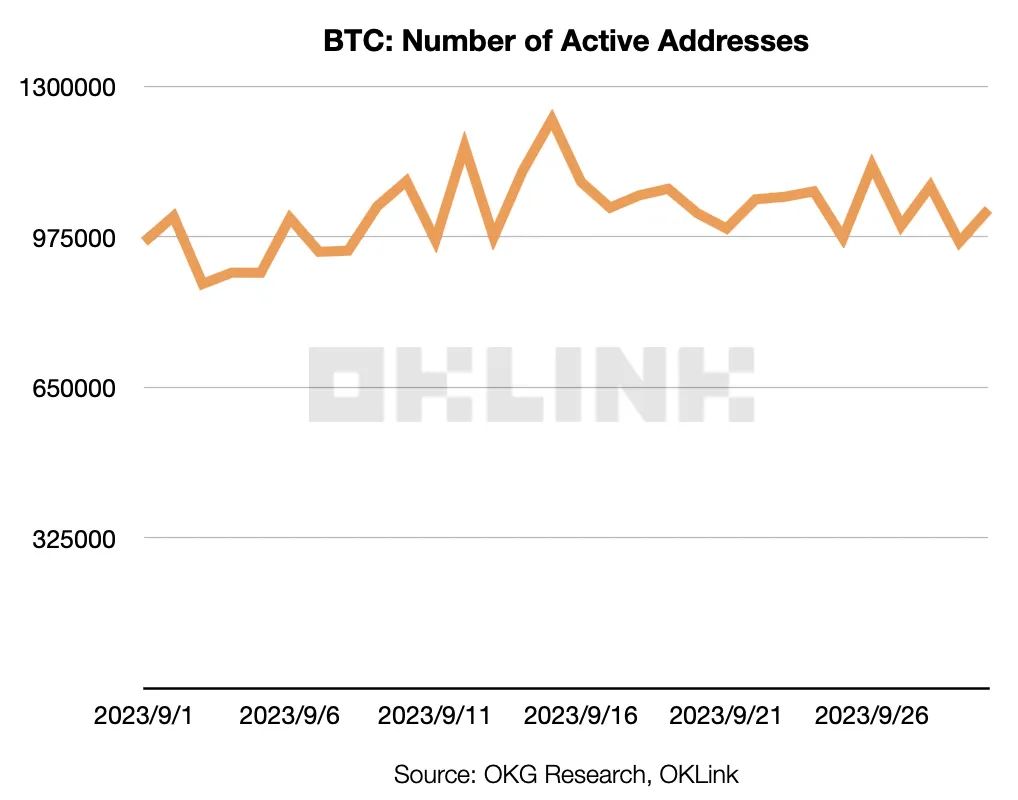

- Overview of address changes: The number of new addresses has a slight advantage of 0.02% over the monthly average of Q3, and the number of active addresses increased by 7.24% in September.

From January 1, 2023, to October 8, the number of BTC on-chain addresses increased from 1,070,107,188 to 1,199,213,543, achieving a growth rate of 12.06%. This indicates that Bitcoin network has attracted more users and participants this year, showing a continuous growth trend.

In the data for the third quarter (Q3) of 2023, the growth rate of new Bitcoin addresses in September was 1.34%, only slightly higher than the monthly average growth rate of Q3 by 0.02%.

Source: OKG Research, OKLink

Regarding active addresses, as mentioned by Grayscale, it increased by 69,783 in September, with a growth rate of 7.23%. However, in October, from September 30 to the present (October 8), the number of active addresses decreased by 160,275, with a decrease of 15.50%.

