Author: Biteye Core Contributor Louis Wang

Editor: Biteye Core Contributor Crush

Community: @BiteyeCN

01. What is Arkham?

On July 10th, Binance announced that the on-chain data analysis platform Arkham’s token $ARKM will be listed on LaunchLianGuaid, marking the first issuance and listing of a tool-type product on Binance.

- Inventory of OP Stack’s star projects and airdrop interaction strategies

- Kakarot Exploring the EVM Compatibility of Starknet

- After FTX’s collapse caused the crash of SOL, what new changes will Solana have in 2023?

In fact, as early as the beginning of this year, we introduced Arkham in the article “Seven New Generation Web3 Data Tools”, but at that time, it was not well-known and did not appear in the tweets of various KOLs like it does now.

Arkham currently has two business segments, one is the data analysis platform, similar to Nansen and 0xscope, and the other is Intel Exchange, an on-chain intelligence trading platform.

Below, we will introduce them one by one and finally provide Biteye’s valuation analysis of Arkham.

02. On-chain data analysis platform and operational tips

Arkham, as a powerful on-chain data analysis platform, has the following advantages compared to projects in the same field:

1. Provides extensive support for public chains, including Bitcoin and various EVM-compatible mainstream public chains.

2. Rich address labels.

By utilizing the functions and advantages of Arkham, it is very helpful in mining Alpha. Due to its support for multiple chains, detailed label system, and wide statistical coverage, the asset and behavioral statistics of each entity are more comprehensive and accurate.

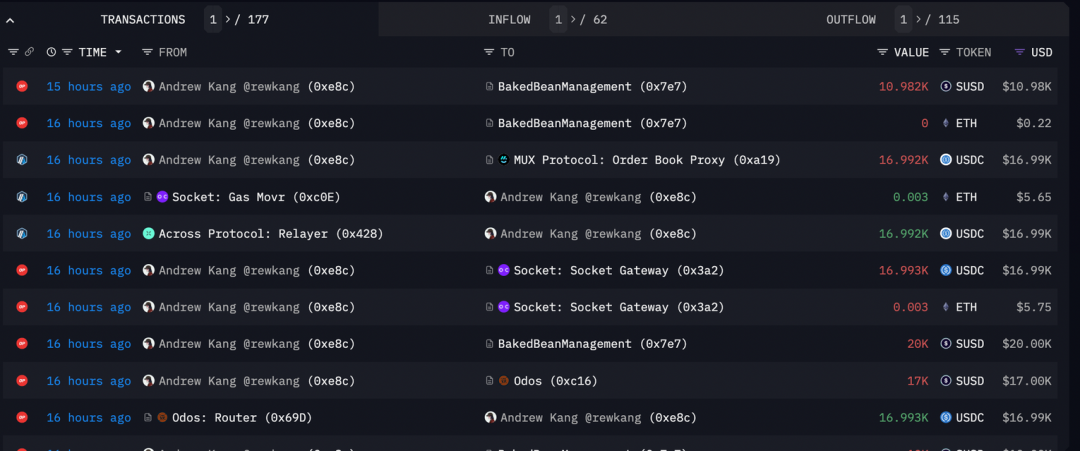

Now let’s take the legendary trader Andrew Kang as an example to see how to analyze the behavior of various entities and discover Alpha among them.

