friend.tech is one of the most popular projects on the current base chain. In the distant “ancient internet” era, the “friend trading” mini-game was once active on major SNS websites. Friend.tech is a Web3 product that is similar to the “friend trading” model.

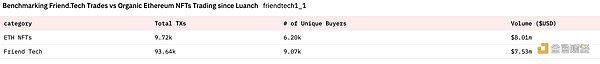

The product ignited community discussions on the day it launched, and according to Dune data, it has already generated over $8 million in transactions.

What are the highlights of this rapidly popular product and how does it differ from SocialFi?

- DAI’s 8% deposit interest rate hits USDC’s weak spot

- What is special about Helio Protocol that Binance Labs invested 10 million US dollars?

- Evening Must-Read | An Inventory of 8 Old Projects in LSD’s Transformation

Web3 People Trading Platform

friend.tech is built on the L2 network base launched by Coinbase. The product is forcibly linked to Twitter to obtain users’ Web2 social identities. Without linking to Twitter, this product cannot be used.

This product is quite mysterious. If you directly visit its official website, you won’t find any information about the product. Currently, there are no product introductions or official documents available.

If users want to learn more about this product, they can only access and use friend.tech through their mobile phones. For specific operations, please refer to the tutorial previously published by Odaily Star Daily.

In friend.tech, each user is tokenized. Users’ influence can be directly priced by the market.

Specifically, users are abstracted as a type of encrypted asset. One user can purchase shares of “other users”.

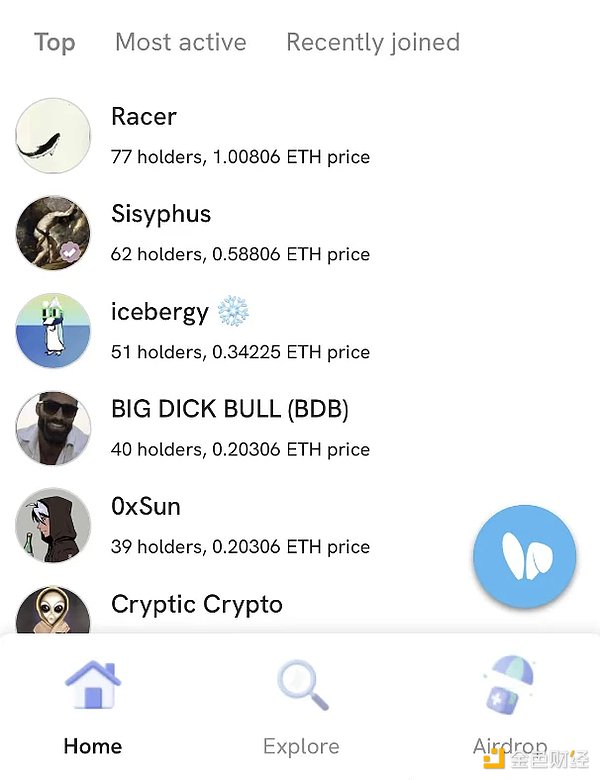

Why would anyone be willing to pay real money to buy other people’s shares? For those who have strong social influence (such as popular analysts, project founders, etc.), many of their fans hope to have private conversations with them or directly seek their advice.

However, on traditional social platforms like Twitter, the direct message feature is often abused due to its unrestricted nature. KOLs receive a large number of DM requests and cannot respond to all of them. This is different in friend.tech. By default, users cannot initiate private chats. For buyers, they can only have the privilege to initiate private chats with someone after owning shares of that person. The price of shares will also fluctuate with market supply and demand. Users can also resell the shares they hold to earn profits.

For social influencers whose shares are purchased, each transaction allows them to earn “subject fees”.

How are real-life stocks priced?

Roughly speaking, the more popular a person is and the more their shares are traded, the higher their stock price.

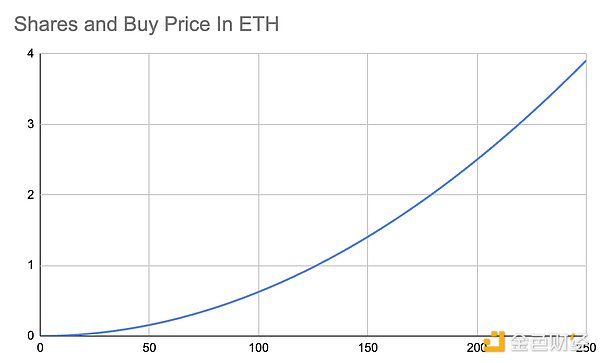

So, specifically, how is the stock price determined? Twitter user @functi0nZer0 has compiled the pricing model for this product.

As the sale of shares increases, the price also rises significantly. The more people buy someone’s shares, the more valuable their shares become.

And 5% of each transaction is earned by the original “issuer” (the object named after the stock). This also leads to a very strong network effect. The more transactions and speculation a person has, the more money they can earn.

Although this product is not a fan token issuance platform for KOLs, its product design inevitably reminds people of traditional fan tokens.

Previously, the category of “fan tokens” had a significant influence in the SocialFi track. It is generally believed that issuing fan tokens by individuals with social influence and empowering fan tokens is a combination of social and encryption.

However, as the fan token products take shape, it is not difficult to find the various problems that exist in such products. On the one hand, it is difficult for fan tokens to establish a deeper connection (or binding) with influencers. Often, apart from the name, fan tokens no longer have more connection with the influencers they represent.

The problem this brings is that fan tokens are difficult to have liquidity in the market. These projects are difficult to trade and in most cases do not have investment or speculative value.

The change brought by friend.tech to social tokens is that it gives trading value to the “stocks” of influencers through the setting of the price curve. Just as DEX abandoned the “order book” with higher requirements for immediacy and chose the AMM mechanism. The change in the price of a person’s stock does not require continuous trading all the time. Even with few buying and selling activities, individual stocks will still generate sufficient fluctuations based on the pre-set price curve.

Invitation code farce reappears, different paths leading to the same destination in the social track?

friend.tech is currently in the testing phase and can only be used by users with invitation codes.

In addition, when the invitation code is used, users can also receive “points.” Due to the expectation of receiving airdrops for “points,” this further attracts people’s enthusiasm for its “CX”.

But when we look back at history, it is not difficult to find that such social products that become popular overnight and have limited invitation codes will appear in each cycle.

In 2021, the social product Monaco became popular overnight, and because the product also adopted an invitation mechanism, only those who used an invitation code could register. This also caused the price of the invitation code for the platform to soar to hundreds of dollars.

Earlier this year, Nostr, which was strongly promoted by Twitter founder Jack Dorsey, became popular in the crypto world and was even repeatedly discussed whether it could replace Twitter.

Social networks are one of the most core and fundamental application scenarios of the Internet, and they can reach the most common and extensive C-end users. This also makes it a popular entrepreneurial field in the crypto industry.

However, with the rise and decline of concepts such as SocialFi and DeSocial, users reviewing the past cannot help but find that encrypted social products seem to have the same fate-after a rapid “surge in popularity,” they fall silent. Of course, the same goes for Web2, and I believe everyone still remembers the popularity of Clubhouse.

During the initial stage of a product, a common practice in social products is to use an access mechanism to restrict the influx of ordinary users on a large scale. Creating scarcity and raising the user threshold artificially is a common approach to attract attention. However, without real demand and the accumulation of relationship networks, the initial novelty cannot determine user retention and conversion.

In the Web3 world, although new social protocols and applications are emerging like mushrooms after rain, with the support of popular concepts such as DID and SBT, none of them have really accumulated a large number of active users after the initial hype, how long can the popularity of friend.tech last?

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!