The future DeFi lending market is very likely to be a “dual super and multiple strong” competition.

Foreword: Web3.0 – New Opportunities for Financial Technology Development

Dear readers,

I am honored to introduce this “Insightful Analysis Report on the 2023 Global Decentralized Financial Lending Track” to you. As the director of the HKUST Crypto-Fintech Lab at the Hong Kong University of Science and Technology, I have been committed to promoting the development of cryptographic financial technology and exploring innovative possibilities in this field. This report is carefully written by our team and Go2Mars Capital, combining academic research and industry practices to share our joint wisdom and insights.

In the past few years, the rise of Web3 technology has brought about tremendous changes in the financial industry. With decentralization, security, transparency, and programmability as its core features, Web3 has brought unprecedented opportunities and challenges to the lending sector. With the help of technologies such as blockchain, smart contracts, and cryptocurrencies, the financial market is undergoing a transition from the traditional centralized model to the decentralized model.

- Cryptographic Aesthetics, Singing Freedom

- Income-oriented RWA Report US Treasury Bonds Drive Income Growth, Cryptocurrency Native User Demand Surges

- How sophisticated are the operational methods behind the new high of ETHS?

This report aims to delve into the development trends, key challenges, and future prospects of the Web3 lending track. Researchers from Go2Mars Capital and our lab’s research team have conducted extensive research and analysis in this field and engaged in in-depth discussions with experts and practitioners in the industry. We will provide a comprehensive overview of key topics such as Web3 lending protocols, decentralized lending markets, asset collateralization, and risk management. In addition, this report will also introduce some of the latest lending innovation cases, such as Prestare Finance, which is an innovative project from our lab that explores how Web3 technology promotes the development and innovation of the financial market. We will explore emerging areas such as blockchain-based lending protocols, decentralized lending platforms, and lending derivatives, and discuss their potential impact on the traditional financial system.

Through this report, we hope to provide readers with a comprehensive perspective on the Web3 lending track and valuable references for practitioners in the industry, researchers in the academic community, and policymakers. We believe that with the development of Web3 technology, the lending market will become more open, efficient, and inclusive, contributing to the sustainable development of the global financial system.

Finally, I would like to sincerely thank the team members of our lab and the partners from Go2Mars Capital for their hard work and support. I would also like to thank the readers for their attention and support. I hope this white paper can bring you inspiration and guidance.

May our collective efforts drive the better development of the financial world and pave the way for the future of financial technology.

共勉!

Kani CHEN

HKUST, Department of Mathematics (Director).

Fellow of Institute of Mathematical Statistics.

Director of HKUST Crypto-Fintech Lab.

Foreword

Lending is the beginning of everything in the financial market, it is the source.

Whether it is “The Wealth of Nations” or Mankiw’s economics textbook, we can easily understand that the core of financial activities is based on trust between people. Trust enables people to lend and borrow funds or assets from each other, thus achieving optimal allocation of resources.

Lending is a credit activity, referring to the lender (bank or other financial institutions) lending currency funds to the borrower (corporations, individuals, or other organizations) according to certain interest rates and conditions to meet their production or consumption needs. In lending activities, the borrowing party can increase their income by expanding their capital scale, which is the role of leverage. However, leverage can also amplify the risks of the borrowing party. If the borrower fails to repay on time, it can result in losses or even bankruptcy. In order to avoid or transfer this risk, people have invented various financial derivatives such as futures, options, and swaps, which can be used to hedge or speculate on market fluctuations. It is no exaggeration to say that finance and financial derivatives are built on the underlying proposition of “lending”.

Due to the inconvenience of centralized finance, people have turned their attention to blockchain, hoping to achieve more efficient, fairer, and more secure financial services through decentralization. Decentralized lending is one important application scenario, which uses smart contracts to achieve functions such as matching lenders and borrowers, asset locking, interest calculation, and repayment execution, without relying on any third-party institution or individual.

As of now, the DeFi lending track has become one of the most important tracks in the blockchain market, with a TVL of $14.79 billion. However, the current innovation of DeFi lending protocols is insufficient, and market focus is gradually shifting. How to innovate on the basis of existing models and combine the latest technologies has become a problem facing innovators.

The DeFi lending track needs a new narrative.

Chapter 1: DeFi Lending Principles Deconstructed – How Decentralization Changes the Development of Financial Lending

The Distributed Transformation of Financial Foundations: From Traditional Finance to “Decentralized Finance”

“Lending can promote the flow and accumulation of capital. Capitalists can lend idle capital to those in need of financial support, thereby promoting economic development and capital accumulation.”

