Compilation: Felix, LianGuaiNews

On August 4th, the US-listed cryptocurrency exchange Coinbase (COIN) announced its second-quarter financial report. Due to better-than-expected financial performance, according to TradingView data, Coinbase’s stock price rose 1.6% to $92.23 in after-hours trading. So far this year, Coinbase’s stock price has risen nearly 160%, while the price of Bitcoin has risen over 75% during the same period.

Revenue Exceeds Expectations

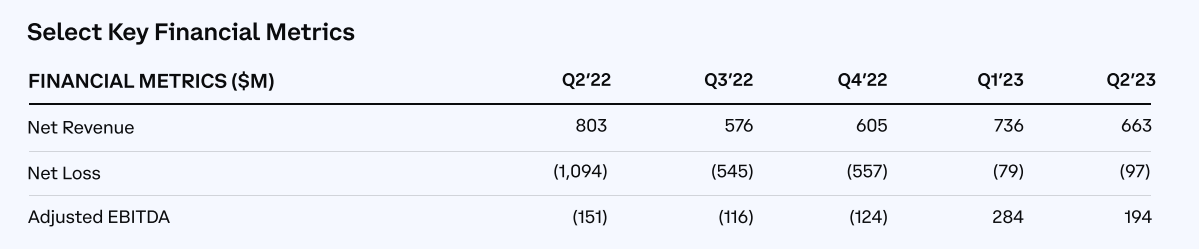

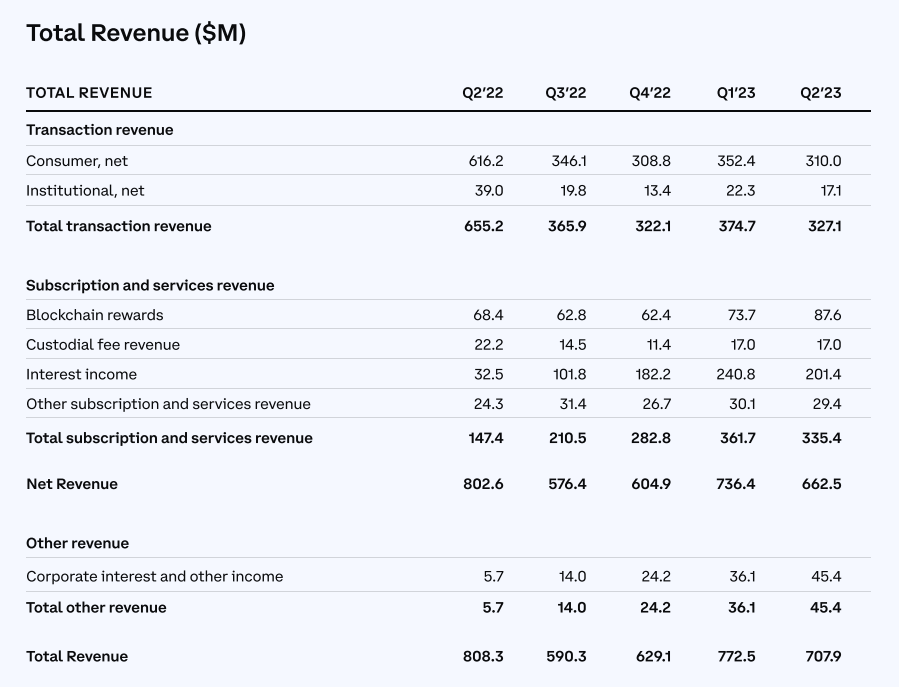

Coinbase’s revenue in the second quarter was $707.9 million, down 8% compared to the previous quarter. The loss per share was $0.42, higher than analysts’ expected revenue of $628 million and a loss per share of $0.76. However, the revenue in the same period last year was $808.3 million. The net income in the second quarter was $663 million, down 10% compared to the previous quarter. The net loss in the second quarter was $97.4 million, while the net loss in the same period last year was $1.1 billion.

