Highlights of this issue

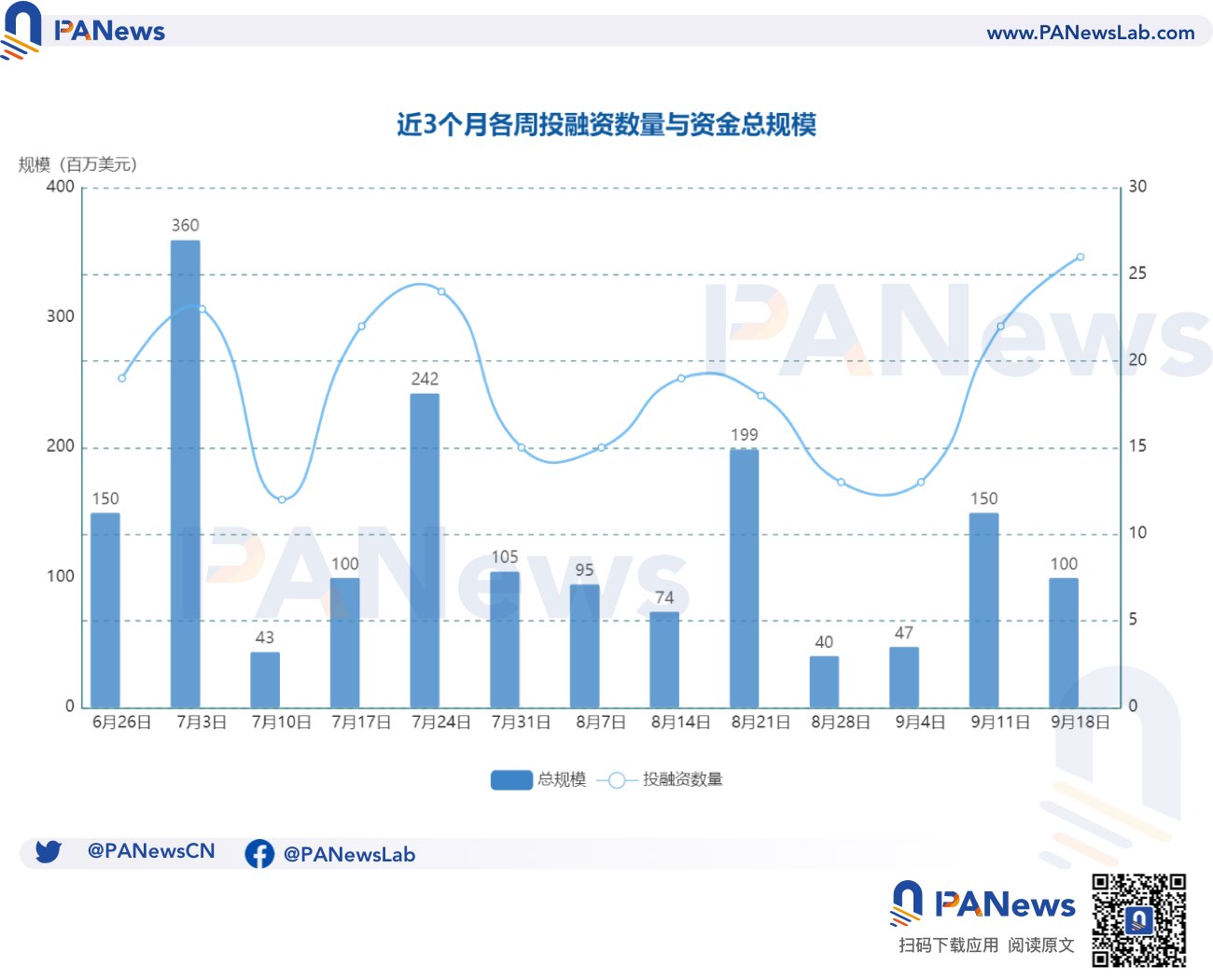

According to incomplete statistics from LianGuaiNews, there were 26 blockchain investment and financing events worldwide last week (9.11-9.17), with a total funding scale exceeding $100 million. The overview is as follows:

