Interview: Jack, BlockBeats; Vision, MetaStone

Editing: Sharon, BlockBeats

Currently, blockchain is facing three major challenges: scalability, security, and lack of decentralization. These challenges include the lack of trustless cross-chain communication, insufficient scalability when transaction volume grows significantly, and the inability to maintain high levels of security and decentralization when aiming to improve throughput. This is a long-standing problem, and the essence of the problem lies in finding a method that can securely store data in a smaller and lighter container without the need for large or expensive storage devices.

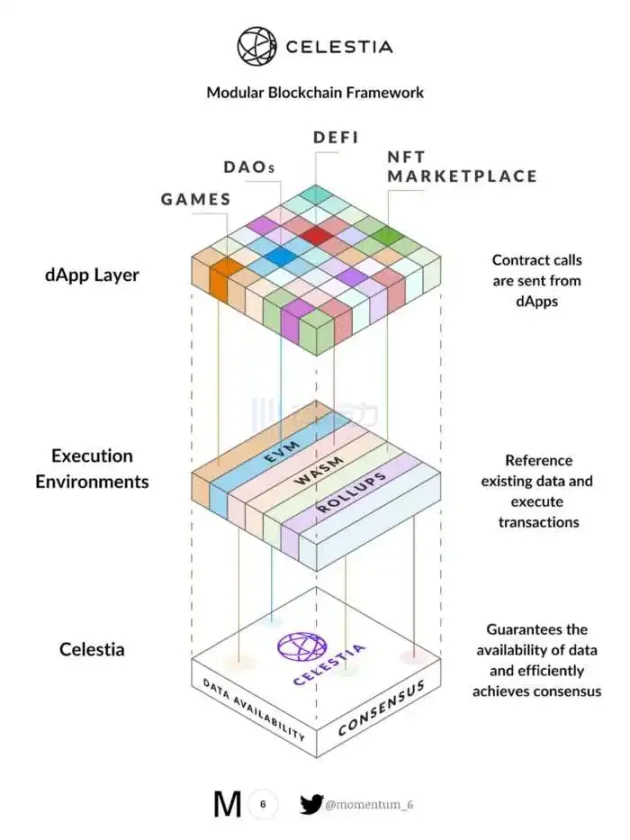

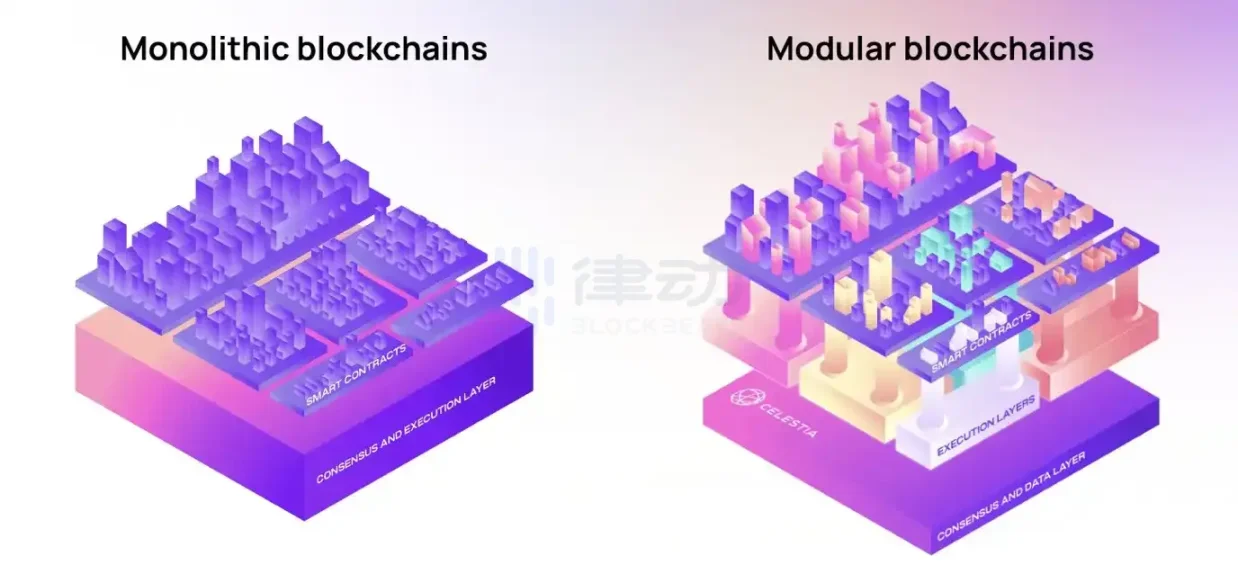

Most of today’s blockchains are monolithic, where core functions such as execution and consensus occur simultaneously and are executed by the same group of validators. Monolithic architectures are difficult to scale because every transaction must be executed by full nodes, leading to bottlenecks. On the other hand, modular blockchains are blockchains that outsource at least one of the four components (consensus, data availability, execution, settlement) to external chains.