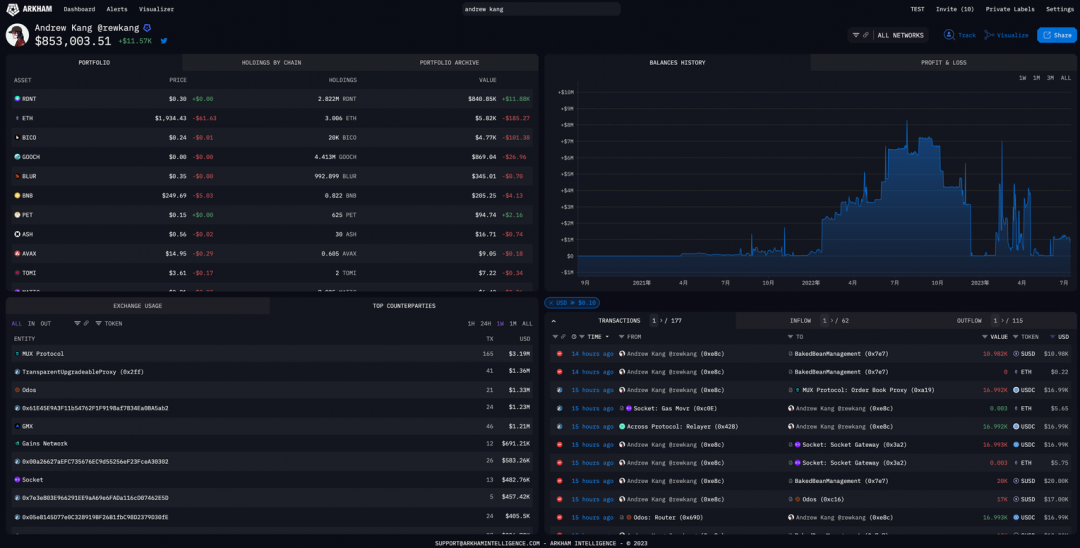

Take the legendary trader Andrew Kang as an example. Just enter Andrew Kang in the search bar, and his Entity label will appear. After clicking on it, there will be four analysis sections:

- Current positions

- Historical asset net value, gains, and losses

- Recent on-chain interaction objects

- On-chain operations

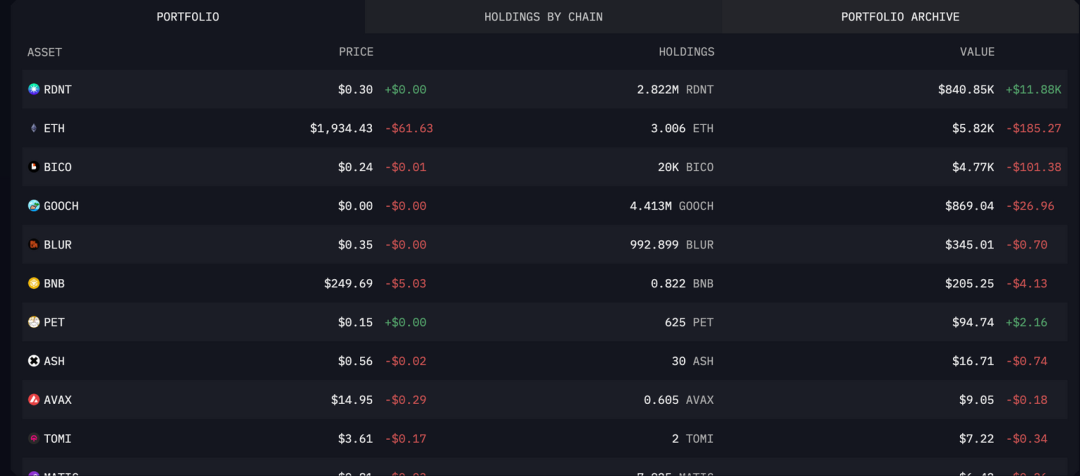

For top on-chain traders like Andrew Kang, observing their positions is very valuable. Currently, AK has earned over $1.7 million through on-chain trading. His largest position is currently in RDNT, worth approximately $840,000.

