Today’s Headlines:

Insiders: US Department of Justice considers fraud charges against Binance, but worries about causing a run on the bank

Direxion has submitted a Bitcoin and Ethereum futures ETF application to the US SEC

Exclusive: Hong Kong Securities and Futures Commission approves license upgrade for HashKey Exchange, allowing it to provide services to retail investors

- The good days of the US dollar are over? In-depth exploration of the impact of DeFi and central bank digital currencies on the global financial system.

- Crazy multi-chain universe, crazy OP Stack

- HashKey Exchange becomes the first trading platform to obtain the newly issued virtual asset license in Hong Kong.

Coinbase will officially launch the Base mainnet on August 9th

Du Jun purchases 10 million CRV tokens from the founder of Curve for $4 million

Futureverse launches $50 million Web3 technology fund, Born Ready

Deposits in the Apple Card savings account, launched in collaboration with Goldman Sachs, exceed $10 billion

Data: Founder of Curve sells a total of 72 million CRV tokens, raising $28.8 million

Regulatory News

Insiders: US Department of Justice considers fraud charges against Binance, but worries about causing a run on the bank

According to sources cited by Semafor, officials from the US Department of Justice are considering fraud charges against Binance, but are concerned that if they prosecute Binance, it could lead to a run on the bank similar to what happened with FTX, resulting in consumer losses and potentially causing panic in the crypto market. Insiders say that prosecutors are considering other options, such as fines, deferred prosecution, or non-prosecution agreements. Such an outcome would be a compromise, holding Binance accountable for alleged wrongdoing while minimizing harm to consumers.

Jiangsu Public Security Bureau: Multiple individuals suffer heavy losses from involvement in “virtual currency” related investments, please be vigilant

A mass message recently issued by the Jiangsu Public Security Bureau states: “In recent times, multiple individuals in our province have been defrauded and suffered heavy losses from ‘virtual currency’ related investments on relevant websites or apps. We urge the public to be vigilant and not to trust investment and financial channels that are not approved, regulated, or endorsed by national authorities.”

Australian financial regulator files lawsuit against eToro, accusing it of improper conduct leading to losses for tens of thousands of users

According to Cointelegraph, the Australian Securities and Investments Commission (ASIC) has filed a lawsuit against the multi-asset investment platform eToro, alleging that its contracts for difference (CFD) products provided to retail investors were overly broad in their market positioning and violated design and distribution rules. ASIC claims, “The CFDs offered by eToro were high risk and volatile, and the platform’s target market determination test failed to adequately screen out unsuitable customers to trade the product; between October 5, 2021, and June 14, 2023, nearly 20,000 of eToro’s customers incurred losses in CFD trading.”

It is reported that CFDs are leveraged derivative contracts that allow buyers to speculate on the price movements of underlying assets, such as foreign exchange rates, stock market indices, individual stocks, commodities, or cryptocurrencies. eToro’s cryptocurrency CFDs allow leverage of up to two times for certain assets, while others involve stocks, currencies, commodities, and precious metals.

NFT

Web3 project Nifty’s announces closure after failed transition due to lack of development funding

Nifty’s, a project that aimed to transform from an NFT social media platform to a Web3 creator portal, announced on Twitter that it will gradually wind down its operations starting today. Nifty’s stated, “Earlier this year, considering our limited resources in a challenging market, we pivoted to developing a platform for Web3 creators. Since then, we have been focused on developing new products and seeking opportunities to secure the funds needed to continue development. Unfortunately, despite our best efforts, the investment opportunities we have been pursuing have not materialized, and we now find ourselves at an impasse.”

In addition, Nifty’s stated, “In the past few weeks, the team has made every effort to ensure that the NFT projects released on Nifty’s can continue, including ‘The Matrix Avatars,’ ‘Looney Tunes: What’s Up, Block?,’ ‘Game of Thrones: Build Your Realm,’ and ‘Bullet Train.’ The team has decentralized all NFT media and re-allocated NFTs on the Polygon blockchain, unless they are already on Ethereum.” Nifty’s has provided instructions for Warner Bros. NFT holders to export their private keys to preserve their collections.