- In the DeFi sector, there were 4 investment and financing events, including Range Protocol completing a $3.75 million seed round financing, led by HashKey Capital and Nomad Capital;

- In the NFT and Metaverse field, there were 2 investment and financing events, including Animoca Brands raising $20 million for its NFT project Mocaverse, with CMCC Global as the lead investor;

- In the Blockchain Game track, there were 3 investment and financing events, including GamePhilos Studio, the development studio of the Web3 strategy game Age of Dino, completing an $8 million seed round financing, with Xterio, Animoca Ventures, and others as lead investors;

- In the Infrastructure and Tools track, there were 6 financing events, including Ethereum Layer 2 network Layer N completing a $5 million seed round financing, led by Founders Fund and dao5;

- In the Other Web3/Crypto-related Projects sector, there were 8 financing events, including Web3 collaborative entertainment protocol Mythic Protocol completing a $6.5 million seed round financing, led by Yida Gao, founder of Shima Capital;

- In the field of Centralized Finance, there were 3 financing events, including financial technology service provider Flashwire Group announcing the completion of a $10 million Series A financing, with participating investors including Legend Trading.

DeFi

Range Protocol completes $3.75 million seed round financing, led by HashKey Capital and Nomad Capital

- LianGuai Morning News | Stoner Cats NFT creator agrees to pay $1 million to reach a settlement with the SEC

- Summary of the latest Ethereum execution layer meeting EIP-7514 will be part of the Dencun upgrade.

- Why is Coinbase so obsessed with the concept of the stablecoin Flatcoin, which aims to combat inflation?

Range Protocol, a blockchain asset management platform, announced the completion of a $3.75 million seed round financing, led by HashKey Capital and Nomad Capital, with participation from SLianGuairk Digital Capital, Mirana Ventures, Symbolic Capital, Asymm Ventures, and Comma3 Ventures. Range Protocol aims to provide a fair competitive environment between retail investors and professional digital asset managers. The platform is currently deployed on Ethereum, BSC, Mantle, Polygon, and Arbitrum.

DeFi yield aggregator Portals completes $500,000 seed round extension financing, with participation from DCG, etc.

DeFi yield aggregator Portals has completed a $500,000 seed round extension financing, with participation from Bankless Ventures, Digital Currency Group (DCG), and Founderheads. Previously, DeFi platform Portals announced the completion of a $2 million seed round financing, led by Lightshift Capital, with participation from Poolside, Basement Labs, LongHash Ventures, and others.

Hybrid on-chain exchange Gravity completes seed round financing, with participation from ABCDE, etc.

Hybrid on-chain exchange Gravity has completed seed round financing, with participation from ABCDE, Jingwei China, Delphi Digital, C² Ventures, and others. Gravity plans to launch its testnet in the fourth quarter of 2023 and its mainnet in the first quarter of 2024. Gravity is an on-chain trading platform using an order book model, providing options and futures trading, and ensuring that each user’s transactions are invisible to other on-chain users through Validium technology.

Mountain Protocol Launches Interest-Bearing Stablecoin USDM and Announces Seed Round Financing

Mountain Protocol has announced the launch of a compliant and interest-bearing stablecoin called USDM. The token is fully backed by short-term US Treasury bonds and differentiates itself by providing daily rewards to users through staking, currently offering an annual interest rate of 5%. Mountain Protocol obtained a license from the Bermuda Monetary Authority to become a digital asset issuer on July 27. However, USDM is not available to US customers, and the asset is also not registered as a security in the US. Mountain Protocol also announced a seed round financing led by Nic Carter of Castle Island Ventures, with participation from Coinbase Ventures, New Form Capital, Daedalus Angels, and others.

