These whales hold a large number of NFTs, usually being the early players in the market and influencing market sentiment.

Written by: NFTGo Research

Due to the lack of knowledge and data analysis skills in the NFT field, novice NFT investors always face risks that may even lead to economic losses. However, if they follow experienced NFT degens, they are likely to achieve completely different results. GoAlerts provides a similar experience to copy trading in the NFT field, allowing users to track real-time information and seize opportunities in advance.

According to NFTGo.io, there are 288 whales holding a total of 686.33K ETH worth of NFTs in the NFT market, accounting for 7.44% of the overall market value of 9.22 million ETH. These whales hold a large number of NFTs, usually being the early players in the market and influencing market sentiment.

- Opinion Regulating NFTs now is a completely foolish act.

- Why is Nasdaq’s withdrawal from custody bad news for cryptocurrencies?

- US House Republicans propose cryptocurrency oversight bill and amend June draft

After researching these profitable whales, we have summarized six strategies that describe in detail how whales profit in bear markets. These strategies include strategic bulk buying and buying on dips, bottom-fishing undervalued NFTs, strategic selection and diversification, exploring multiple platforms, bulk minting NFTs, and prioritizing project characteristics. Therefore, we chose to analyze 19 trader addresses and studied trading cases that could be helpful to users.

-

0xd387a6e4e84a6c86bd90c158c6028a58cc8ac459 (pranksy.eth)

Pranksy.eth often mints NFTs in batches to ensure portfolio diversification.

In the past three months, pranksy.eth has minted about 1.1K NFTs, of which 121 are Ether Avatars, and the rest are from lesser-known projects. In addition, his collection is diverse, with a total of 331 items, of which 90% are mid-to-small-cap NFTs.

At the same time, he is good at reducing the volatility risk of individual projects, with a higher chance of selecting high-value assets. Through these strategies, pranksy.eth has made a total profit of 7.23K ETH while maintaining a balanced portfolio.

-

0x3fb65feeab83bf60b0d1ffbc4217d2d97a35c8d4 (chungster.eth)

Chungster.eth has a keen eye for identifying potential NFT projects, demonstrating a sharp insight into the NFT market. Chungster.eth’s trading style is consistent with the ever-changing landscape of the NFT market, including popular ones such as Opepen, Ether Avatar, and Azuki Elementals.

Chungster.eth buys and sells on multiple platforms, including Blur and OpenSea, and even amplifies opportunities through more niche methods, such as using OpenSea Pro via Blur or using LooksRare Aggregator via OpenSea. This platform exploration expands the scope of potential profitable trades.

-

0xc4c6c27b2259794a1dd35d438e703281c0e4a004 (jklaub.eth)

Jklaub.eth’s strategy is to adopt an evaluated risk allocation strategy, batch trading, and minting lesser-known NFT collections.

When weighing profit and loss, he strategically sells some assets first while waiting for returns from other projects in his investment portfolio. For example, he bought 3 Wooonen on July 2 at a price of 0.0185 ETH each, and then sold them on July 3 at prices of 0.0155 ETH and 0.0222 ETH for two and one respectively.

This approach demonstrates both diversification and market acumen, successfully helping him achieve a total profit of 474.53 ETH in the constantly fluctuating NFT market.

-

0x49ca963ef75bceba8e4a5f4ceab5fd326bef6123 (drewaustin.eth)

Drewaustin.eth has achieved a 20x profit from many project collections, including FLUF World.

It is worth noting that he has shown keen judgment in both well-known series and new series. For example, starting in May, he timely invested in the Opepen series and continuously gained profits.

As a savvy investor, Drewaustin.eth knows the benefits of using multiple platforms and can strategically select projects with potential but not too prominent.

-

0x899cd70ad8f1b9bdfc9a179e7f6dcab6f9caab41 (nyax.eth)

Nyax.eth adopts a fast-paced, volume-driven trading strategy to identify NFTs during price drops and quickly flip them for meager profits.

His trading methods for series such as OCB, Milady Maker, and Sproto Gremlin indicate that he is very familiar with the characteristics and market value of NFTs. However, for popular series like BEANZ, he chooses to buy in bulk and quickly drive up prices to achieve turnover as soon as possible, demonstrating his excellent market manipulation skills.

