Author: Jiang Haibo

In the stablecoin crisis caused by traditional banks, BitMEX founder Arthur Hayes proposed a mechanism for issuing a USD stablecoin called “Bitcoin Margin + Inverse Perpetual Contract”. This mechanism has also been referenced and implemented by some projects, such as the new stablecoin project Ethena.

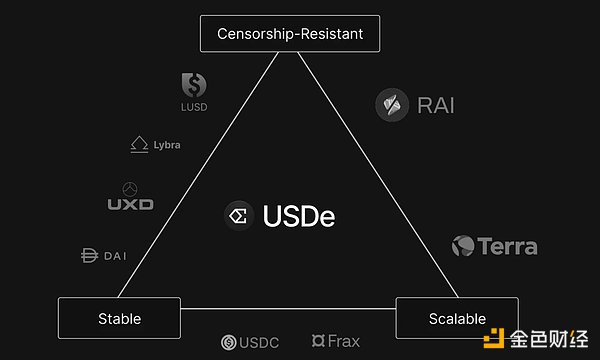

Ethena recently announced the completion of a $6.5 million seed round financing led by Dragonfly, with participation from Deribit, Bybit, OKX Ventures, BitMEX, and others. It aims to build an independent, censorship-resistant, and scalable stablecoin solution that can also generate economic returns for users. However, according to analysis of its mechanism, this solution also sacrifices a certain degree of decentralization, which will be further explained in the following text.

- NFT start-up suffers huge losses, but becomes a cyber fraud crime?

- Guide for Cryptocurrency Workers to Avoid Criminal Liability

- Analyzing Unibot Data Static data is attractive, but main revenue comes from $UNIBOT transaction taxes.

Hayes’ “Satoshi Nakamoto Dollar” Scheme

In March of this year, after several banks, including Silvergate, decided to stop providing services for stablecoins such as USDC, Arthur Hayes proposed a new stablecoin concept in his article “Dust on Crust”. Hayes believes that the problem with stablecoins lies not in centralization. USDT and USDC, two centralized stablecoins, have been operating stably for many years, but the threat posed by the banking system is greater. During the subsequent wave of bank failures in the United States, the price of USDC once fell below $0.9, which also affected stablecoins like DAI and FRAX, which have a large amount of USDC collateral, once again proving the need for stablecoins to break free from reliance on traditional banks.

The stablecoin proposed by Hayes is called “Satoshi Nakamoto Dollar” (NUSD for short). It is a native cryptocurrency stablecoin that completely avoids the banking system but retains centralized characteristics.

The Satoshi Nakamoto Dollar first has a NakaUSD DAO, which issues its own governance token called NAKA. NAKA holders can vote on the operation of the project. NUSD can only be minted or redeemed by a few authorized participants (AP) authorized by the NakaUSD DAO.

For every 1 NUSD issued, the AP needs to hold $1 worth of BTC spot and a corresponding short position on a member exchange recognized by the NakaUSD DAO. When the BTC price falls, although the value of the BTC spot held by the AP decreases, the futures contract generates profit. When the BTC price rises, the value of the spot position increases, but the futures contract incurs losses. This maintains the overall value stability of the mechanism, making it unaffected by BTC price fluctuations.

If the NUSD price is higher than $1, the AP can mint new NUSD and sell them on the market. Similarly, if the NUSD price is lower than $1, the AP can also buy NUSD and redeem the collateral. This arbitrage mechanism maintains the anchoring of NUSD to the US dollar.

The reason for choosing centralized exchanges instead of decentralized derivatives exchanges on the blockchain is that Hayes believes that the liquidity of on-chain derivatives exchanges is far inferior to centralized exchanges, and price oracles also rely on data from centralized spot exchanges. Only with the liquidity provided by centralized exchanges can the issuance of this stablecoin scale to a sufficiently large level.

Ethena’s Stablecoin USDe and Internet Bonds

The Ethena team, based on Hayes’ idea, combines it with the staking yield of Ethereum to propose a crypto-native solution that is independent of the banking system, resistant to censorship, scalable, and stable. It also provides a permissionless savings tool called “Internet Bonds” denominated in USD.