—Adam Smith, “The Wealth of Nations”

One core function of the financial sector is to channel savings into productive investment opportunities. Traditionally, ignorant savers deposit their money in banks to earn interest; banks then lend funds to borrowers, including businesses and households. The key is that as lenders, banks screen borrowers to assess their creditworthiness, ensuring that scarce capital is allocated to the best use.

During the screening process, banks combine hard information and soft information. The former includes the borrower’s credit score, income, or educational background, while the latter is usually obtained through extensive relationships with the borrower. From this perspective, the history of financial intermediaries is an exploration of improving information processing. For borrowers who are difficult to screen, the lender may require collateral to secure the loan, thereby mitigating information asymmetry and coordinating incentives. For example, entrepreneurs often have to mortgage their home equity when applying for a loan. If there is a default, the lender can seize the collateral and sell it to recover the loss.

Collateral has played a common role in loans for centuries, with real estate as collateral dating back to ancient Rome. Over time, market carriers and forms have changed, and DeFi lending platforms also bring depositors and potential borrowers together without a central intermediary like a bank. More precisely, lending activities occur on the platform, or on a series of smart contracts that manage loans according to pre-defined rules. One party is the individual depositor (also known as the lender), who deposits their own encrypted assets into a so-called liquidity pool to earn deposit interest rates. The other party is the borrower, who obtains encrypted assets and pays loan interest rates. These two interest rates vary based on the demand for encrypted assets and loans, and are also influenced by the size of the liquidity pool (representing the supply of funds). The platform usually charges a service fee to the borrower. Due to the automation of the process, loan disbursement is almost instantaneous, and the associated costs are low.

A key difference between DeFi lending and traditional lending is the limited ability of DeFi lending to screen borrowers. The identities of borrowers and lenders are hidden behind encrypted digital signatures. As a result, lenders cannot access information such as the borrower’s credit score or income statement. Therefore, DeFi platforms rely on collateral to coordinate the incentives of borrowers and lenders. Only assets recorded on the blockchain can be borrowed or used as collateral, making the system largely self-referential.

A typical DeFi loan is issued in stablecoins, while collateral consists of higher-risk unsecured encrypted assets. Smart contracts assign a haircut or margin to each type of collateral, which determines how much minimum collateral the borrower must provide to obtain a given amount of loan. Due to the high price volatility of encrypted assets, over-collateralization occurs, where the required collateral is often much higher than the loan amount. The minimum collateralization ratio on major lending platforms is usually between 120% and 150%, depending on expected price appreciation and volatility.

-

The Exploration Period (2017-2018) was the starting phase of the DeFi ecosystem, during which a batch of decentralized financial protocols based on smart contracts emerged on the Ethereum platform, providing users with various types of encrypted asset lending services. Among them, MakerDAO was the earliest stablecoin issuance protocol, which allowed users to generate DAI stablecoins by collateralizing encrypted assets; Compound was the first interest market protocol, which allowed users to deposit or borrow encrypted assets and dynamically adjust interest rates based on market supply and demand; Dharma was the first bond issuance protocol, which allowed users to create, buy, or sell fixed-rate bonds based on encrypted assets. These protocols laid the foundation for the DeFi ecosystem and provided inspiration and references for later innovators.

-

The Expansion Period (2019-2020) was a phase of rapid growth in the DeFi ecosystem. During this period, the on-chain lending market demonstrated diversification and innovation. Not only did more DeFi projects enter the market competition, but more lending protocols also underwent innovation and optimization to adapt to different user needs and market environments. These lending protocols involved various encrypted assets, including stablecoins, native tokens, synthetic assets, and NFTs. They adopted different risk management methods, such as collateral ratio, liquidation penalty, insurance pools, and credit scoring. They designed different interest rate models, including fixed rates, floating rates, algorithmic rates, and derivative rates. They also implemented different governance mechanisms, including centralized governance, decentralized governance, community governance, and token incentives. These lending protocols achieved a higher degree of interconnection and synergies, providing users with richer and more flexible financial services and income opportunities through smart contracts and composite strategies. Some rising or developing lending protocols during this period include Aave, dYdX, Euler, and Fraxlend, each with its own characteristics, advantages, challenges, and risks.