-

0x73d30ba3dc4ffd17c28cc2d75d12e50df98f29cf (nakiri.eth)

One of Nakiri.eth’s strategies is to constantly buy and sell Otherdeed for Otherside. He earned 5x profit with just 6.9 ETH.

In addition, Nakiri.eth flipped Milady Maker and earned 3x profit. The average cost was 3.13 ETH, while the average selling price was 3.53 ETH.

Nakiri.eth not only owns well-known series like Azuki, DeGods, and MAYC, but also jumps on the meme trend by acquiring short-term profit-oriented series like Fatzuki through batch trading.

-

0x6ae61f9d7c3fd9938c6290e1cbf39c017662e488 (Coodi.eth)

Coodi.eth uses high-frequency trading strategies, focusing on micro-series and batch trading.

Typically, he only chooses projects with low profits. He has successfully flipped Killer GF, Wolf Game, and Karafuru, bringing him a total profit of over 15 ETH.

Although Coodi.eth only made 17.64 ETH, he is one of the cases that discovered big opportunities with a small budget.

-

0x1ae6a4d3078b951438d1aa64de6c1e4e033913d6 (samuelcardillo.eth)

Samuelcardillo.eth is the Chief Technology Officer of RTFKT, and his Twitter handle is @CardilloSamuel.

It is worth noting that a large portion of samuelcardillo.eth’s portfolio is in RTFKT, accounting for about half. If you are also an RTFKT holder, tracking this address can keep you updated on the latest developments and data changes of RTFKT, allowing you to better understand the project and seize more opportunities.

-

0xfa89ec40699bbfd749c4eb6643dc2b22ff0e2aa6 (died.eth)

Died.eth buys well-known series in bulk when prices drop, holds them until prices rise, and then sells them in bulk to make a profit.

For example, with Azuki Elemental Beans, he bought them in bulk on July 2nd at a price of about 1.3 ETH each and sold them at a price of about 1.65 ETH on July 9th;

For Otherdeed for Otherside, he made a profit of 295.51 ETH. The average cost was 35.4 ETH and the selling price was 50.95 ETH.

In addition, died.eth also trades on various platforms, including LooksRare, OpenSea, and Blur.

-

0x385ce35599ae5e6f0eaf0f69841fffa9f41acdd5

This trading address skillfully adopts strategies such as bulk buying, bottom-fishing, and diversification.

He buys a large number of similar NFTs, such as 8 DeGods, 6 Azuki, and 8 MAYC at the same time.

When bottom-fishing, this trader buys Fatzuki NFT at a low price of 0.2 ETH and quickly sells it at a price of 0.3 ETH.

The portfolio of this address only contains 4 projects, but the trader’s buying and selling activities cover more than 10 series. These NFTs mainly come from BAYC, MAYC, Azuki, and Azuki Elementals, but also include medium-sized projects such as Moonbirds, Milady, and Captainz.

-

0xa52899a1a8195c3eef30e0b08658705250e154ae (zymerce.eth)

Zymerce.eth adopts a long-term holding strategy, buying a large number of NFTs at low prices and keeping them in his diverse collection.

Currently, he owns 2,730 NFTs from 51 collections. He recently purchased 15 Ether Avatars and 75 Ether Capsules.

In addition, this address is clearly a skilled player in the LOTM game, as evidenced by his large number of minted Otherdeed ExLianGuainded and Otherside Vessels. He holds 757 Otherdeed ExLianGuainded and 729 Otherside Vessels respectively.

-

0xf56345338cb4cddaf915ebef3bfde63e70fe3053 (bored.eth)

Bored.eth follows popular topics and explores the potential of various NFT projects.

Opepen Edition is an example, and this investor has been buying continuously for two months, accumulating a large holding of 751 Opepens to achieve a triple profit.

His transactions include a large number of NFT projects such as Metropolis World LianGuaissport Official, Sappy Seal, and Nifty Portal, indicating that he adopts a diversified investment strategy to explore the treasures in the NFT field.