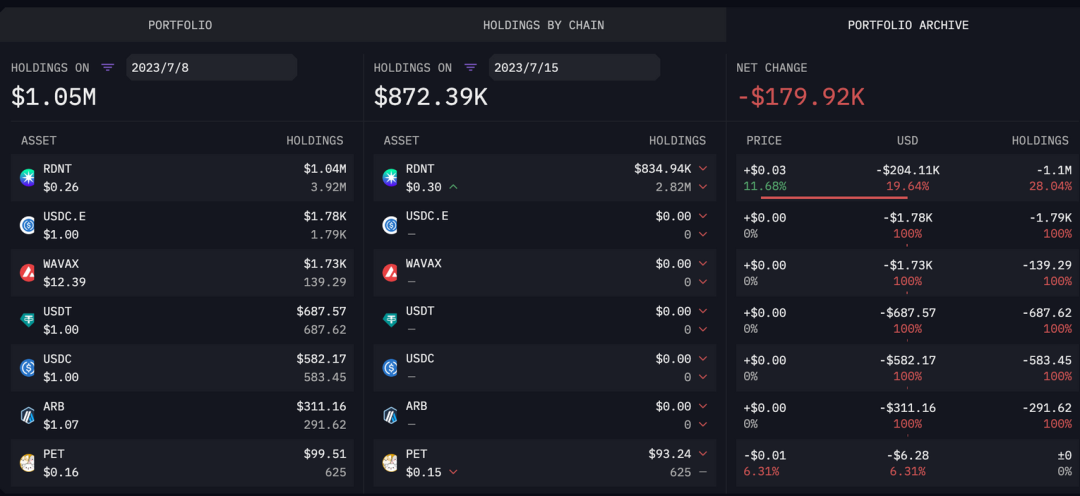

Through the Portfolio Archive function, you can view the changes in token holdings and corresponding values within a specified time period, thereby deducing the trading process. For example, AK has started to gradually sell some RDNT in the past week.

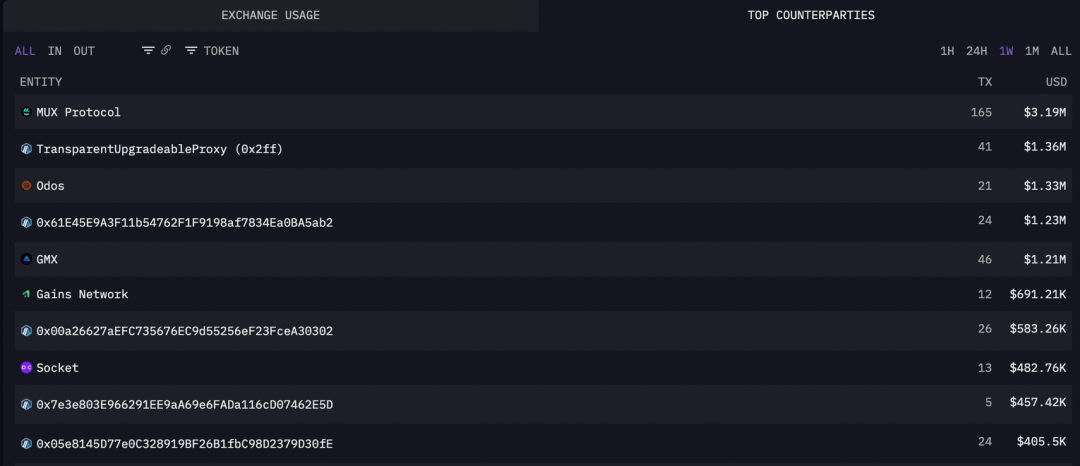

In the Top Counterparties section, you can see the rankings of the most recent interactions of the entity, including the number of interactions and the amount of interaction. Within a week, AK has interacted with MUX Protocol 165 times, with a total interaction amount of $3.19 million.

Many people may be familiar with AK starting from his orders on GMX, but from his recent interactions, it is clear that he has a new favorite, MUX.

MUX is a competitor to GMX, another on-chain derivatives exchange. A platform that top traders can switch to must have its unique features. Users who are interested in on-chain derivatives trading can follow AK’s operations to learn about MUX.

AK’s daily interactions are highly specialized, involving various spot and derivatives trading. Odos is also an aggregator that is more suitable for professional traders.

The Top CounterLianGuairties function is useful for tracking professional traders and can yield good results. By observing the contracts they have recently interacted with, it may be possible to discover hidden opportunities for making a fortune.

