Author: Wu Hai, LianGuaiNews

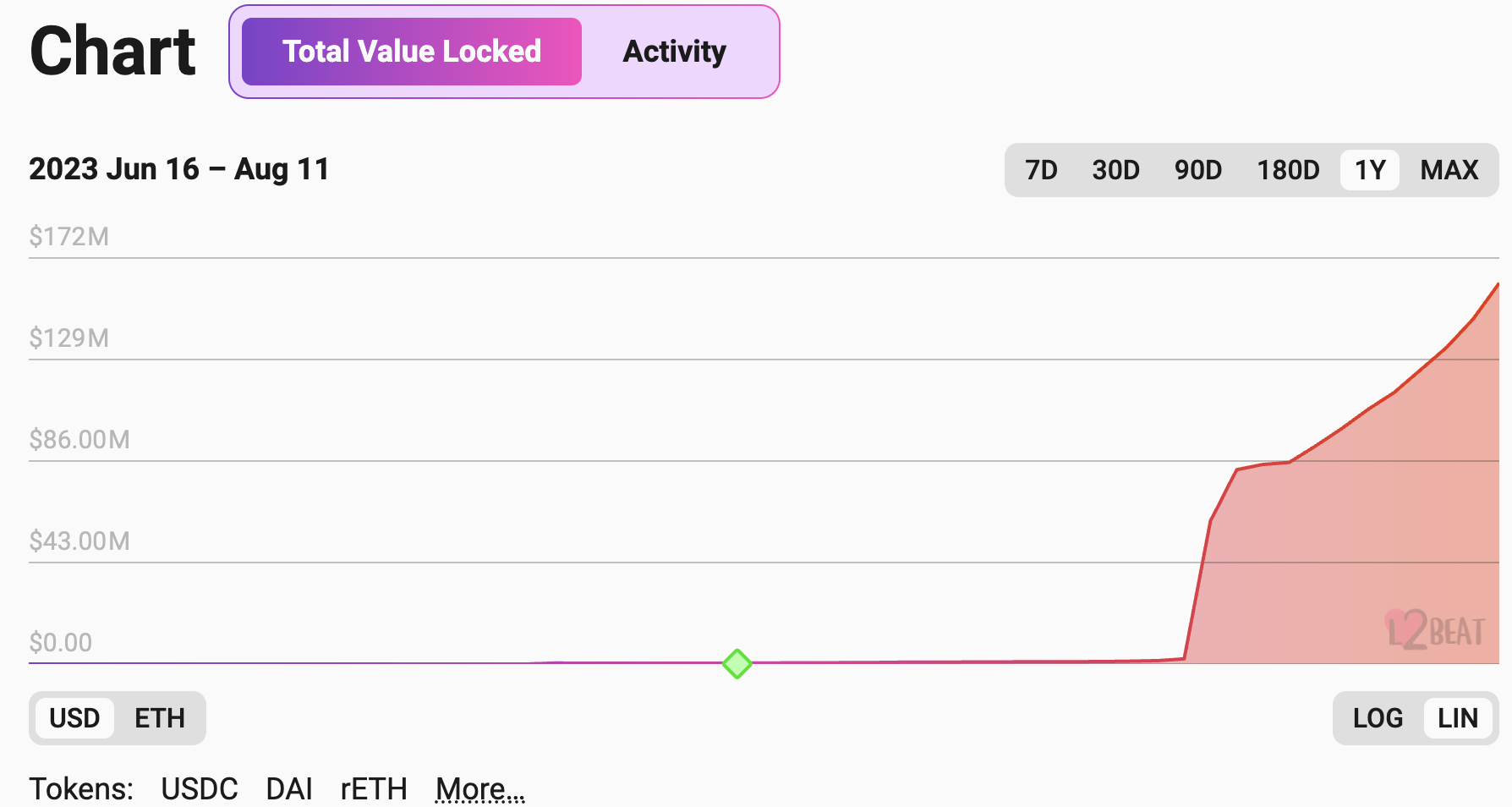

In February of this year, Coinbase announced the launch of the Ethereum L2 network Base, built on the OP Stack. It was not widely mentioned by more users until the end of July, when a meme token called BALD broke the silence of the Base chain. Its short-term exponential growth and the wealth effect circulated in the community attracted attention from users across the network, and the total assets of the Base chain increased from millions of dollars to 80 million dollars. It is worth noting that there was no cross-chain bridge support for the Base network during this period, and users had to bridge assets into the Base network through contract transfers.