- New Zealand Finance and Expenditure Committee Report A New Milestone in the Development of Cryptocurrencies?

- Why does the autonomous world need digital physics?

- The First Criminal Case In Hong Kong Crypto Circle What is JPEX Guilty of?

Celestia is the first modular blockchain network and a cloud computing network for Web 3. It is a pluggable consensus and data availability layer that allows anyone to quickly deploy decentralized blockchains without the cost of bootstrapping a new consensus network. Some in the industry believe that Celestia is the most important underlying innovation in the blockchain industry since Ethereum. Both Ethereum and Celestia are building secure foundational layers. In this exclusive interview by BlockBeats at the TOKEN 2049 conference, co-founder and COO Nick White of Celestia explores the relationship between Celestia and Ethereum, as well as the story behind Celestia.

Without Celestia, Ethereum Cannot Scale Rollup

Among these three challenges, the lack of scalability has the greatest impact. Only by enhancing the scalability of blockchain can billions of people have access to the blockchain. This is also the biggest challenge faced by mainstream blockchains including Ethereum. Currently, Ethereum has various scalability solutions such as Optimism, ZKsync, and Starknet. However, the data availability of these scalability solutions heavily relies on Ethereum itself. Additionally, Ethereum gas fees remain high.

Previously, Ethereum founder Vitalik described his vision of the ultimate form of the Ethereum blockchain, which extensively depicted a new Ethereum built by Rollup and DA. In some ways, this points to the path for Ethereum’s breakthrough in the next decade – modularity.

BlockBeats: Can you introduce yourself and your background?

Nick: Of course. I’m Nick White, the Chief Operating Officer (COO) of Celestia Labs. We are building Celestia, the first modular blockchain network. This means that Celestia is a supporter of a new paradigm for building blockchains. Instead of trying to accomplish all functions in a single protocol, we divide the protocol into different layers, with each layer focusing on specific functions. These layers can then be recombined to build blockchains and applications.

Therefore, Celestia focuses on the consensus and data availability layers of the stack and does not perform any execution. Execution is achieved through Rollup (one of the Layer2 solutions). People can deploy Rollup on top of Celestia, and Celestia provides a scalable decentralized block space for people to build on. So you can think of us as a first layer specifically designed for Rollup, with the goal of extending Rollup.

BlockBeats: When did you first start considering modular blockchains?

Nick: It all started with two white papers that emerged in 2018 and 2019. The first white paper was co-authored by Mustafa Albasan, co-founder of Celestia, and Vitalik, titled “Data Availability Sampling and Fraud Proofs.” In this paper, they demonstrated the construction of a blockchain that can scale the lock space as the number of nodes in the network expands, thereby solving the scalability problem.

Then, based on his previous work, he wrote another white paper called “Lazy Ledger.” “Lazy Ledger” is a continuation and extension of the concept of data availability scaling, in which he proposed a new idea – to build a blockchain that is only responsible for data availability and does not execute any transactions. At the time, he referred to it as “client-side smart contracts.”

The blockchain client operates independently of the first layer, which is now Rollup. Rollup is essentially the off-chain execution of smart contracts and applications. Therefore, “Lazy Ledger” did introduce the concept of modular blockchains. Subsequently, when Rollup emerged, he further demonstrated how the entire system works, as Rollup can make the execution layer as scalable as data availability sampling.

MetaStone: The introduction of Ethereum’s project sharding will lower the cost of Layer2, does it have any impact on Celestia?

Nick: ETH sharding, which is Ethereum, actually shifted its roadmap to mimic the way Celestia is being built. Before that, they were building ETH 2.0, which is sharding technology, but at the end of 2020, they decided to shift and follow the construction method of Celestia. Over time, they gradually aligned their architecture more closely with Celestia’s model. So, Danksharding is basically a different implementation of a similar idea to Celestia.

However, there are several differences. First, there is the timing. Celestia will be launched in a few months, while Danksharding is still in the design and research phase, and it is difficult to know when it will be launched. I don’t think they have even set a date, but they do have Proto-Danksharding, which is EIP-4844, but this will only result in a one-time small increase in Ethereum’s block space.

Based on the demand we see for Layer2 deployment, I believe it is far from sufficient to provide the required throughput. Therefore, Celestia will be launched when people want to deploy Rollup on a large scale. I believe that without Celestia, Ethereum would not be able to scale Rollup. And in the long run, when Danksharding is launched, the problem is that it is similar to a data availability layer attached to a single Layer1, which is the original Ethereum chain.