Here is just a statistic, and specific operations can be viewed in the Transactions section. Compared to blockchain browsers, this platform aggregates transactions from all chains, eliminating the need to switch between different browsers, which is very convenient.

Link to the above dashboard:

https://platform.arkhamintelligence.com/explorer/entity/rewkang

Another feature that is very helpful for trading is the token dashboard, which allows you to view the current holdings of major holders of a specific token.

This feature can also be achieved through browsers like Etherscan, but they only show wallet addresses without revealing the identity of the holders. Arkham, on the other hand, uses its powerful entity tagging system to directly disclose the entities holding the tokens.

Each token has a cap table showing the token distribution at the time of issuance. However, as time goes by, the entire token distribution also changes, and this change is often opaque. By comparing the current token holdings with the initial distribution chart through Arkham’s token dashboard, you can determine which teams are long-term-oriented and which teams are secretly selling, adding an extra layer of security to value investments.

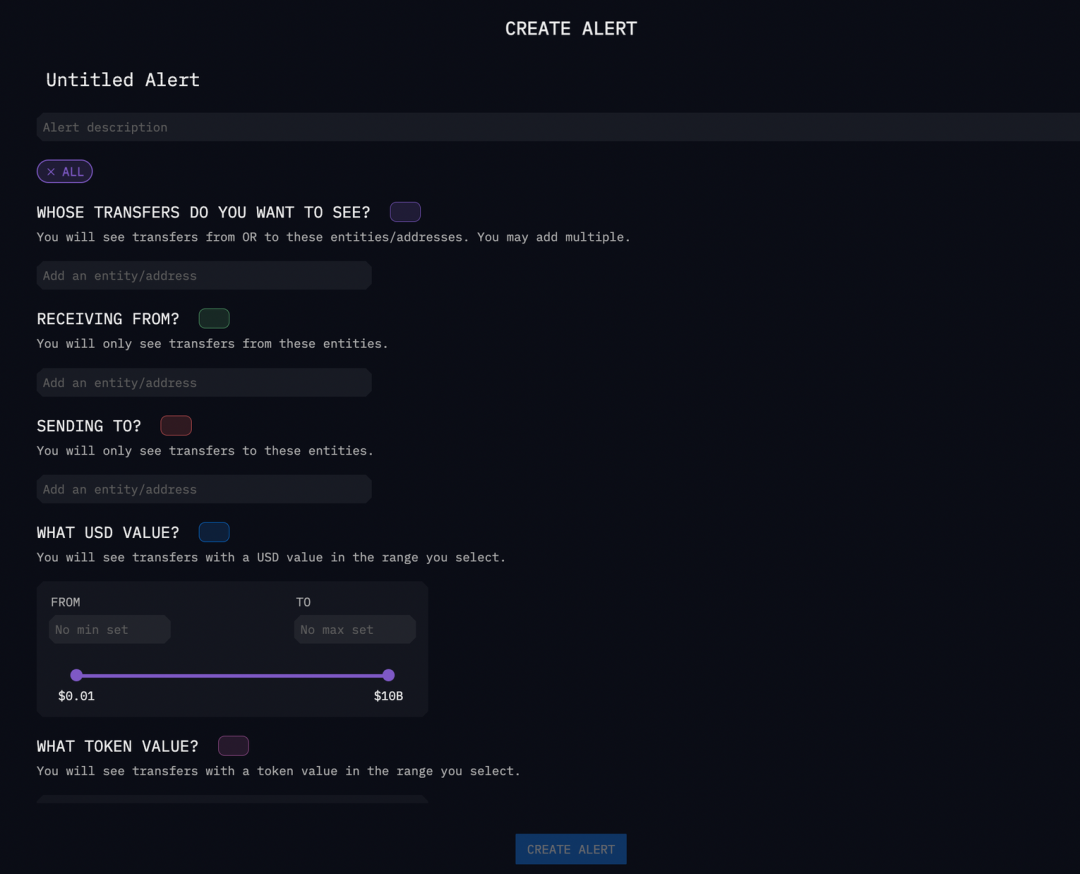

In addition to the above analysis features, Arkham also has an alert function. If you are a copy trader or pay close attention to the whale’s holdings of a certain token, you can use the Alert function to set threshold amounts, observation targets, and even specific accounts. When there is abnormal activity, you will be directly notified by email.

