Author: Charles, Crypto Investor; Translator: Blockingxiaozou

I don’t know if you’ve heard, but passive index products (worth $22 trillion) make up 26% of the global stock market. In the world of cryptocurrency, indexes only make up 0.065% of the entire market cap. This is a trillion-dollar opportunity that almost everyone is ignoring…

In this article, we will primarily explore the following: index opportunities, projects worth watching, and bullish or bearish positions.

- What happened to Multichain? Cross-chain asset delay causes token to plummet by 35%.

- FTX Crisis Review: After being seen by CZ, the ending is doomed

- Read the recent FTX crash story, how did SBF fall overnight?

1. Index Opportunities

In my opinion, indexes will take off in the next bull market, providing at least $1 billion in opportunities, even if the cryptocurrency market cap remains unchanged ($110 billion/$1.2 trillion). Assuming the crypto market grows to $5 trillion, $10 trillion, or even higher, it will bring trillions of dollars in opportunities…

2. Projects Worth Watching

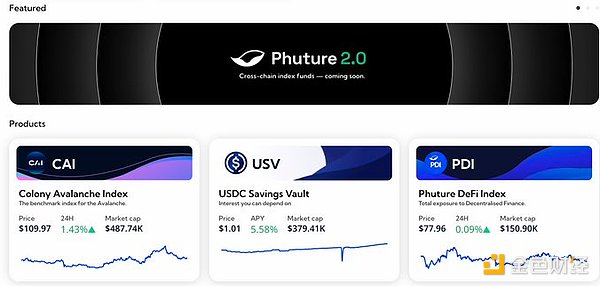

(1) Phuture Finance

Phuture Finance is a leading project with innovative products:

undefined Phuture DeFi Index (PDI) – the largest on-chain asset index

undefined Colony Avalanche Index (CAI)

undefined USCDC Savings Vault (USV) supported by Notional lending protocol

Its PHTR token market value (FDV) is $2,318,700.

PHTR is my largest holding. Very bullish.

undefined Phuture has a good track record of building innovative products

undefined Superb team

undefined Developing index products since 2020

All of Phuture’s products are fully collateralized, permissionless, on-chain products. The team is currently developing Future 2.0, which will change the landscape of on-chain asset management. However, the index market is not a winner-takes-all market. I anticipate many successful protocols in this field.

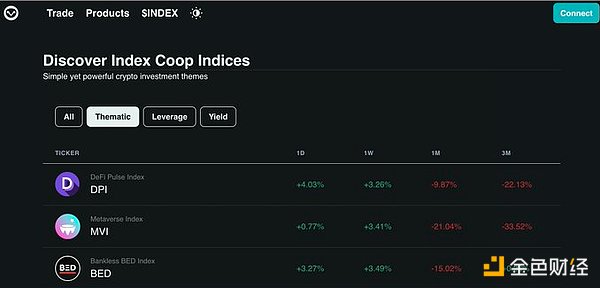

(2) Index Coop

I believe Coop is one of the best-run DAOs, and they have done a great job in expanding their active contributor base.

Like Phuture, Index Coop has created a variety of indexes and on-chain products, including:

undefined DeFi Pulse Index (DPI)

undefined Bankless BED Index (BED)

undefined Metaverse Index (MVI)

They also have a few concise products built around ETH.

The FDV of the INDEX token is $14,344,299. I do hold some INDEX tokens, and I expect INDEX to perform well in the next bull market.

(3) Alongside Finance

The next project we’re going to talk about is Alongside Finance, whose team has made some inaccurate comments about Phuture. However, that’s not what we’re here to discuss, I think their product is interesting. So far, their first and only product is the Alongside Cryptocurrency Market Index (AMKT). Unlike Phuture and Index, Alongside creates its own products based on Coinbase, and all of its index funds are custodied by Coinbase Custody.

The project supports token minting/burning. To participate, you need to have an entity that has been approved through the KYB process. However, you can buy its index token AMKT on an exchange and sell it for ETH or stablecoins.

3. Conclusion

Now is a good time. Institutions need indexes, and wealth management firms want indexes to provide risk exposure for their clients. Everything is unfolding. The index narrative is still in its early stages, and this is one of the biggest opportunities I see. Bullish on on-chain suppliers, but remember: DYOR, always do your own research.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!