Although the BALD liquidity pool was withdrawn by tens of thousands of ETH afterwards, and its token price once trended towards zero, the funds attracted and the user attention did not dissipate. According to l2beat data, the total assets of the Base network currently reach 160 million dollars, and the number of transactions has also surpassed the once-popular L2 network Starknet. In this article, LianGuaiNews will explain the Base network ecology in detail and explore possible investment opportunities.

- Lessons from the Gambling Industry From GGR to NGR, the Attraction Rule of Cryptocurrency Games?

- A Quick Look at Recent Popular DeFi Narratives and Innovative Projects

- Admitting fault, American exchange Bittrex settles with SEC for a $24 million fine.

DeFi

Base Swap

Before Base Swap, Leet Swap was the largest DEX on the Base network, and the tokens it launched also enjoyed the first wave of dividends. However, its liquidity pool suffered price manipulation attacks, resulting in financial losses. Subsequently, its token liquidity pool was removed and the token price returned to zero.

Following that, Base Swap was created, built on the fork of Uniswap V2. Tokens have already been launched, and the official website has launched mining and treasury functions for users to earn tokens. According to the official website data, the total locked amount of Base Swap is currently 34.5 million dollars. Whether the relevant information has been audited has not been disclosed yet, and users should be aware of the risks when using it.

In addition, Uniswap and Sushi have also announced their support for the Base network.

GranaryFinance

GranaryFinance is a lending market similar to AAVE, which currently supports eight chains including Ethereum and OP. According to the official website data, the total locked amount of GranaryFinance on the Base network is 380,000 dollars.