03, Intelligence Exchange

Traders, investors, researchers, project teams, etc., all have an increasing demand for on-chain data analysis, but they lack the time and expertise to conduct comprehensive on-chain analysis;

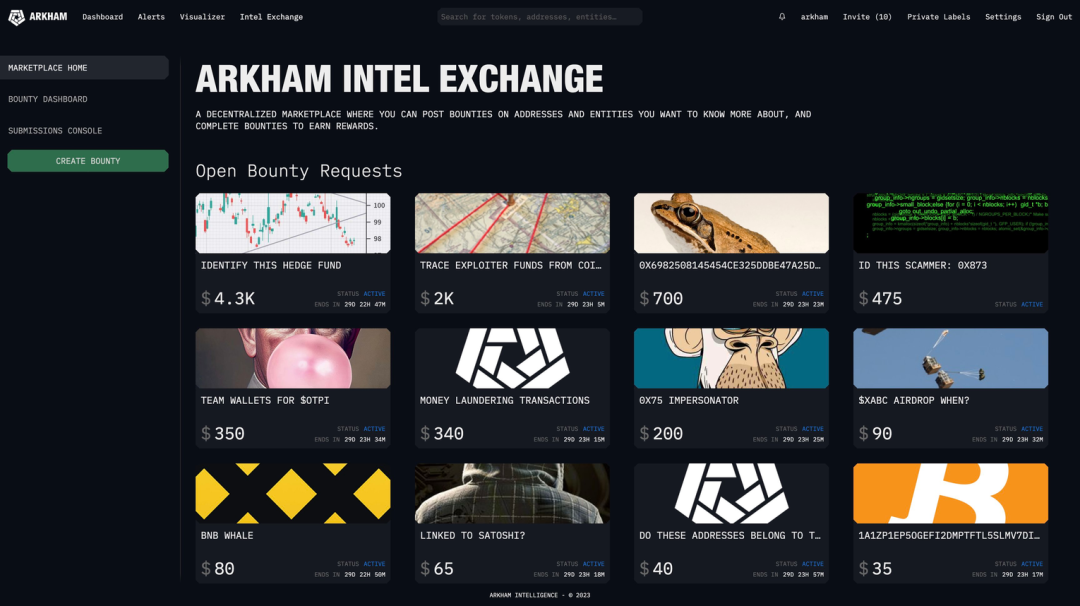

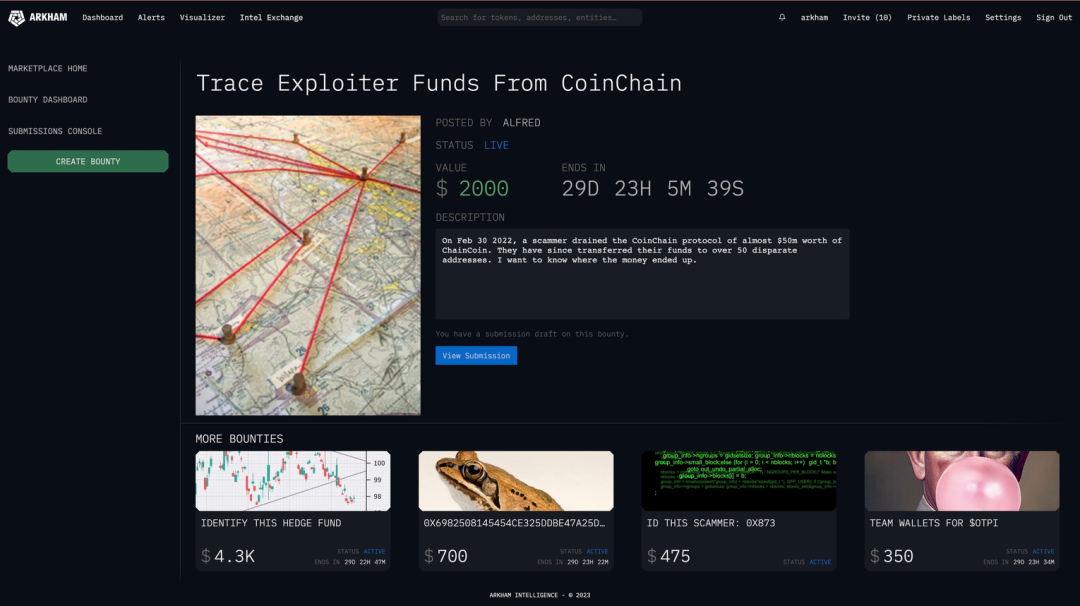

Many researchers with on-chain data analysis capabilities are also eager for a platform that can monetize their skills. Therefore, Arkham has launched The Arkham Intel Exchange, the first trading platform that supports rewards for on-chain intelligence. It connects people who want to buy or sell any information about cryptocurrency wallet addresses.

Buyers can gather any information they want to know by posting bounties, and bounty hunters can claim rewards by submitting the requested information.

At the same time, anyone with valuable information about wallets or their owners can offer this information to other users at a fixed price or through auctions.

This creates a fluid marketplace for information, allowing on-chain detectives to monetize their work on a large scale, intel-to-earn.

The information that can be traded on the intelligence exchange is not limited to physical tags. For example, vulnerability victims can pool resources to obtain information about exploiters; a trading company may want to buy information about its own wallets before competitors discover it.