-

The Expansion Period (2021-Present) presents more challenges and opportunities for the on-chain lending track. On one hand, as the Ethereum network becomes congested and transaction fees rise, lending protocols have begun seeking cross-chain and multi-chain solutions to improve efficiency and reduce costs. Some lending protocols have been deployed on other public chains or adopted cross-chain bridging tools to achieve interoperability of assets and data, such as the all-chain lending protocol Radiant. On the other hand, with the demand and attention from the real economy and traditional finance, lending protocols have also begun exploring the possibility of on-chain securitization of real-world assets (RWA) to expand the scale and influence of the lending market. Some lending protocols have attempted to tokenize assets such as real estate, automobiles, and bills, and provide corresponding lending services. Representative lending protocols in this regard include Tinlake, Centrifuge, Credix Finance, etc.

The Core Elements of Decentralized Lending

Whether it is decentralized lending based on blockchain technology or traditional lending based on financial institutions, they have certain similarities in their core components. Regardless of the lending method, there needs to be elements such as borrowers, lenders, interest rates, terms, and collateral. These elements constitute the basic logic and rules of lending, and also determine the risks and returns of lending. In decentralized lending, various parameters are determined by DAO, so the governance module is added to the entire financial model. Specifically, it includes the following elements:

-

Borrower: The borrower refers to the party that needs to borrow funds. They usually have funding needs for investment, consumption, emergencies, etc. The borrower needs to make a loan request to the lender or platform and provide some necessary information and conditions, such as loan amount, term, interest rate, collateral, etc. After obtaining the loan, the borrower needs to repay the principal and interest to the lender or platform according to the agreed manner and time.

-

Lender: The lender refers to the party willing to lend funds. They usually have some idle funds and want to earn certain returns. The lender needs to provide their funds to the borrower or platform and accept some necessary information and conditions, such as loan amount, term, interest rate, risk, etc. After lending the funds, the lender needs to recover the principal and interest according to the agreed manner and time.

-

Platform: The platform refers to the party that acts as an intermediary or coordinator in the lending process. They can be centralized institutions, such as banks, credit unions, P2P lending platforms, etc., or decentralized systems, such as blockchain, smart contracts, DeFi platforms, etc. The main function of the platform is to provide a trustworthy and efficient lending market for borrowers and lenders, and to realize the matching and flow of funds. The platform usually charges certain fees or profits as compensation for its services.

-

Governance: In decentralized protocols, indicators such as interest rates, collateral assets determination, LTV, etc. are obtained through voting by governance tokens. Therefore, governance plays an important role in protocol decision-making. Governance usually needs to hold or pledge a certain amount of governance tokens to obtain voting rights and governance rewards. Governance can influence the development direction and parameter settings of the protocol by proposing or supporting proposals.

Breakdown and Analysis of the Lending Process

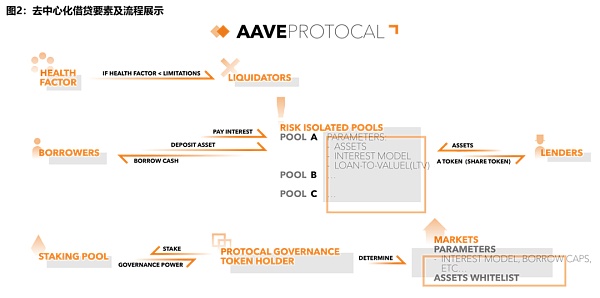

The decentralized lending process is the same as centralized lending, both of which involve similar steps, including initiating and processing loan requests, providing and managing collateral, loan repayment and liquidation. The characteristic of decentralized lending is that it does not require trust in any intermediaries, but rather automates the execution of lending agreements through smart contracts. The process of decentralized lending is as follows (refer to Figure 2):

On decentralized platforms, there are usually different collateral pools corresponding to different risk levels of assets. Their loan interest rates, collateral ratios, liquidation ratios, and other parameters are different. Borrowers first need to select a collateral pool based on the assets they are collateralizing, and then deposit their collateral into the collateral pool contract to obtain the assets they borrow. Due to the difficulty of verifying credit on the chain, decentralized lending often chooses over-collateralized loans, where the value of the collateral / loan amount > 100%.

After choosing the collateral pool, borrowers can enter the type and quantity of assets they want to borrow. The platform will display the corresponding loan term, interest rate, collateral ratio, and other information based on the current market conditions and collateral pool parameters for borrowers to reference. Generally, the platform will provide a series of cryptocurrencies as collateral options, such as Bitcoin, Ethereum, stablecoins, etc. Different cryptocurrencies have different risk levels, so they also have different parameter settings. Borrowers can choose more stable or more volatile cryptocurrencies as collateral based on their risk preferences and return expectations.

