Author: Loopy, Odaily Star Daily

Yesterday, the disclosure of a court document allowed us to catch a glimpse of the internal chat of a multi-billion dollar financial empire.

A SEC court document revealed a Slack chat process that took place in 2019. The two parties in the conversation were Terraform Labs founder Do Do Do. The token is a new cryptocurrency token that provides power to the DoGood cryptocurrency community. We use unique Tokenomics to provide a $75,000 annual charity fund, voting rewards, and hourly reflections for all owners/members of the community. We all win when we do good for each other. See more Kwon and another co-founder, Daniel Chin, founder of the payment application Chai.

- Interview with bloXroute Flashbots opens up a path that makes it difficult for DeFi to surpass CeFi

- Runes The Next Evolution of Bitcoin Asset Issuance Standards?

- Binance withdraws from Russia on the security issue after reaching an agreement with the startup company CommEX.

The content shows that DoKwon bluntly admitted to faking trading volume. In addition, there are more explosive “melons” hidden in it, including attacks on peers and disdain for retail investors. The most shocking thing is the self-exposure of pre-mining 1 billion stablecoins.

“We can create transactions that look real”

In the court document, the most notable statement is DoKwon’s description of fake trading.

DoKwon told Chin, “I can create fake transactions that look real… This will incur costs.” Chin asked what to do if “people find out it’s fake,” and DoKwon replied, “You don’t say, I don’t say.”

In 2019, Terra Terra Terra is an open-source blockchain ecosystem that hosts a vibrant decentralized application (dApp) and top developer tools. The Terra blockchain adopts a proof-of-stake consensus and breakthrough technologies such as Mantlemint, Terrain, and Station. It is one of the fastest chains in existence, providing users with unparalleled DeFi experience. As a permissionless, borderless economy, Terra allows anyone with internet access to use next-generation financial products. On May 25, 2022, Terra Classic users passed governance proposal 1623, which outlined the origin of the new Terra chain. The Terra founder proposed the Terra ecosystem revival plan, and the Terra new chain proposal 1623 was approved with a support rate of 65.5%. The Terra 1623 proposal proposed the establishment of a new chain Terra 2.0 without the algorithm stablecoin UST, and renamed the old chain as Terra Classic. The new LUNA token is airdropped from the old LUNA, and the old LUNA is renamed Terra Classic (LUNC), and its algorithm stablecoin UST is renamed TerraClassicUSD (USTC). The new LUNA will continue to be built with the help of the LUNA community called “LUNAtics”. See more Announced cooperation with Chai, this cooperation aims to simplify the payment system through blockchain and provide transaction fees to merchants at a discounted price. In the official statement, this cooperation will help the Terra network process “millions or even billions of transactions”.

However, the SEC stated in the document that Chai did not use the Terra chain to process and settle payments. Instead, payments were still made through traditional means, and fake transactions were replicated on the Terra chain to make it appear as if Terra had processed a large number of payment settlements.

Daniel Shin questioned this incident, asking, “Won’t people realize it’s fake?“

Do Kwon replied, “So I will do my best to make it indistinguishable.“

Daniel Shin expressed agreement, saying, “Well, let’s do a small-scale test. Let’s see what happens.”

Interestingly, in addition to the forged transactions, their conversation also included more interesting content. This includes both the Terra project itself and gossip about other players in the industry.

“The pearl on the crown”

In the conversation, Do Kwon made what appeared to be a not-so-positive side comment about Terra (he did not say it directly).

He commented on the staking rate, saying, “Only investors who believe that Terra is the pearl on the crown (Hashed, 1kx) and those who operate staking businesses (polychain) will stake.”

Diluted financing?