In addition, users who submit information for training Ultra (Arkham’s AI de-anonymization engine) can also receive rewards.

To prevent a large amount of spam information, all bounty hunters also need to pledge a small amount of funds to the smart contract when submitting information. If their application is not approved, this part of the funds will be forfeited.

04. Valuation of $ARKM

Arkham has raised over $10 million through two rounds of equity financing, accounting for 20% of the total supply of ARKM tokens. The latest round of equity financing has a valuation of approximately $150 million.

Investors include Tim Draper, Bedrock Capital, Wintermute Trading, GSR Markets, as well as the co-founders of LianGuailantir and OpenAI.

Arkham’s token $ARKM announced its launch on Binance LaunchLianGuaid on July 10, marking the first data analysis platform to issue tokens.

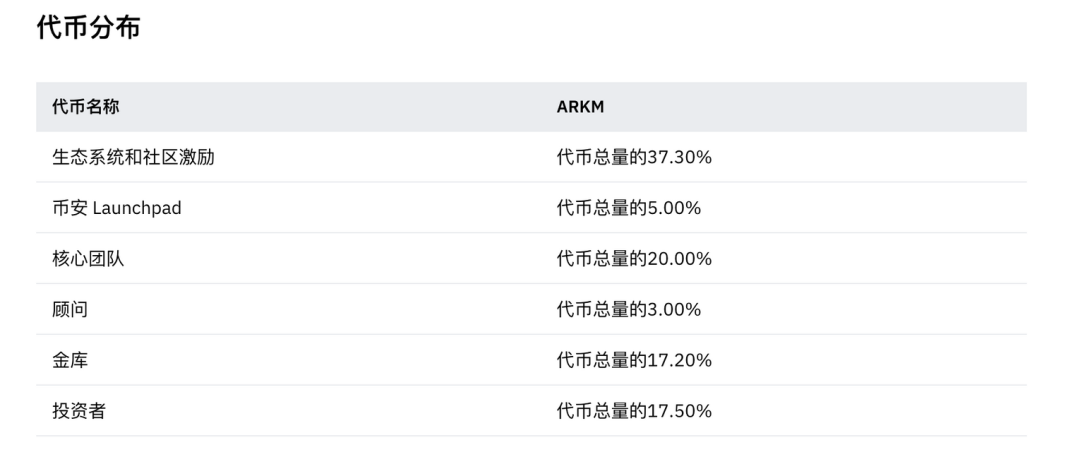

The total supply of tokens is 1 billion, with an initial circulation of 15%. The sale price of Binance LaunchLianGuaid is $0.05, with 50 million tokens to be issued, accounting for 5% of the total supply.

