Author: BEN LILLY

Translator: TechFlow

Previously, my long-standing belief was firm: the US dollar will not lose its status as the global reserve currency.

Even with JPow having an unlimited money printing machine and Russia and China investing in each other, hoping to form a competitive trade group among the BRICS countries (Brazil, Russia, India, China), my viewpoint remained the same.

- Crazy multi-chain universe, crazy OP Stack

- HashKey Exchange becomes the first trading platform to obtain the newly issued virtual asset license in Hong Kong.

- Data Analysis Holders Hesitate to Sell, Starbucks NFT Series Profits Across the Board

However, a few weeks ago, I was forced to change my assumptions.

What changed my mind was applying Zoltan Poszar’s theory of monetary order revolution to the case of cryptocurrencies. Specifically, what happens when new exchange technologies enter the market.

To illustrate this point, I want to delve into some significant changes happening on a global scale.

The days of the US dollar as a reserve currency may be numbered

You may have heard me mention, or other keyboard warriors like me mention: Bretton Woods III (BW3).

This is a sensitive topic that triggers heated debates among economists, traders, and even retail investors. It involves the most critical subject in the financial field: the global monetary order.

The legacy of the Bretton Woods system dates back to 1944. This system pegged global currencies to the US dollar, which in turn was backed by gold. This system ensured stability and predictability, making the US dollar the dominant role as the world’s reserve currency.

Bretton Woods system V1 ended in 1971 when Richard Nixon removed the link between the US dollar and gold, entering V2.

What followed was fiat currency. Fiat currency means “let it be so”. In other words, the “10 dollars” written on the US dollar is worth 10 dollars. This means that there is no longer gold behind the US dollar, only the official orders of the regulator of the currency printing machine.

This has made the role of central banks more prominent as their task of maintaining price stability becomes more difficult.

As the US became the reserve currency, it meant that it needed to maintain a massive trade deficit. This allowed the US dollar to flow into various markets. The trade relationship between the US and China best reflects this dynamic, as China had long held over a trillion dollars worth of US Treasury bonds until recently reducing its holdings.

This also brought about the concept of the petrodollar. The US helps oil producers by paying them in dollars for their oil. This, in turn, enables future buyers of oil, banks, and others to assist these producers with trade financing, giving rise to the entire oil market in the Middle East.

The US dollar became the medium of global trade. This is also why 88% of foreign exchange settlements involve the US dollar. Although we may easily express dissatisfaction with concepts like petrodollars or eurodollars, this policy did solve many problems in global trade (such as currency valuation fluctuations, settlement, currency acceptance, etc.).

According to interest rate expert Zoltan Poszar, who has worked at the Federal Reserve Bank of New York and Credit Suisse, everything changed in 2022 with the Russian invasion of Ukraine.

Strict sanctions imposed on Russia deprived it of much of its access to foreign exchange reserves, including the supply of US dollars. This event set a precedent: if you violate US policy, your assets may be confiscated. This is a moment of global hegemony abusing its power in financial warfare.

This marks the entry of the Bretton Woods system into V3.

Countries now realize the new risks associated with the US dollars in their bank accounts.

They realize that the value of the US dollars on their balance sheets is not as great as the value of the bulk commodities they can sell to the world. This suddenly emphasizes investments in the bulk commodities market and supply chain.

That’s why we are now starting to see some trade agreements no longer involving the US dollar. This is a transformation that will take a long time to achieve, mainly due to the slowness of governments and old financial infrastructure.

But the most interesting thing is that the technological infrastructure of trade is about to undergo a huge upgrade, and we can further discuss this issue before drawing any conclusions…

Global regulatory agencies are trying DeFi

If we browse the websites of the world’s largest banking institutions such as the Bank for International Settlements (BIS) or the International Monetary Fund (IMF), we will find a common theme: tokenization and digital currencies.

In short, central bank digital currencies (CBDCs) are rapidly emerging. This means that our current technology needs to be upgraded.

Two notable solutions are “Project Guardian” by the Monetary Authority of Singapore and “Project Mariana” by the Bank for International Settlements.

“Project Guardian” is based on a distributed ledger technology called Multi-CBDC Bridge (mBridge). It is a fancy name for exchanging CBDCs. Or, for us cryptocurrency enthusiasts, it’s just using Uniswap v2 AMM technology to exchange some tokens.

If you read the report on “Project Guardian”, you will find a very lengthy explanation of how to efficiently exchange tokens.

I must say, Wall Street is really good at making some great technology extremely boring.

Anyway, as most of us know, you can now exchange assets at the end of the liquidity curve… Imagine token exchanges between Vietnam and Costa Rica without the need for US dollars.

Another popular solution is Project Mariana. This project involves the Monetary Authority of Singapore, the Bank for International Settlements, the Bank of France, the Swiss National Bank, and other institutions.

They say this is an experiment… utilizing Curve’s AMM technology. We can truly see how they understand the working principles of these AMMs and the advantages of certain AMMs in different use cases.

To summarize the content of Project Mariana… it implements token transfers (referred to as “wCBDC” on the network). Central banks can issue and provide liquidity, and then commercial banks can use wCBDC tokens to transact with AMMs and other banks.

Think of it as a central bank’s permissioned minting contract, where commercial banks can interact with AMMs.

The commonly used vocabulary in these explanations are “security,” “cross-border,” and “efficiency.” There’s nothing wrong with that. But what’s missing here is, what happens to the role of the US dollar as a medium of trade?