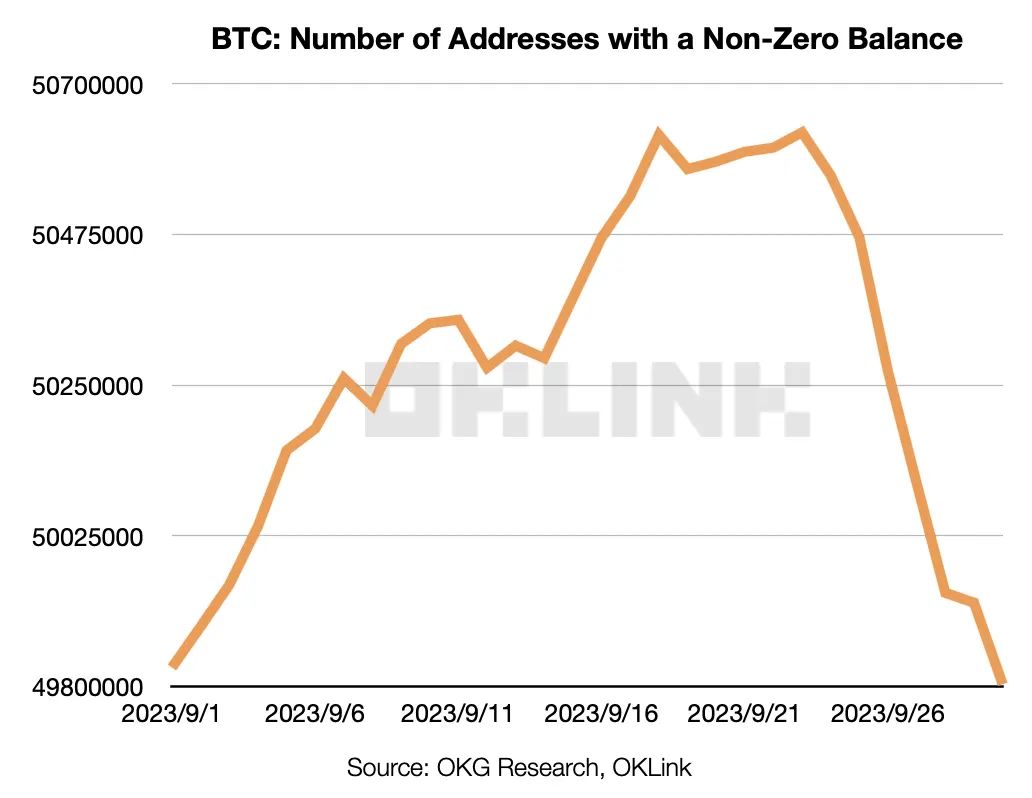

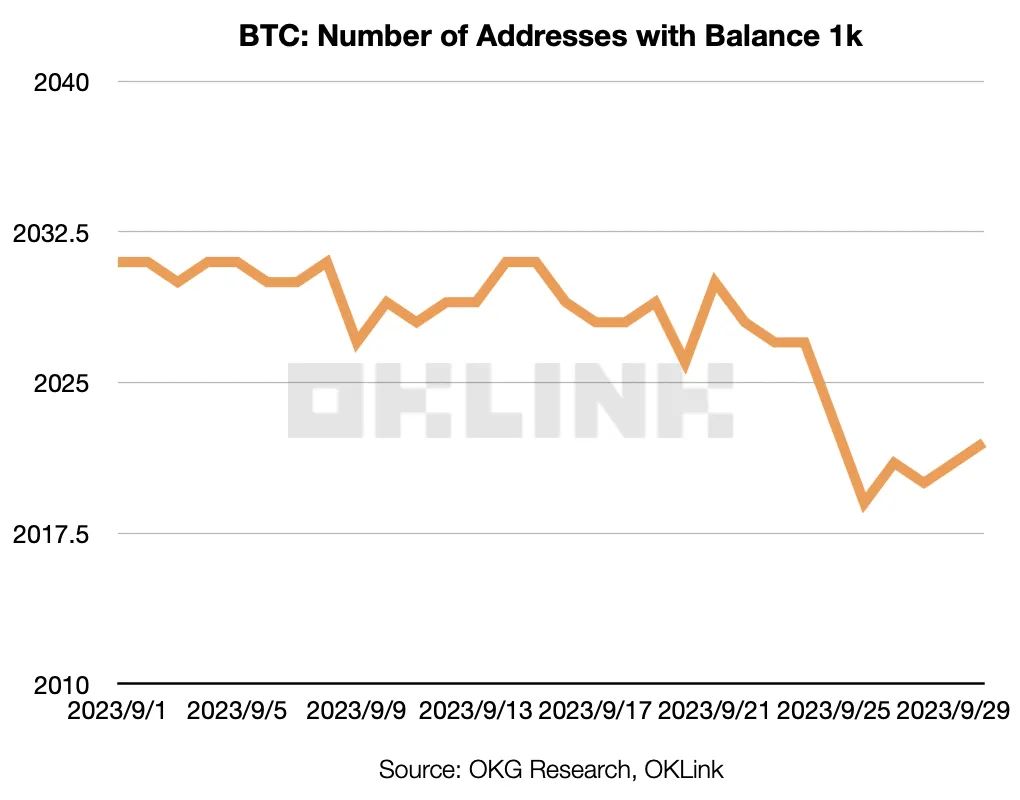

- After excluding zero assets, the number of addresses and whale addresses showed a downward trend in September.

After excluding zero assets, the number of Bitcoin addresses and whale addresses showed a downward trend in September. According to the data statistics from OKLink provided by European Cloud Chain, after excluding zero asset addresses, the number of Bitcoin addresses in September decreased by 24,817 compared to August, which performed poorly compared to the increase of 456,217 new addresses in August.

Meanwhile, in terms of whale addresses, there was a decrease of 9 addresses in September, compared to an increase of 10 addresses in August. This means that the number of Bitcoin addresses held by whales has experienced a certain decline in September.

- Compared with the performance of other L1 markets: BTC is not the top in terms of the number of active addresses, ETH performs better than BTC in terms of adding non-zero asset addresses.

Looking at the entire industry, BTC, which performs well in terms of the number of active addresses, ranks fourth in the industry, second only to Near.

Source:OKGResearch, OKLink

ETH, which has always been compared with BTC by the market, can be observed to have slightly fewer new addresses than BTC. However, when excluding zero asset addresses, compared to BTC, ETH has achieved significant growth in the number of addresses, while BTC has shown a downward trend in September.