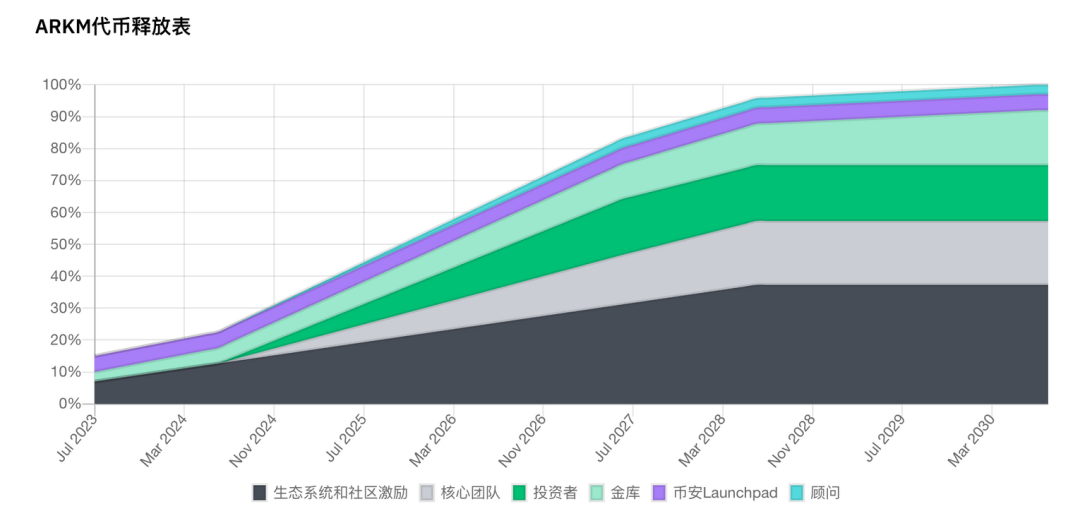

The token allocation and token release of $ARKM are as follows:

Arkham is the first project to issue tokens in the data platform/on-chain data tool category, making it difficult to find suitable benchmarks. The Graph may be a relevant comparison.