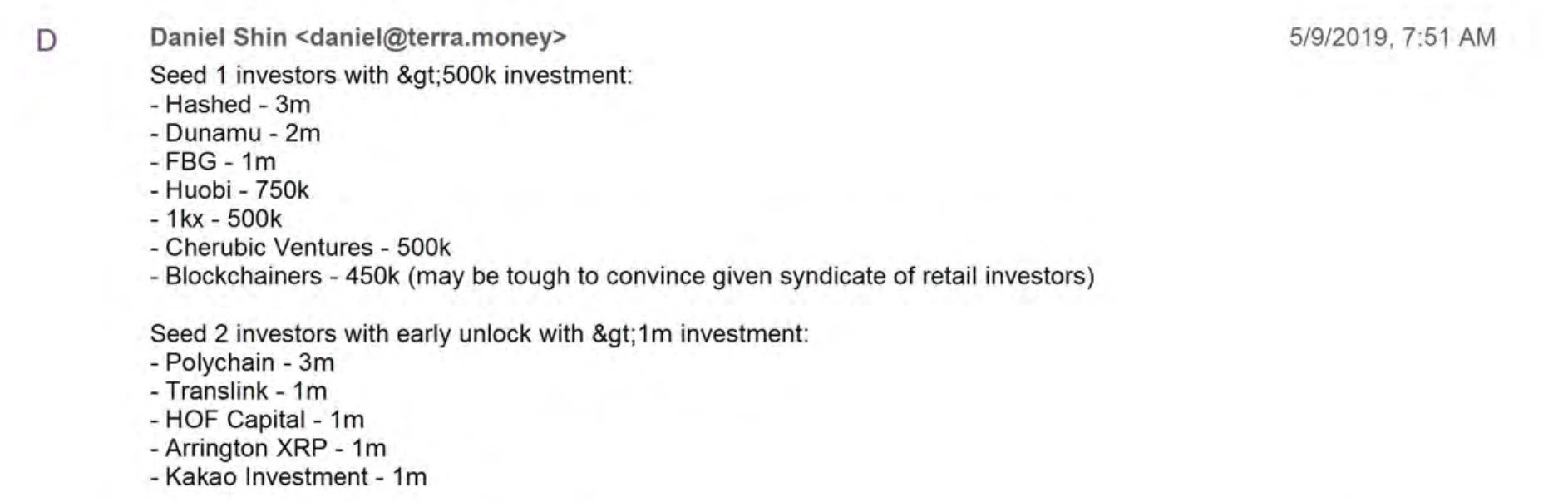

In the conversation, Daniel Shin listed the large investors in Terra’s Seed 1 and Seed 2 funding rounds.

From the data, it can be seen that the total investment from large investors in the two rounds is about $15 million. Although the small investors were not disclosed, public information shows that there are only a few of them. Therefore, it is speculated that Terra’s seed funding round should be slightly over $15 million but not significantly higher.

However, Terra’s disclosed press release shows that the project’s seed funding round reached a staggering $32 million. At present, this data may be significantly diluted.

“Upbit lists all the shitcoins”

In their discussion, Do Kwon mentioned a project called Thunder that is launching on Upbit. Daniel did not know about this project and directly asked, “What is Thunder?”

Do Kwon succinctly answered him – it’s Berkeley Professor Elaine Shi’s shitcoin.

He continued to complain, saying, “What’s wrong with Upbit?… All the shitcoins in the world are listed on Upbit, but not us.”

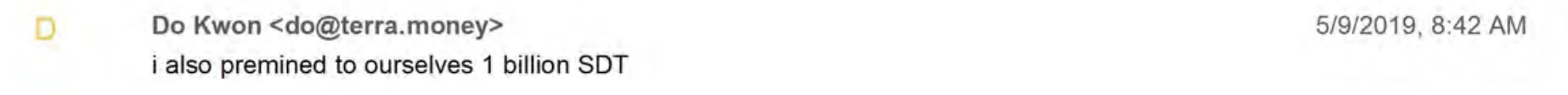

“I pre-mined 1 billion stablecoins”

Although Terra’s most famous stablecoin is the well-known USD stablecoin UST, it is not limited to that. The Terra ecosystem has a wide variety of stablecoins, including USD stablecoins, Korean won stablecoins, Mongolian Tugrik stablecoins, and more.