Source:OKGResearch, OKLink

02. Ordinals and Inscriptions are the main reasons for the active ecology on the BTC chain

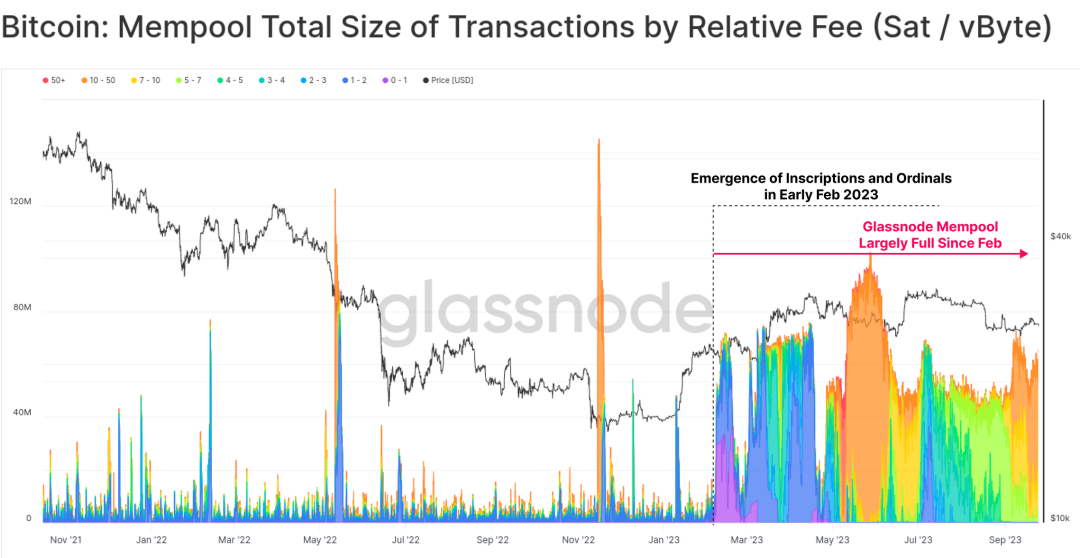

Since the end of last year, Casey Rodarmor, a core contributor to Bitcoin, created the Ordinals protocol, introducing the concepts of Ordinals and Inscriptions, thus giving birth to the first NFT on the Bitcoin network. On March 8, 2023, DOMO proposed to use Ordinals Inscriptions in the JSON data format to achieve token contract deployment, minting, and transfer. Since then, the BTC ecosystem has sparked discussions in the market.

Source: brc-20; Date: Oct 8, 2023

According to data from the Mempool, starting from February, the demand for the Bitcoin ecosystem has been in a state of supply shortage, the so-called “seller’s market”. The more unconfirmed transactions in the Mempool, the more transactions initiated, and the higher the demand for on-chain usage. This high demand has continued to the present and is consistent with the release of Ordinals and Inscriptions.

Furthermore, by comparing the transaction volume and the number of transactions, we can observe that in September, the amount of each transaction was relatively small, with small transactions being the main type. However, from the chart, it can be seen that after September 23, the amount of each transaction started to show an increasing trend. One possible factor is that more investors have gained confidence in the BTC ecosystem and are willing to engage in large transactions, thereby driving the growth of the amount of each transaction.

Source: Glassnode

03. Insights from On-chain Data

By analyzing the on-chain data of Bitcoin itself, comparing it with other L1s, and conducting in-depth research on the Bitcoin ecosystem, we have made two main findings:

1. Merely relying on metrics such as active addresses does not fully explain the improvement of on-chain indicators for BTC this month. The number of whale addresses and addresses excluding zero assets decreased in September.

2. The activity of on-chain addresses does not necessarily reflect the activity level of BTC investors. After in-depth ecological analysis, it can be said that on-chain activity more indicates investors’ confidence in the BTC ecosystem. Ordinals and Inscriptions are the main reasons for the active on-chain ecosystem of BTC. And through the analysis of the amount of single transactions, we can observe signs of market sentiment rebounding.

On-chain data, as verifiable data that reflects real-time blockchain transaction activity, more reflects the direction of activity of a small number of people within the industry or the “cutting-edge core.” For public chains, all development in terms of core technology or application innovation happens on-chain, just like Ordinals and Inscriptions for Bitcoin. Its advancement can be regarded as a compass. Rather than saying that on-chain data constitutes the fundamental aspect of this chain, it is more accurate to say that this fundamental aspect is different from the ordinary stock market and emphasizes “advancement.” After all, the technological nature of blockchain technology has also brought certain barriers to participants.

With the increasing proportion of mature investors in the industry, the analysis of on-chain data is becoming an important reference for investment decisions. It is like a microscope of the market, able to delve into the internal ecosystem and reveal the inner world of the chain through various indicators. It is worth emphasizing that this data cannot be falsified.

Conclusion

From the perspective of on-chain data, BTC’s story is gradually moving away from being a “expensive payment tool.” Ecological innovations including Ordinals, Inscriptions, and BRC20 will become the main force in continuing to write the story, providing more possibilities for the BTC ecosystem. In addition to the on-chain data analyzed in this article, the Bitcoin halving (reduction of block rewards) is also one of the important factors affecting the BTC market. By reducing the rate at which new bitcoins enter the market, the halving effectively reduces the available supply.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!