Previously, in March 2021, Nifty’s completed a pre-seed funding round with participation from Mark Cuban, Joseph Lubin, and others. According to Decrypt, Nifty’s raised $10 million in this funding round.

Project Updates

Direxion submits application for Bitcoin and Ethereum futures ETF to the U.S. SEC

According to CoinDesk, ETF issuer Direxion has submitted an application to the U.S. Securities and Exchange Commission (SEC) for a Bitcoin and Ethereum futures ETF. The product, named “Direxion Bitcoin Ether Strategy ETF,” will invest in Bitcoin and Ethereum futures contracts and may also invest in other ETFs with exposure to futures products. Earlier this week, six other companies applied to launch Ethereum futures ETFs, including Volatility Shares, Bityise, Roundhill, VanEck, Proshares, and Grayscale.

Curve Finance terminates CRV rewards for multiple liquidity pools affected by recent attack incidents

Gabriel Shapiro, General Counsel at Delphi Labs, tweeted that Curve Finance’s emergency multisig has terminated CRV rewards for multiple liquidity pools affected by recent attack incidents, including liquidity pools affected by the recent Vyper compiler vulnerability and the multiBTC pool affected by the recent Multichain vulnerability. This action has been taken to prevent users from further participating in these attacked liquidity pools. The affected liquidity pools include alETH+ETH, msETH-ETH, pETH-ETH, crvCRVETH, Arbitrum Tricrypto, and multibtc3CRV.

Genesis extends mediation deadline with creditors for the final time, aiming to reach an agreement by August 16th

According to Bloomberg, bankrupt cryptocurrency lending firm Genesis’ lawyer stated during a hearing on Wednesday that the company has extended the mediation deadline with creditors for the final time. The company’s lawyer, Sean O’Neal, told U.S. Bankruptcy Judge Sean Lane, “If we cannot make substantial progress on the transaction front in principle within the next two weeks, we do not anticipate seeking any further extension of the mediation deadline.” Therefore, negotiations must conclude by August 16th.

The lawyer said that if the two parties fail to reach an agreement by August 16th, Genesis will continue to implement its existing bankruptcy plan, but with some modifications. This mediation is one of the final obstacles to prevent Genesis from going bankrupt.

It is reported that since May, Genesis has been mediating with major stakeholders, including its parent company Digital Money Group and Gemini Trust Co. They are trying to salvage the proposed bankruptcy exit plan supported by DCG, but the plan has been rejected by the official committee of unsecured creditors.

Exclusive: Hong Kong Securities and Futures Commission has approved the license upgrade of HashKey Exchange, allowing it to serve retail investors

Insiders at Hashkey Group revealed that the Hong Kong Securities and Futures Commission has approved the license upgrade of HashKey Exchange’s license 1 and 7, allowing it to serve retail investors.

According to official sources, after this license upgrade, HashKey Exchange becomes the first licensed trading platform in Hong Kong to serve retail users, which will further expand the business scope of HashKey Exchange from serving only professional investors to retail users. In addition, HashKey Exchange has officially launched the virtual asset OTC trading business HashKey Brokerage and is now open for pre-registration.

SlowMist: Large-scale macOS attack software macOS-HVNC appears in the dark web, risk should be noted

SlowMist’s Chief Information Security Officer 23pds tweeted that they have noticed the recent appearance of macOS-HVNC, a software for large-scale attacks against macOS, in the dark web. Mac computers and devices are widely used by individual and small and medium-sized cryptocurrency businesses due to their security and usability.

23pds pointed out the characteristics of macOS-HVNC: 1. Hidden operation: HVNC is designed to run in stealth mode, making it difficult for individuals and small and medium-sized enterprises to detect its presence on their systems. This hidden operation allows cybercriminals to maintain access without raising suspicion. 2. Persistence: HVNC typically includes mechanisms to ensure that it remains active even after system restart or attempts to remove it. 3. Data theft: The main purpose of HVNC is to steal sensitive information from individuals’ and employees’ computers, such as login credentials, personal data, virtual assets, financial information, or other valuable data. 4. Remote control: HVNC allows cybercriminals to remotely control computers, giving them full access to the system.

In addition, 23pds reminded, “Although Mac has historically been less targeted by cybercriminals, attackers are now developing more macOS malware. Be aware of the risk.”