NFT

BakerySwap

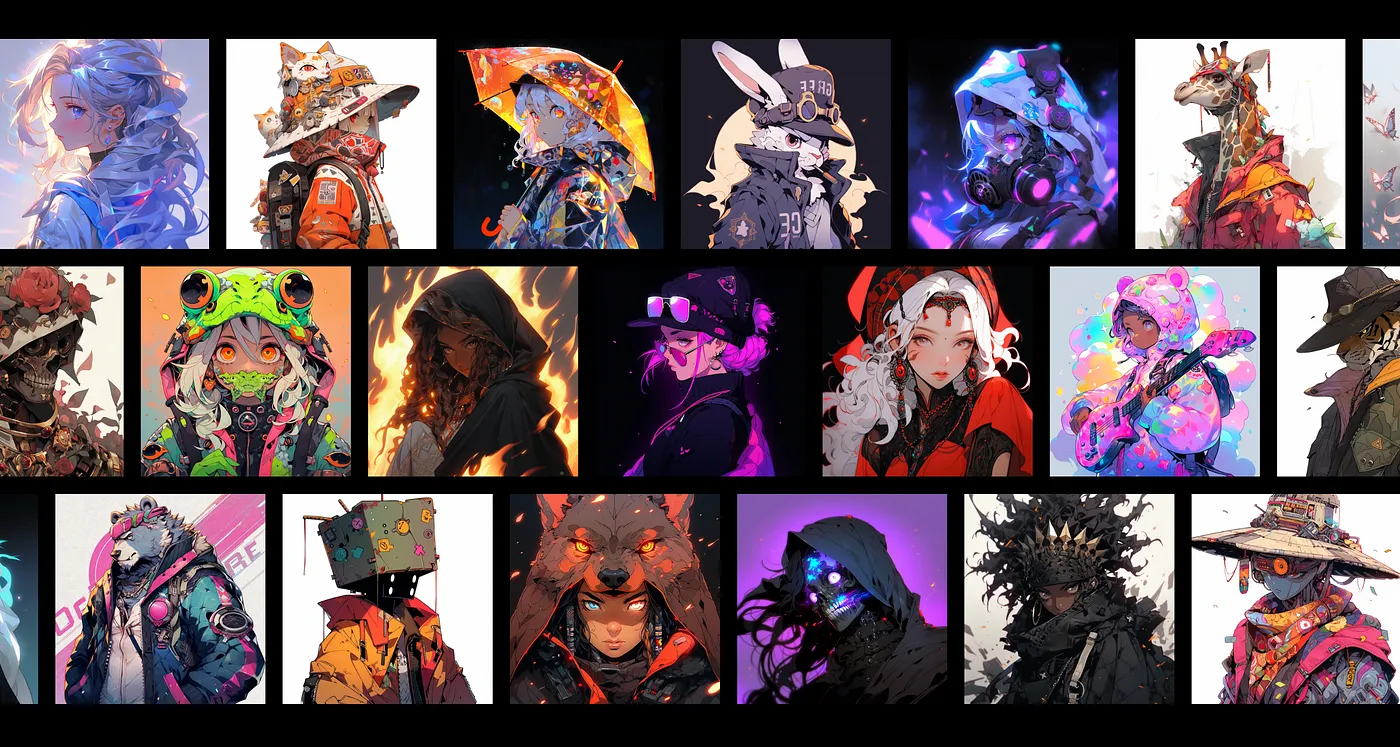

In August, BakerySwap announced the launch of an AI-based NFT series called Punk X on the Base network, with a total of 10,000 pieces. At the beginning of the release, the intention was to enhance the liquidity of NFTs by tokenizing them. 40% of the total token supply bound to NFTs was used for fundraising, 40% for users to add liquidity, 10% for airdrops, marketing, etc., and 10% for advisors, etc.

As it was the first project developed openly on the Base network, it raised more than 1600 ETH within half an hour of the fundraising, and the official ended the fundraising early due to excessive popularity. According to official information, their NFTs will soon be listed on NFTSwap, and users will be able to exchange PUNK NFTs at a 1:1 ratio.

Manifold/mintfun

Manifold is an NFT minting platform that recently announced support for the Base network. It has already launched NFT minting, claiming, burning, and airdrop functions. Mintfun is an aggregated NFT minting platform that also announced support for the Base network. Users can see a series of NFTs being minted on the Base network, allowing them to observe the latest NFT collections and their popularity. Currently, many community projects based on mintfun have been launched, so users need to be cautious in their selection.

Social

friend.tech

friend.tech is a fan economy product similar to bitclout. It recently went online on the Base network. Due to its innovative approach of turning personal influence into tradable shares, it suddenly gained popularity on August 11th, causing a surge of users and server crashes. The social behavior generated by its invitation code system also makes it highly topical and viral.

The product can be understood as each account being a token that can be bought and sold, with the token price fluctuating accordingly. If other users purchase your account token, you can earn a share of the transaction. If you buy tokens of other users’ accounts, you can enter their private chat rooms to communicate with the purchased account’s owner, as well as participate in chat rooms with all the token holders of that account.

According to LianGuairsec data, the floor price for purchasing the founder’s account token in the friend.tech project has risen to 1.4 ETH, and the floor price for purchasing the account token of well-known Twitter blogger cobie has risen to 2.3 ETH. Each transaction on friend.tech incurs a 10% tax, with 5% going to the traded account and 5% going to the project team.

Currently, some users have developed scripts to monitor the situation of high-profile Twitter influencers joining friend.tech. They then purchase the influencer’s tokens as soon as possible and wait for other users to continuously purchase their tokens. Subsequently, the monitoring personnel who bought the tokens at a high price sell them at the right time.

According to community rumors, this project will issue points in the later stage to attract more users to participate in the early incentives. The specific steps are as follows:

1) Open the website https://www.friend.tech/ on your mobile browser and add the webpage to your home screen;

2) Register with your phone number or Google email;

3) Fill in the invitation code (can be obtained from social media or communities);

4) Link your Twitter account;

5) Transfer 0.011 ETH to the base wallet address provided by the official to complete the activation (assets can be withdrawn at any time, and the private key of the address can also be exported).

Related reading: “Your social circle represents your value,” how does the decentralized social application friend.tech interpret this statement?

Summary

According to historical patterns, after the launch of a chain with a strong background, there are often investment opportunities within its ecosystem. For developers and project teams, a new chain represents new vitality and attention. Furthermore, due to the early stage, most projects temporarily occupy unique sectors, which gives them the opportunity to gain the most users and funds. For users, due to the demand for new chains and projects in the ecosystem and the higher expectations generated by more users, they can gain timing and chip advantages by participating earlier.

As more projects are built on the Base chain, there will be more early investment opportunities to participate in the game. However, the current overall market is still in a mode of PvP among existing users, so when participating, remember to withdraw in a timely manner. At the same time, before participating, try to conduct due diligence as much as possible to reduce various risks such as rug pull.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!