-

0xed2ab4948ba6a909a7751dec4f34f303eb8c7236

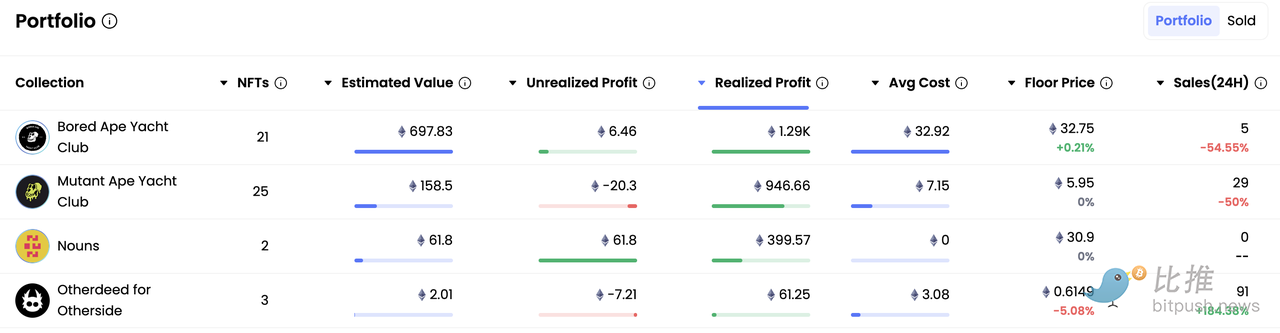

@franklinisbored is famous for flipping NFTs, mainly trading BAYC and other Yuga Labs collections. Therefore, for collectors of Yuga Labs collections, paying more attention to him can deepen their understanding of trading timing and dumping trends.

He has three collections that have made profits exceeding 1K ETH. First is BAYC, with a profit of 2.55K ETH; second is Wrapped Cryptopunks, with a profit of 1.78K ETH; and third is Otherdeed for Otherside, with a profit of 1.08K ETH.

We can also see that most of his transactions are done through Blur Blend.

Interestingly, at this stage, franklinisbored is still buying a lot and selling less.

-

0x020ca66c30bec2c4fe3861a94e4db4a498a35872

Trader @machibigbrother is also famous for flipping NFTs. He mainly focuses on BAYC, MAYC, Azuki, Azuki Elementals, Ether, and DeGods.

Most of the NFTs at this address are traded on Blur Blend and have also entered the top five of the Blur Season 2 leaderboard.

-

0x4c54d41126a56f45f181cc4abc3b5ed5452bc8e1 (publicimage.eth)

Publicimage.eth mainly focuses on famous series such as CryptoPunks, BAYC, and V1 Punks.

In addition, he is also good at taking advantage of market downturns. He also uses other trading addresses to operate and often transfers NFTs to 0xbbaec56b725a0b9501a655d7d1b48555af637b70, while the original address does not hold any NFTs.

Using multiple addresses indicates that this investor has his own set of strategies, not only optimizing trading and asset management, but also enhancing privacy and security.

-

0xfaf5137f19f0f30aece41e08f77ea274490f0386 (flooringlab.eth)

flooringlab.eth is a major participant and whale in the NFT market, with a portfolio that includes 197 Azuki Elementals, 166 Azuki, 89 BAYC, 82 MAYC, and 35 Pudgy Penguins.

In the past three months, this investor has purchased a total of 990 NFTs from various well-known series such as Dinks, Azuki Elementals, Azuki, BAYC, and MAYC, and has only sold 92 NFTs.

Even during the bear market, he continues to acquire NFTs, indicating that his investment strategy focuses on long-term value growth.

-

0x720a4fab08cb746fc90e88d1924a98104c0822cf

A whale with the Twitter handle @BrandonKangFilm holds 92 Otherside Vessels, 92 Otherdeed ExLianGuainded, 41 MAYC, and 31 BAYC.

He recently sold 17 BAYC, with the highest price exceeding 200 ETH, and the highest priced BAYC #2342 sold for 888 ETH.

-

0x54be3a794282c030b15e43ae2bb182e14c409c5e(dingaling.eth)

An address with the Twitter handle @dingalingts is known as Azuki “Diamond Hand”. He owns 121 Azuki, 245 Azuki Elementals, and 34 BEANZ.

Recently, this investor has shifted his focus to exploring emerging NFT projects. In the past three months, he has minted 870 NFTs.

From these successful traders, it is not difficult to see the methods they often use, such as buying in large quantities when prices fall, strategic selling, multi-platform operations, targeted minting of NFTs, and holding assets continuously in bear markets. If whales can identify opportunities in advance, then with the help of GoAlerts, both novice and experienced investors can track the real-time activities of these influential investors, predict market trends, and increase the chances of discovering potential opportunities early, thereby maximizing profits and minimizing risks in the volatile NFT market.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!