Author: MatthewLee

On August 7, 2023, LianGuaiyLianGuail, with 431 million users, announced the issuance of the stablecoin PYUSD in partnership with LianGuaixos. LianGuaixos is a regulated company by the New York State Department of Financial Services, specializing in stablecoins pegged to fiat currencies such as the US dollar. However, LianGuaixos has gradually faded from the public eye after being called out by the SEC.

Why did LianGuaiyLianGuail collaborate with LianGuaixos to return to the public eye?

Firstly, as a fully licensed limited-purpose trust company in the United States, LianGuaixos has a natural advantage in compliance and the selection of US dollar assets.

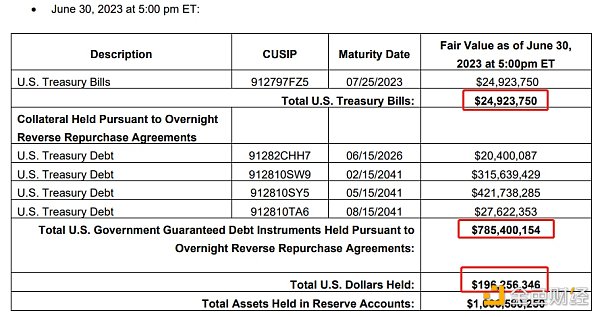

Secondly, in terms of asset disclosure, LianGuaixos is diligent in regularly disclosing the holdings of US Treasury bonds and the circulation of stablecoins, and publishing audit reports. Taking USDP as an example, according to the audit report disclosed in the figure below, they are anchored to highly liquid assets such as ample cash, short-term Treasury bonds, and reverse repurchase agreements with the Federal Reserve.

- Ethereum’s Cancun upgrade is approaching, reviewing the past, present, and future of the Cancun upgrade.

- SLianGuairkDAO airdrop rules interpretation The airdrop is expected to take place next year, with an estimated yield rate in the single digits.

- LianGuai Daily | US judge revokes SBF’s bail and he was imprisoned today; multiple institutions submit amicus briefs in support of Coinbase.

Image source: LianGuaixos official website

Although the US dollar stablecoin BUSD jointly launched by LianGuaixos and Binance was forced to stop minting by the regulatory authorities of New York State in February due to insufficient anchoring asset reserves off the Ethereum chain, it does not involve other issued currencies. Its stablecoins USDP and LianGuaiXG have not been affected by regulatory crackdowns and have sufficient liquidity in the market.

There are already enough stablecoins in the market, so why continue to “reheat leftovers”? The main reason is “profitability”.

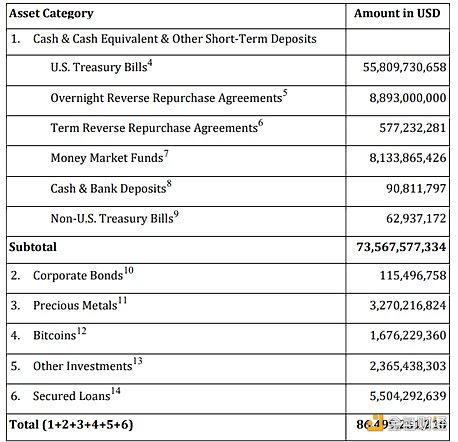

Image source: Tether official website

According to the audit report disclosed by Tether for the first quarter, its total assets under management reached $86.5 billion, and the pure profit disclosed in the first quarter alone was $1.48 billion, with only a few tens of employees. Just the issuance of stablecoins alone can make them earn a lot of money.

Recently, LianGuaiyLianGuail has performed mediocrely in financial reports and business expansion. Investors are disappointed with the quarterly operating profit margin. However, on the day of the stablecoin issuance announcement, the stock rose by 3%. If Tether can make a profit of $1.48 billion with a market share of 60%, when PYUSD achieves a market share of 15% in the same market environment (without considering operating costs, non-operating expenses, and taxes), LianGuaiyLianGuail may earn a profit of $370 million, equivalent to a 46.5% increase in profit.