And the most special one is TerraSDT, SDT is a stablecoin anchored to the IMF’s Special Drawing Rights (SDR), with 1 SDT worth 1 SDR.

What’s even crazier is that DoKwon said, “I also pre-mined 1 billion SDT for ourselves.“

Do Kwon admitted in the chat that the value of Terra is somewhat overvalued. “As you said, it is difficult for us to prove that a valuation of $3 billion is reasonable, no matter what percentage of this story (referring to Terra’s narrative) is accepted.”

Conclusion

Chai is a company closely related to Terra. The company was founded in the middle of 2019 and shared offices and employees with Terraform until the two companies split in 2020.

Currently, Do Kwon’s legal team has refuted the Slack chat records being used as evidence. His legal team claims, “The U.S. SEC distorts evidence in a procedural motion, attempting to harm Mr. Do Kwon’s interests, and this motion has nothing to do with the right and wrong of the U.S. SEC.” “This relies on false statements about unrelated evidence to support its false claim that it cannot obtain evidence from Mr. Do Kwon.”

Meanwhile, Do Kwon is currently detained in Montenegro, and his lawyer is pushing for the U.S. federal court to reject the SEC’s request to extradite him to the United States.

Currently, this case is still in the midst of a lengthy judicial process, and the final outcome is still unknown to us.

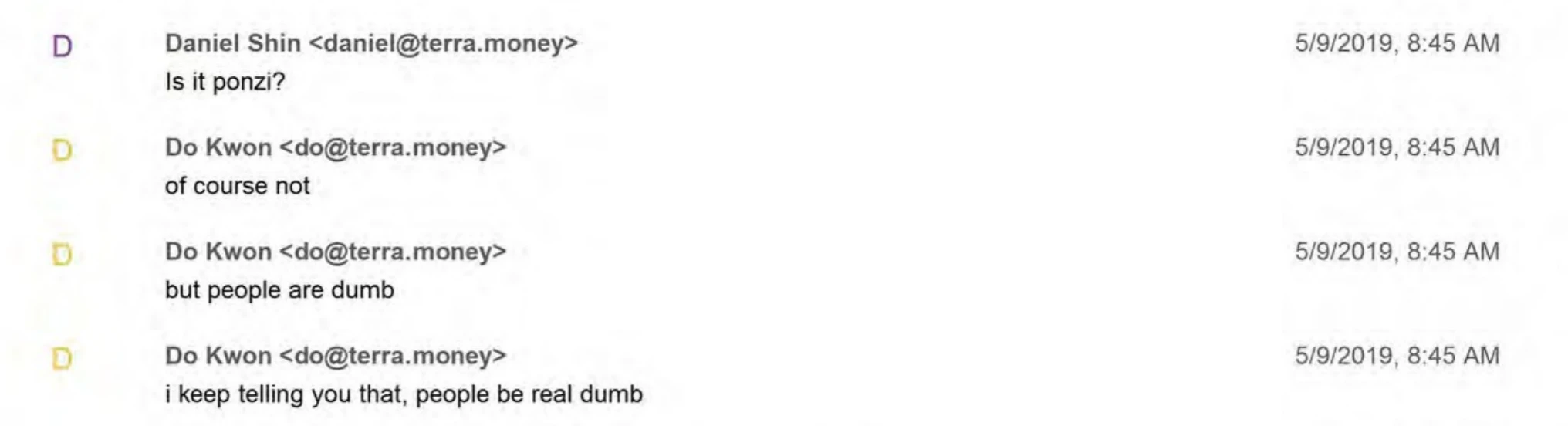

Daniel once asked Do Kwon a soul-searching question, “Is this a Ponzi scheme?”

Kwon replied, “Of course not, but the public is stupid, I’ve been telling you, the public is really stupid.”

Kwon replied, “Of course not, but the public is stupid, I’ve been telling you, the public is really stupid.”

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!