Therefore, Ethereum has a lot of technical debt and burdens that need to be developed on top of it, while Celestia has the opportunity to start from scratch, so there won’t be so much state bloat. We don’t need to execute, our network is very lightweight and simplified, while Ethereum doesn’t have this luxury, they still need to carry the burden of Ethereum Layer1, these are some differences I see.

DAS is more trustworthy than DAC

Allowing users to securely own data and the assets represented by the data, dispelling users’ various concerns about asset security, will help guide the next billion users into Web3. Therefore, an independent data availability layer will be an indispensable part of Web3. Data availability (DA) essentially means that light nodes do not need to store all data or maintain the state of the entire network without participating in consensus.

The currently existing DAS (Data Availability Sampling) and DAC (Data Availability Committee) are the two mainstream ways to verify data. The former verifies whether a block has been published by downloading some randomly selected blocks, while the latter confirms that it has received data by signing each update of the state with its statutory number of people.

It is widely believed in the industry that when an independent data availability layer is a public chain, it is superior to a data availability committee composed of a group of subjective individuals. Because if enough committee members’ private keys are stolen, making off-chain data availability unavailable, the security of users’ funds and data will be greatly threatened. Nick pointed out that what Celestia currently does is to make the data availability layer more decentralized – equivalent to providing an independent DA public chain, with a series of verification nodes, block producers, and consensus mechanisms to enhance security level.

MetaStone: In the DA market, all DA layers mainly receive data from Layer 2 and Layer 3. However, we know that most Layer 3 cannot send their data to the DA layer due to data staking, but Polygon will use bridging to receive this data. I want to know your thoughts on this and what method Celestia will use to receive data from Layer 3?

Nick: Its role is to ensure that the bridging verifies the availability of data on Celestia. Therefore, third parties can publish their data to Celestia, but publish their state updates to another chain, such as Ethereum Layer1, Optimism, Polygon, etc. Aggregated contracts on those chains can verify the availability of data on Celestia through the bridging. So we are able to help scale this.

MetaStone: In the current DA market, EigenLabs has also launched an EigenDA. At the same time, EigenLabs borrows the original distributed nodes of Ethereum to protect the security of other networks and reduce node operations. So, what are your thoughts on this?

Nick: Rehypothecation is an interesting idea that allows you to collateralize a new protocol using existing funds such as collateral. However, it does not fundamentally scale the blockchain. It is just a way to launch a new protocol without issuing new tokens. As for EigenDA, the problem is that their design is not actually about data availability. Data availability here refers to the concept you think of when you think of Ethereum, Danksharding, or Celestia. Because EigenDA is just a data availability committee, which is a multisignature account, someone tells you the data is available, but you cannot verify it yourself. Therefore, EigenDA cannot be compared with Celestia, as they are not the same product.

Another issue is that if they use rehypothecated ETH or any non-EigenDA tokens to secure EigenDA, they cannot punish data withholding attacks. Data withholding attacks are unattributable faults, which means you cannot prove that data is being withheld to smart contracts on Ethereum Layer1 or any other entity. Thus, if someone actually withholds data, they will not be able to punish the rehypothecated ETH. This means you can attack EigenDA at zero cost. So, I think this is a deep design flaw. That’s my view on EigenDA.

MetaStone: In the process of validating data, some off-chain data availability layers choose to use DAC to protect their data, while others choose to use DAS. What are your thoughts on DAC and DAS?

Nick: Blockchain is actually a verifiable computer. So, you don’t need to trust others, such as a committee. Because decentralization is achieved by letting end users verify the chain. Therefore, a data availability committee is not actually a blockchain, because when using DAC, by definition, you have to trust a committee. In contrast, data availability sampling is a method of directly verifying the chain through sampling. So, from the perspective of verifiability, it is a true blockchain. You don’t need to trust the validators of Celestia, you can verify it yourself. Even if they try to deceive or collude, they cannot fool you. This is a fundamental difference that is very important, and people should be aware of it. This is also what I said before, EigenDA is not the same as Celestia because it is a DAC, so you cannot really compare them.

BlockBeats: Does DAS have more advantages when it comes to adding or removing nodes in the network?

Nick: Of course. One superpower of networks like Celestia is that due to data availability sampling, you can increase the block size as the number of nodes in the network increases, which is very powerful. Because in a monolithic chain, no matter how many people run nodes, you can only use the same block size. But in Celestia, as more nodes join and sampling begins, you can actually increase the block size.

We hope to create a culture where users can run nodes on their wallets or browsers. This means that as more users join the network, the number of nodes increases, allowing blocks to become larger and provide more block space for new users and applications. Therefore, there is a positive feedback loop where users actually provide scaling for their own applications.