The widespread impact of stablecoin issuance necessitates regulatory standards

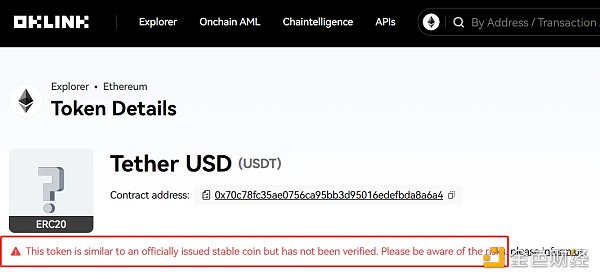

Stablecoins generate numerous problems during their issuance process. For example, after LianGuaiyLianGuail issued stablecoins, counterfeit coins began to emerge like mushrooms after rain. Counterfeit stablecoins have become a common trick used by fraudsters. According to OKLink Explorer, Tether, the stablecoin with the highest market share, has also been counterfeited by illegal individuals, causing losses to many investors.

Image source: OKLink Explorer

Patrick McHenry, Chairman of the U.S. House Financial Services Committee, expressed his views on the launch of payment stablecoins by LianGuaiyLianGuail, stating that “issued within a clear regulatory framework, stablecoins have the potential to become the cornerstone of the 21st-century payment system, and clear regulations are crucial for stablecoins to fulfill their potential.”

The attitude of U.S. regulators towards stablecoins can be seen from the public stance of senior officials. However, due to the “currency” attributes of stablecoins, they to some extent replace certain responsibilities of central bank legal tender, making them more likely to cause market turbulence. For example, central banks use currency minting to purchase securities, provide loans to banks, and conduct “open market operations” to influence the money supply and manipulate interest rates. However, the emergence of stablecoins can disrupt the central bank’s “monopoly,” causing currency appreciation/depreciation, inflation/deflation, so stablecoin issuance needs to be conducted within a sound regulatory framework.

Another very important area that is often overlooked is “anti-money laundering for stablecoins.”

Kenneth Blanco, head of the Financial Crimes Enforcement Network (FinCEN), pointed out that stablecoins also need to comply with anti-money laundering laws. Stablecoin issuing entities are classified as money services businesses (MSBs) and need to comply with more demanding regulations similar to exchanges. Because compliance requirements for exchanges are relatively simple, they only need to control funds at the deposit and withdrawal gateways. However, the circulation and issuance of stablecoins are more complex, requiring more stringent KYC and AML measures to address more complex on-chain tracking activities.

Tether, the so-called “decentralized” stablecoin issuer, also needs to follow regulatory directives and collaborate with on-chain data service providers. In order to fulfill its anti-money laundering compliance responsibilities, Tether has established a blacklist mechanism on the blockchain. Any address suspected of engaging in fraudulent activities, money laundering, terrorist financing, and other illegal activities will be included in Tether’s blacklist. Currently, Tether has frozen hundreds of millions of USDT.

According to the information on LianGuaiyLianGuail’s Github, LianGuaixos must have the function of asset protection due to regulatory requirements. This means that when the law requires the freezing or seizure of the assets of a criminal party, addresses with AssetProtectionRole permission can initiate freezing, unfreezing, or even wiping out the balance of any account. In this way, relevant authorities can effectively seize the corresponding assets. Otherwise, stablecoins allow large amounts of funds to change hands without touching the formal banking system, enabling criminals to engage in large-scale money laundering activities.

In order to meet the needs of regulation to the greatest extent, LianGuaiyLianGuail has also collaborated with on-chain data service providers to monitor criminal activities on the blockchain and monitor blockchain nodes in the early stages.

The role of on-chain data service providers in regulation cannot be ignored

Stablecoins, as bridges between real assets and virtual assets, are highly valued by governments around the world. Hong Kong, one of the New Ren Harbor, plans to launch a Hong Kong dollar stablecoin in 2024 to enhance the efficiency and inclusiveness of the Hong Kong financial system. It is also formulating a detailed stablecoin regulatory framework to regulate the orderly development of stablecoins. Recognizing the urgent need for regulation and the rampant crime on the blockchain, the KYT function in OKLink’s product on-chain AML can also utilize a vast address label library to obtain real-time information about fund sources, monitor addresses controlled by entities comprehensively according to customized anti-money laundering strategies, and issue real-time warnings. After identifying high-risk activities, it can quickly trace on-chain data and trace the origin of digital assets to fully curb money laundering and other illegal activities.

Regulations have higher compliance requirements for stablecoin issuers, so powerful on-chain data service providers need to play the role of “on-chain police”.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!