NFT & Metaverse

Animoca Brands Raises $20 Million for its Mocaverse Project, Led by CMCC Global

Animoca Brands has announced a new round of binding financing commitments to accelerate the development of its NFT project, Mocaverse. Animoca Brands raised $20 million by issuing new ordinary shares at a price of AUD 4.50 per share. As part of this financing, the company distributed free additional utility token warrants to investors on a 1:1 US dollar basis. The financing was led by CMCC Global, with participation from investors including Kingsway Capital, Liberty City Ventures, GameFi Ventures, Aleksander Larsen (Founder of Sky Mavis), Gabby Dizon (Founder of Yield Guild Games), and institutional investors from Koda Capital. Yat Siu, the Executive Chairman and Co-Founder of Animoca Brands, also participated in this round of financing.

Xmultiverse Labs, a Web3.0 Infrastructure Service Metaverse Aggregation Platform, Completes $1.5 Million Seed Round Financing

Xmultiverse Labs has announced the completion of a $1.5 million seed round financing, with a post-money valuation of $95 million. The investment funds were contributed by investment funds Xblade Ventures, DLCC Capital, and well-known former CEO of a global gaming company, Richard Wang. Xmultiverse Labs is a virtual world digital infrastructure aggregation metaverse innovation platform driven by advanced technologies such as AI, Unity, and liquid-cooled high-density distributed computing power. It is reported that Xmultiverse Labs has already reserved high-performance GPU resources (H800, A800, A100, etc.) worth nearly $30 million. In addition, Xmultiverse Labs will soon launch an early user “Purple Diamond” lucky program, opening up a brand-new NFT-MINT interactive experience scene driven by AIGC for global users.

Blockchain Games

Web3 Game Studio GamePhilos Completes $8 Million Seed Round Financing, Led by Animoca Ventures

GamePhilos Studio, the development studio behind the Web3 strategy game Age of Dino, has completed an $8 million seed round financing. The round was led by Xterio, Animoca Ventures, SevenX Ventures, and Chain Hill Capital, with participation from Hashkey Capital, Sanctor Capital, Game7, Bas1s, GSR Markets, GSG Ventures, and others. The funding will be used to develop their mobile/PC strategy game Age of Dino, which will be built on the Xterio platform and integrated with features such as deploying on the opBNB network and incorporating NFTs. Xterio platform will provide technical support and software development tools for Age of Dino. Age of Dino is planned to be released on selected countries/regions for mobile devices in early next year.

NFT Sports Game Analysis Platform Podium Completes €2 Million Seed Round Financing, Led by Fabric Ventures

NFT sports game analysis platform Podium (formerly known as SorareData) has raised €2 million in seed round financing, led by Fabric Ventures, with participation from Sfermion and Seedcamp. Podium’s foundation SorareData is a leading analytics tool within the Sorare community, with over 12,000 paying subscribers. This financing round will consolidate SorareData’s position and promote its operations and products. The funding will also support the launch of ReignMetrics, a new analytics tool tailored for the emerging fantasy sports product DraftKings Reignmakers.

Web2.5 Gaming Service Platform Salvo Games Raises $1.5 Million in Angel Round Financing

Web2.5 gaming service platform Salvo Games has completed a $1.5 million angel round financing on September 10, led by a prominent producer from a well-known Asian listed game company. Salvo’s project team is mainly distributed in Asia, the Middle East, and Australia, with core members having over 7 years of experience in the traditional gaming field as well as blockchain technology. The first casual competitive game with a MOBA theme, Ace3, to be launched by its game studio, has completed the first round of community Alpha testing and will open beta version testing activities in the fourth quarter.

Infrastructure & Tools

Digital Asset Service Provider Fipto Completes €15 Million Seed Round Financing

French fintech company Fipto has completed a €15 million (approximately $16.12 million) seed round financing, led by Serena Capital and Motier Ventures. The new funding will allow Fipto to further develop its platform, providing integrated payment and treasury solutions that enable businesses to convert and send any currency by leveraging the advantages of blockchain technology (speed, cost-efficiency, and transparency).