Once the borrower has determined the loan conditions, they can click to initiate the loan request. The platform will verify the borrower’s identity, address, and whether the provided collateral meets the requirements. If everything is normal, the platform will transfer the borrower’s collateral into the smart contract and transfer the corresponding amount of borrowed assets from the contract to the borrower. At the same time, the platform will record the borrower’s relevant information, such as loan amount, term, interest rate, collateral ratio, etc., and generate a unique loan ID in the contract.

The platform will match suitable lenders from the collateral pool based on the borrower’s loan request and transfer the assets they provide to the borrower. Lenders can be individual individuals or institutions, or multiple collections or pools. In addition to providing assets, lenders will also receive corresponding interest income and token rewards.

Lenders can increase or decrease the assets they provide at any time to adjust their own returns and risks. The platform will dynamically adjust the loan interest rate based on market supply and demand to balance the interests of both borrowers and lenders. Borrowers can repay part or all of the loan and interest at any time during the loan term and retrieve the corresponding amount of collateral from the smart contract. If the borrower repays the full loan and interest on time, the platform will end the loan relationship and delete the relevant information.

At the same time, the platform will monitor the value of the collateral in real time and calculate the collateral ratio, liquidation ratio, and health factor for each loan. The collateral ratio refers to the ratio of the value of the collateral to the loan amount, the liquidation ratio refers to the minimum collateral ratio that triggers liquidation, and the health factor refers to the ratio of the collateral ratio to the liquidation ratio, reflecting the borrower’s repayment ability and risk level. The platform will provide borrowers with this information in various ways and remind them to pay attention to the risks.

If the borrower is unable to repay on time or if their collateralization rate is lower than the liquidation rate (such as 150%), the platform will automatically trigger the liquidation process. The collateral will be sold to a liquidator at a certain discount to repay the debt and collect a certain penalty.

The liquidator can be the platform itself or a third-party institution, and they can profit by purchasing the collateral. After the liquidation, if there is any remaining value in the collateral, the platform will return it to the borrower. If the value of the collateral is not enough to repay the debt, the platform will reset it to zero and bear the loss.

The game of interest distribution in the lending process

For a lending agreement, the sources of income are the interest paid by the borrower, the liquidation of collateral, and service fees. These income will be distributed to the protocol itself, LP (Liquidity Provider), and secondary market support. The distribution of interests can be seen as a game and optimization process.

In order to attract a higher TVL (Total Value Locked) in the early stage, the project party will choose to make concessions. This means they will take various measures to attract LPs and borrowers. For example, they may set higher interest rates to attract LPs to deposit assets into the liquidity pool. At the same time, they will also provide convenience for borrowers, such as subsidies to reduce borrowing costs. In the later stage, the project party will pay more attention to the stability of the stablecoin price. To achieve this goal, they may engage in market-making in the secondary market to support the token price. This can be achieved through buying or selling tokens. In addition, the project party may also adjust interest rates and subsidy policies to balance supply and demand and maintain market stability.

In summary, in this process, the protocol needs to balance the interests of all parties. It needs to attract enough LPs to provide liquidity while also providing borrowers with competitive interest rates and convenient borrowing conditions. In addition, the protocol needs to support its token price through secondary market-making and maintain operation through service fees. Therefore, the protocol needs to constantly adjust the proportion of interest distribution among all parties to achieve optimal results.

DeFi Lending Model Breakdown: How Decentralized Systems Affect Lending Mechanisms

DeFi Lending Mechanism 1: Peer-to-Peer and Peer-to-Pool Lending Models

By classifying lending models based on the matching methods of lending activities, lending models can be divided into peer-to-peer and peer-to-pool lending. Matching methods refer to how borrowers and lenders find each other and reach lending agreements. Peer-to-peer lending refers to direct transactions between borrowers and lenders. Both parties can freely choose lending conditions but need to spend time and costs to find suitable counterparts. Peer-to-pool lending refers to borrowers and lenders transacting through a common fund pool. Both parties do not need to know each other’s identity and only need to follow the rules of the fund pool for lending. This can improve efficiency and liquidity but also faces some risks and limitations.

Point-to-pool is currently the mainstream method, and protocols such as AAVE and Compound belong to the lending models of point-to-pool. This model allows liquidity providers to pool different assets into their respective liquidity pools, and borrowers can borrow assets from the liquidity pool of the target asset by collateralizing token assets. The interest paid by the borrower is the profit of the liquidity pool, and the interest is distributed to all liquidity providers in the borrowed asset pool, without allocating interest to specific liquidity providers, hence it is called the lending model of point-to-pool.