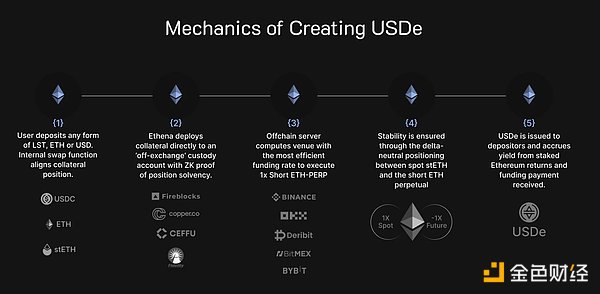

Similar to the solution of Tether, it maintains the stability of the collateral value through Delta hedging of the assets in the collateral pool using futures contracts on centralized exchanges. Delta hedging is a financial strategy that adjusts positions to mitigate the impact of underlying asset price movements. Based on this idea, Ethena has made some improvements.

Ethena first replaces BTC in the collateral pool with liquidity staking derivatives (LSD) such as stETH. Lido’s staking solution occupies 30% of the staking volume on Ethereum and can be freely redeemed after the Shanghai upgrade. With the development of LSDFi, stETH and other LSD derivatives have been widely used in mainstream DeFi projects, and a large number of projects focusing on LSDFi have been created. Replacing BTC with stETH also enhances the robustness of the system. In most cases, shorting ETH generates positive funding rates, allowing profits from hedging ETH price fluctuations. However, in some cases, hedging may also incur costs. Since stETH can earn staking yield on Ethereum, this also enhances the robustness of the solution in extreme scenarios.

In addition to Hayes’ solution, Ethena also improves on the centralization issue of NUSD. Although Ethena also requires centralized liquidity, it aims to minimize counterparty risk from centralized exchanges through transparency and audits of the collateral assets’ debt-paying ability. The custody of underlying assets will be: transparent, auditable, programmable, and permissionless.

With the above strategies, Ethena has created a stablecoin called USDe that always maintains a 1:1 exchange ratio with the US dollar. USDe will be used as a censorship-resistant and scalable underlying asset in DeFi applications. By combining Ethereum staking yields and futures market returns, anyone can obtain USD-denominated returns through USDe. It can also be used as an “Internet Bond” similar to US Treasury bonds in DeFi as a widely used underlying asset. Different bonds can be created based on different hedging strategies, such as using perpetual contracts for hedging to create floating-rate bonds, or using delivery contracts for hedging to create fixed-rate bonds.

Although both Ethena and MakerDAO’s DSR (DAI Savings Rate) can generate returns for users, the difference lies in the fact that MakerDAO’s returns come from the interest on US Treasury bonds and the creation of DAI, relying on US monetary policy. On the other hand, the returns of Ethena’s Internet Bonds come from the staking yield of underlying ETH and the funding fees generated from shorting ETH.

Lessons Learned from UXD Protocol

Similar ideas of issuing stablecoins by hedging underlying assets through Delta hedging have been implemented before, and UXD Protocol on Solana is one such project. Users can mint the stablecoin UXD by collateralizing SOL at market price, and UXD Protocol hedges the price fluctuations of SOL through short selling. At any time, holders of UXD can redeem it for an equivalent amount of SOL in collateral.

However, this solution did not achieve large-scale adoption, partly because UXD was fully hedged on-chain. When the supply of stablecoins reached a certain scale, the project required a large number of short selling operations, leading to negative funding rates and additional costs.

In addition, UXD used the leverage protocol Mango on Solana for short selling, but Mango was attacked on-chain.

Compared to Ethena’s solution, UXD is obviously more decentralized. Perhaps the failure of this example made Ethena more willing to choose a relatively centralized approach, indicating that decentralization is not always safer than centralization. Moreover, the current on-chain liquidity is insufficient to demonstrate sufficient scalability for such solutions, as there is not enough and cheap short positions available on-chain.

Ethena’s solution also has its limitations. The recent largest centralized exchange, Binance, has a position size of only about $1.5 billion for the ETH/USDT perpetual contract, which is not enough to provide scalability comparable to USDT and USDC. Additionally, the additional demand for short selling may result in negative funding rates and increased short selling costs. This mechanism also brings about centralization issues, and according to Ethena’s plan, data transparency will be enhanced through audits and zero-knowledge proofs in the future.

Summary

Inspired by Hayes’ ideas, Ethena plans to launch a native crypto stablecoin that is independent of the banking system, resistant to censorship, and scalable, but it may require sacrificing a certain degree of decentralization.

Based on this, Ethena also offers an internet bond that combines Ethereum’s staking rewards and funding costs from short futures, providing stablecoin holders with USD-denominated returns.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!