Worldcoin confirms that it has suspended its services in Kenya after receiving a notification from the Kenyan government yesterday

According to The Block, Worldcoin, an identity crypto protocol co-founded by OpenAI CEO Sam Altman, has confirmed that it has temporarily suspended its services in Kenya after receiving a suspension notice yesterday.

It is reported that Kenya has been a major market for the project. A spokesperson for the Worldcoin Foundation said that there is a significant demand for its verification services in Kenya, with thousands of people queuing for World IDs in just two days.

Earlier yesterday, the Kenyan government suspended the operation of Worldcoin due to privacy and security concerns.

Coinbase will officially launch the Base mainnet on August 9th.

According to CoinDesk, Coinbase announced that its second-layer blockchain Base, built using the Optimism OP Stack, will be open to the public on August 9th. Starting from Thursday (today), users will be able to bridge their Ethereum (ETH) to the Base network. Subsequently, Base also tweeted that six Base cross-chain bridges have been opened, and commemorative NFTs have been launched in collaboration with Galxe, Layer3, and mint.fun.

BNB Chain releases version 1.2.9 of the BSC mainnet, introducing Plato and Hertz hard forks.

Plato is expected to be deployed on August 10th (block height 30,720,096), and Hertz is expected to be deployed on August 30th (block height 31,302,048). BNB Chain stated that all validator nodes and full node operators of the mainnet must switch their software version to v1.2.9 before August 10, 2023.

Du Jun purchases 10 million CRV tokens from Curve founder for $4 million.

Du Jun, CEO of New Fire Technology, purchased 10 million Curve tokens (CRV) from Curve founder Michael Egorov for $4 million. Egorov continues to seek to reduce his risk loan position. Du Jun confirmed his purchase of the tokens via Twitter DM and locked them as veCRV (in exchange for having voting rights on the Curve platform after the tokens have been locked for a period of time). Du Jun said, “I will lock them for at least one year and hope Curve will become better and better.”

Investment and Financing

Futureverse launches $50 million Web3 technology fund Born Ready.

According to Fortune, Futureverse, an AI metaverse startup, co-founders Aaron McDonald and Shara Senderoff announced the establishment of a $50 million Web3 technology fund called Born Ready, providing investments ranging from $250,000 to $2 million to companies building Futureverse Web3 infrastructure and content networks. The Born Ready portfolio already includes sneaker startup FCTRY Lab and Web3 game studio Walker Labs. The Born Ready fund will also launch an accelerator to help nurture some of the portfolio companies.

AI chip developer Tenstorrent receives $100 million investment from Samsung and Hyundai.

AI chip developer Tenstorrent announced a strategic financing of $100 million led by Hyundai Motor Group and Samsung Catalyst Fund, with participation from Fidelity Ventures, Epiq Capital, Maverick Capital, and Eclipse Ventures. Tenstorrent stated that these funds will be used to “accelerate the company’s product development, the design and development of AI small chips, and the progress of the machine learning software roadmap.”

Important Data

Data: Curve founder sells a total of 72 million CRV tokens, raising $28.8 million in funds.

According to on-chain analyst Yu Jin, as of 10:00 on August 3rd, Curve founder has sold a total of 72 million CRV tokens to 15 investors/institutions, raising $28.8 million in funds.

Apple Card Savings Account Deposits Exceed $10 Billion in Collaboration with Goldman Sachs

According to Bloomberg, Apple (AAPL.US) and Goldman Sachs (GS.US) announced in a statement on Wednesday that the deposits in their newly launched high-yield savings account have exceeded $10 billion.

It is reported that Apple officially launched the Apple Card savings business for Apple Card users on April 17th this year, with an annual interest rate of 4.15%, more than 10 times the average level in the United States. This feature allows Apple Card users to open a high-yield savings account with Goldman Sachs in the iPhone Wallet app and start earning interest from their Daily Cash balance.

Changpeng Zhao: Binance’s registered users reach 150 million

Binance founder Changpeng Zhao tweeted that this week Binance (so far): Binance Japan officially launched; Binance obtained an operational MVP license in Dubai (the first exchange in the world to obtain this license); 2 new Binance Launchpools: CYBER and SEI; Binance’s registered user count reached 150 million.