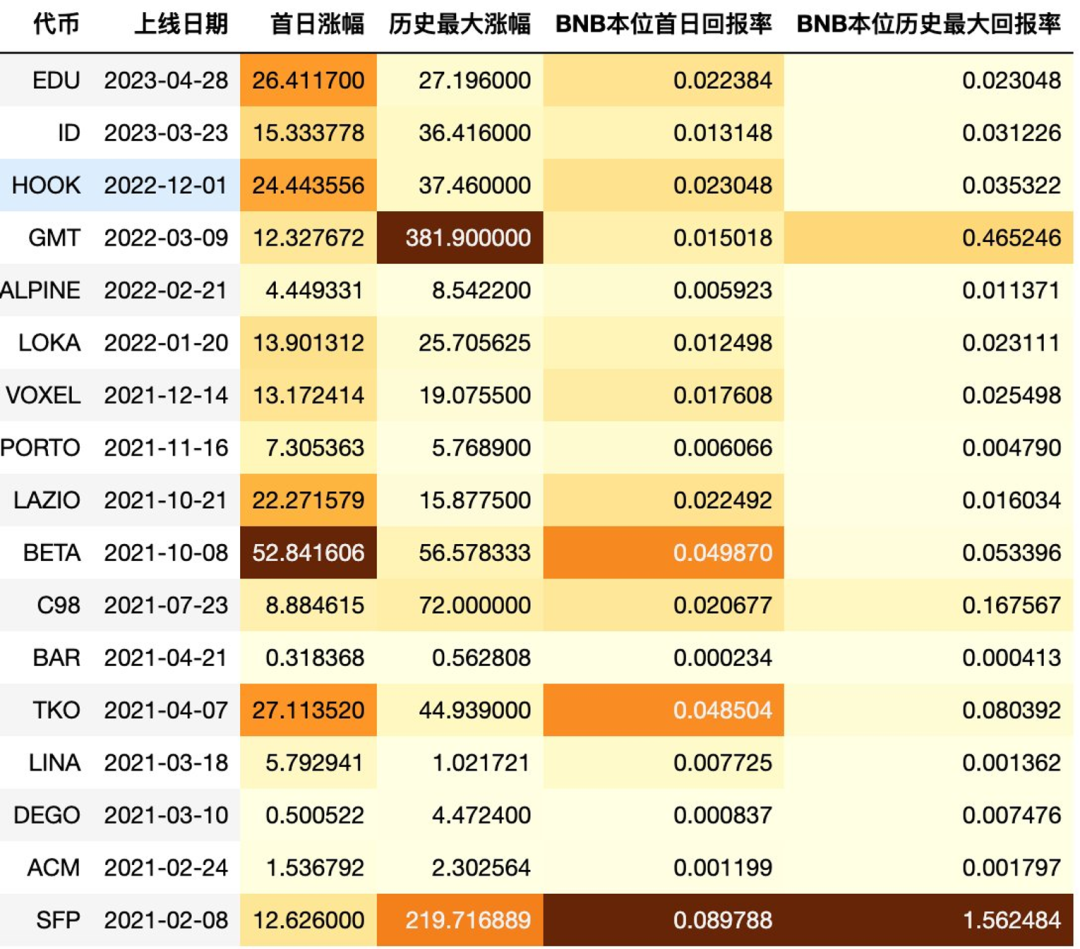

However, since The Arkham Intel Exchange has not yet launched and there is no actual business data to compare with The Graph, only rough estimates can be made based on the historical return rate of Binance Launchpad.

According to statistics from @CapitalismLab, taking the median of all Launchpad projects since 2021, the first-day increase is 12.6 times, the highest historical increase is 25.7 times, the first-day return rate of BNB is 0.015, and the highest historical return rate of BNB is 0.031.

Since the launch of HOOK, the three tokens have all performed at above-average levels. The median first-day increase is 24.4 times, which is 1.9 times the historical median, and the highest historical increase is 1.4 times the historical median. The first-day return rate based on BNB is 1.5 times, and the highest historical return rate of BNB is 1.3 times.

Based on the recent three IEO data, we can estimate the price range of $ARKM as shown in the table below, with a range of $0.77 to $1.32 on the first day.

At the same time, if we compare Arkham’s valuation at the time of financing, we can see that the circulating tokens at the time of listing were 150 million. If the circulating market value is equal to the equity financing valuation, the token price would be around $1. We roughly speculate that the market’s expected valuation will not differ too much from the valuation at the time of financing, so we can temporarily conclude that the final price of $ARKM in the short term should not exceed $1 by much.

When the token price is $1, the project’s total market value reaches $1 billion, which is about 7 times the valuation of equity financing.

It should be noted that with the subsequent unlocking of tokens (7% will be unlocked for incentives at the time of listing), the circulating market value will increase, and there may be a certain downward risk in the subsequent token price. At the same time, Binance will implement a limit price mechanism within the first five minutes of opening.

During this period, the upper limit of price increase is set to ten times the public offering price (taking $ARKM as an example, the upper limit of price increase will be set to ten times the $0.05, which is $0.5). The limit price mechanism will be lifted after five minutes, and trading will proceed normally according to market conditions.

The introduction of this mechanism may also have a certain impact on the volatility of $ARKM during the opening period, limiting the huge fluctuations in the first five minutes after opening.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!