In addition, Fipto is committed to facilitating instant cross-border payments and possesses institutional-grade custody and wallet security, as well as multi-party computation (MPC) wallets, offering businesses security and privacy in the digital realm. It is worth mentioning that Fipto is registered as a Digital Asset Service Provider (DASP) with the French Financial Markets Authority (AMF).

L2 Network Layer N Completes $5 Million Seed Round Financing, Led by Founders Fund and dao5

Ethereum Layer 2 network Layer N has announced the completion of a $5 million seed round financing, co-led by Founders Fund and dao5, with participation from Kraken Ventures and Spencer Noon, among others. Founders Fund’s investment in this financing round is reportedly $1.8 million. Layer N previously planned to build its blockchain on Solana and announced funding from FTX Ventures before FTX’s collapse in November last year. However, these funds were never realized, and the team subsequently decided to pivot to Ethereum. Layer N plans to release its testnet in one to two months. The company has not yet decided whether to release tokens like other Layer-2 tokens such as Optimism and Arbitrum.

Cross-border payment platform LianGuairallax completes $4.5 million seed round of financing, led by Dragonfly Capital

Cross-border payment platform LianGuairallax has completed a $4.5 million seed round of financing, led by Dragonfly Capital. Circle Ventures, General Catalyst, gumi Cryptos Capital, LianGuailm Drive Capital, Comma Capital, Firsthand Alliance, as well as angel investors Balaji and Zach Abrams, participated in the investment. LianGuairallax focuses on providing salary, invoice, and wage payments for freelancers, remote workers, and other global professionals. Its initial product allows users outside the United States to open a virtual US dollar account and receive US dollars using only their passport. The team is building and expanding stablecoin cross-border payment functionality.

Blockchain infrastructure Movement Labs completes $3.4 million pre-seed round of financing

Modular blockchain infrastructure Movement Labs, based on the Move language, has completed a $3.4 million pre-seed round of financing. It was led by Varys Capital, dao5, Blizzard The Avalanche Fund, Borderless Capital, and its cross-chain fund focused on the Wormhole ecosystem, with participation from Colony and others. Movement Labs also announced the launch of the Movement SDK (Software Development Kit), which provides a secure and high-performance Move environment to the blockchain ecosystem. The first major tool of the Movement SDK is M1, built on Avalanche Subnet technology stack, enabling pioneers like Movement Labs to develop infinitely scalable custom blockchains.

Web3 wallet security login system 0xLianGuaiss completes $1.8 million financing, with participation from Alchemy Ventures and others

0xLianGuaiss, a web3 wallet security infrastructure incubated by the Stanford Blockchain Club, has announced the completion of a $1.8 million financing round. Participants include AllianceDAO, Soma Capital, Alchemy Ventures, Blockchain Builders Fund, Formulate Ventures, Kommune, Hashed EM, Signum Capital/UOB, Nonce Classic, and individual investors Balaji Srinivasan and Cory Levy. 0xLianGuaiss allows developers to add multiple authentication methods to non-custodial wallets. Its web2 counterpart would be infrastructure like Auth0 or password managers like 1LianGuaissword.

Web3.0 distributed business application service Boundary Intelligent completes tens of millions of yuan in Series A financing

Shanghai Boundary Intelligent Technology Co., Ltd. has completed tens of millions of yuan in Series A financing, with investment from Xialang Fund, a subsidiary of Hengdian Capital, and Fosun Fan Yi Fund. This round of financing will be used to increase investment in technology research and development, as well as global market expansion. Established in 2016, Boundary Intelligent (Bianjie.AI) is a global Web3.0 (next-generation internet) infrastructure service and distributed business application service provider. At the product level, Boundary Intelligent has built a three-layer product/service matrix covering underlying blockchain infrastructure, LianGuaiaS-layer blockchain application API platform, and upper-layer blockchain applications. At the infrastructure level, Boundary Intelligent relies on core technologies such as blockchain cross-chain, NFT, and big data privacy protection. Based on its self-developed enterprise-level consortium chain product “IRITA,” it has created the open consortium chain “Wenchang Chain.” Wenchang Chain has supported the deployment of over 3,000 distributed business applications/projects.