The point-to-pool lending model has some advantages. First, it effectively diversifies risks. Since the default risk is borne by the entire liquidity pool, each liquidity provider bears relatively small risks. Secondly, this model ensures liquidity. As liquidity providers pool different assets into their respective liquidity pools, borrowers can borrow assets from the liquidity pool of the target asset, ensuring that borrowers can obtain the required funds in a timely manner.

However, the point-to-pool lending model also has some disadvantages. First, the income received by each liquidity provider is dispersed. Since the interest is distributed to all liquidity providers in the borrowed asset pool, without allocating interest to specific liquidity providers, each liquidity provider receives relatively small income. Secondly, the capital utilization rate of liquidity providers is low. Since most of the funds are idle, the capital utilization rate of liquidity providers is relatively low.

Peer-to-peer (p2p) on-chain lending model was initially proposed by the ETHLend protocol, attempting to achieve 100% capital utilization efficiency by matching the trading orders of both borrowers and lenders. Using the p2p lending model, borrowers and lenders can engage in lending activities at negotiated prices and interest rates. Currently, protocols like Morpho belong to p2p lending. Secondly, this model ensures that the borrower receives all interest income. Since the borrower can complete the lending with 100% capital utilization rate, they can receive all interest income.

However, the peer-to-peer (p2p) on-chain lending model also has some disadvantages. First, completing transactions on-chain is not easy. Since all prices and transactions need to be recorded on-chain, borrowers and lenders need to pay a considerable amount of gas fees to complete the lending, which is not user-friendly for both parties. Secondly, this model requires the borrower to bear all the risks – insufficient collateral or default risks caused by market price fluctuations will be borne by the borrower.

DeFi Lending Mechanism 2: Overcollateralized and Undercollateralized Lending Models

Based on the degree of credit enhancement between the borrower and lender, lending business can be divided into two different models. One model is overcollateralized lending, where the borrower needs to provide collateral worth more than the borrowed assets to ensure that the lender can recover the principal and interest by selling the collateral in the event of market fluctuations or default. This model is suitable for borrowers with low credit or high risk, as they need to pay more costs to obtain funds.

Another model is undercollateralized lending, where borrowers only need to provide collateral worth less than the borrowed assets, in order to leverage the potential increase in asset prices for higher returns. This model is suitable for borrowers with high creditworthiness or low risk, as they can amplify their returns with lower costs. However, this model also comes with greater risks, as lenders may not be able to fully recover their losses by selling the collateral in the event of market reversal or default.

-

Overcollateralization requires the value of the collateral to be greater than the loan amount. For example, when AAVE lends out $6,400 worth of DAI, the user needs to have at least $10,000 worth of collateral on AAVE. In the DeFi market, the prices of most assets are highly volatile. To avoid the risk of bad debt due to the value of collateral falling below the loan amount caused by price fluctuations, overcollateralization protocols incorporate a liquidation threshold. When a borrower’s loan-to-value ratio (the ratio of the loan amount to the collateral value) exceeds the liquidation threshold, the protocol introduces external liquidators to liquidate the borrower, reducing the LTV back to the safe range. In this process, various incentive mechanisms are used to encourage liquidators to initiate liquidation, ensuring the safety of the funding pool. Overcollateralization leads to lower capital utilization. Currently, most on-chain assets are considered liquid assets, and the lower capital utilization of overcollateralization does not meet people’s needs, limiting the effectiveness of financial instruments.

-

Undercollateralization: In traditional finance, credit is also an important tool. Credit allows borrowers to bring forward their expenses and stimulate economic activity. However, due to the censorship-resistant and anonymous nature of blockchain, when bad debts occur, individuals cannot be held accountable, and DeFi protocols cannot assess the creditworthiness of each address. Therefore, to ensure the safety of funds and protocols, overcollateralization is the preferred approach for lending protocols. However, in the current DeFi market, there are also many protocols that attempt to combine on-chain and off-chain methods to provide undercollateralized loans for whitelisted users. One way to combine off-chain methods is by introducing KYC. Protocols or protocol token holders review and evaluate the backgrounds and funds of borrowers. When the evaluation is passed, a loan agreement is formed with the crypto institution, including details such as the amount, term, interest rate, and collateral ratio. The final decision on whether to grant the loan to the borrower is made through proposals or multiple voting methods. Currently, protocols like Maple and TrueFi define borrowers as established crypto institutions or crypto fund organizations.