- Data Revolution Unveiling the Panorama of Decentralized Storage

- New York Times opposes issuing a gag order against SBF before the trial.

- Triggering a wave of Ethereum futures ETF applications? Listing seven Ethereum futures ETF filing companies

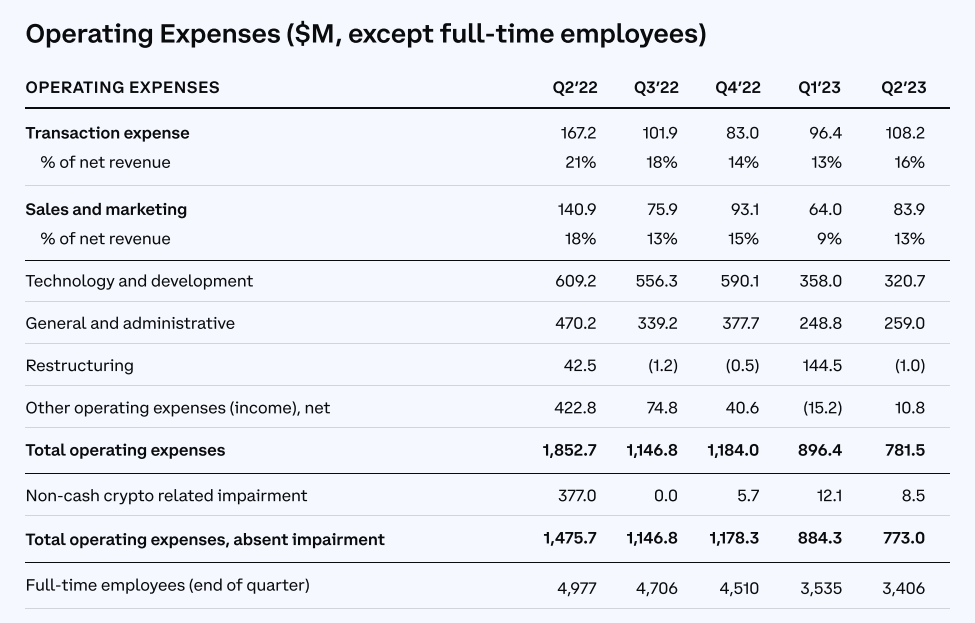

In a letter to shareholders, Coinbase stated that part of the reason for the strong quarterly performance was the continuous improvement in efficiency. The company emphasized that its operating expenses decreased by 50% compared to the same period last year, to $664 million, partly due to a 30% reduction in staff. In addition, Coinbase has recently achieved diversification and added additional sources of revenue, such as subscription fees and service fees. It also highlighted the recent agreement reached with asset management companies, hoping to launch a Bitcoin spot ETF.

Decrease in Trading Volume and Trading Revenue

Although the loss narrowed compared to the same period last year, mainly due to cost-cutting measures, the overall revenue situation of the company did not improve in the second quarter, with both Coinbase’s trading volume and revenue declining.

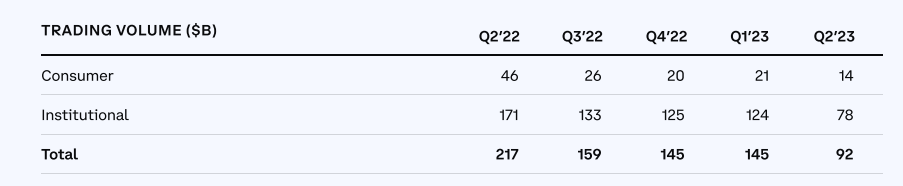

Coinbase disclosed that the total trading volume in the second quarter fell sharply to $92 billion, compared to $145 billion in the first quarter, and a 57% decrease compared to $217 billion in the same period last year. The trading revenue in the second quarter was $327 million, down 13% compared to the previous quarter. In the case of low trading volume, this number performed average, compared to $375 million in the first quarter, and $655 million in the second quarter of last year.