Others

Web3 Collaborative Entertainment Protocol Mythic Raises $6.5 Million in Funding, Led by Shima Capital Founder

Web3 collaborative entertainment protocol Mythic Protocol has completed a $6.5 million seed round of financing, led by Shima Capital founder Yida Gao. Other participants include Alpha JWC, Saison Capital, GDV Venture, Planetarium Labs, Arcane Group, Presto Labs, MARBLEX, EMURGO Ventures, HYPERITHM, and some angel investors. The funds will be used for the development and launch of the initial core product. Mythic Protocol is a Singapore-based entertainment company that develops games, media, and platforms. Its goal is to establish a collaborative entertainment ecosystem and acquire, retain, and expand users through a game-first strategy.

Web3 Open Source Software Developer Platform ONLY Dust Raises $3 Million in Funding, Led by Fabric Ventures

Web3 open source software developer platform ONLY Dust has announced a $3 million funding round led by Fabric Ventures, with participation from Frst, Ergodic (LambdaClass), and Stake Capital. ONLY Dust supports permissionless innovation on open platforms and helps build trustless peer-to-peer networks with token-driven incentives and governance systems. ONLY Dust provides support in ZK Rollups, privacy, decentralized finance, and other aspects to 500 developers from 17 countries. Starkware, Starknet Foundation, OP Foundation, Nethermind, Aptos, Zama, and Ethereum Foundation all use ONLY Dust to coordinate cash and token rewards for contributors.

Web3 Cross-Chain Community Operating System Club3 Raises $3 Million in Seed Funding

Web3 cross-chain community operating system Club3 has announced a $3 million seed round of financing, led by LinkVC with participation from FarSight Capital, BCH Foundation, Digifinex, and others. Club3 is a one-stop Web3 cross-chain community operating system that provides accurate user traffic, loyalty management, and other zero-code SaaS tools for project parties based on user on-chain data, helping achieve the Go To Community (GTC) strategy of project parties. Headquartered in Hong Kong, Club3’s team members mainly come from internet companies such as Microsoft, Google, and Tencent. Club3 has officially launched the first round of $200,000 community subsidy program to provide growth subsidies for early-stage high-quality projects. Club3 has established traffic and community partnerships with hundreds of platforms such as OKX, BNB Chain, Hashkey, ZKSync, TP wallet, and Lens.

DeFi Data Analysis Platform Octav Raises $2.65 Million in Seed Funding

DeFi data analysis and tax reconciliation platform Octav has announced a $2.65 million seed round of financing. Investors include Nascent, Polymorphic Capital, LianGuairallel Studio, SLianGuaiceship DAO, Investmeows, Possible Ventures, Speedinvest, ACET Capital, as well as individuals such as Aave’s Head of Strategy Markc Zeller, Sagard Holdings CEO LianGuaiul Desmarais, and former CEO of Sushiswap 0xMaki. The funds will be used to integrate more chains into the platform. Octav is a free and editable data analysis platform that helps decipher DeFi investment activities. Currently in testing phase, Octav has thousands of users, has integrated seven chains, and has indexed over 100 million transactions.

Bakery Incubator Invests $2 Million in Web3 Social Platform Topic.Market

Bakery Incubator, the investment arm of AMM and NFT exchange BakerySwap on BNB Chain, has strategically invested $2 million in Web3 social platform Topic.Market. Topic.Market is a social platform and a “hot topic” trading platform where users can purchase “support” to express their views on hot topics and also profit through trading.

Okapi Completes Pre-seed Seed Funding with Mirana Ventures and Mask Network as Lead Investors

dApp evaluation platform Okapi has announced the completion of its Pre-seed round of funding, with Mirana Ventures and Mask Network as lead investors and GoPlus Labs participating. Okapi is a dApp discovery platform that combines content creation with on-chain reputation. Users endorse dApps with on-chain reputation and engage in dApp reviews and content creation, collectively building a Web3 investment, entertainment, and other multi-perspective content and user ecosystem. It is reported that Okapi will launch its Private Alpha version in the coming weeks and invite external users for testing.