DeFi Lending Mechanism Three: Floating Rate and Fixed Rate Lending Models

-

Floating Rate Model: The predecessor of AAVE, Ethlend, demonstrated a p2p lending model based on an order book, with clear expiration dates and fixed interest rates. However, it was eliminated from the DeFi market due to insufficient liquidity and low sales due to poor matching of funds. AAVE, on the other hand, introduced a p2pool model that controls interest rates based on supply and demand. In this model, there is no fixed expiration date for loans. To maintain the balance of funds in the market, the interest rate is influenced by the utilization rate of funds. When the utilization rate of funds in the market rises, indicating greater demand than supply, the interest rate increases to suppress market demand and ensure the safety of the funding pool. When the utilization rate of funds decreases, indicating oversupply, the interest rate decreases to stimulate market demand. AAVE and Compound are representative lending protocols that use this floating rate model. They adjust interest rates in real-time based on market changes. This approach has its advantages and disadvantages. The advantage is that it can quickly respond to market changes and maintain the safety of the funding pool. However, the disadvantage is that the floating interest rate brings greater risk exposure and is not conducive to long-term financial activities. In this model, investors need to closely monitor market dynamics and adjust their investment strategies accordingly. At the same time, risk control should be taken into consideration to avoid over-investment or excessive leverage.

-

Fixed Rate Model: In traditional finance, fixed rate lending is more common, as predictable interest rates provide appropriate tools for building stronger investment portfolios. However, in the DeFi space, it is challenging to price assets properly and establish corresponding fixed interest rates. Currently, different protocols in the DeFi market use different methods to form fixed interest rates, with two common categories being zero-coupon bonds and interest rate markets.

Zero-coupon bonds are bonds that do not pay interest. The trading price is lower than the face value, and the face value is paid to the bondholder at maturity. The lender can purchase zero-coupon bonds at a discounted price and receive the funds equal to the face value at maturity. The difference between the purchase price and the face value is the lender’s interest, and the fixed interest rate received by the lender is the ratio of interest to the time from purchase to maturity. The borrower can lend out zero-coupon bonds through collateralized assets and sell them at a discount to obtain funds. If the borrower wants to redeem the collateral, they need to repay the debt on the zero-coupon bonds. The difference between the face value of the zero-coupon bonds lent out by the system and the funds obtained from the sale is the interest on the loan. Depending on the market supply and demand, both the lender and borrower can trade zero-coupon bonds at a fixed interest rate, thereby achieving a fixed interest rate.

The representative lending agreement for fixed interest rates is Yield Protocol. Yield Protocol is a permissionless market for collateralized fixed-rate lending on Ethereum. It introduces a derivative model for zero-coupon bonds used as collateral, making fixed-rate borrowing possible. This means that borrowers can lock in a fixed interest rate to protect themselves from interest rate fluctuations.

The protocol defines yTokens as ERC-20 tokens that settle in a specified amount of the target asset on a specified date. This allows for the creation of markets for these tokens, where buyers and sellers can trade at prices that reflect market expectations of future interest rates. These tokens are collateralized by the underlying assets and have similar maintenance collateral ratio requirements as other DeFi platforms. This means that borrowers must deposit collateral to secure their loans, and if the value of the collateral falls below the maintenance requirement, the custodian can sell part or all of the collateral to repay the debt and liquidate the position. This provides additional security for lenders, as they can be confident that their funds are backed by collateral.

In addition to zero-coupon bonds, investors can also obtain fixed-rate income products through other means. One method is to derive a secondary market for trading rates based on existing interest sources, such as floating rates or liquidity mining. In this secondary market, investors can buy and trade various fixed-rate products to earn stable returns. Additionally, the protocol can generate fixed-rate income products in other ways, providing investors with more choices. In general, these can be classified into two categories:

-

Principal-Interest Separation: This involves using the potential interest returns from DeFi investments as income products, splitting the investment amount into principal and interest portions and pricing them separately. After maturity, investors holding the principal portion can receive the initial investment amount, while investors holding the interest portion can receive all the interest earned from the investment. Taking the example of earning interest income from depositing 10,000 DAI into the Compound protocol, if the market’s interest rate expectation is around 4% at that time, the principal is priced at 9,600 and the interest is priced at 400. After the product is sold and matures, holders of tokens representing the principal portion will receive 10,000 DAI, while holders of tokens representing the interest portion will receive the remaining interest. This product includes fixed-rate products and a bullish view on the Compound interest market. The representative protocol for this type is Pendle. Pendle is a yield trading protocol that allows users to purchase assets at a discount or gain leveraged exposure without facing liquidation risks. This is achieved by deploying fixed-rate derivative protocols on Ethereum and Arbitrum. The protocol tokenizes future returns by separating principal and interest, providing users with more flexibility and control over their investments. Users can deposit assets that generate income into the platform, and the smart contract separates the principal and interest by minting principal tokens and interest tokens. These tokens can then be traded on the platform using an automated market maker (AMM) algorithm. This allows for efficient and transparent trading of these assets, offering users more options for managing their investments.