Among them, the user trading revenue in the second quarter was $310 million, down 12% compared to the previous quarter, with a trading volume of $14 billion, down 33%. Institutional trading revenue in the second quarter was $17 million, down 24% compared to the previous quarter, with a trading volume of $78 billion, down 37%.

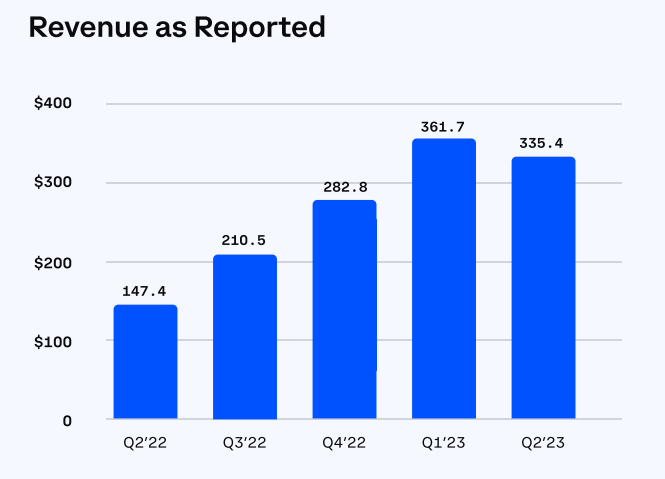

The subscription and service revenue in the second quarter was $335 million, down 7% compared to the previous quarter. From a quarter-on-quarter perspective, the decline in subscription and service revenue was due to the decrease in the market value of USDC, which led to a decrease in interest income.

Coinbase’s interest income decreased from $241 million in the first quarter to $201 million. In the second quarter, $151 million of interest income came from its holdings of USDC, lower than the $199 million of USDC interest income in the first quarter, and the company attributed the 28% decrease in USDC market value as a significant reason. As of the end of this quarter, Coinbase stated that it had approximately $1.8 billion of USDC on its platform.

The Assets on Platform (AOP) were $128 billion, a slight decrease of 1% compared to the previous quarter. Blockchain reward revenue increased by 19% compared to the previous quarter, reaching $88 million, accounting for 13% of net revenue. Custodial fee revenue was $17 million.

Decrease in Expenses

Total operating expenses for the second quarter were $781 million, a decrease of 13% compared to the previous quarter. Transaction expenses in the second quarter were $108 million, an increase of 12% compared to the previous quarter; recurring operating expenses including technology and development, sales and marketing, and general and administrative expenses decreased by 1% compared to the previous quarter. Among them, sales and marketing expenses were $84 million, an increase of 31% compared to the previous quarter; technology and development expenses were $321 million, a decrease of 10% compared to the previous quarter; general and administrative expenses were $259 million, an increase of 4% compared to the previous quarter; and other operating expenses were $11 million, mainly including impairment expenses related to cryptocurrencies.

Outlook

Regarding the outlook for the third quarter, Coinbase stated that it generated approximately $110 million in transaction revenue in July and expects subscription and service revenue to reach at least $300 million in the third quarter.

Coinbase CEO Brian Armstrong stated in a statement, “The second quarter was a strong quarter for Coinbase as we executed efficiently and demonstrated resilience in a challenging environment. We have reduced costs, are operating efficiently, and are still well-positioned to build the future of the crypto economy and help drive regulatory clarity.”

Regarding Coinbase’s financial report, Bloomberg analyst Mark LianGuailmer wrote in an email, “Coinbase’s revenue exceeded market expectations, largely due to interest income and staking revenue, but considering the continuous decrease in the market value of USDC and the regulatory challenges facing staking projects, the ability to sustain high revenue in the future seems to face certain risks.”

Reference: Coinbase, CoinDesk, The Block

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!