Web3 Incentive Platform Cultos Global Completes New Round of Funding

Dubai-based Web3 incentive platform Cultos Global has announced the completion of a new round of funding, with participation from Sameer Mehta, Founder and CEO of boAt Lifestyle, Tarun Katial, Founder and CEO of women’s social crypto platform Coto, Vijay RatnaLianGuairkhe, Head of Bosch Southeast Asia, among others. The specific amount of funding has not been disclosed. Cultos Global is committed to helping brands issue their own tokens and establishing incentive systems based on these tokens.

Zero Number Technology Receives Strategic Investment from GuoXin ZhongShu, a Subsidiary of National Information Center, in B2 Round

Zero Number Technology has announced the completion of its B2 round of funding, with the investor being Beijing GuoXin ZhongShu Investment Management Co., Ltd., a subsidiary of the National Information Center. This round of funding will be mainly used to promote product innovation, marketing, and team expansion. It is reported that Zero Number Technology Co., Ltd., established in 2016 and headquartered in Shanghai, has branches in Beijing, Hainan, Suzhou, Qingdao, and other cities. The company is a leading provider of data sharing and asset circulation infrastructure in China, serving the digital economy with its advanced blockchain and privacy computing technologies.

Centralized Finance

Financial Group Flashwire Group Completes $10 Million Series A Funding

Financial technology service provider Flashwire Group announced today that it has previously completed a $10 million Series A funding round, with participation from Legend Trading, Cobo, Gate.io, VeChain, CyberX, SuperChain Capital, and others. Flashwire’s investors cover various areas including traditional banking, underlying blockchain technology, cryptocurrency trading, liquidity, asset custody, and investment. Since this round of funding, Flashwire has been committed to designing and implementing its unique and leading financial service solutions. Its products include crypto-friendly digital bank (Flashwire.com), cryptocurrency debit card Stella LianGuaiy (stellaLianGuaiy.io), and cryptocurrency lending platform Anxin Finance (Anxin.finance).

Blockchain startup Immix raises $2.7 million in seed funding with participation from Ripple

London-based cryptocurrency startup Immix has raised $2.7 million in seed funding, led by MassMutual Ventures with participation from Ripple. The funding will be used to develop Immix’s trading platform and improve the execution capabilities of its market-making products. Immix was originally a cryptocurrency hedge fund but has now shifted its focus to a non-custodial trading system for institutional investors.

Web3 financial services company LianGuaifin completes new funding round with participation from Sony Innovation Fund

Japanese Web3 financial services company LianGuaifin has completed a new funding round with participation from DG Daiwa Ventures, Sony Innovation Fund, and MZ Web3 Fund. LianGuaifin is developing financial technology and Web3-related businesses, such as the cryptocurrency asset automated profit and loss calculation service Cryptact and the Web3 family ledger tool defitact. The funding will be used to strengthen marketing and recruitment efforts, expand its main business service range, and build Web3 infrastructure.

Venture Capital Firms

C Capital, founded by Hong Kong real estate tycoon Adrian Cheng, raises over $250 million, previously invested in Animoca Brands

C Capital, founded by Adrian Cheng, Vice Chairman and CEO of New World Development, has announced the successful completion of its third round of private equity fundraising. The total investment amount of its main fund and related co-investment vehicles exceeds $250 million, equivalent to approximately RMB 1.8 billion, making it the largest private equity fund raised by the company to date. It is reported that more than 20 senior investors have joined the third round of private equity fundraising, including diversified funds, financial institutions, and well-known family offices from the Asia-Pacific, Middle East, Europe, and other regions.

Venture capital firm Modular Labs completes Pre-Seed funding round with Hashed and K300 leading the way

Venture capital firm Modular Labs has completed its Pre-Seed funding round with Hashed and K300 leading the way, and participation from GuildFi and GBV. Modular Labs aims to provide support for technologists developing with modular blockchain technology.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!