-

Structured Products: By leveraging the uncertainty of floating rates and taking into account each investor’s risk tolerance and opportunity cost of capital, the protocol can design structured products that reallocate risk based on individual needs. This allows investors to choose suitable structured products for investment based on their risk tolerance and investment goals. These products can help investors manage risks and maximize returns in uncertain market environments. In structured products, Class A products distribute priority profits with reduced risks and fixed interest rates, while Class B products offer higher risks and higher returns. Using the example of depositing 10,000 DAI into the Compound protocol, Class A investors only receive a stable 4% return, while Class B investors can receive the excess returns. If the interest rate is less than 4%, Class B investors need to make up for the shortfall of 5% in Class A investors’ interest.

DeFi Loan Model 4: Auction Liquidation and Partial Repayment Liquidation Loan Model

In DeFi lending, the liquidation process involves the health factor of an account (also known as the health index). The health factor is related to the collateral and loan amount of the account. If the value of the health factor reaches a critical threshold (equal to or less than 1), the loan collateral is insufficient. It will be liquidated, and the user will lose all collateral assets:

Due to market fluctuations, the health factor can be expressed in two different ways: when the value of the deposited assets increases and the corresponding collateral value increases, the numerical value of the health factor behaves the same (also increases), higher than the critical value of 1. When the value of the deposited assets decreases and the corresponding collateral value decreases, the numerical value of the health factor behaves in the same way (also decreases), making the loan position riskier as the value approaches the critical value of 1. If it falls below the critical threshold, the loan collateral is insufficient and will be liquidated. Users can increase the health factor by depositing more assets as collateral to maintain a safer loan position. By doing so, on the one hand, to avoid the risk of position liquidation, on the other hand, it allows users to borrow more profits.

During the lending process, if the borrower’s health factor is less than 1, the borrower will face liquidation. The liquidation process can be divided into partial repayment liquidation and auction liquidation models. The partial repayment liquidation model refers to directly selling a portion of the borrower’s collateral at a certain discount through contract orders, allowing any user to repay the debt on behalf of the borrower and immediately resell for arbitrage. This method can quickly solve the borrower’s loan problem and also provide arbitrage opportunities for other users. The auction liquidation model refers to starting from a base price and gradually increasing the price to publicly auction the collateral. This method can ensure the maximization of the collateral value and also provide the borrower with more time to resolve the loan problem.

When choosing the liquidation model, it needs to be determined based on the actual situation. If the borrower wishes to quickly resolve the loan problem and is willing to bear a certain asset loss, the partial repayment liquidation model can be chosen. If the borrower wants to retain their assets as much as possible and is willing to spend more time resolving the loan problem, the auction liquidation model can be chosen.

Comparison of the Advantages and Disadvantages of Four Defi Loan Models

-

Peer-to-Peer Model vs. Pool Model: In terms of security, the existing peer-to-peer lending model Morpho Finance’s underlying assets are the interest-bearing tokens of Compound and Aave. So besides the potential security risks of their own protocols, their security also depends on the protocols to which their underlying tokens belong. However, in terms of efficiency and flexibility, Morpho has optimized the interest rate model of the traditional P2Pool protocol, making the interest rates more favorable for both lenders and borrowers. Undoubtedly, it increases the efficiency of capital utilization.

-

Full Collateral vs. Non-full Collateral Model: In terms of transparency and security, the full collateral protocol performs better and can withstand market tests. Most non-full collateral protocols have an additional security assumption, which is to trust a centralized institution or organization. When the market performs well, the non-full collateral model is undoubtedly attractive, but when the bear market comes, non-full collateral or zero collateral to an institution will inevitably carry the risk of bad debts. In terms of the borrower’s return rate, the non-full collateral model will perform better, but due to protocol limitations, it may not be able to use the protocol for loop lending, so the gameplay is also more limited.