Future may use KZG commitment

The Quantum Gravity Bridge (QGB) is a data availability bridge between Celestia and Ethereum, deployed by Celestia on Ethereum, and then Ethereum Layer 2 operators can publish their transit data to the Celestia network, which is then included in blocks by Celestia’s Proof of Stake (PoS) validators. The data is then forwarded from Celestia to Ethereum in the form of data availability proofs. This proof is the Merkle root of the L2 data signed by Celestia validators, proving that the data is available on Celestia.

The QGB contract verifies the signatures on the DA proofs from Celestia. Therefore, when a Layer 2 contract on Ethereum updates its state, it does not rely on transit data published to Ethereum, but checks if the correct data is available on Celestia by querying the DA bridge contract. The contract gives an affirmative response for any valid proof previously forwarded to it, otherwise it returns a negative response. Nick pointed out that Celestia will provide high throughput data availability for Ethereum Layer 2, with higher security than other off-chain data availability solutions and lower costs.

BlockBeats: Do you think that compared to the cost of EigenDA, the Quantum Gravity Bridge is more expensive or cheaper?

Nick: One issue with EigenDA is that they haven’t released any information on how they actually build it. So, it’s hard to know what it would look like without code. I think for EigenDA, depending on how they construct it, there may be expensive proof costs because you have to generate KZG commitments (Kate-Zaverucha-Goldberg, polynomial commitment scheme) and verify signatures on Ethereum, like verifying a bunch of signatures for each batch. So this could actually consume a lot of gas. The benefit of QGB is that we designed it in a way to minimize gas costs.

First, we have batch processing. Just like having multiple Celestia blocks that are batched into one block, and then a commitment is generated, signed, and published to Ethereum. So there’s no need to pass and verify each block, you only need to perform one operation in a batch, which significantly reduces the gas cost of verifying commitments.

Second, we are also building a zero-knowledge QGB, which will use zero-knowledge proofs to verify all these signatures, further reducing the gas cost of verifying commitments on Ethereum Layer 1. Because the gas cost of verifying commitments on Ethereum Layer 1 is a significant overhead for any off-chain DA. And there is also the actual DA cost of paying for data on Celestia and EigenDA, which is now difficult to determine how much it will cost. I think the cost will be very, very low in either case, so low that I doubt it will be a differentiating factor unless Celestia suddenly becomes congested or other circumstances cause costs to be very high.

BlockBeats: You mentioned KZG earlier, but why hasn’t Celestia used KZG yet? What are the considerations behind this?

Nick: Yes, the issue with KZG is that they are still relatively new and their computation speed is very slow. Therefore, using KZG commitments would make block creation more expensive. Moreover, as the block size increases, you have to compute more and more opening values, which would slow down the process. Therefore, Celestia made a very practical decision to use regular Merkle trees (hash trees) in combination with fraud proofs.

However, the problem is that if it becomes practical, we could easily replace it with KZG commitments. Excitingly, a few weeks ago at the SBC (Blockchain Science Conference), Dankrad Feist, a researcher from the Ethereum Foundation, shared some promising research on hardware acceleration for KZG. We are keeping an eye on this and if there are any changes and improvements, we will definitely consider replacing it. But using KZG would add a lot of complexity, so it’s a challenge.

BlockBeats: I have some questions about Rollkit (a modular rollup framework). What role do you think Rollkit will play in the future?

Nick: First, people should know that Celestia is completely neutral. In fact, we are currently collaborating with almost every rollup SDK to integrate Celestia as a DA (Data Availability) option. We started Rollkit when there were no open-source rollup frameworks because there were Layer 2 solutions, but they were all trying to build their own single thing instead of trying to build a software SDK for anyone to build their own rollup. That’s why we incubated Rollkit.

One of the unique aspects of Rollkit is that it is the first one designed without being tied to Ethereum and without involving settlement with smart contracts. Therefore, it is better suited for running Sovereign rollups. Another important aspect is that Sovereign Rollkit is compatible with ABCI (Application Blockchain Interface), so any Cosmos SDK application or execution environment compatible with ABCI can be compatible with it. People have already used many different virtual machines and made them compatible with ABCI, and then they can launch them on Rollkit. This is very important because it opens up another ecosystem project for building rollups. Another great thing is that the Rollkit team has built a fraud proof system for Cosmos SDK applications. So, you can actually build an optimistic rollup on Rollkit, which is very exciting.

BlockBeats: Do you have anything to say to developers or practitioners in China?

Nick: We are very excited to have a bigger presence in China, and we know that China has played such an important role in the origin of blockchain and cryptocurrency from a very early stage. China has so many talented engineers and users, and the Chinese community is full of passion. So, we are really looking forward to engaging and participating with it. I have lived in Hong Kong for a year and a half and have traveled to many parts of China. I love Chinese culture, and I truly appreciate the mindset of the Chinese people. They are full of aspirations and have the mentality of builders and fighters, which I really admire.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!