We all know that AMMs are more about transfers that don’t require the US dollar or even Ethereum. This means it will reduce the dependence on exchanging and trading the US dollar. In other words, the 88% of forex settlement data that involves the US dollar mentioned earlier will face 100% risk.

The next source of inflation

I vividly remember the time I wrote academic papers. Looking back at those papers, I can’t help but feel that I sounded robotic.

And it was hard to understand. That’s why these studies changed my way of thinking within a few days. But the reason I got hooked on these papers is because I wanted to see if anyone was studying what would happen if the demand for the US dollar decreases.

If someone combined this with new AMM technology, that would be great.

But I really couldn’t find anything… except for two papers from the International Monetary Fund (IMF).

The first one is “Digital Currencies and Central Bank Business,” and the second one is “Declining Cash Usage and the Demand for Retail Central Bank Digital Currency.”

The title of the second one is really obvious. These papers discuss how the transition from physical cash to digital substitutes is changing monetary policy and inflation dynamics.

Simply put, the authors discuss central bank digital currencies (CBDC) and inflation. I like their approach because they discuss two outcomes.

First, the authors mention the increase in the use of digital banking services and the decrease in the use of non-bank alternatives to cash, which will reduce the demand for physical cash.

This transition will impact the ratio between physical cash and gross domestic product (GDP) as well as the broader money supply. If there is no requirement for holding reserves against electronic money (i.e., physical storage of digital currency), the shift from bank deposits to electronic money will decrease the broader money supply.

They mean there needs to be some form of capital controls in place.

Otherwise, we’ll get the second outcome: in economies where reserves are required to be held in proportion, the shift from cash to electronic money will not have an impact on the broader money supply.

All of this involves what’s called “shadow banking.” It’s a part of the monetary system that is not regulated by the money supply.

This indicates that these non-central bank digital currency forms may reduce the use of the US dollar, leading to inflation.

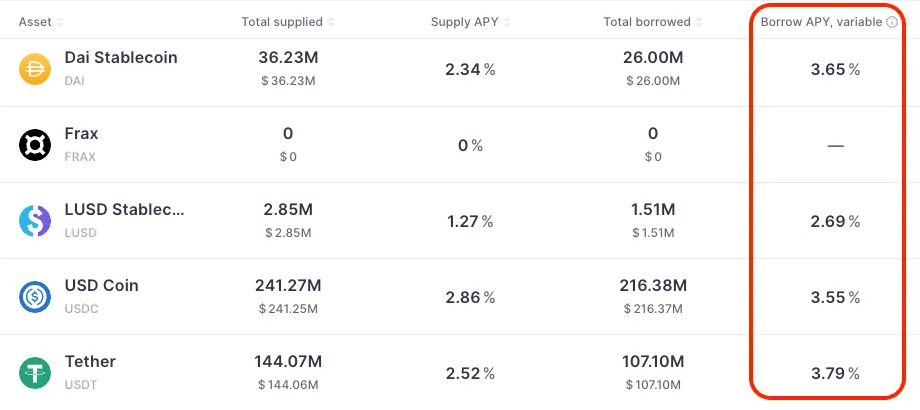

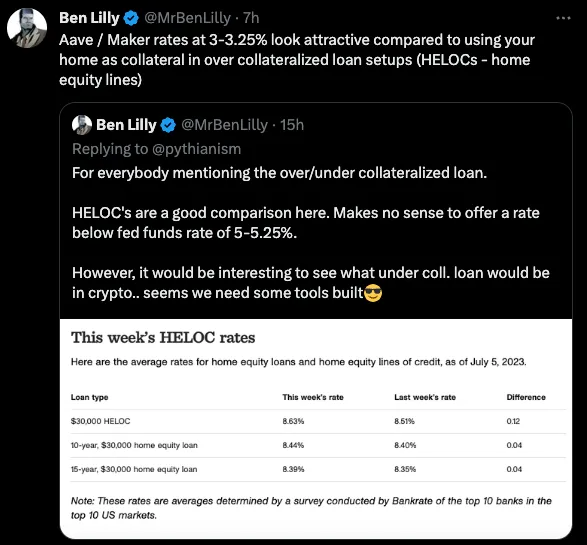

For the cryptocurrency Degen… if you borrow tokens using Aave as collateral in excess, this provides this possibility…

When you go to the bank and borrow money with your house as collateral at such an interest rate…

These other forms of the US dollar — DAI, USDC, USDT — are not printed by the Federal Reserve, which actually creates interest rate problems that the Federal Reserve is trying to control.

This will lead to a decrease in demand for actual dollars… and higher inflation.

Thinking about this issue is interesting. To some extent, I understand why Basel’s new guidelines will be released soon. These guidelines tell banks how much capital they need to hold in their vaults to support their operations. It addresses the problem mentioned above.

Therefore, we should expect stablecoin guidelines to be consistent with this thinking… otherwise, they will actually undermine the goals that the Federal Reserve is trying to achieve.

Before I receive hate mail for supporting the Fed’s regulatory stance, I want to say that the dollar is theirs. Creating our own dollars is just us copying their invention. We have our own native tokens… maybe we’re just creating additional stability in it, rather than being uneasy about regulating stablecoins.

But before I digress too much, I want to really emphasize the focus of this discussion on currency demand and inflation…

These papers do not mention the potential decline in currency demand related to new foreign exchange swap technologies like “Project Guardian” and “Project Mariana”. I’m curious when these institutions will address this issue, because I believe someone at the Federal Reserve, the Bank for International Settlements, or the International Monetary Fund is pondering this question.

This is not just a major issue for the United States, but global. It seems to act as a catalyst, triggering a hidden inflation tsunami.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!