-

Floating Interest Rate vs. Fixed Interest Rate Model: Generally speaking, floating interest rates are more flexible and usually change according to the utilization rate of the lending pool, thereby better capturing market changes. And floating rate protocols like AAVE have simpler product logic, larger TVL, and certain security guarantees. Fixed interest rate products are more complex, with more influencing factors, and the yield rate is usually difficult to calculate. And at the protocol level, there are more protocols launching fixed income products, with TVL very dispersed, and the security of the protocols is also unknown. Considering these factors, fixed interest rate products have certain entry barriers for ordinary DeFi users.

-

Auction Liquidation vs. Partial Repayment Liquidation Model: In practical applications, both liquidation models have their advantages and disadvantages. The partial repayment liquidation model can quickly solve the borrower’s loan problem, but since the collateral is sold at a discount, the borrower may lose some assets. The auction liquidation model can ensure the maximization of the collateral value, but the auction process may be relatively long and not conducive to the rapid resolution of the borrower’s loan problem. Therefore, when choosing the liquidation model, it needs to be decided based on the actual situation.

-

Design of Collateral Ratio: Different lending protocols, such as MakerDAO, AAVE, and Compound, have different collateral ratios for different collateral types. For example, mainstream assets like ETH and WBTC have relatively low collateral ratios (or relatively high loan-to-value ratios) due to their high consensus, good liquidity, and relatively small volatility, while non-mainstream coins have higher collateral ratios. MakerDAO even provides different collateral ratios for the same collateral in its Vaults to encourage higher collateralization behavior and reduce liquidation risks.

-

Clearing Mechanism with Multiple Insurance: To deal with extreme market conditions, some mainstream lending protocols have designed multi-level defense mechanisms. For example, MakerDAO has a Maker Buffer Pool, debt auction model, and emergency shutdown mechanism; AAVE has a Safety Module and attracts funds into the Safety Module by allocating protocol revenue. In addition, auction mechanisms are also continuously being improved.

-

Accuracy of Price Feeds: The entire liquidation process heavily relies on price feeds from oracles, so price accuracy is crucial. Currently, MakerDAO ensures security by establishing its own oracles, while AAVE uses the leading oracle provider Chainlink.

-

Participation of Liquidators: Active participation of liquidators is the solid guarantee for the liquidation process. Currently, major protocols incentivize liquidators by providing benefits to increase their motivation.

Summary: Issues and Challenges of On-Chain Lending

On-chain lending provides users with fast, convenient, and low-cost lending services in a decentralized manner. Since its development, decentralized lending has attracted a large amount of funds and users, forming a vast and active market that supports the circulation and investment of digital assets. However, decentralized lending also faces some common problems and challenges:

-

Liquidity: On-chain lending platforms rely on users depositing or borrowing crypto assets to form liquidity pools and provide lending services. The level of liquidity determines whether the platform can meet users’ borrowing needs and the interest rates of loans. Insufficient liquidity can lead to the platform’s inability to attract and retain users, reducing its competitiveness and profitability. Excessive liquidity can depress interest rates and reduce user incentives. Therefore, on-chain lending platforms need to design reasonable mechanisms to balance the supply and demand of liquidity, such as dynamically adjusting interest rates, providing liquidity mining rewards, and achieving cross-chain interoperability.

-

Security: On-chain lending platforms are controlled by smart contracts, which means they may be vulnerable to programming errors, logic loopholes, or malicious attacks. Once a security incident occurs, it can lead to the theft, freezing, or destruction of users’ funds, causing significant losses. Therefore, on-chain lending platforms need to undergo rigorous code audits, security testing, and risk management, as well as establish emergency mechanisms and governance models to ensure the security of users’ funds.

-

Scalability: On-chain lending platforms are limited by the performance and capacity of the underlying blockchain, such as transaction speed, throughput, and fees. When the blockchain network is congested or fees are high, the user experience and efficiency of on-chain lending platforms are affected. Therefore, on-chain lending platforms need to find more efficient and low-cost blockchain solutions, such as layer-2 scaling, sidechains, and cross-chain bridges.

-

Compliance: Due to their decentralized and anonymous nature, on-chain lending platforms may face challenges and risks in terms of legal and regulatory compliance, such as anti-money laundering, anti-terrorism financing, consumer protection, and tax management. These issues can affect the legality and sustainability of on-chain lending platforms, as well as user trust and security. Therefore, on-chain lending platforms need to communicate and coordinate with relevant regulatory agencies and stakeholders, comply with applicable laws and regulations, and ensure compliance and social responsibility.

The above is the content of Chapter One of the “Insight Analysis Report on the Global Decentralized Financial Lending Track in 2023”. Please continue to follow for updates on subsequent content.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!