LianGuaiNews APP points – PT (grape) officially launched, participate in Read to Earn together!

PT (short for grape in Chinese) is the points reward that LianGuaiNews users earn by participating in interactive activities such as reading news, sharing content, liking, and collecting on the LianGuaiNews website and app. PT grapes cannot be traded or transferred, and can only be used to redeem various prizes in the “Points Mall” of LianGuaiNews and participate in various daily activities. Experience it now!

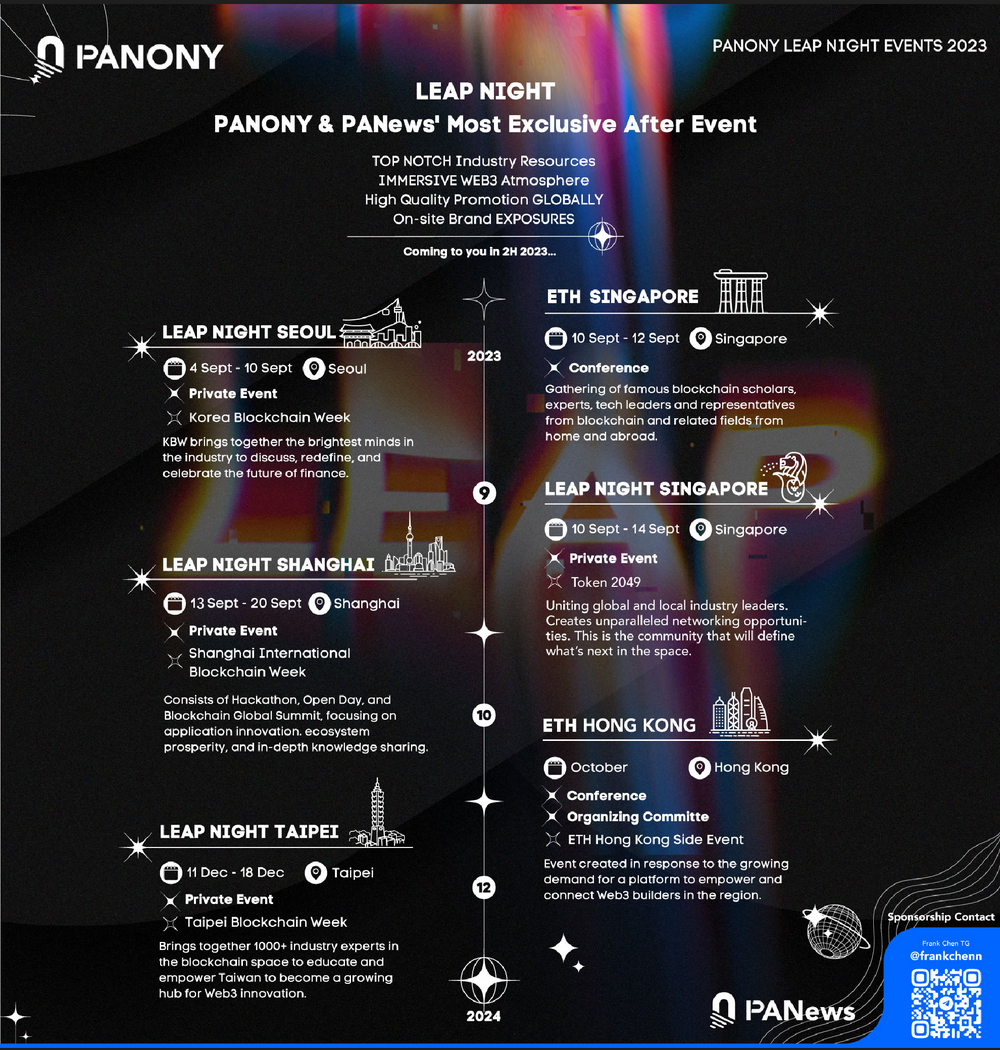

LianGuaiNews Launches Global LEAP Tour!

Korea, Singapore, Shanghai, Taipei, September to December, multiple places come together to witness a new chapter in globalization!

📥Activities in multiple places are being built, welcome to communicate!

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!